Texas 04

Description

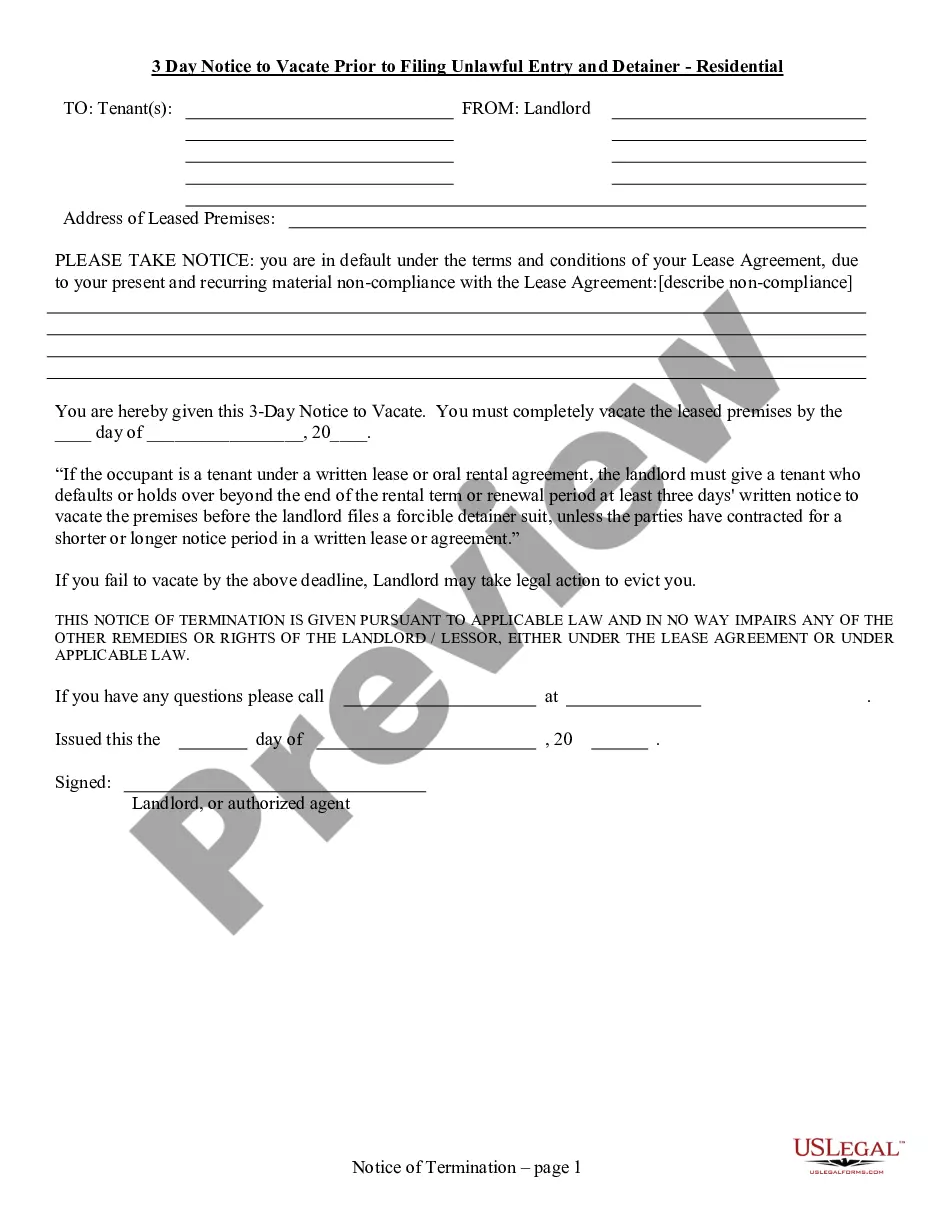

How to fill out Texas 3 Day Notice To Pay Rent Or Vacate (Prior To Filing Unlawful Entry And Detainer) - Residential?

