Original Release Of Lien

Description

How to fill out Texas Release Of Lien?

It’s clear that you cannot transform into a legal authority in a single night, nor can you swiftly acquire the skill to draft an Original Release Of Lien without having a specialized foundation.

Generating legal documents is a labor-intensive process that demands specific education and competencies.

So why not entrust the drafting of the Original Release Of Lien to the professionals.

If you need any other form, feel free to initiate your search anew.

Create a free account and choose a subscription plan to purchase the template. Select Buy now. Once your payment is completed, you can download the Original Release Of Lien, complete it, print it, and send it to the relevant individuals or organizations.

- With US Legal Forms, featuring one of the most comprehensive collections of legal documents, you can discover everything from court filings to office communication templates.

- We recognize the importance of compliance and observance of federal and local regulations.

- Thus, all templates on our platform are tailored to specific locations and are current.

- To get started, utilize the search bar located at the top of the page to find the form you require.

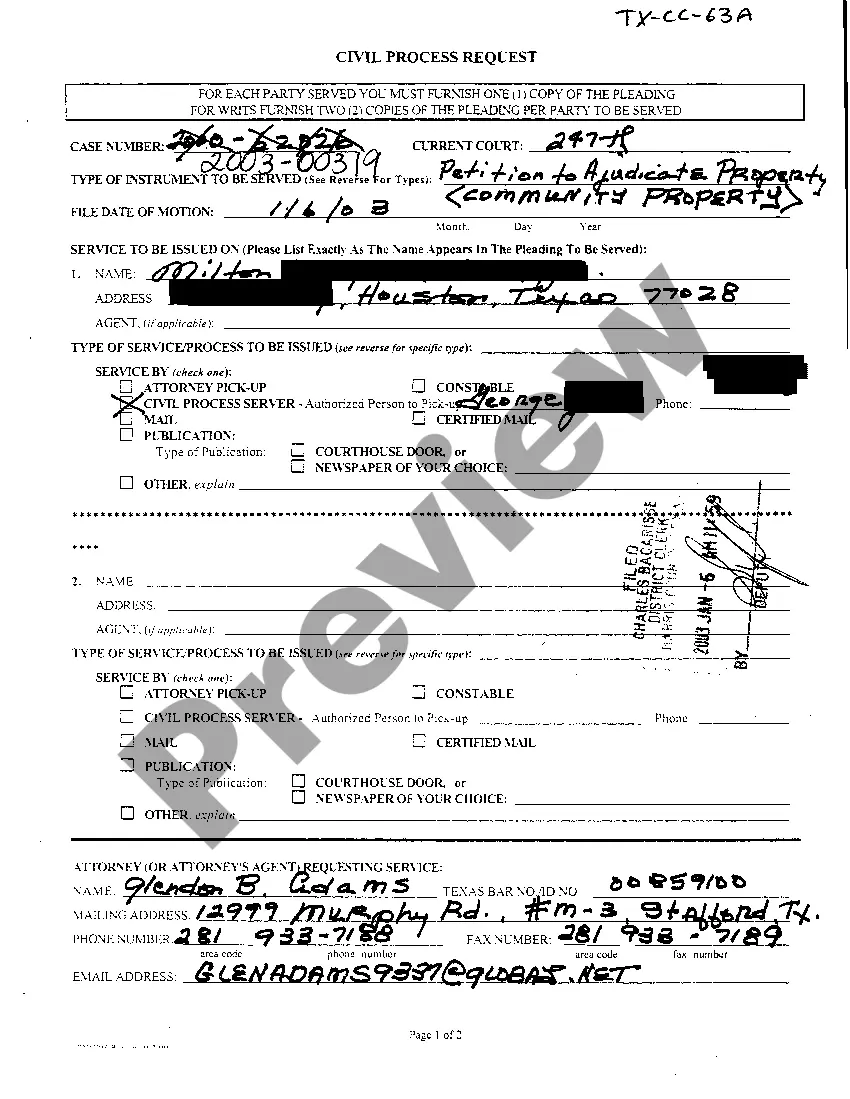

- If available, preview it and review the accompanying description to ascertain if the Original Release Of Lien meets your needs.

Form popularity

FAQ

A lien is a legal claim or right against an asset that is typically used as collateral to satisfy a debt. When a lien is placed on a property, it means the creditor has an interest in that property until the obligation is fulfilled. Understanding the original release of lien is crucial, as it signifies the removal of that claim once the debt is settled. This process helps property owners regain full control and ownership of their assets.

The property owner will need to have the judgment lien removed so the title can be cleared and the property sold. A knowledgeable California debt settlement attorney can have the lien taken off, possibly without payment to the creditor or debt collector.

To add or remove a lien on your vehicle title, visit your local county tax office. The title fee is $28 or $33, depending on your county, and must be paid at time of application. Please contact your local county tax office for the exact cost.

Writing an effective Notice of Lien Letter is crucial to protect the interests of both parties involved in a debt dispute. It should include the debtor's full contact information and business details, an exact breakdown of the amount owed, and any relevant legal and factual information.

Release details: Provide a statement confirming that the borrower has fully repaid the debt and that the lienholder is relinquishing their legal claim on the property or asset. Include the date when the borrower paid off the debt.

Protect Yourself With a Release of Lien (Lien Waiver) Fortunately, it's a simple process. A Lien Waiver is similar to a receipt. It basically states that you've paid the subcontractor what is owed, they accept the payment in full, and they waive the right to put a lien on your property.