Difference Between Deed And Deed Of Trust

Description

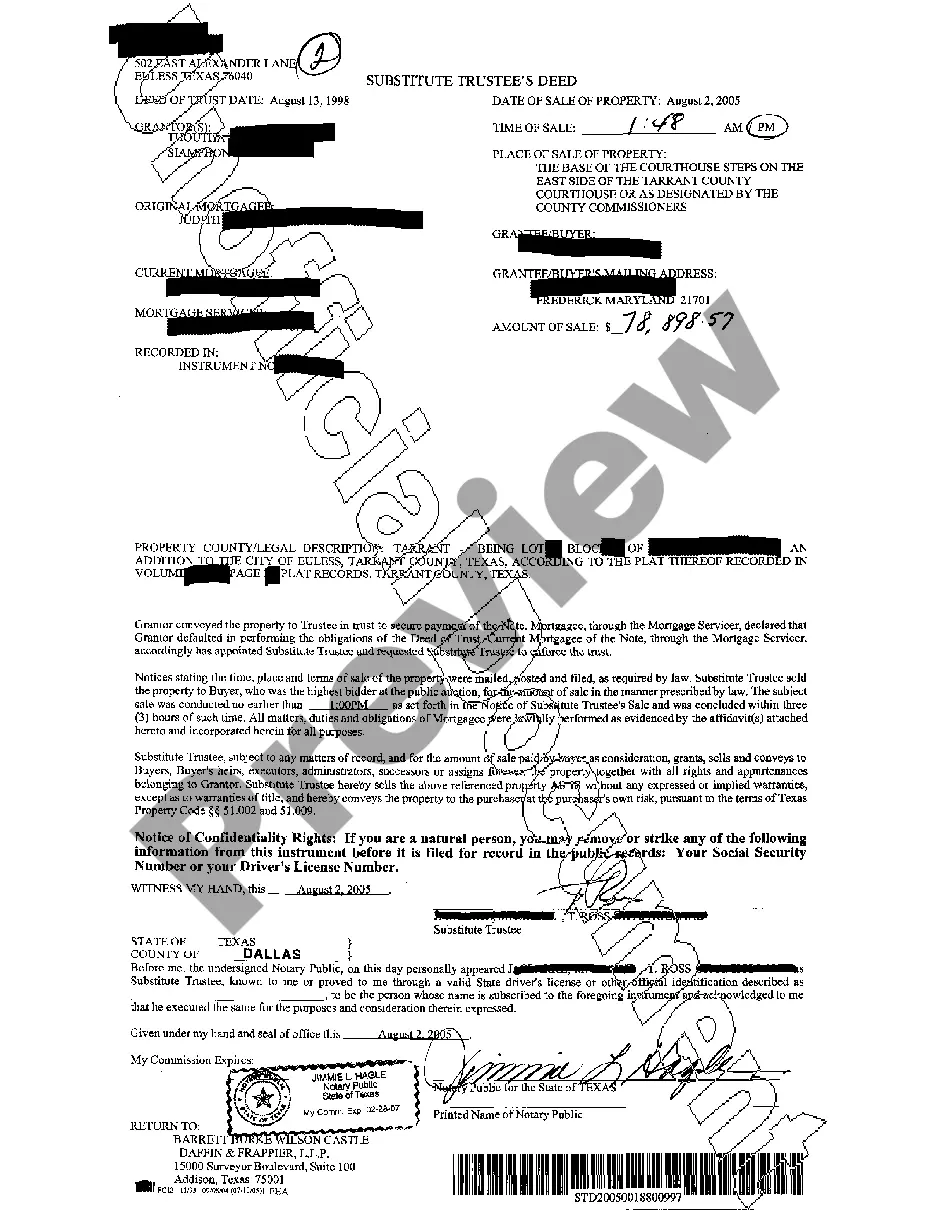

How to fill out Texas Substitute Trustee's Deed?

It’s clear that you cannot instantly become a legal expert, nor can you swiftly master how to prepare the Difference Between Deed And Deed Of Trust without a specialized skill set.

Drafting legal documents is a lengthy undertaking that demands specific education and expertise. So why not entrust the preparation of the Difference Between Deed And Deed Of Trust to the experts.

With US Legal Forms, one of the largest legal document repositories, you can locate everything from court filings to templates for office correspondence. We recognize how crucial compliance with federal and local laws and regulations is. That’s why all forms on our platform are location-specific and up-to-date.

Click Buy now. Once the payment is completed, you can acquire the Difference Between Deed And Deed Of Trust, complete it, print it, and send it by mail to the relevant individuals or entities.

You can access your documents again anytime from the My documents tab. If you’re a returning client, simply Log In and retrieve the template from the same tab.

