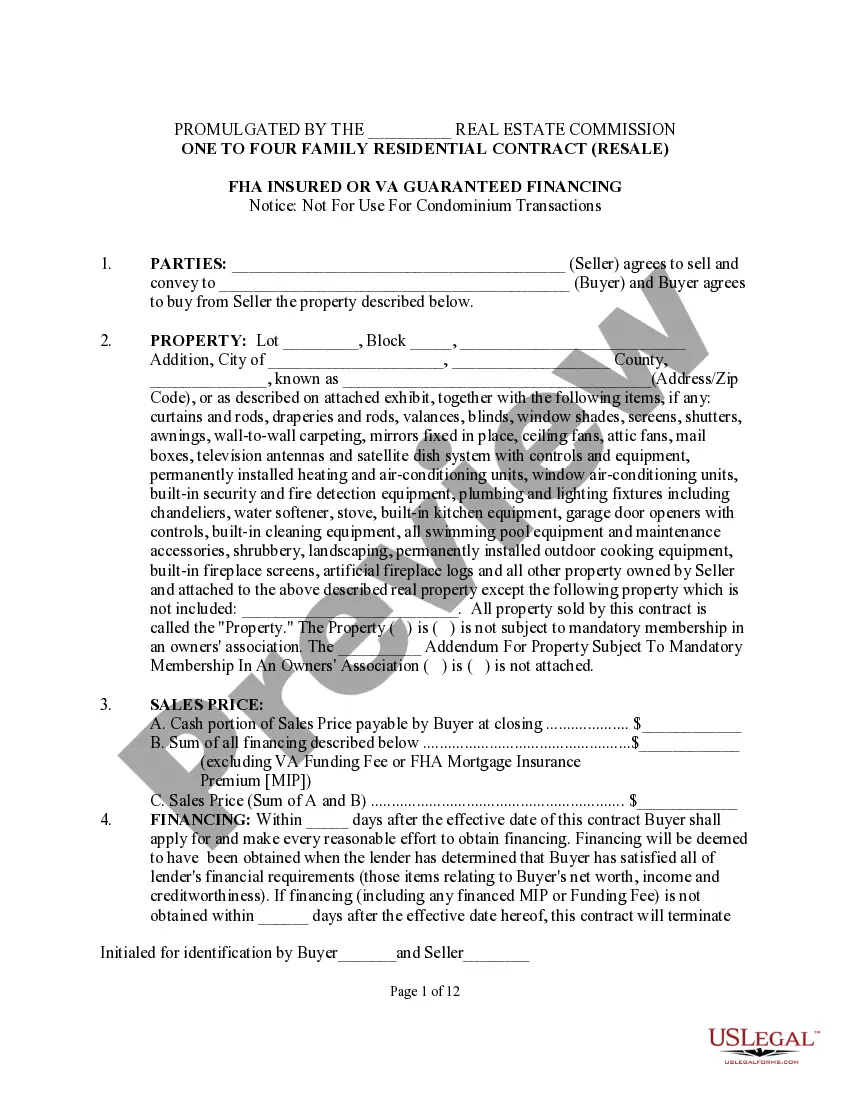

Residential Contract Selling With Payments

Description

How to fill out Texas One To Four Family Residential Contract - Resale - All Cash, Assumption, Third Party Conventional Or Seller Financing?

Identifying a reliable source to obtain the latest and pertinent legal templates is a significant part of navigating bureaucracy. Locating the appropriate legal documents requires accuracy and carefulness, which is why it's crucial to gather samples of Residential Contract Selling With Payments exclusively from trustworthy sources, such as US Legal Forms. An incorrect template can squander your time and delay the matter at hand. With US Legal Forms, you can have peace of mind. You can access and review all the details regarding the document’s application and pertinence for your situation and within your jurisdiction.

Take into account the outlined steps to complete your Residential Contract Selling With Payments.

Eliminate the hassle associated with your legal documents. Browse the extensive US Legal Forms library to discover legal templates, evaluate their relevance to your situation, and download them with ease.

- Use the library navigation or search tool to find your template.

- Review the form’s details to determine if it meets the criteria of your region and locale.

- Check the form preview, if accessible, to confirm that the template is the one you require.

- Return to the search results and find the appropriate document if the Residential Contract Selling With Payments does not meet your needs.

- Once you are certain of the form’s applicability, download it.

- If you are a registered user, click Log in to verify and access your selected templates in My documents.

- If you do not possess an account yet, click Buy now to purchase the form.

- Select the pricing plan that suits your needs.

- Proceed to the registration to complete your purchase.

- Finalize your payment by selecting a method (credit card or PayPal).

- Choose the file format for downloading Residential Contract Selling With Payments.

- After you have the form on your device, you can edit it with the editor or print it out and complete it manually.

Form popularity

FAQ

You are subject to the terms of your bankruptcy for at least 12 months. Then you are usually 'discharged,' and the terms no longer apply.

There are times when it's necessary to update (amend) the forms. You must file an amendment when: there is a mistake or error in your bankruptcy forms, or. there is an omission, missing information, or information you forgot to include, or. your circumstances have significantly changed since you filed the case, or.

If you make a mistake or accidentally leave information out of your bankruptcy forms, you can almost always amend them after you file. The trustee in your bankruptcy case may also ask you to file an amendment after meeting with you in your 341 meeting.

Chapter 7 bankruptcy requires that you liquidate your non-exempt assets to receive a discharge of your outstanding debts. When you are ready to take control of your debt, a Chapter 7 lawyer in Hawaii can help.

Dismissal of a Bankruptcy Case ? Dismissal ordinarily means that the court stopped all proceedings in the main bankruptcy case AND in all adversary proceedings, and a discharge order was not entered. Dismissal can occur because a debtor requested the dismissal and qualifies for voluntary dismissal.

To add debt to Chapter 13, the debtor must motion the court to modify their repayment plan. Once your lawyer files the motion, you must show you cannot pay the new debt outside of the plan. Additionally, adding the new debt cannot negatively impact the current creditors.

If you receive this notice, it means one of three things: The address you provided for the creditor in your bankruptcy paperwork was incorrect, The court sent you notice of your own bankruptcy via this form, or. Someone who owes you money filed bankruptcy.

Background. A chapter 7 bankruptcy case does not involve the filing of a plan of repayment as in chapter 13. Instead, the bankruptcy trustee gathers and sells the debtor's nonexempt assets and uses the proceeds of such assets to pay holders of claims (creditors) in ance with the provisions of the Bankruptcy Code.

If your total monthly income over the course of the next 60 months is less than $7,475 then you pass the means test and you may file a Chapter 7 bankruptcy. If it is over $12,475 then you fail the means test and don't have the option of filing Chapter 7.

Chapter 7 bankruptcy allows liquidation of assets to pay creditors. Unsecured priority debt is paid first in a Chapter 7, after which comes secured debt and then nonpriority unsecured debt.