Affidavit Of Trust Withdrawal Sample

Description

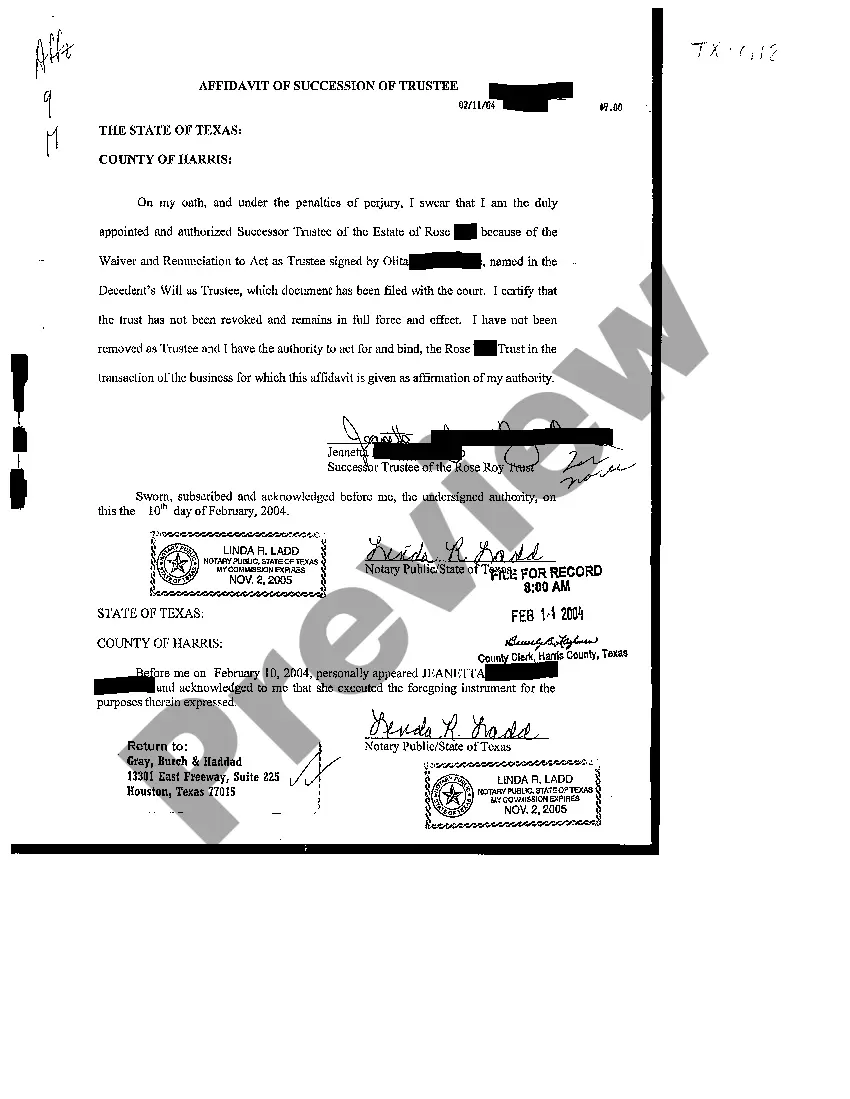

How to fill out Texas Affidavit Of Succession Of Trustee?

Creating legal documentation from the ground up can frequently be daunting.

Certain situations may require extensive research and significant monetary investment.

If you are looking for an easier and more economical approach to generating Affidavit Of Trust Withdrawal Sample or other documents without unnecessary complications, US Legal Forms is always available to assist you.

Our online library of more than 85,000 current legal forms encompasses nearly every aspect of your financial, legal, and personal issues. With just a few clicks, you can quickly access state- and county-specific documents meticulously prepared for you by our legal experts.

Ensure that the template you select adheres to the regulations and laws of your state and county. Choose the appropriate subscription plan to obtain the Affidavit Of Trust Withdrawal Sample. Download the form, then fill it out, certify it, and print it. US Legal Forms prides itself on a flawless reputation and over 25 years of experience. Join us today and make form completion straightforward and efficient!

- Utilize our platform whenever you require trustworthy and dependable services to effortlessly locate and download the Affidavit Of Trust Withdrawal Sample.

- If you are familiar with our site and have created an account before, just Log Into your account, choose the form, and download it instantly or retrieve it later in the My documents section.

- Don't have an account? No issue. It takes only a few minutes to register and explore the catalog.

- However, before you begin downloading the Affidavit Of Trust Withdrawal Sample, consider these suggestions.

- Examine the form preview and descriptions to ensure you are on the correct document.

Form popularity

FAQ

It depends on the terms of the trust. It may happen quickly or it could take years or even decades to distribute. It's important to point out that the longer it takes to distribute the assets, the more money it will cost to keep the trust active since you must pay for maintenance and trustee fees.

The trustee of an irrevocable Trust cannot withdraw money except to benefit the Trust. These terms include paying maintenance costs and disbursement income to beneficiaries. However, it is not possible to withdraw money for personal or business use.

Whether or not the trustee can withhold funds from you depends on the terms of the trust itself. If the trust requires withholding distributions under certain circumstances, such as the beneficiary reaching a specific age, the trustee must follow those stipulations.

With an irrevocable trust, the transfer of assets is permanent. So once the trust is created and assets are transferred, they generally can't be taken out again. You can still act as the trustee but you'd be limited to withdrawing money only on an as-needed basis to cover necessary expenses.

The grantor can opt to have the beneficiaries receive trust property directly without any restrictions. The trustee can write the beneficiary a check, give them cash, and transfer real estate by drawing up a new deed or selling the house and giving them the proceeds.