Texas Filing Form Withdrawal

Description

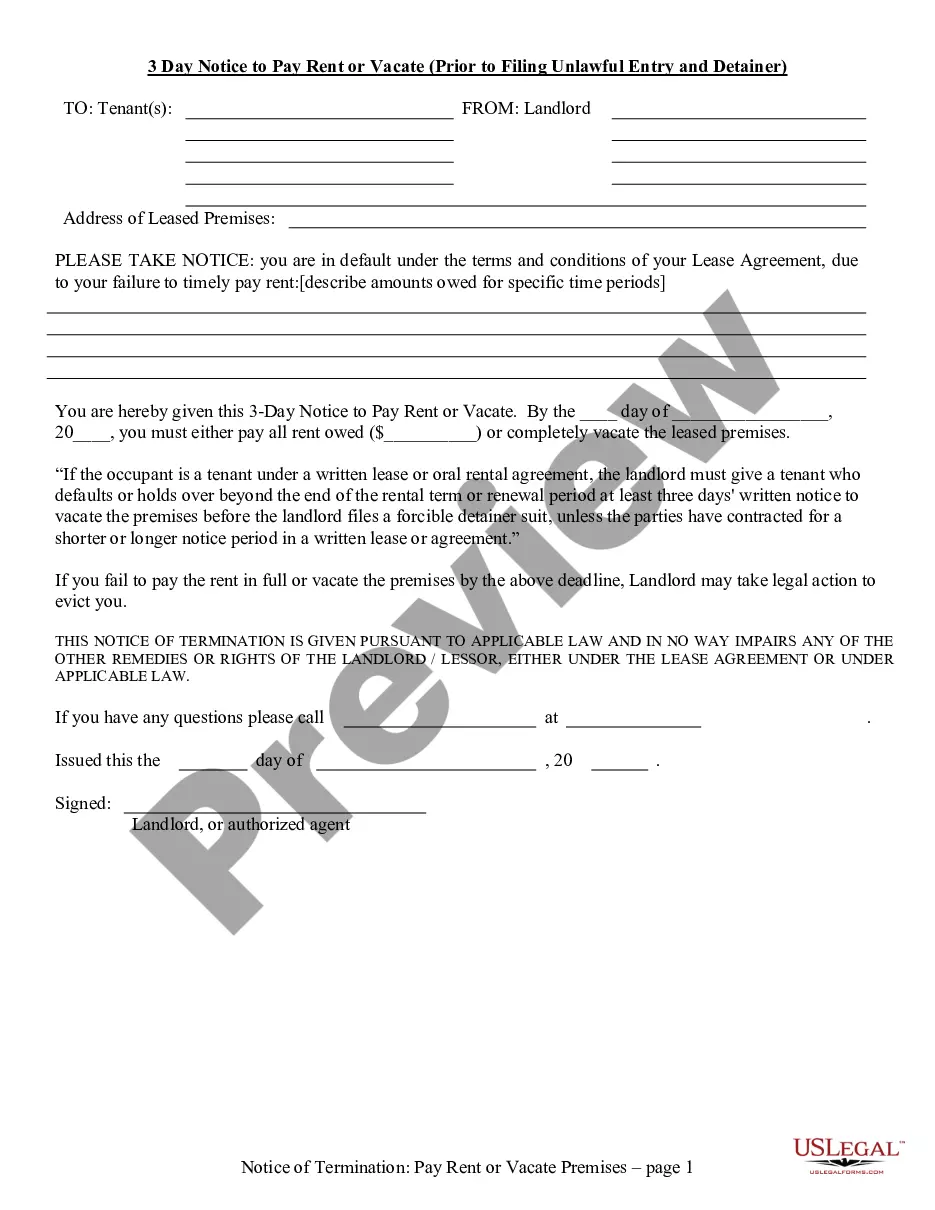

How to fill out Texas 3 Day Notice To Pay Rent Or Vacate (Prior To Filing Unlawful Entry And Detainer) - Residential?

Accessing legal document samples that meet the federal and local regulations is essential, and the internet offers many options to pick from. But what’s the point in wasting time looking for the appropriate Texas Filing Form Withdrawal sample on the web if the US Legal Forms online library already has such templates collected in one place?

