Special Warranty Deed With Assumption

Description

How to fill out Texas Assumption Warranty Deed?

Creating legal documents from the ground up can occasionally be daunting.

Specific circumstances may require extensive research and significant financial investment.

If you're in search of an easier and more cost-effective method for preparing a Special Warranty Deed With Assumption or any other documentation without unnecessary complications, US Legal Forms is always available to assist you.

US Legal Forms has a flawless reputation and over 25 years of experience. Join us today and simplify the document preparation process!

- Review the document preview and descriptions to confirm that you are locating the correct document.

- Ensure that the form you choose adheres to the regulations and laws of your jurisdiction.

- Select the most appropriate subscription option to purchase the Special Warranty Deed With Assumption.

- Download the document. Then complete, validate, and print it out.

Form popularity

FAQ

What Are The Dangers Of A Special Warranty Deed? Property debts are tied to the property's title, so buyers agreeing to a special warranty deed assume all responsibility for any liens or claims against the property that may have existed prior to the seller's ownership.

The Bank hereby consents to the sale, transfer, and conveyance of the Property by the Borrower to the Buyer, provided, however, that the Buyer hereby agrees to assume all obligations of the Borrower under the Mortgage, which obligations the Buyer hereby affirms and assumes.

An assumption clause is a provision in a mortgage contract that allows the seller of a home to pass responsibility for the existing mortgage to the buyer of the property. In other words, the new homeowner assumes the existing mortgage andalong with itownership of the property that secures the loan.

Typically, a Court orders the spouse responsible for the mortgage to sign a Deed of Trust to Secure Assumption. In this document, the spouse responsible for the mortgage assumes the payment of the mortgage.

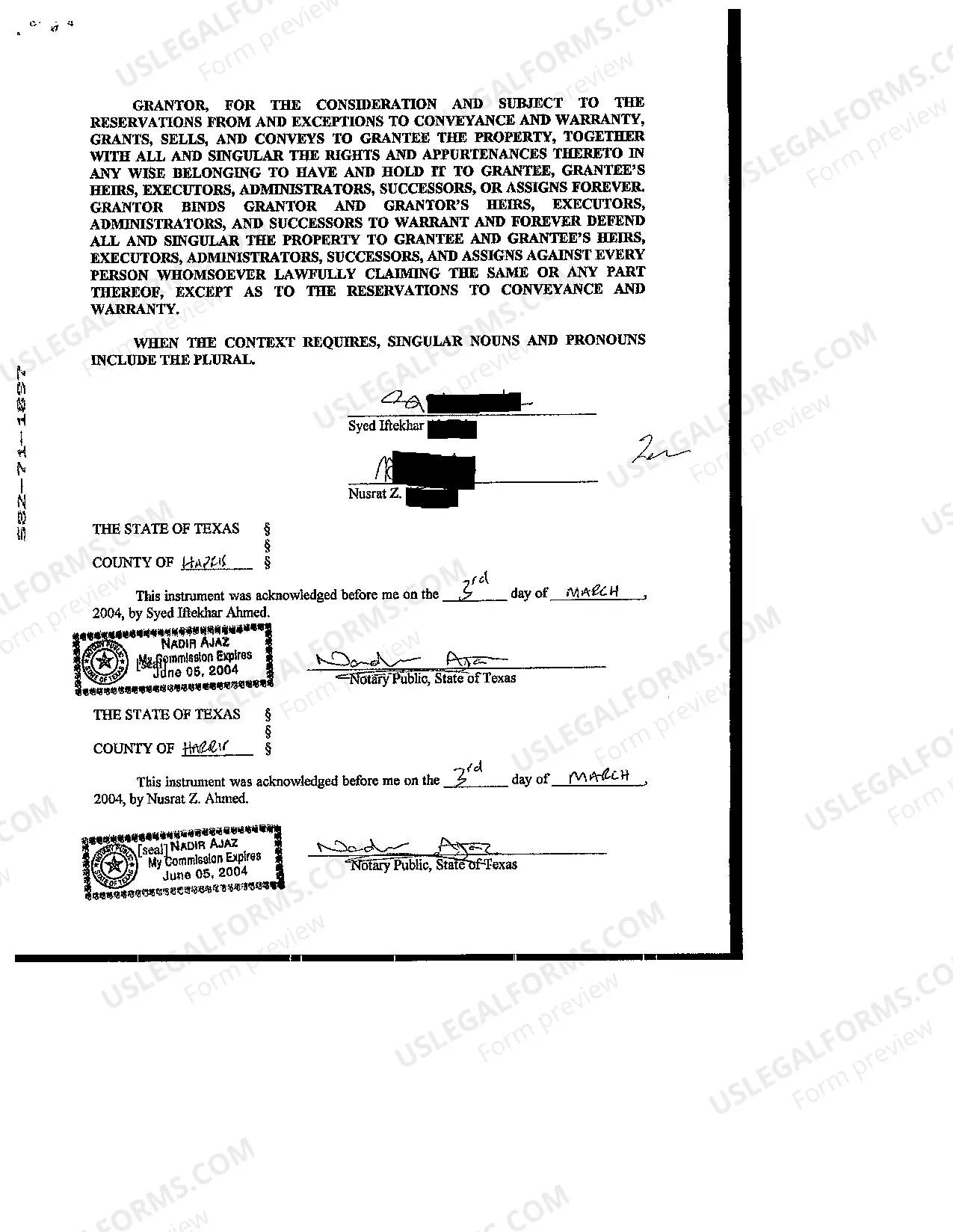

A general warranty deed must include the following to be valid: The name and address of the seller (called the grantor) The name and address of the buyer (called the grantee) A legal description of the property (found on the previous deed) A statement that the grantor is transferring the property to the grantee.