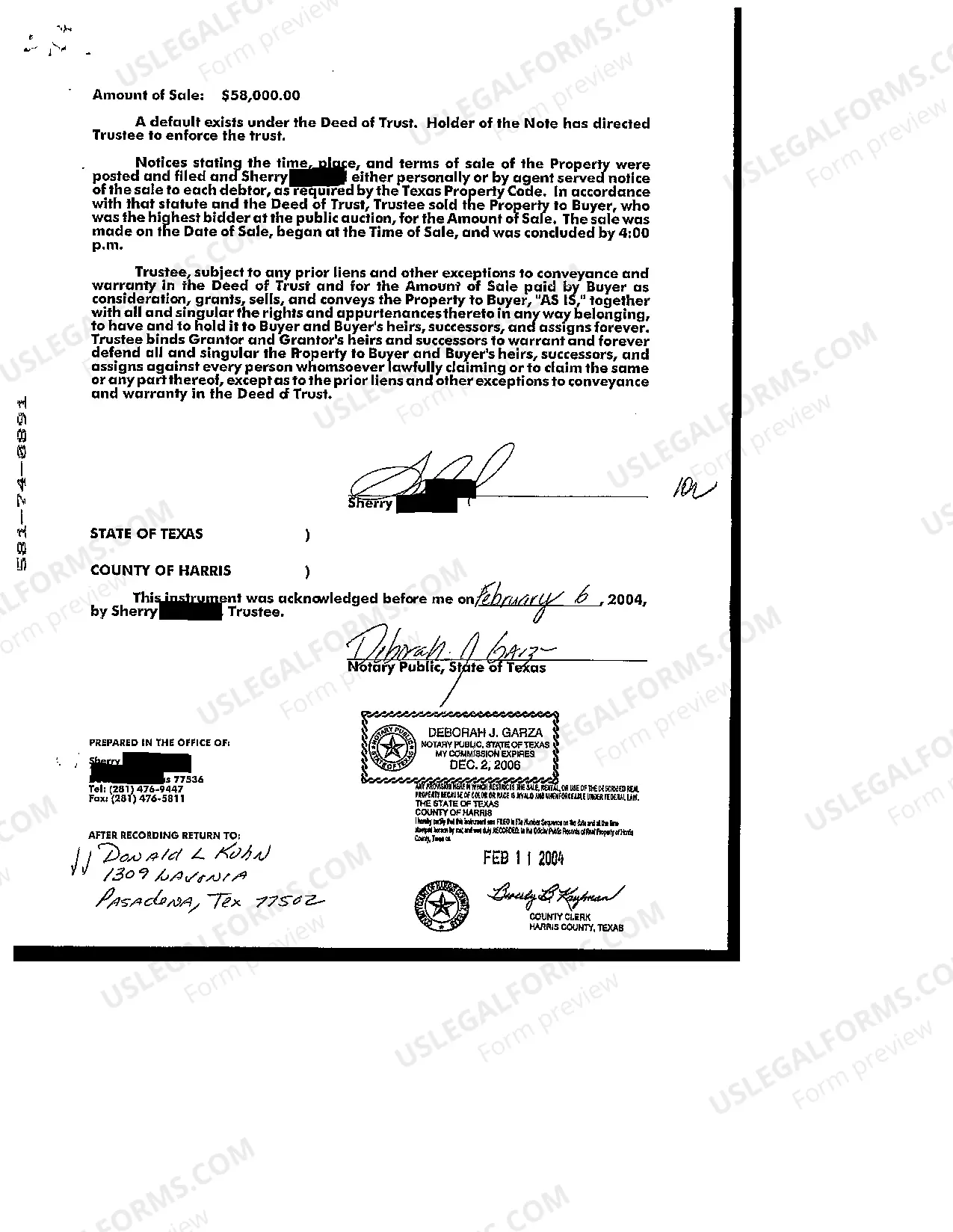

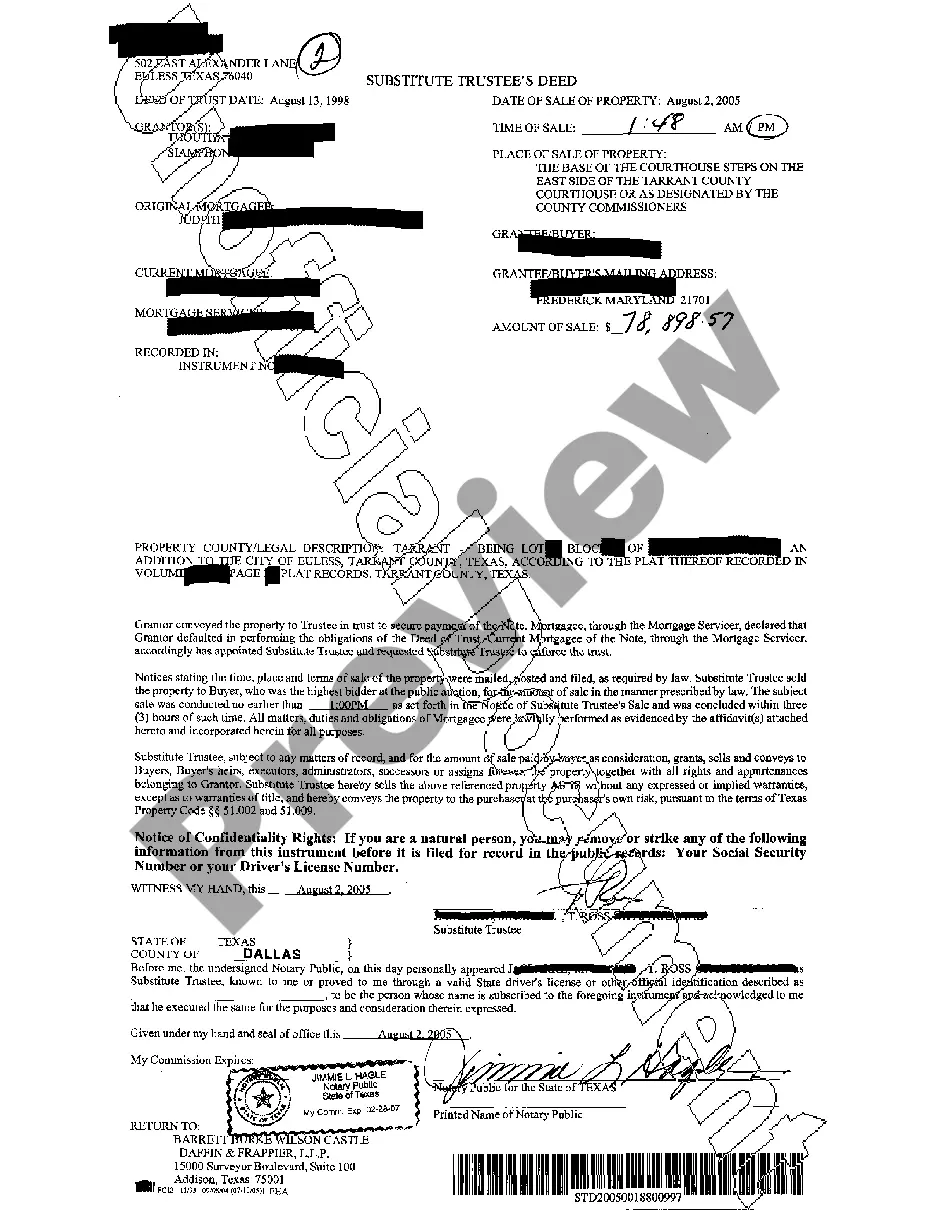

Trustee With Deed Of Trust

Description

How to fill out Texas Trustee's Deed?

