Texas Filing Form For Irs

Description

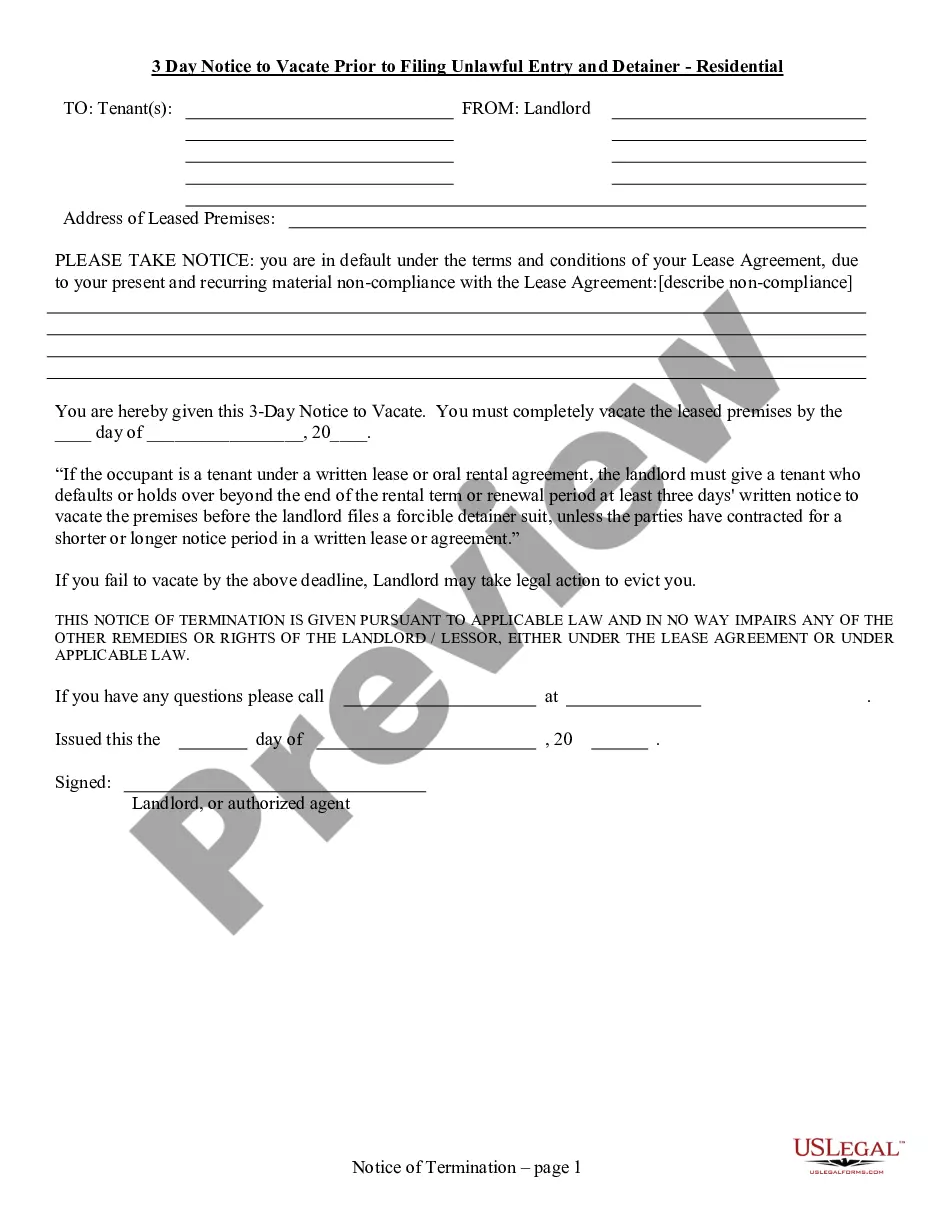

How to fill out Texas 3 Day Notice To Pay Rent Or Vacate (Prior To Filing Unlawful Entry And Detainer) - Residential?

Dealing with legal documents and operations might be a time-consuming addition to your entire day. Texas Filing Form For Irs and forms like it usually need you to look for them and understand the best way to complete them appropriately. For that reason, if you are taking care of economic, legal, or personal matters, having a extensive and hassle-free online library of forms at your fingertips will help a lot.

US Legal Forms is the best online platform of legal templates, featuring over 85,000 state-specific forms and a variety of tools that will help you complete your documents effortlessly. Explore the library of pertinent documents available to you with just one click.

US Legal Forms provides you with state- and county-specific forms offered at any time for downloading. Protect your document management processes having a top-notch services that lets you prepare any form in minutes without any extra or hidden charges. Simply log in in your account, locate Texas Filing Form For Irs and acquire it immediately within the My Forms tab. You may also access previously downloaded forms.

