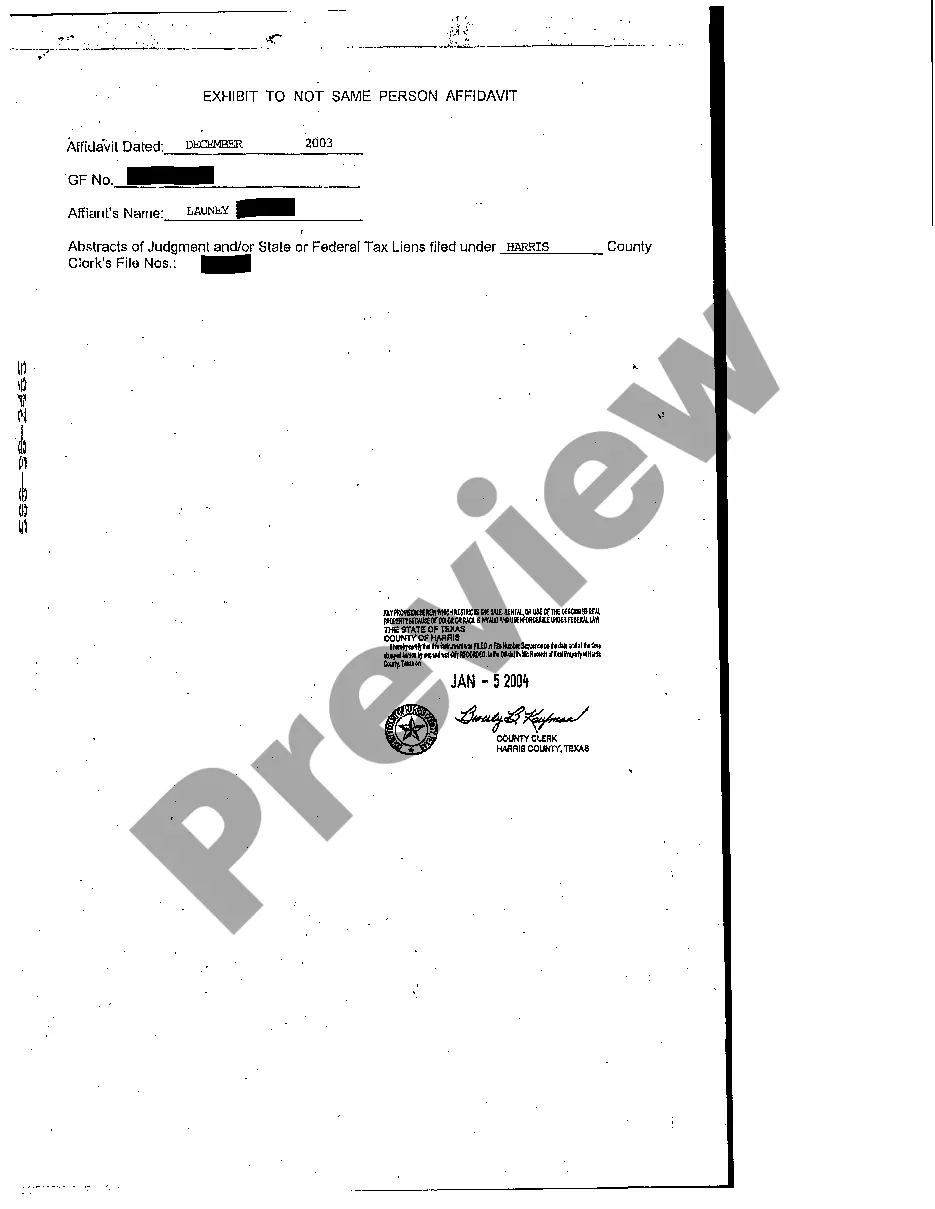

One In The Same Affidavit Form Texas

Description

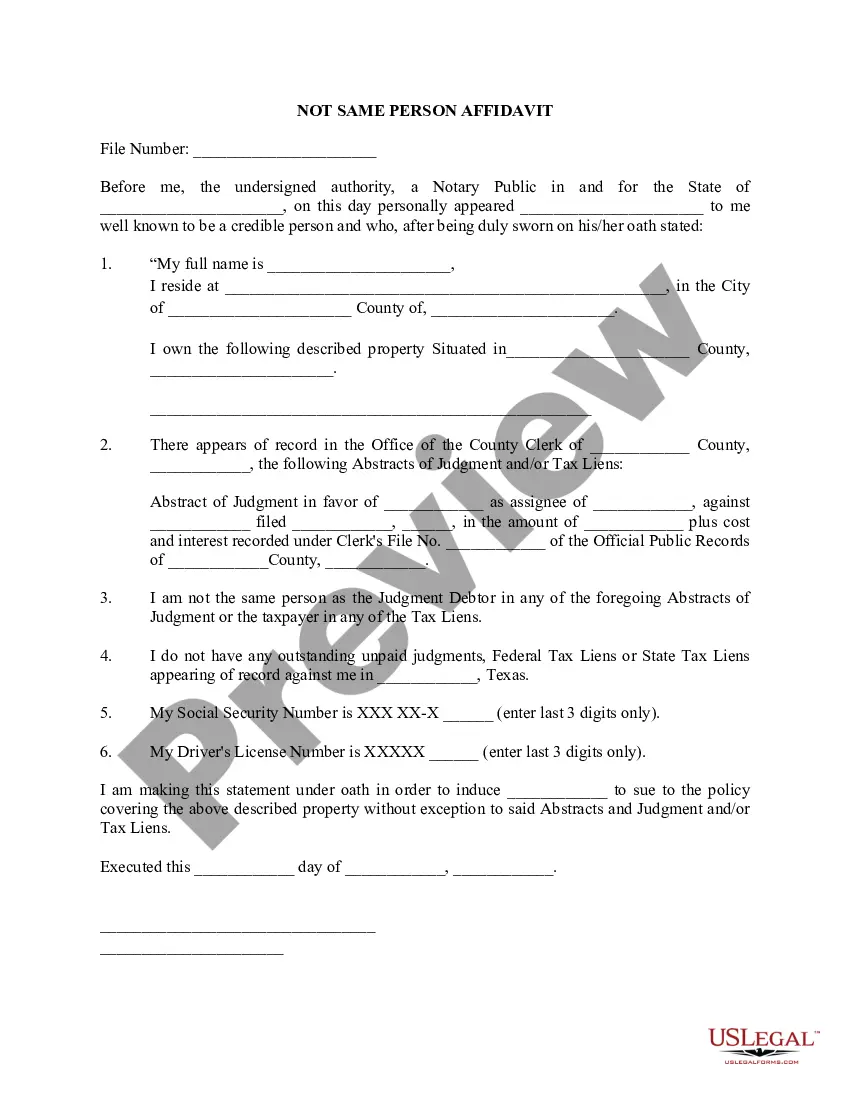

How to fill out Texas Not Same Person Affidavit?

Administrative systems necessitate exactness and correctness.

If you do not manage the completion of documents such as the One In The Same Affidavit Form Texas regularly, it may lead to some misunderstanding.

Choosing the appropriate template from the beginning will ensure that your document submission proceeds smoothly and prevent any troubles of resubmitting a document or recreating the same work from zero.

If you are not a registered user, finding the necessary template will require a few extra steps: Find the template using the search bar. Ensure the One In The Same Affidavit Form Texas you have found is applicable for your state or district. View the preview or read the description containing the details regarding the use of the template. If the result matches your search, click the Buy Now button. Choose the appropriate option among the proposed subscription plans. Log In to your account or create a new one. Finalize the purchase using a credit card or PayPal account. Save the form in your preferred format. Securing the right and updated templates for your documentation takes just a few minutes with an account at US Legal Forms. Eliminate the administrative worries and simplify your work with forms.

- You can always acquire the correct template for your documents in US Legal Forms.

- US Legal Forms is the largest online compilation of forms that provides over 85 thousand templates for various topics.

- You can obtain the latest and most applicable version of the One In The Same Affidavit Form Texas simply by searching it on the site.

