Texas Filing Form For Student

Description

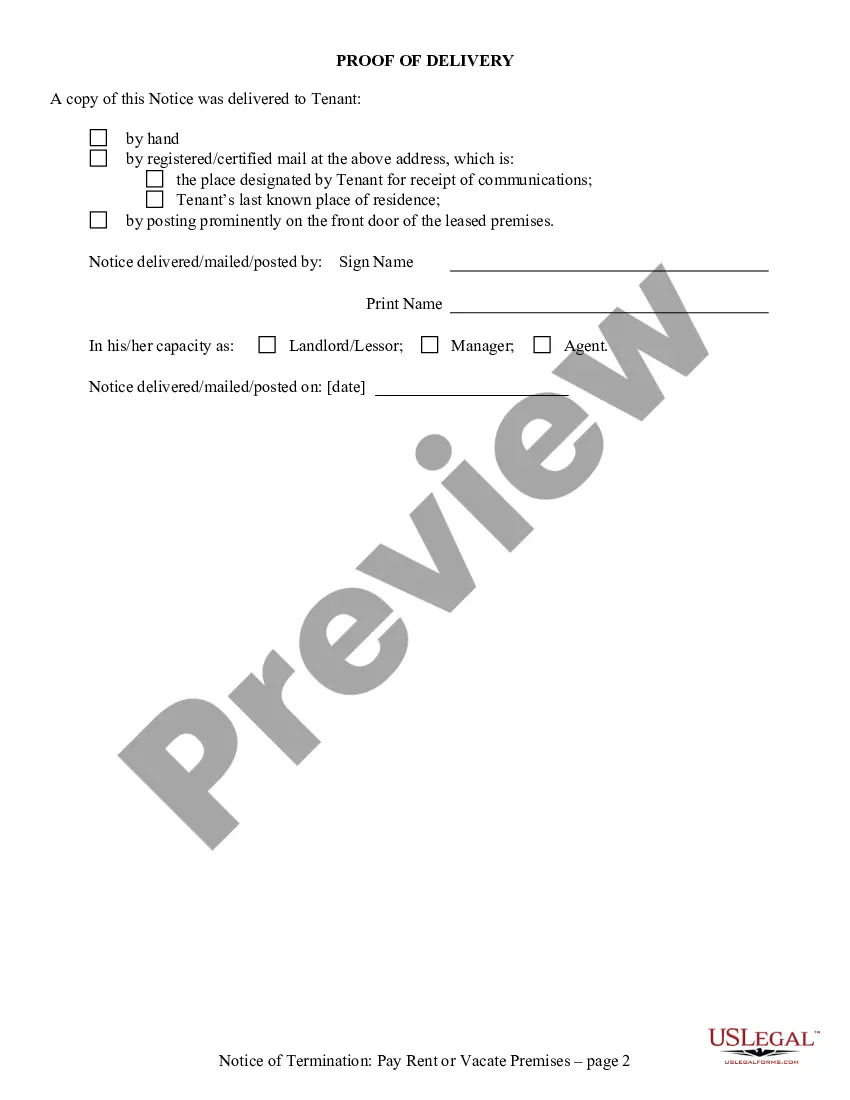

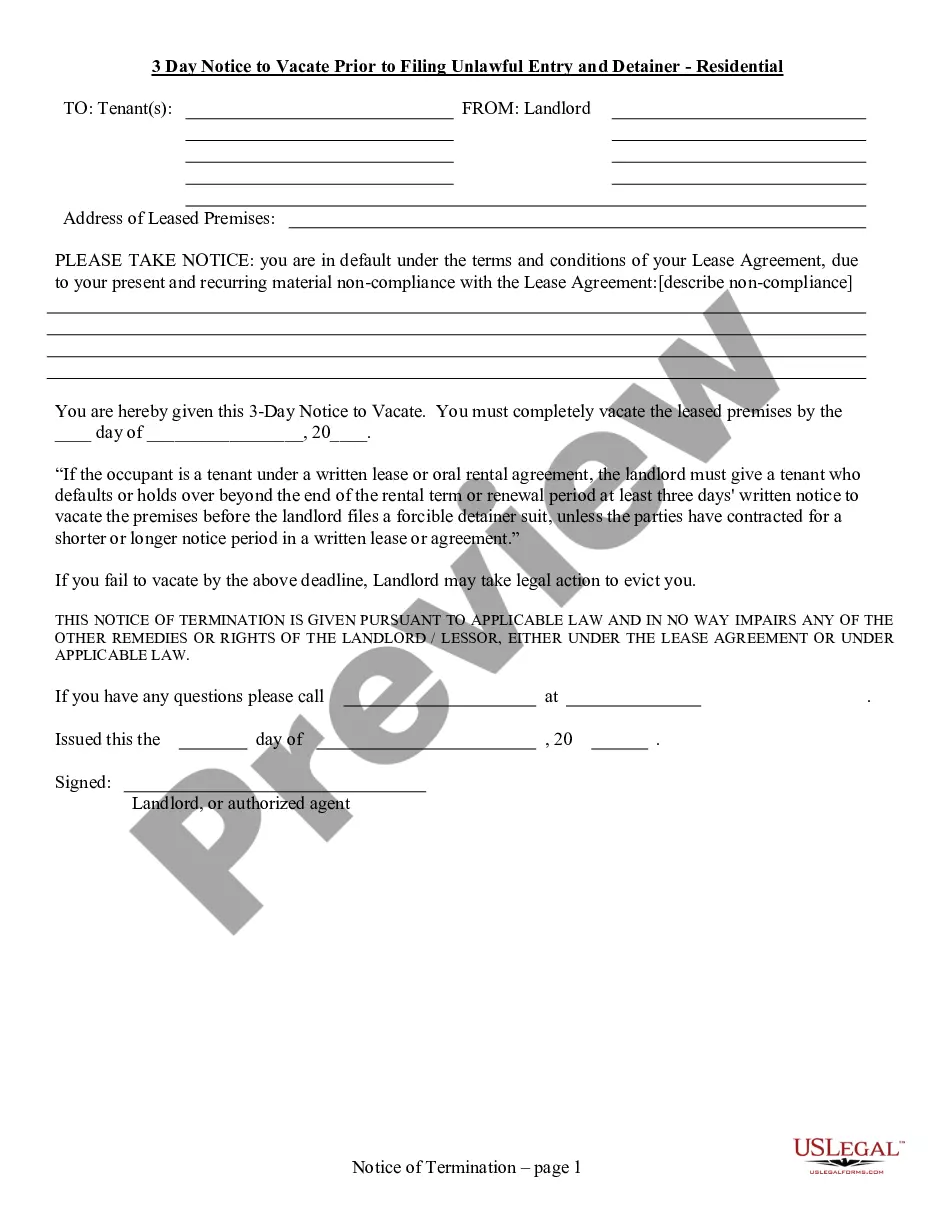

How to fill out Texas 3 Day Notice To Pay Rent Or Vacate (Prior To Filing Unlawful Entry And Detainer) - Residential?

Finding a go-to place to access the most recent and relevant legal samples is half the struggle of handling bureaucracy. Discovering the right legal papers demands precision and attention to detail, which is the reason it is very important to take samples of Texas Filing Form For Student only from trustworthy sources, like US Legal Forms. An improper template will waste your time and hold off the situation you are in. With US Legal Forms, you have little to worry about. You may access and check all the information concerning the document’s use and relevance for the situation and in your state or region.

Consider the listed steps to finish your Texas Filing Form For Student:

- Utilize the library navigation or search field to locate your sample.

- View the form’s information to check if it suits the requirements of your state and county.

- View the form preview, if available, to make sure the form is definitely the one you are interested in.

- Go back to the search and look for the proper template if the Texas Filing Form For Student does not fit your needs.

- If you are positive regarding the form’s relevance, download it.

- When you are an authorized customer, click Log in to authenticate and access your selected forms in My Forms.

- If you do not have a profile yet, click Buy now to obtain the template.

- Pick the pricing plan that fits your needs.

- Proceed to the registration to finalize your purchase.

- Finalize your purchase by selecting a payment method (bank card or PayPal).

