Texas Filing Form With Irs

Description

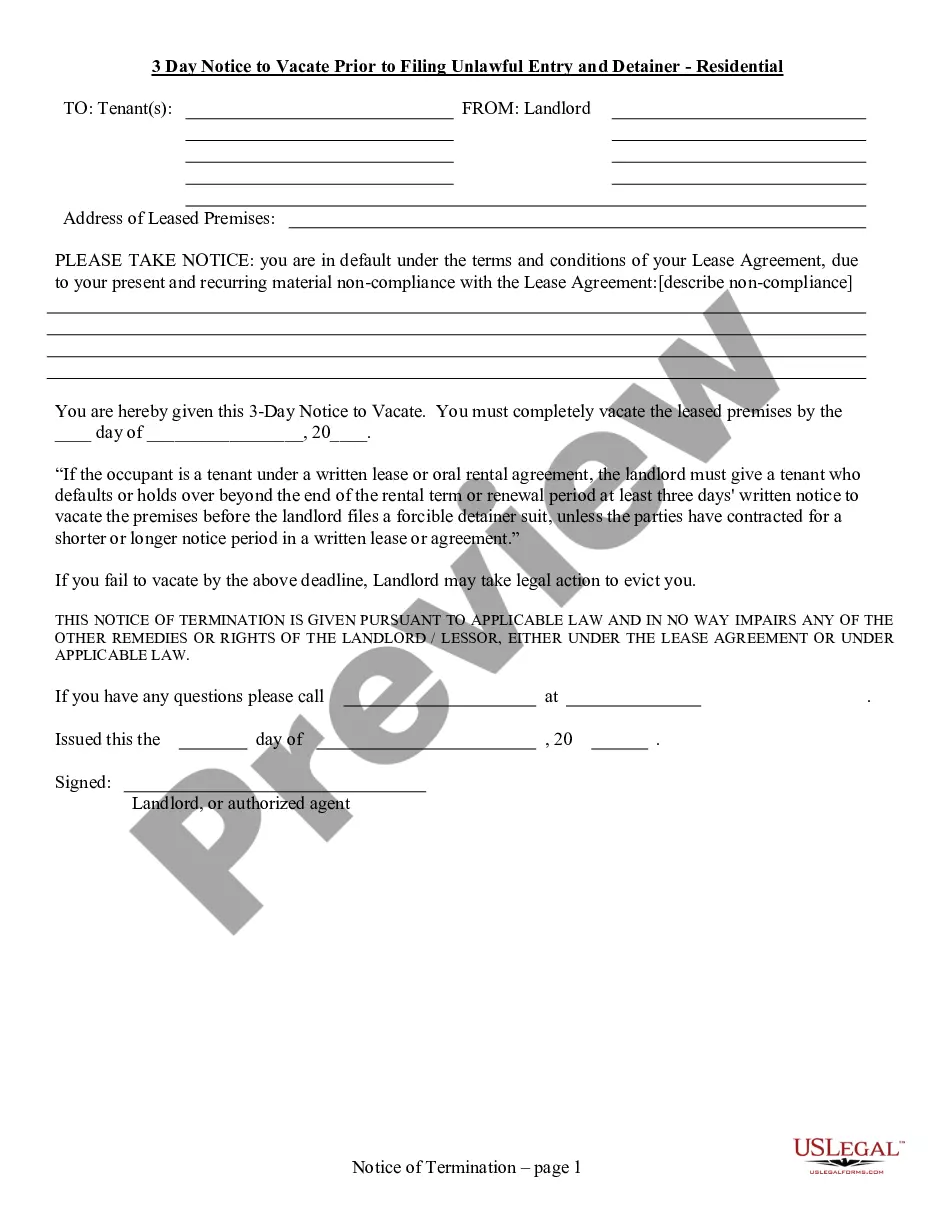

How to fill out Texas 3 Day Notice To Pay Rent Or Vacate (Prior To Filing Unlawful Entry And Detainer) - Residential?

Finding a go-to place to take the most current and appropriate legal templates is half the struggle of dealing with bureaucracy. Discovering the right legal documents needs precision and attention to detail, which is the reason it is vital to take samples of Texas Filing Form With Irs only from reliable sources, like US Legal Forms. A wrong template will waste your time and delay the situation you are in. With US Legal Forms, you have very little to be concerned about. You can access and check all the information regarding the document’s use and relevance for the circumstances and in your state or region.

Consider the listed steps to complete your Texas Filing Form With Irs:

- Make use of the catalog navigation or search field to find your sample.

- Open the form’s description to see if it suits the requirements of your state and region.

- Open the form preview, if there is one, to make sure the form is the one you are interested in.

- Go back to the search and find the correct template if the Texas Filing Form With Irs does not fit your requirements.

- If you are positive regarding the form’s relevance, download it.

- When you are a registered user, click Log in to authenticate and gain access to your picked forms in My Forms.

- If you do not have an account yet, click Buy now to obtain the form.

- Choose the pricing plan that suits your needs.

- Proceed to the registration to finalize your purchase.

- Finalize your purchase by picking a payment method (bank card or PayPal).

- Choose the document format for downloading Texas Filing Form With Irs.

- When you have the form on your device, you may change it using the editor or print it and complete it manually.

Remove the hassle that accompanies your legal documentation. Discover the comprehensive US Legal Forms collection where you can find legal templates, check their relevance to your circumstances, and download them on the spot.

Form popularity

FAQ

IRS.GOV/FREEFILE. Visit the Free File Site. Start the Process. Get Registered. Select Your 1040. Fill Out Your Tax Forms. E-File Your Tax Form. CREATE AN ACCOUNT.

What documents do I need to file my taxes? Social Security documents. Income statements such as W-2s and MISC-1099s. Tax forms that report other types of income, such as Schedule K-1 for trusts, partnership and S corporations. Tax deduction records. Expense receipts.

Choose an IRS Free File option, guided tax preparation or Free File Fillable Forms. You will be directed to the IRS partner's website to create a new account or if you are a previous user, log in to an existing account. Prepare and e-file your federal tax return. Receive an email when the IRS has accepted your return.

NETFILE Access Code You can file your tax returns directly through a NETFILE-certified tax software, which is more accurate with fewer chances of errors. You get immediate confirmation that we have received your tax return. You don't have to send in receipts, unless we ask for them at a later date.

Since Texas does not collect an income tax on individuals, you are not required to file a TX State Income Tax Return. However, you may need to prepare and efile a Federal Income Tax Return.