US Legal Forms is the largest online legal library with over 85,000 fillable templates drafted by attorneys for any professional and personal situation. They are easy to browse with all papers grouped by state and purpose of use. Our specialists stay up with legislative changes, so you can always be confident your form is up to date and compliant when getting a Texas Filing Form Withdrawal from our website.

Obtaining a Texas Filing Form Withdrawal is simple and fast for both current and new users. If you already have an account with a valid subscription, log in and save the document sample you need in the right format. If you are new to our website, adhere to the instructions below:

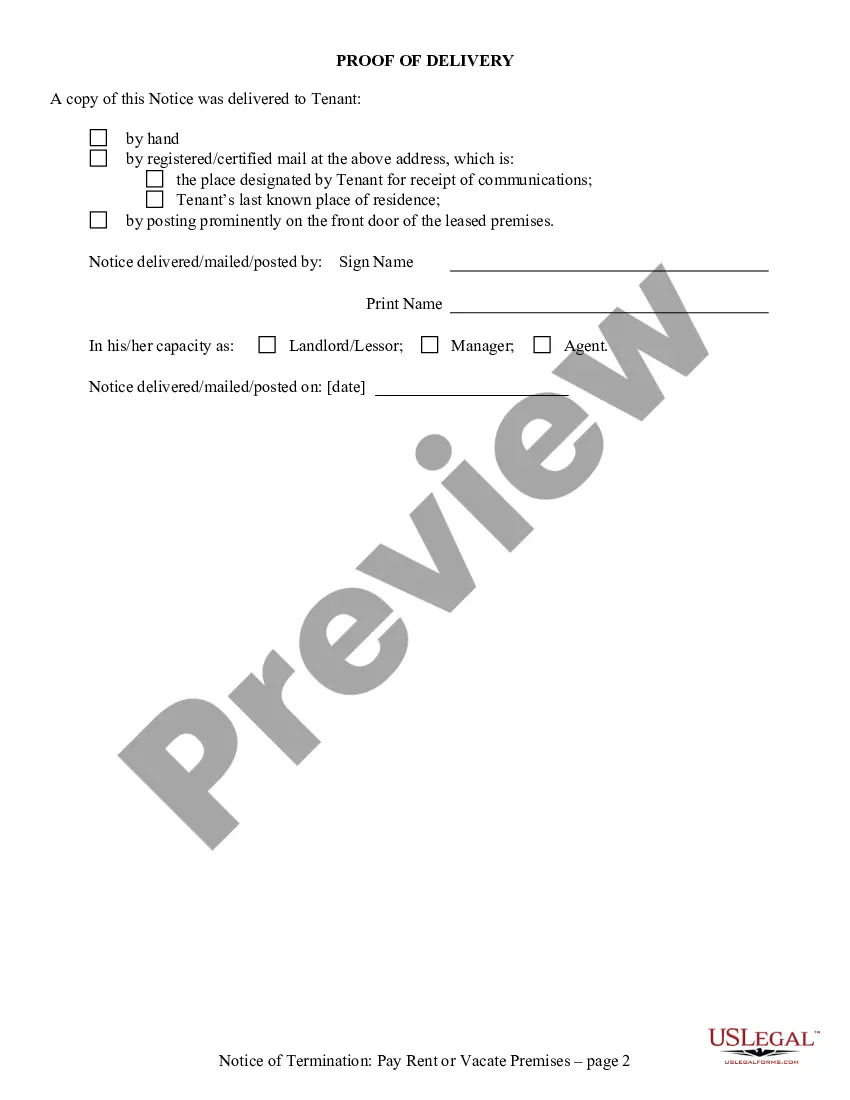

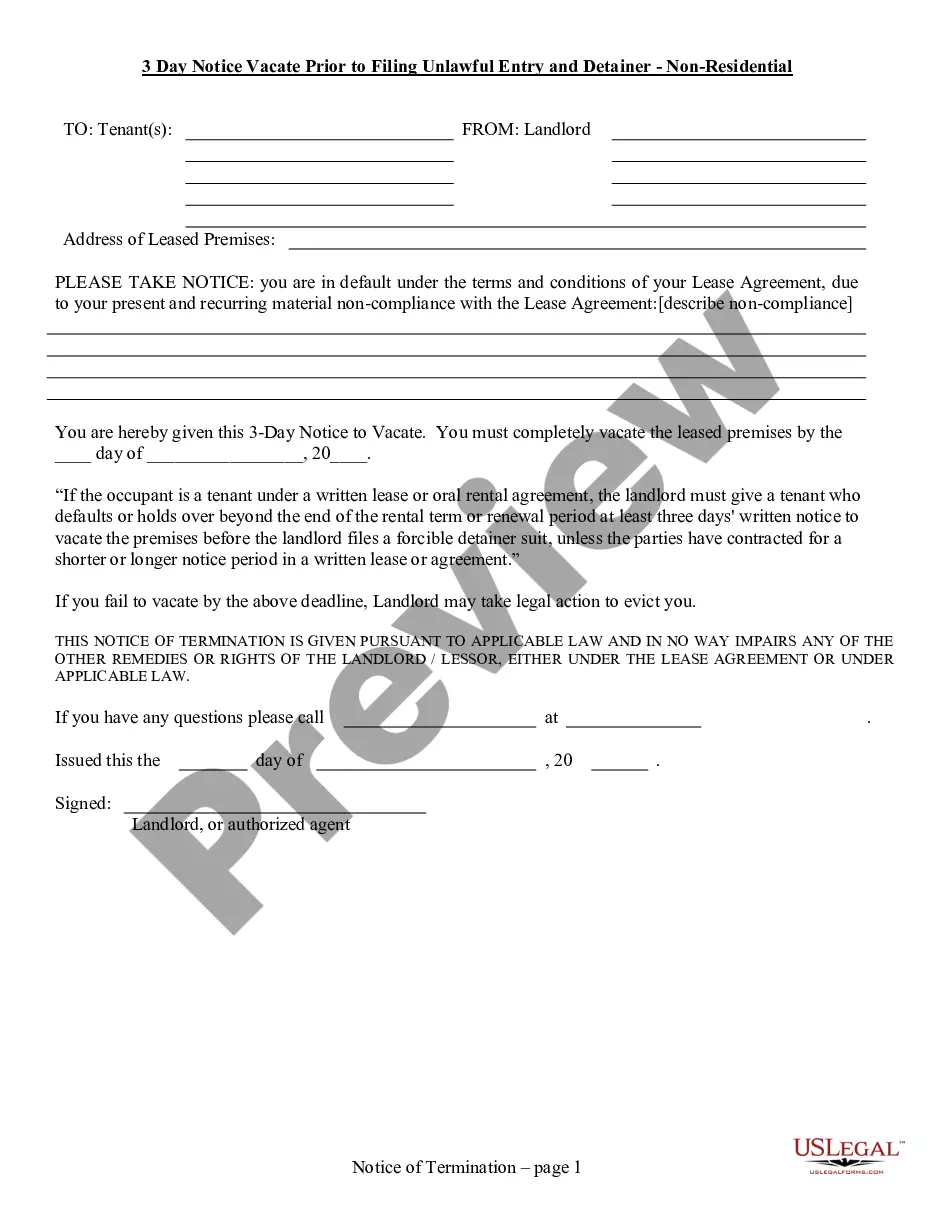

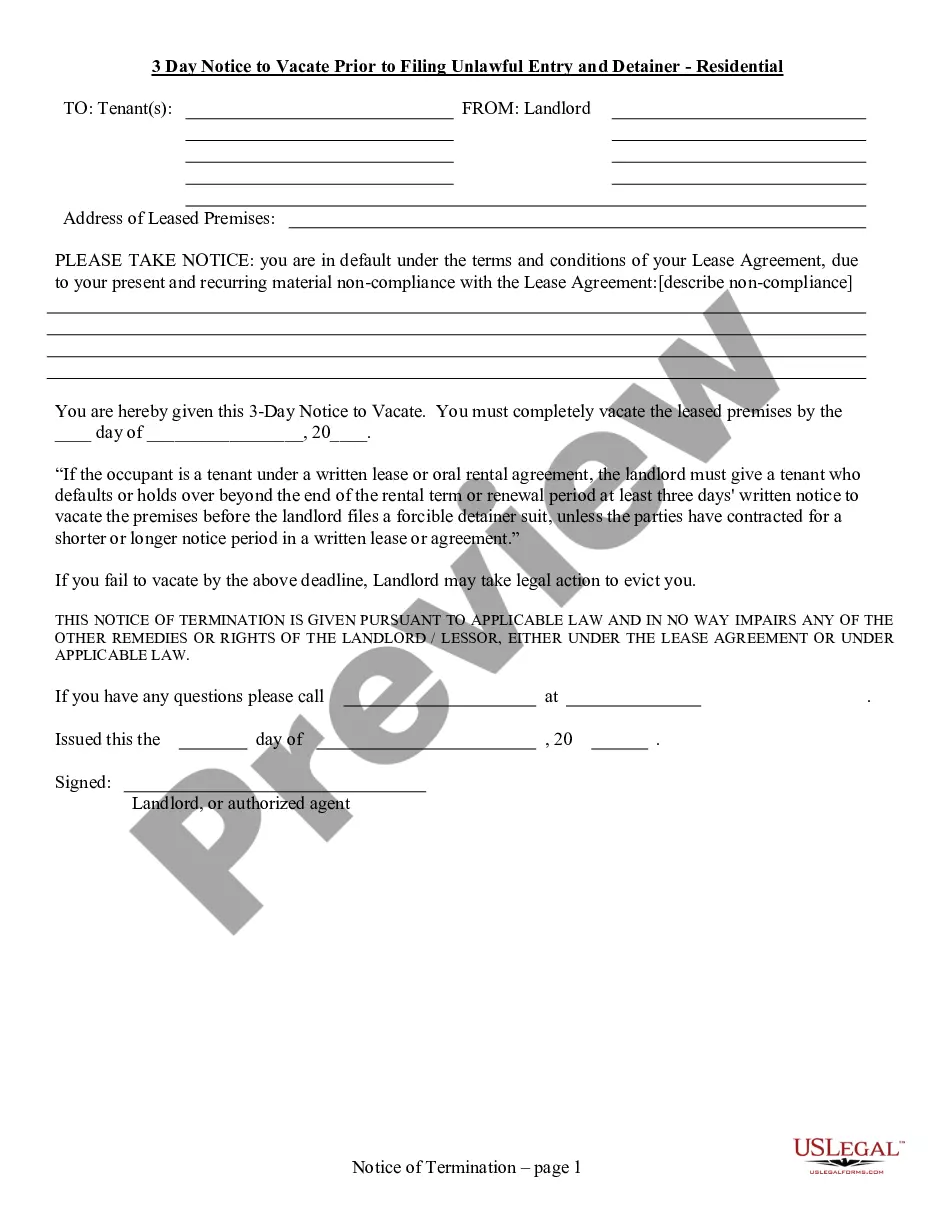

- Examine the template using the Preview option or via the text outline to ensure it fits your needs.

