Business Cred Bauru

Description

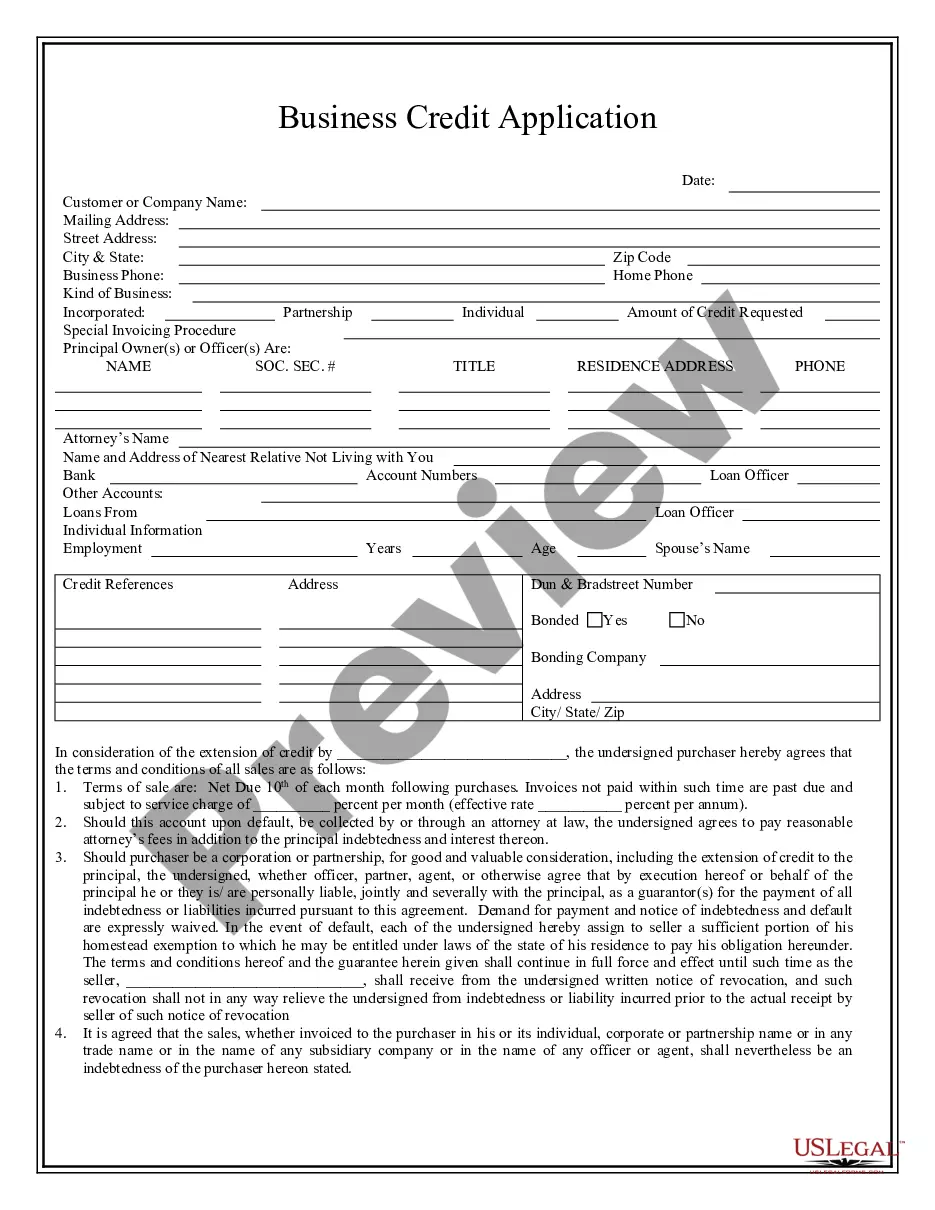

How to fill out Texas Business Credit Application?

- Start by logging into your US Legal Forms account if you're an existing user. Confirm that your subscription is active; if not, renew it.

- For new users, preview the available forms and descriptions to find one that meets your needs and adheres to local jurisdiction requirements.

- If you don't find what you need, use the search feature to explore more templates. Make sure any alternative is correct before proceeding.

- Once you've located your desired form, click the 'Buy Now' button and select the subscription plan that suits you best. You'll need to create an account for access.

- Complete your purchase by entering your payment details, either via credit card or PayPal.

- Finally, download your template and save it to your device. Access it anytime from the 'My Forms' section of your account.