- Find, store, and download templates in your account or verify with the description to confirm you have the correct one available.

- With an account at US Legal Forms, you can gather, save in one location, and browse through the templates you preserve to access them in several clicks.

- While on the site, click the Log In button to authenticate.

- Then, proceed to the My documents page, where your list of forms is stored.

- Review the descriptions of the forms and download those you require at any time.

Form popularity

FAQ

To add another lienholder on the vehicle title, you will need the vehicle title, Application for Texas Title and/or Registration (Form 130-U) and an Additional Lien Statement (Form VTR-267).

1. TO COMPLETE THE TX MOTOR VEHICLE TRANSFER NOTIFICATION ONLINE: PREFERRED METHOD If possible, we highly recommend completing forms online instead of by mail, so you may easily save and print out a copy for your records that includes a date/timestamp.

The title application must be accompanied by Affidavit of Motor Vehicle Gift Transfer (Texas Comptroller of Public Accounts Form 14-317). The Donor and Recipient must both sign the affidavit and title application. Either the donor or recipient must submit all forms and documents in person to the county tax office.

One and the same is the logical formulation of the expression meaning the same person or thing.

Complete a Statement of Facts (REG 256) attesting the vehicle was given as a gift and no tax is due....STEP 3.Date of purchase.Seller name and address.Buyer name and address.Vehicle description, including make, model, year, vehicle identification number (VIN), and license plate number.More items...