- Log in to your account if you have used US Legal Forms before. Ensure your subscription is active; if not, renew it according to your plan.

- Browse through the Preview mode and form description to verify that you have selected the appropriate document that aligns with your legal needs and jurisdiction.

- If necessary, utilize the Search tab to locate other templates that may suit your requirements better.

- Purchase your selected form by clicking the Buy Now button and choosing the subscription plan that works best for you. Create an account to access the full range of resources.

- Complete your purchase by entering your payment details, whether via credit card or PayPal.

- Download your chosen form and save it directly to your device. You can always find it again in the My Forms section of your profile.

Using US Legal Forms ensures you gain access to a vast collection of over 85,000 documents, all designed to be user-friendly. Additionally, the service allows for expert assistance during form completion, guaranteeing that your documents are accurate and legally compliant.

Start your journey with US Legal Forms today and experience the convenience and expertise at your fingertips. Don't wait—unlock the benefits now!

Form popularity

FAQ

To obtain a level 4 security license in Texas, you must meet specific requirements set by the Texas Department of Public Safety. Start by completing the required training program and passing the necessary background checks. After that, you can submit your application, including all required documents and fees. For detailed information on legal forms and guidance through this process, consider using uslegalforms.

In Texas, District 4 encompasses several counties, including Collin, Dallas, Denton, and parts of Grayson County. Each of these regions contributes to the unique characteristics of Texas 04. Residents and businesses in these counties benefit from the services and resources available within the district. If you need assistance with legal forms specific to these counties, uslegalforms can guide you through the necessary documentation.

Most states have their own version of a W4 form that determines state tax withholding. However, Texas is unique in that it does not impose any state income tax, meaning there is no state W4 form to fill out. Residents only need to concern themselves with the federal W4. Explore US Legal Forms for easy access to the proper documentation for your tax situation.

If you fail to file your Texas franchise tax, your business may face penalties and interest on the owed amount. Additionally, not filing can lead to your business being marked as 'inactive' or even revoked entirely. To avoid such issues, it's advisable to file your taxes on time and stay informed. Using US Legal Forms can help you keep track of your obligations effectively and ensure timely submissions.

To file your Texas franchise tax online, visit the Texas Comptroller's website and follow the prompts for business filings. You will need to create an account if you do not already have one, and then you can submit your reports electronically. Ensure that you have your business information and any necessary financial documents ready. US Legal Forms offers guidance to help you navigate online filings with ease.

No, Texas does not have a state W4 because it does not collect state income tax. Employees in Texas only need to complete the federal W4 for federal income tax purposes. This alleviates some paperwork and confusion, allowing you to focus on managing your finances more efficiently. For more information, you can explore US Legal Forms for easy access to the federal forms you need.

Since Texas does not have a state income tax, there is no specific form needed for state income tax withholding. Employees only complete the federal W4 to determine their federal tax withholdings. The absence of state income tax can be a financial relief for residents in Texas, making tax planning simpler. Use resources from US Legal Forms to obtain the necessary federal documentation effortlessly.

Texas does not have a specific state W4 form since it does not impose a state income tax. Therefore, you only need to complete the federal W4 form for your employer. This means your income will be subject to federal withholding, but you won’t need to worry about state tax deductions. By utilizing resources like US Legal Forms, you can access the federal W4 easily and correctly.

To fill out the W4 in Texas, begin by entering your personal information, such as your name and Social Security number. Next, indicate your filing status and dependents if applicable, which will help determine your withholding allowances. At the end, sign and date the form before submitting it to your employer. Remember, using services like US Legal Forms can simplify this process, ensuring you complete your Texas 04 accurately.

Filling out the Texas two step involves providing information such as your name, address, and the required vehicle details on the application. You may also need to include proof of insurance and other necessary documentation. After completing the form, submit it at your local Department of Public Safety. For assistance and templates, check US Legal Forms.