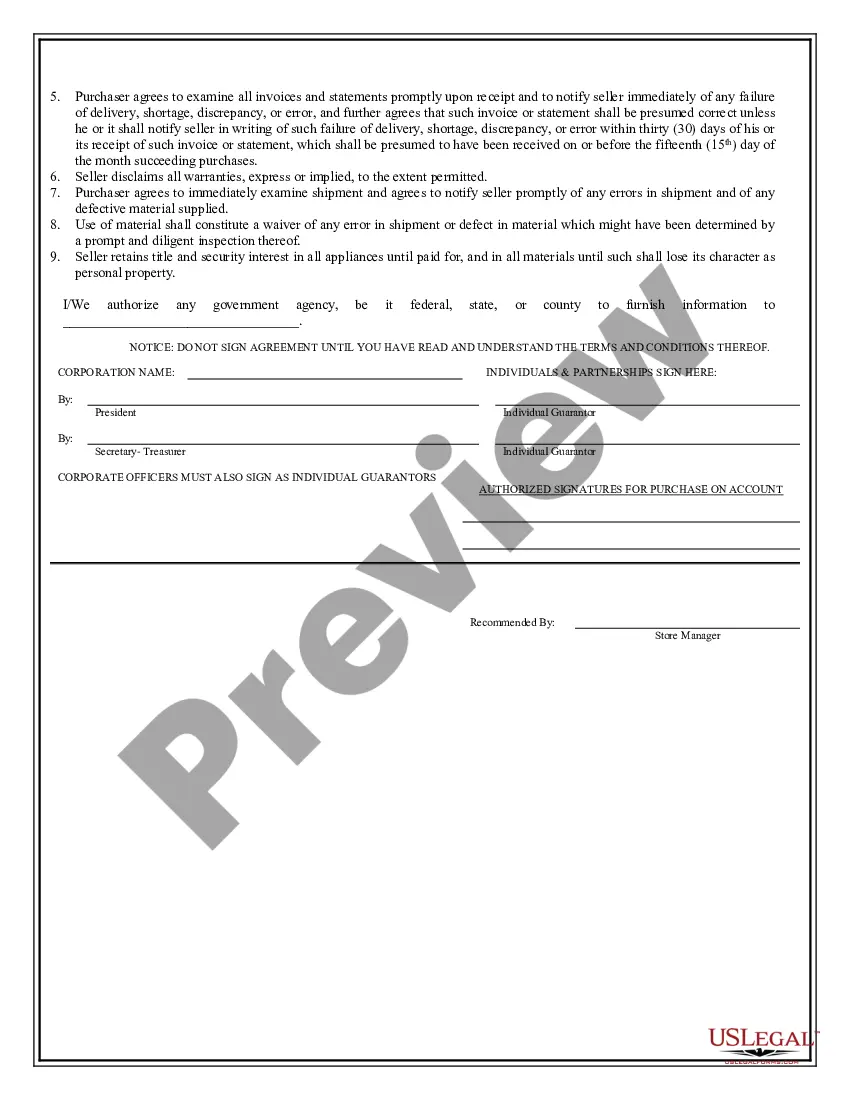

In conclusion, US Legal Forms simplifies the process of obtaining essential legal documents with its extensive library and user-friendly service. By following these steps, you can ensure that you find and complete the forms you need accurately and efficiently.

Ready to empower your legal journey? Start with US Legal Forms today!

