Property Lien Release Form Texas With Lien Release

Description

How to fill out Texas Release Of Lien?

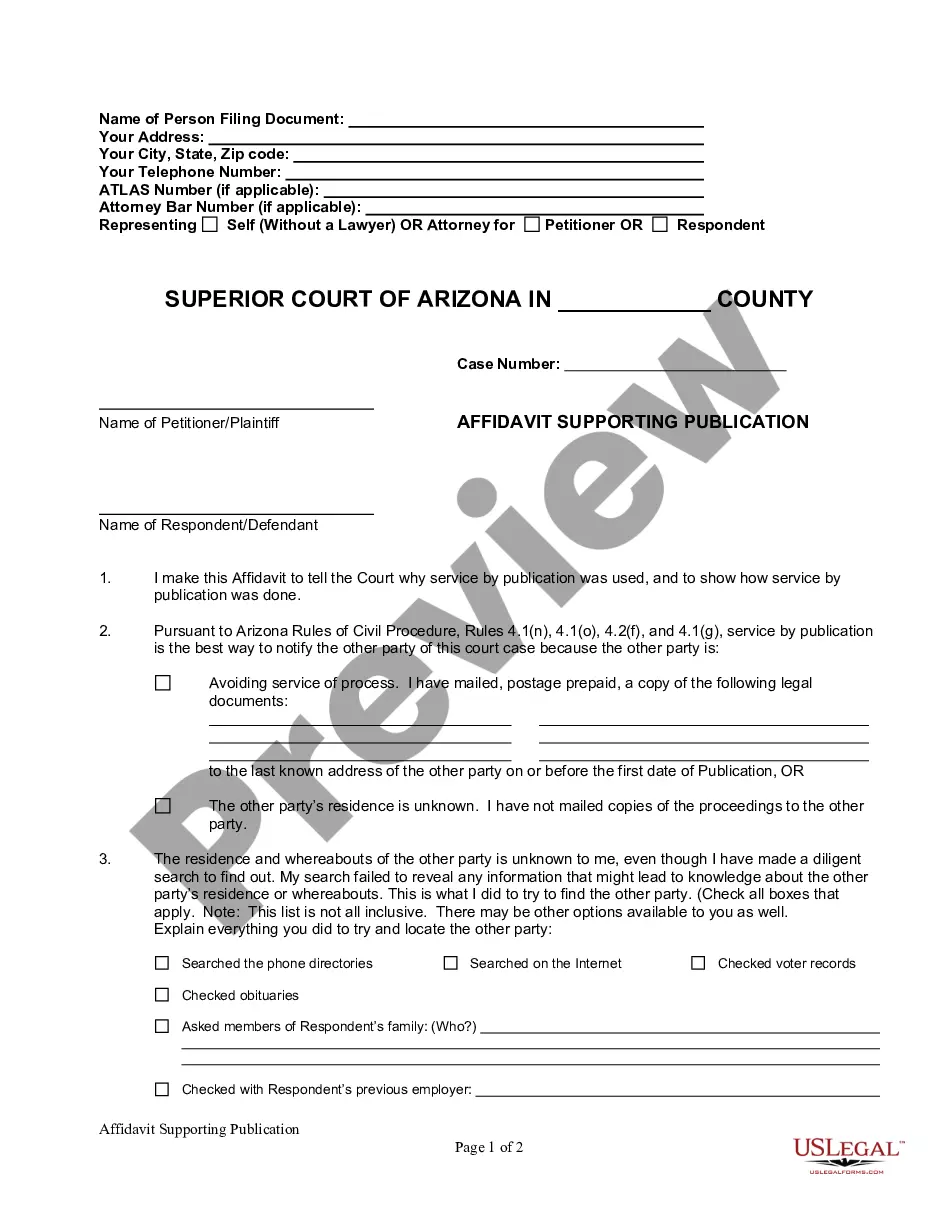

Whether for business purposes or for personal affairs, everyone has to deal with legal situations sooner or later in their life. Completing legal documents requires careful attention, starting with choosing the appropriate form template. For instance, when you select a wrong version of the Property Lien Release Form Texas With Lien Release, it will be declined once you submit it. It is therefore crucial to have a dependable source of legal papers like US Legal Forms.

If you have to obtain a Property Lien Release Form Texas With Lien Release template, stick to these simple steps:

- Get the template you need by using the search field or catalog navigation.

- Look through the form’s description to ensure it suits your situation, state, and county.

- Click on the form’s preview to examine it.

- If it is the wrong form, return to the search function to locate the Property Lien Release Form Texas With Lien Release sample you require.

- Download the file if it meets your requirements.