Regardless of your document's purpose—be it financial, legal, or personal—our website has everything you need. Try US Legal Forms now!

- Begin by visiting our website and obtaining the form you need within minutes.

- Use the search bar at the top of the page to find the document you need.

- Preview it (if this option is available) and review the accompanying description to see if Difference Between Deed And Deed Of Trust is what you require.

- If you need a different form, restart your search.

- Create a free account and select a subscription plan to purchase the template.

Form popularity

FAQ

The decision to enter a trust deed depends on your specific financial situation and goals. It's essential to understand the difference between deed and deed of trust, as each serves different purposes. A trust deed can provide a structured way to repay loans while securing the lender's interest. Consider consulting a financial advisor or using US Legal Forms to explore your options and make an informed choice.

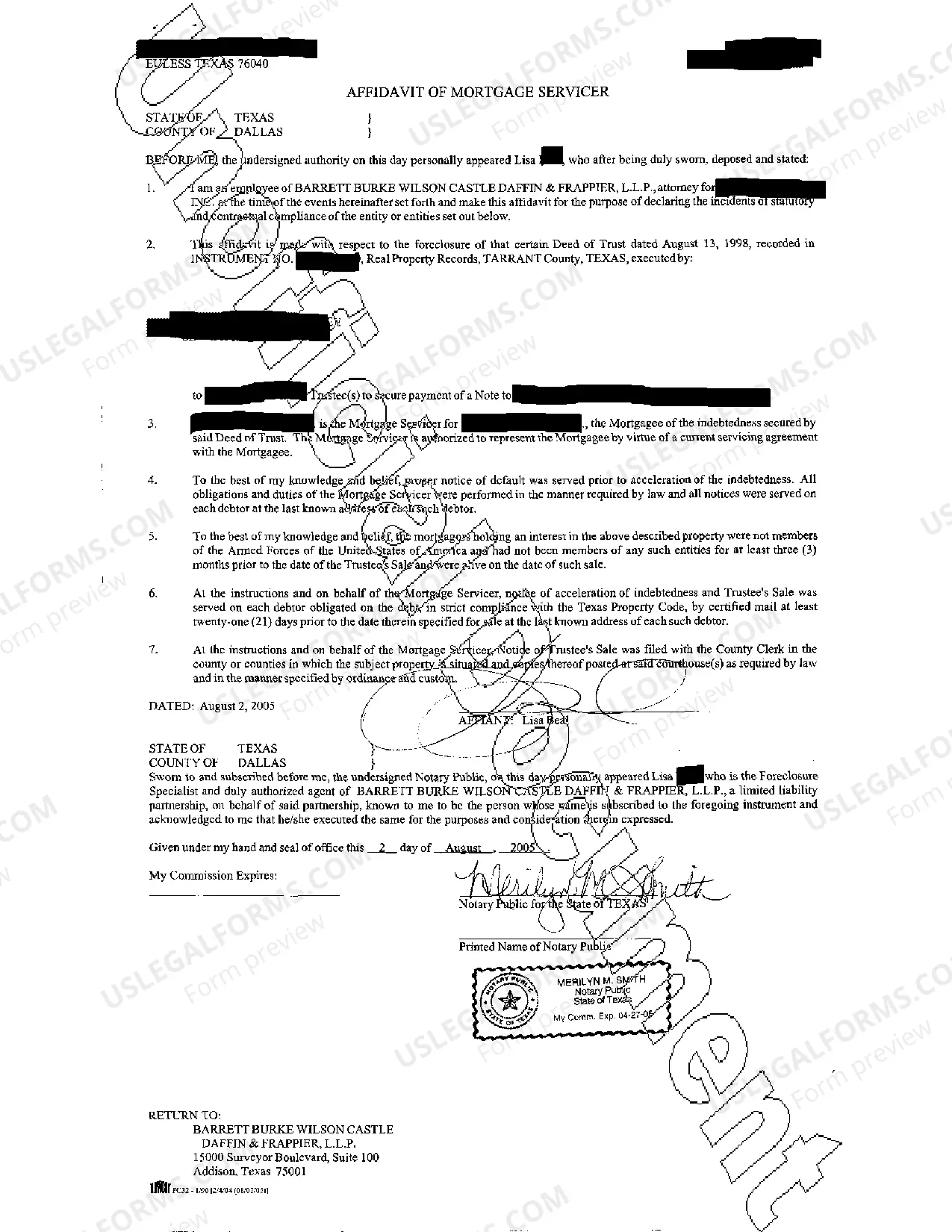

This Deed of Trust (the ?Trust Deed?) sets out the terms and conditions upon which: [Settlor Name] (the ?Settlor?), of [Settlor Address], settles that property set out in Schedule A (the ?Property?) upon [Trustee Name] (the ?Trustee?), being a Company duly registered under the laws of [state] with registered number [ ...