Form popularity

FAQ

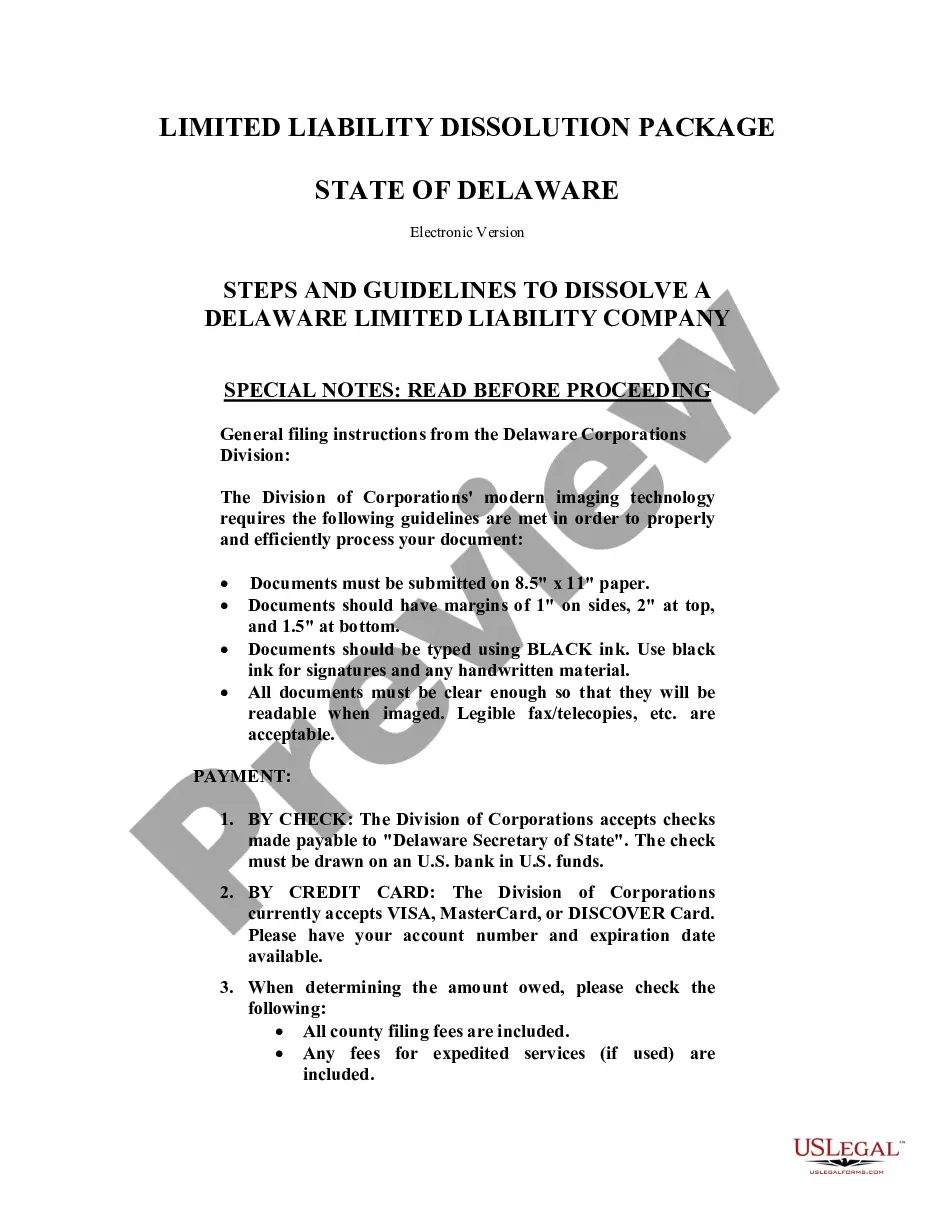

To establish credit for your business, start by registering with credit bureaus, and ensure you have a legal structure in place, like an LLC or a corporation. Open a business bank account and obtain a business credit card to help build a positive credit history. US Legal Forms can assist in this process by providing templates that guide you in establishing your business credit efficiently.

Reporting to credit bureaus as a business involves submitting your business credit activities to major bureaus like Dun & Bradstreet. You should report on your payment history, debts, and credit behaviors. Having a reliable partner like US Legal Forms can streamline this reporting process by providing the right forms and guidance needed to ensure accurate and timely submissions.

Creating a business credit file starts with registering your business with major credit bureaus. Obtain an EIN, open a business bank account, and ensure that your business stays compliant with state regulations. With US Legal Forms, you can access the necessary documentation and guides that facilitate the building of a strong business credit file, enhancing your business’s credibility.

To get a business credit file, you’ll need to register your business with credit bureaus like Experian, Equifax, or Dun & Bradstreet. Once registered, you can begin establishing a credit history through loans or business credit cards. If you're unsure about the steps, US Legal Forms provides comprehensive resources to assist you in navigating the creation of a business credit file.

Building credit for your LLC involves several steps. First, ensure that your LLC is legally registered and set up with a business bank account. Make timely payments on all your business obligations, and consider obtaining a business credit card. US Legal Forms offers resources that make it easier to understand the process and bolster your LLC's creditworthiness effectively.

To create a credit profile for your business, start by obtaining an Employer Identification Number (EIN) from the IRS. This unique number links your business to its credit activities. Next, register your business with credit reporting agencies, like Dun & Bradstreet. Using US Legal Forms can help simplify this process by providing easy-to-follow guides and templates tailored for creating a solid credit profile.

The quickest path to acquiring business credit involves setting up your LLC with proper registration and obtaining a business credit card. Additionally, using trade lines and establishing relationships with suppliers can enhance your credit profile quickly. By taking these steps, you'll boost your business cred Bauru efficiently. Tools and guides available on platforms such as USLegalForms can provide valuable insights during this crucial process.

An LLC can establish credit by opening a business bank account and applying for a business credit card. It is essential to ensure that your business is registered with the correct details, as this information will be used by lenders. Additionally, building a good credit history through consistent payments will enhance your business cred Bauru. Consider using platforms like USLegalForms to access the necessary documentation and streamline the process.

Filling out a business credit card application requires careful attention to detail. Start by gathering necessary documents, such as your business financial statements and personal identification. Fill out the application with accurate information about your business, including its EIN, ensuring that you showcase your business cred in Bauru. For assistance, consider platforms like USLegalForms, which provide resources to help you navigate the process smoothly.

When completing a business credit card application, you should include your business name, contact information, and type of business entity. Additionally, you’ll need to provide your EIN or SSN, financial information, and estimated annual revenue. Ensure you present a clear picture of your business cred in Bauru to enhance your application's appeal.