Texas Filing Form For Business

Description

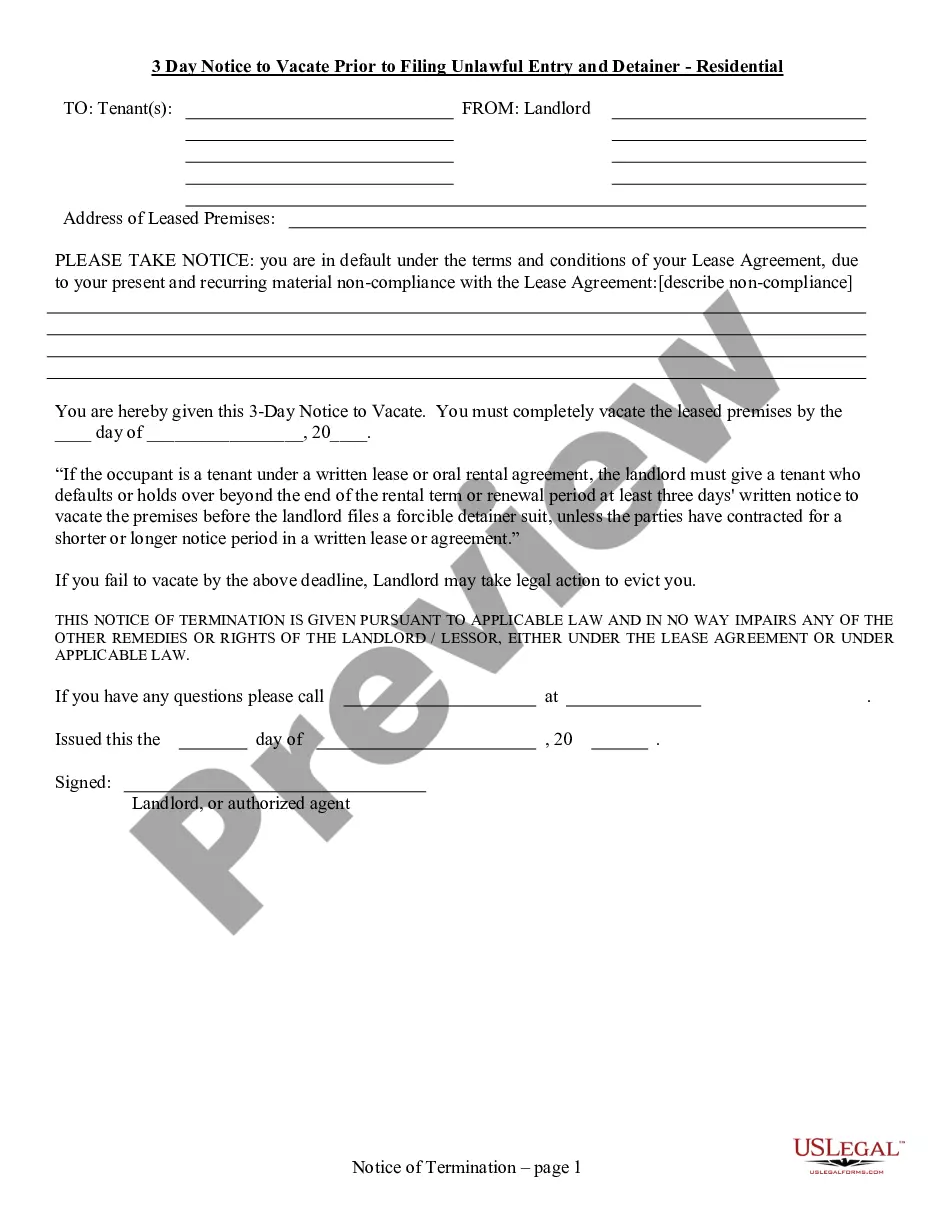

How to fill out Texas 3 Day Notice To Pay Rent Or Vacate (Prior To Filing Unlawful Entry And Detainer) - Residential?

Drafting legal paperwork from scratch can often be a little overwhelming. Certain scenarios might involve hours of research and hundreds of dollars spent. If you’re searching for an easier and more cost-effective way of preparing Texas Filing Form For Business or any other forms without the need of jumping through hoops, US Legal Forms is always at your fingertips.

Our virtual library of more than 85,000 up-to-date legal documents covers virtually every aspect of your financial, legal, and personal affairs. With just a few clicks, you can quickly access state- and county-specific forms carefully prepared for you by our legal experts.

Use our website whenever you need a trustworthy and reliable services through which you can quickly locate and download the Texas Filing Form For Business. If you’re not new to our website and have previously created an account with us, simply log in to your account, locate the form and download it away or re-download it anytime later in the My Forms tab.

