Rental Totvs

Description

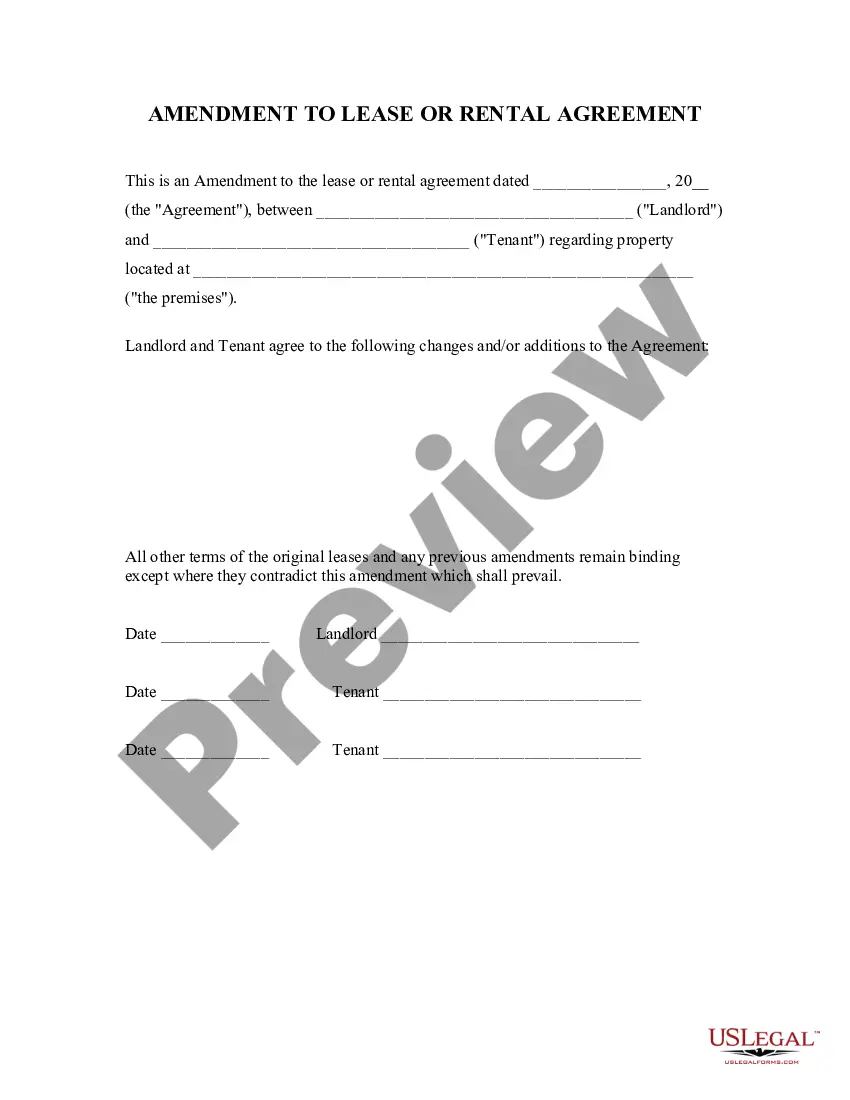

How to fill out Texas Amendment To Lease Or Rental Agreement?

- Log into your account if you've previously used US Legal Forms, ensuring your subscription is active. If not, renew your plan to access the necessary resources.

- In Preview mode, review the selected form's description to confirm it aligns with your needs and complies with local jurisdiction requirements.

- Use the Search tab if you need a different template. Ensure the revised choice meets your criteria before proceeding.

- Click the Buy Now button and select a subscription plan that suits you, ensuring an account setup to utilize the full library.

- Complete the purchase by entering your credit card information or opting for PayPal.

- Download the completed form to your device, allowing you to easily fill it out and find it later in the My Forms section of your profile.

By following these steps, you can take advantage of the robust offerings of US Legal Forms.

Start streamlining your legal processes today with Rental totvs and ensure that you have access to the best forms available. Don't hesitate to explore your options!

Form popularity

FAQ

Filling out a rental application without a rental history involves clearly presenting your financial background. Be upfront about your lack of history and focus on your income, steady job, and positive character references. You might also include additional documentation like a credit report or bank statements. Rental totvs offers guidance and templates to help you create a strong application despite your rental history challenges.

When you have no rental history, consider presenting other financial indicators, such as a steady job and savings accounts. Offer to provide a larger deposit or prepay rent if possible. Being transparent with potential landlords about your situation and demonstrating financial responsibility can also help. Rental totvs can assist you in creating a compelling application that highlights your strengths.

Filling out a rental verification form is straightforward. Start by entering your personal information, including your name and contact details. Then, provide your rental history, including addresses, dates of residency, and the landlord's contact information. Utilizing Rental totvs can simplify this process by guiding you through each step and ensuring accuracy.

Renting with a bad rental history can be challenging, but it is possible. Start by being honest about your past when you apply for a rental. You might consider offering a larger security deposit or getting a co-signer. Additionally, using tools like Rental totvs can help showcase your other positive traits, making you a more appealing candidate.

To file income from a rental, fill out Schedule E as part of Form 1040. You will need to include all rental income and claim any allowable deductions. Utilizing Rental totvs can simplify this filing process by guiding you through the necessary steps and ensuring you don’t miss any important details.

Rental income is listed as revenue on the income statement. It appears at the top, reflecting the earnings generated from rental properties. Rental totvs can help you prepare an accurate income statement, ensuring that your rental income is correctly categorized.

Rental income is reported to the IRS using Form 1040 and attached Schedule E. Each rental property must have its income and expenses documented separately. Using Rental totvs can assist you in efficiently generating these forms to ensure compliance with IRS regulations.

You can document rental income through bank statements, leases, and payment receipts. It's crucial to keep accurate records to support your reported income during tax season. Rental totvs offers features to help you easily store and retrieve this necessary documentation.

To claim rental payments on your taxes, report your total rental income on Schedule E. Be sure to list any associated expenses that can offset your income. Using Rental totvs can help you organize and track these payments, making it easier to ensure you claim everything correctly.

Recording rental income involves noting the income as it is received, usually in a ledger or accounting software. You may want to categorize the income based on each property for better tracking. If you utilize Rental totvs, it can streamline this process, providing a clear record of income for each property.