- If you have a US Legal Forms account, just click Log in to gain access to previously saved documents in My Forms.

- In the event you do not have an account yet, you may download the form by clicking Buy now.

- Select the appropriate pricing option.

- Finish the account registration form.

- Select your payment method: you can use a credit card or PayPal account.

- Select the document format you want and download the Property Lien Release Form Texas With Lien Release.

- After it is saved, you are able to complete the form with the help of editing applications or print it and complete it manually.

With a vast US Legal Forms catalog at hand, you don’t have to spend time seeking for the appropriate template across the web. Use the library’s easy navigation to find the correct form for any situation.

Form popularity

FAQ

VTR-266 Rev 10/16. Form available online at .TxDMV.gov.

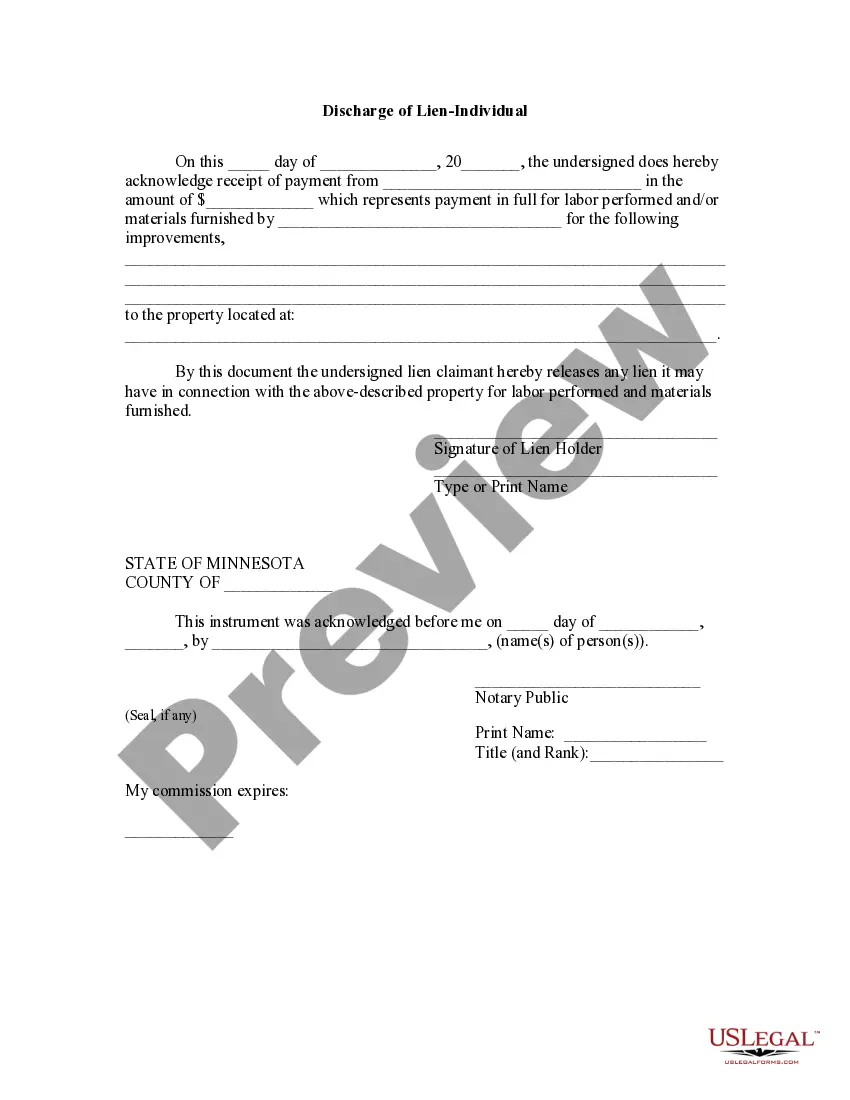

Release Of Lien Texas Form To show that a lien has officially been removed on a property, you have to file a document called a ?lien release? in the real property records of the county where the property is located. A release of lien simply means removing the lien claim from a specific property.

Ing to this law, a debtor must file an affidavit with the county to secure the release of a judgment lien against a primary residence. The debtor must first provide a 30-day notice letter to the creator of the judgment, containing a copy of the affidavit the debtor intends to file.

By filing a judgment lien, if the debtor sells any non-exempt property, you may be able to get all or some of the money you are owed from the proceeds of the sale. A judgment lien lasts for ten years.

You will need to: Schedule a title transfer appointment with the tax office. Complete the Application for Texas Title (130-U) Provide your original release of lien letter or document and a valid photo ID. Pay the $33 application fee for a new title.