Not registered yet? No worries. It takes minutes to register it and navigate the catalog. But before jumping directly to downloading Texas Filing Form For Business, follow these tips:

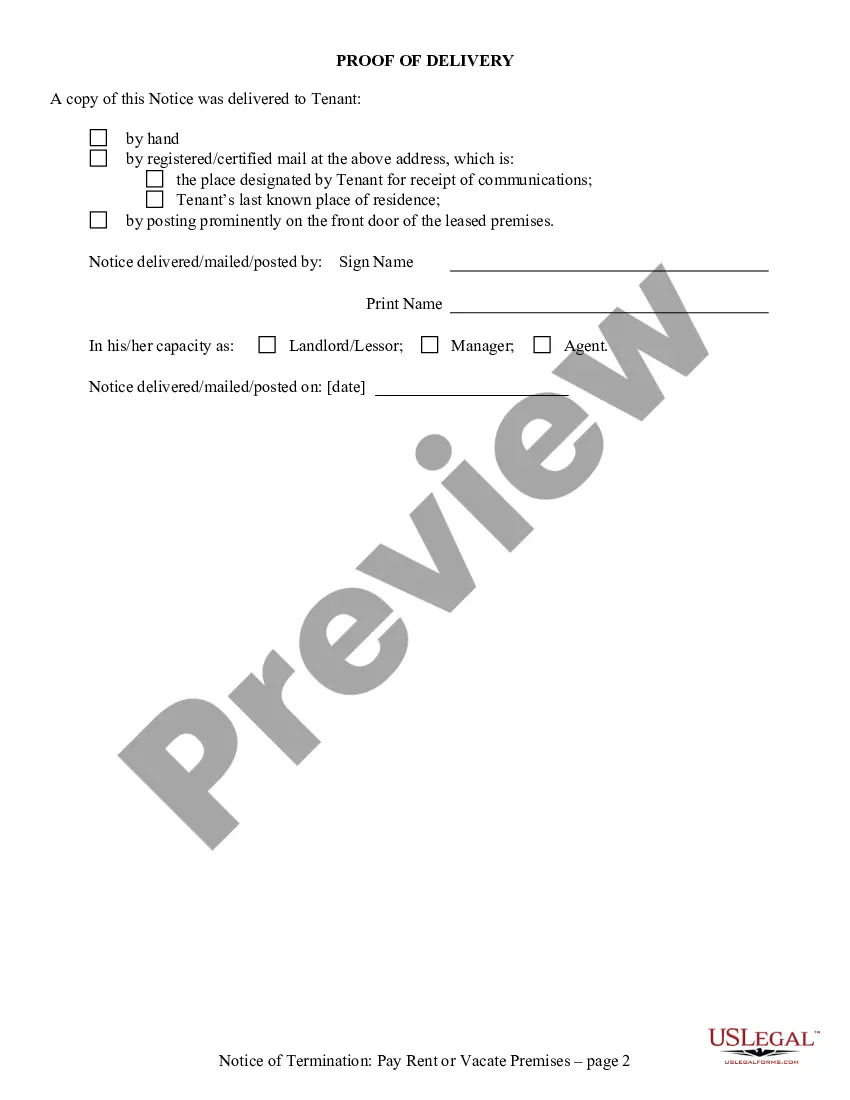

- Check the form preview and descriptions to ensure that you have found the form you are searching for.

- Make sure the template you choose complies with the regulations and laws of your state and county.

- Choose the right subscription option to purchase the Texas Filing Form For Business.

- Download the file. Then fill out, certify, and print it out.

US Legal Forms boasts a good reputation and over 25 years of experience. Join us now and turn form completion into something simple and streamlined!

Form popularity

FAQ

Instead of an annual report, Texas requires LLCs to file an Annual Franchise Tax Return each year. While this is technically a tax, only businesses that make over $1.23 million in annual revenue will actually need to pay money. Businesses earning less than that just need to file a No Tax Due Report.

Official Form 201. Voluntary Petition for Non-Individuals Filing for Bankruptcy.

The LLC needs to file a 1065 Partnership Return and issue a Schedule K-1 to the LLC owners. The K-1s report each owner's distributive share of profits. And the K-1 income ?flows through? to the owners. The income taxes are then paid by each owner on their personal income tax return (Form 1040).

Texas LLC application File a certificate of formation. ... Choose a registered agent. ... Create an LLC operating agreement. ... Get an EIN. ... Apply for business licenses. ... Apply for a tax permit. ... Open a business bank account. ... Obtain business insurance.

Create Your Texas LLC in Five Steps Step 1: Choose a Name for Your LLC. ... Step 2: Appoint a Registered Agent. ... Step 3: File the Certificate of Formation. ... Step 4: Create Your Operating Agreement. ... Step 5: Obtain an Employer Identification Number.