It’s clear that you cannot become a legal professional right away, nor can you learn how to rapidly create Trustee With Deed Of Trust without possessing a specialized background.

Assembling legal documents is a labor-intensive endeavor that demands specific training and expertise.

So why not entrust the creation of the Trustee With Deed Of Trust to the experts.

You can reaccess your documents from the My documents tab at any time. If you are an existing client, you can simply Log In and find and download the template from the same tab.

Regardless of the objective of your forms—be it financial, legal, or personal—our platform has you covered. Try US Legal Forms today!

- Begin by locating the form you require using the search bar at the top of the page.

- Review it (if this feature is available) and examine the accompanying description to verify if Trustee With Deed Of Trust is what you need.

- Restart your search if you require any additional forms.

- Sign up for a complimentary account and choose a subscription plan to acquire the form.

- Select Buy now. Once the purchase is finalized, you can obtain the Trustee With Deed Of Trust, fill it out, print it, and send or deliver it to the intended recipients or organizations.

Form popularity

FAQ

A deed of trust generally requires specific elements, including a clear identification of the parties involved, a description of the property, and the outlined roles of the trustee. Additionally, it needs to be executed in accordance with local laws to be valid. Using a platform like US Legal Forms can simplify the process, ensuring that all necessary elements are in place for your deed of trust.

A deed of trust needs a trustee to facilitate the execution of the trust and ensure that it operates smoothly. The trustee acts as a mediator who holds the legal title to the property in trust for the beneficiaries. This arrangement provides security for the lender and ensures that the interests of all parties involved are managed effectively, highlighting the importance of a trustee with deed of trust.

No, a trustee is not the same as the owner of a trust. The trustee manages the assets held in the trust but does not own them. The trust's beneficiaries are the ones who will ultimately benefit from those assets, making the distinctions between ownership and management key to understanding how trusts operate.

Yes, a deed of trust requires a trustee to oversee the agreement and manage the property involved. The trustee acts as a neutral party who ensures that the terms of the deed are followed and that the interests of all parties are protected. This makes the role of the trustee with deed of trust vital for the successful execution of the agreement.

No, a trust cannot exist without a trustee. The trustee plays a crucial role in administering the trust, managing its assets, and acting on behalf of the beneficiaries. Without a trustee, the trust lacks the necessary oversight and management to fulfill its purpose, making the role indispensable.

Yes, a trustee must typically be appointed through a deed of trust. This legal document formally designates the trustee's role in managing the trust's assets. By having a trustee appointed in this manner, you ensure that the management of the trust complies with legal requirements, providing clarity and structure to the arrangement.

Yes, generally, a trust deed must be signed by all the trustees involved to ensure its validity. This requirement protects the interests of the beneficiaries and ensures consensus among trustees regarding the trust's management. It is vital to have all signatures documented clearly to prevent future disputes. For guidance on these formalities, you can count on resources from UsLegalForms to streamline the process.

On a deed of trust, a trustee is a third party who holds the legal title to the property on behalf of the lender and the borrower. This person's role is to ensure that the terms of the deed are followed, protecting the interests of both parties. In many cases, the trustee is responsible for overseeing the foreclosure process if the borrower defaults. Choosing the right trustee with deed of trust is crucial, and UsLegalForms can assist in this process.

Yes, a primary beneficiary can serve as a trustee with a deed of trust. This arrangement can simplify the management of the trust and enhance the beneficiary's control over the assets. However, it is essential to ensure that this dual role does not create conflicts of interest. Using a service like UsLegalForms can help clarify roles and responsibilities when setting up your trust.

The trustee's role in a deed of trust is to act as a neutral party who manages the trust relationship between the borrower and the lender. They hold the legal title to the property and are responsible for initiating foreclosure if the borrower defaults. This role is vital as it ensures that real estate transactions remain secure and fair. Engaging a trustee with deed of trust provides necessary oversight in property lending.