Would it be your first time using US Legal Forms? Sign up and set up a free account in a few minutes and you’ll have access to the form library and Texas Filing Form For Irs. Then, follow the steps listed below to complete your form:

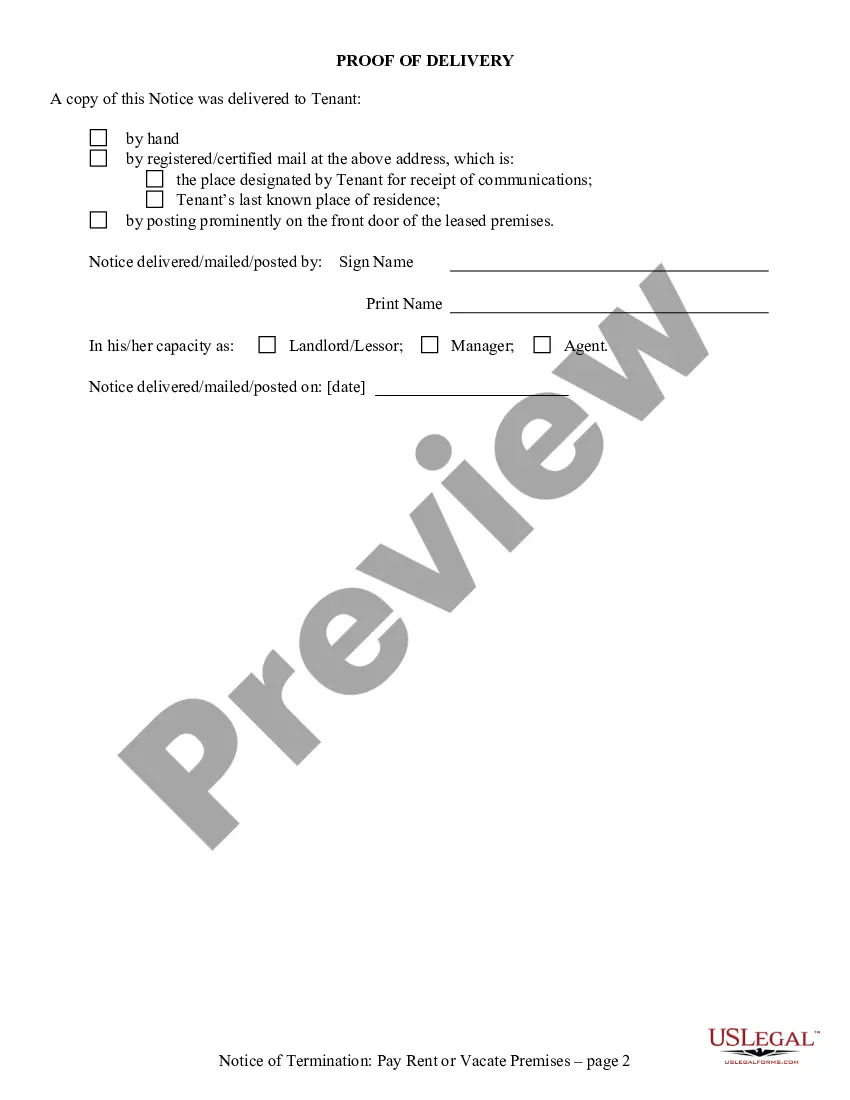

- Be sure you have the proper form using the Preview feature and reading the form description.

- Select Buy Now when ready, and choose the subscription plan that is right for you.

- Select Download then complete, eSign, and print out the form.

US Legal Forms has twenty five years of experience helping users manage their legal documents. Find the form you require right now and streamline any operation without having to break a sweat.

Form popularity

FAQ

The simplest IRS form is the Form 1040EZ. The 1040A covers several additional items not addressed by the EZ. And finally, the IRS Form 1040 should be used when itemizing deductions and reporting more complex investments and other income.

Form 1040 is used by U.S. taxpayers to file an annual income tax return.

Since Texas does not collect an income tax on individuals, you are not required to file a TX State Income Tax Return. However, you may need to prepare and efile a Federal Income Tax Return.

If you live in Texas... and you are filing a Form...and you are not enclosing a payment, then use this address...1040Department of the Treasury Internal Revenue Service Austin, TX 73301-00021040-ESN/A1040-ES(NR)N/A1040-VN/A2 more rows

IRS.GOV/FREEFILE. Visit the Free File Site. Start the Process. Get Registered. Select Your 1040. Fill Out Your Tax Forms. E-File Your Tax Form. CREATE AN ACCOUNT.