Mediation Agreement In Divorce

Description

How to fill out Texas Agreement For Mediation?

Locating a reliable source for the latest and most pertinent legal templates is a significant part of navigating bureaucracy.

Identifying the appropriate legal forms requires accuracy and thoroughness, which is why it is essential to obtain samples of Mediation Agreement In Divorce exclusively from trustworthy sources, such as US Legal Forms. An incorrect template can squander your time and delay your current situation.

Eliminate the stress associated with your legal documentation. Explore the extensive US Legal Forms library to locate legal templates, evaluate their appropriateness for your situation, and download them immediately.

- Utilize the catalog navigation or search box to find your template.

- Examine the form’s details to determine if it satisfies the requirements of your state and locality.

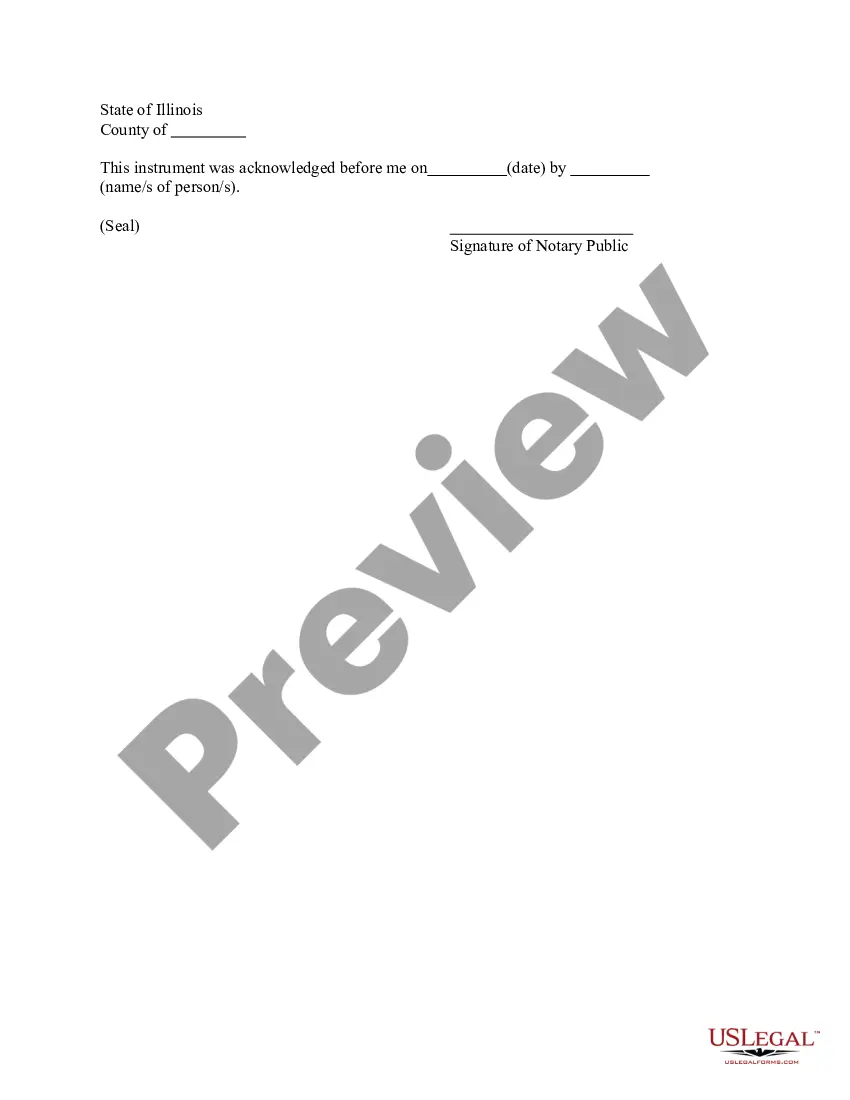

- View the form preview, if available, to confirm that the template is indeed the one you need.

- Return to the search to find the correct document if the Mediation Agreement In Divorce does not meet your requirements.

- When you are confident about the form’s relevance, download it.

- If you are a registered customer, click Log in to verify and access your chosen forms in My documents.

- If you do not yet possess an account, click Buy now to acquire the form.

- Select the pricing option that meets your needs.

- Proceed with the registration to finalize your acquisition.

- Complete your transaction by choosing a payment method (credit card or PayPal).

- Choose the file format for downloading the Mediation Agreement In Divorce.

- Once you have the form on your device, you can edit it using the editor or print it out to fill it in by hand.

Form popularity

FAQ

An assignment of mortgage gives the loan seller's rights under the mortgage, including the right to foreclose if the borrower doesn't make payments, to the new owner of the loan.

An assignment of mortgage under Florida law used to assign and transfer a mortgage from one lender to another.

If the lender fails to record a satisfaction within set time limits, the lender may be responsible for damages set by statute for failure to timely cancel the lien. Depending on your state, a satisfaction may be called a Satisfaction, Cancellation, or Reconveyance.

This document was created when a mortgagee wished to recover his money, but the mortgagor could not pay it back. The mortgagee would assign the mortgage to another person, who would pay him the money he was owed.

In real estate wholesaling, an assignment fee is a financial obligation from one party (the ?assignor?) who agrees to transfer their contractual obligations to another party (the ?assignee.?) In layman's terms, the assignment fee is the fee paid by the end buyer to the real estate wholesaler.

The most common example of an Assignment of Mortgage is when a mortgage lender transfers/sells the mortgage to another lender. This can be done more than once until the balance is paid. The lender does not have to inform the borrower that the mortgage is being assigned to another party.

Mortgages are assigned using a document called an assignment of mortgage. This legally transfers the original lender's interest in the loan to the new company. After doing this, the original lender will no longer receive the payments of principal and interest.

A disadvantage of a mortgage assignment is the consequences of failing to record it. Under most state laws, an entity seeking to institute foreclosure proceedings must record the assignment before it can do so. If a mortgage is not recorded, the judge will dismiss the foreclosure proceeding.