- Locate a different sample using the search tool at the top of the page if needed.

- Click Buy Now when you’ve found the right form and choose a subscription plan.

- Create an account or sign in and make a payment with PayPal or a credit card.

- Choose the right format for your Texas Filing Form Withdrawal and download it.

All documents you find through US Legal Forms are multi-usable. To re-download and complete previously purchased forms, open the My Forms tab in your profile. Enjoy the most extensive and easy-to-use legal paperwork service!

Form popularity

FAQ

The entity must: Take the necessary internal steps to wind up its affairs. ... Submit two signed copies of the certificate of termination. ... Unless the entity is a nonprofit corporation, attach a Certificate of Account Status for Dissolution/Termination issued by the Texas Comptroller. ... Pay the appropriate filing fee.

The certificate of withdrawal revokes the authority of the registered agent for the entity in this state to accept service of process.

When a partner of a partnership or a member of an Limited Liability Company (LLC) wishes to leave or withdraw, the resolution and departure of the partner or the LLC member may be resolved by reference to a dissolution agreement previously embedded in the partnership agreement or the company agreement (operating ... Leaving a Partnership or a Limited Liability Company (LLC) mylawteam.com ? leaving-partnership-limite... mylawteam.com ? leaving-partnership-limite...

Form 704 is a report that needs to be filed with the Internal Revenue Service (IRS) by executors and administrators of estates for the purpose of reporting and paying estate taxes.

Under Texas law, a member of an LLC may neither voluntarily withdraw nor be expelled from a Texas LLC. However, an agreement can modify this statutory default prohibition.