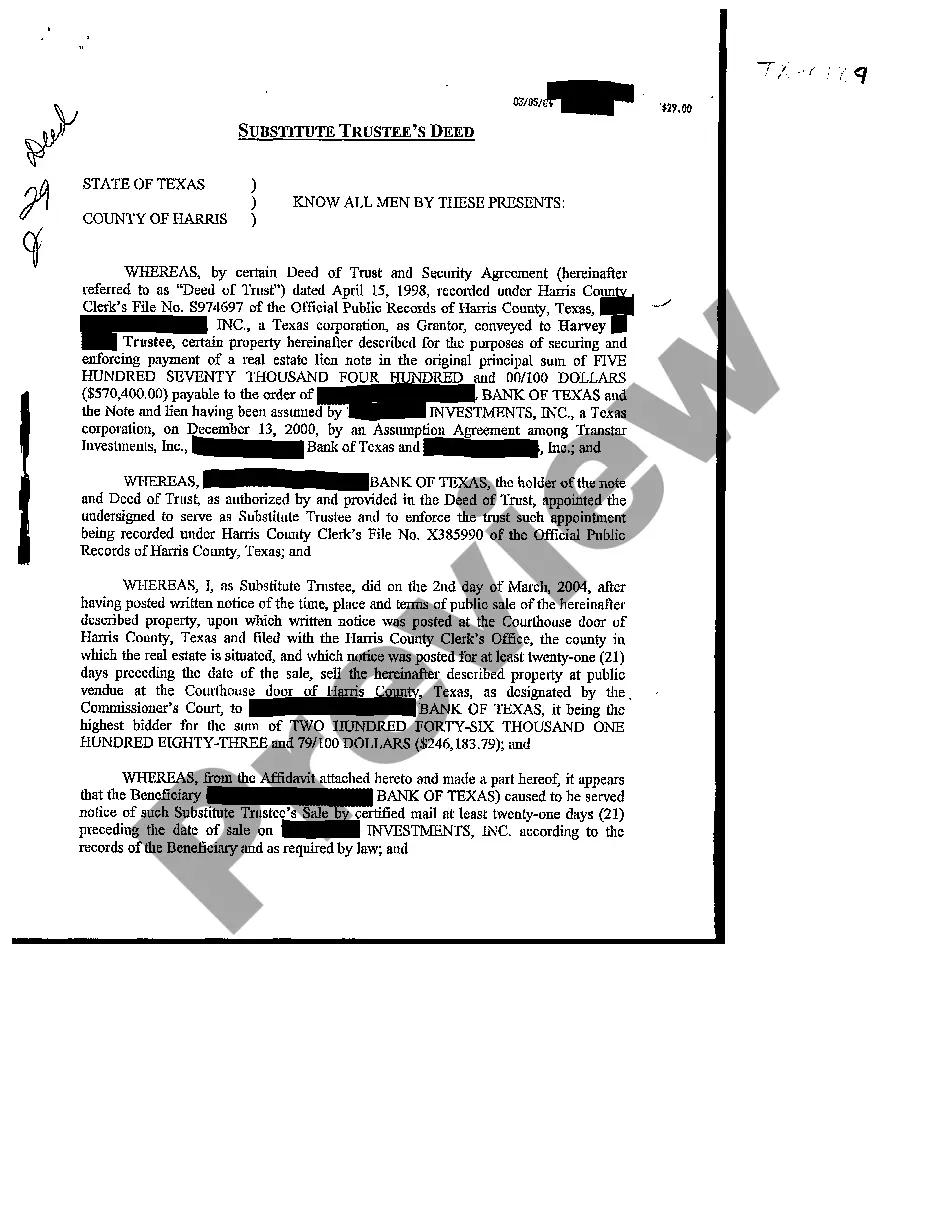

A deed transfers ownership of a property from one party to another, while a deed of trust secures a loan on a property. As a mortgage consultant, it's essential to understand the differences between these documents and how they affect the homebuying process.

Trust Deed Disadvantages You will be unable to obtain credit. ... They are not appropriate for secured obligations. ... They can cause issues for business owners. ... Your trustee has the authority to claim new assets.

What Is A Deed Of Trust? A deed of trust is an agreement between a home buyer and a lender at the closing of a property. The agreement states that the home buyer will repay the home loan and the mortgage lender will hold the property's legal title until the loan is paid in full.

Under trust deed, the settlor transfers the identifiable property to the trustees and makes it obligatory for the trustees to work and manage the trust as per the terms and conditions specified in the trust deed.