- Pick the file format for downloading Texas Filing Form For Student.

- When you have the form on your device, you may change it using the editor or print it and complete it manually.

Eliminate the hassle that comes with your legal paperwork. Explore the extensive US Legal Forms catalog to find legal samples, check their relevance to your situation, and download them immediately.

Form popularity

FAQ

A student with no income can file an ITR. However, it is not at all mandatory. Filing returns is compulsory if an individual comes under the tax slabs( income above 2.5 lacs). Thus a person with income less than 2.5 lacs or no income need not file returns.

How to file the FAFSA as an independent student Determine dependency status. ... Create a Federal Student Aid ID (FSA ID) ... Start the FAFSA application. ... Fill out your personal information. ... List the schools you plan to apply to. ... Answer dependency status questions. ... Sign and submit the FAFSA before the deadline.

An unmarried dependent student must file a tax return if his or her earned or unearned income exceeds certain limits. To find these limits, refer to "Dependents" under "Who Must File" in Publication 501, Dependents, Standard Deduction and Filing Information.

The 1098-T, Tuition Statement form reports tuition expenses you paid for college tuition that might entitle you to an adjustment to income or a tax credit. Information on the 1098-T is available from the IRS at Form 1098-T, Tuition Statement.

Tax Filing Status ? Select Will File, Already Completed, or Not Going to File then click ?Continue.? Select the type of tax return you filed (most likely the IRS 1040) then select your tax filing status.