Texas Property All With Exemptions

Description

How to fill out Texas Correction Warranty Deed?

Handling legal papers and procedures might be a time-consuming addition to your day. Texas Property All With Exemptions and forms like it often need you to search for them and understand the best way to complete them correctly. Therefore, whether you are taking care of economic, legal, or individual matters, having a thorough and hassle-free web catalogue of forms when you need it will help a lot.

US Legal Forms is the best web platform of legal templates, offering over 85,000 state-specific forms and a variety of tools to help you complete your papers easily. Check out the catalogue of relevant documents available to you with just a single click.

US Legal Forms gives you state- and county-specific forms available at any moment for downloading. Shield your papers management operations by using a high quality service that lets you prepare any form within minutes with no extra or hidden fees. Just log in in your profile, identify Texas Property All With Exemptions and acquire it right away within the My Forms tab. You may also gain access to formerly downloaded forms.

Would it be your first time making use of US Legal Forms? Register and set up your account in a few minutes and you’ll have access to the form catalogue and Texas Property All With Exemptions. Then, adhere to the steps below to complete your form:

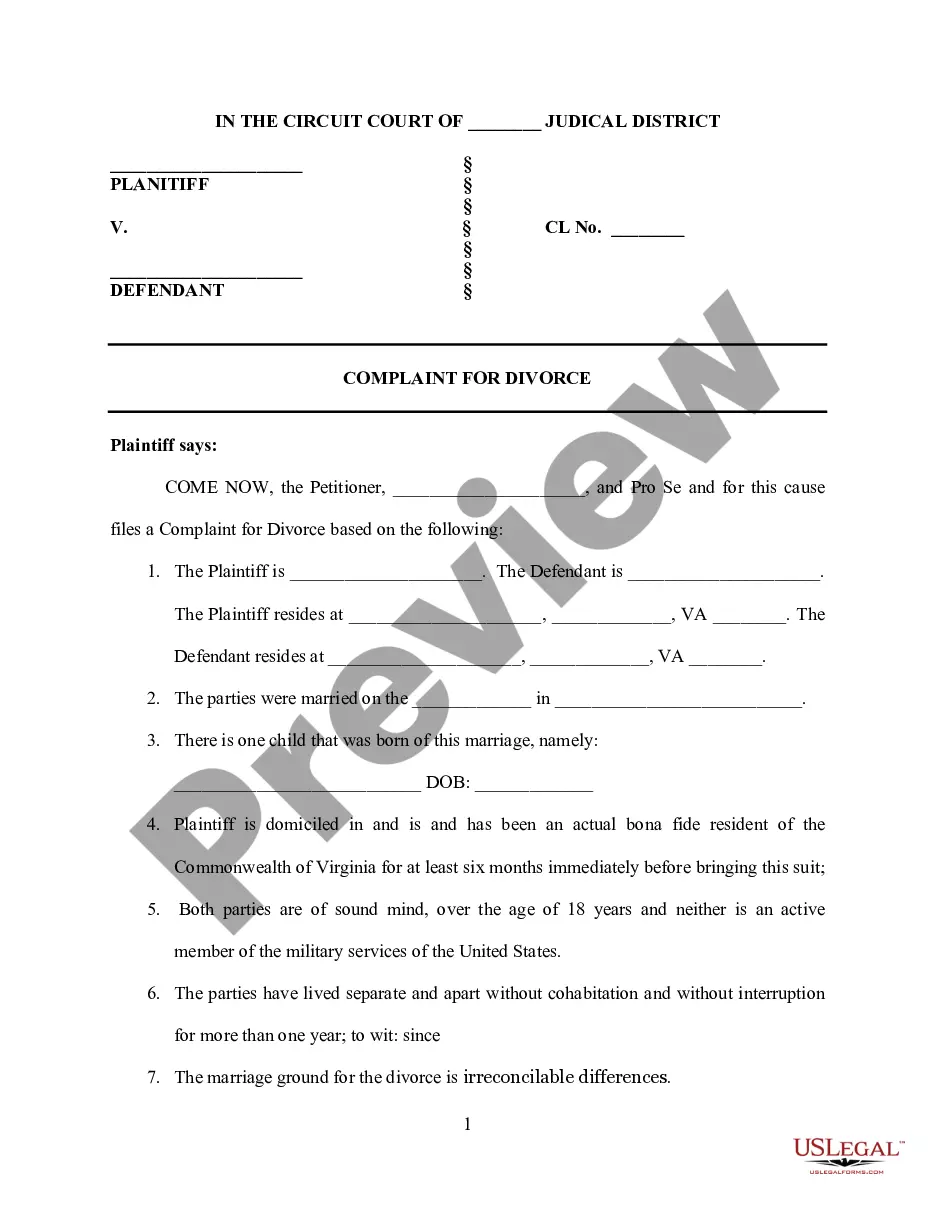

- Be sure you have discovered the proper form using the Review feature and looking at the form description.

- Pick Buy Now once ready, and select the monthly subscription plan that is right for you.

- Choose Download then complete, sign, and print the form.

US Legal Forms has 25 years of experience assisting users deal with their legal papers. Discover the form you require right now and enhance any process without having to break a sweat.

Form popularity

FAQ

An exemption certificate must show: (1) the name and address of the purchaser; (2) a description of the item to be purchased; (3) the reason the purchase is exempt from tax; (4) the signature of the purchaser and the date; and. (5) the name and address of the seller.

HECHO! How to Fill out Texas Homestead Exemption 2022 YouTube Start of suggested clip End of suggested clip Address is different make sure you type in your mailing. Address here for section 3 put in the dateMoreAddress is different make sure you type in your mailing. Address here for section 3 put in the date you became the owner of the property. And then put the date you began living in the property.

To apply for exemption, complete AP-205 and provide all required documentation as listed in the application. If the organization is unincorporated, include a copy of the organization's governing document, such as the bylaws or constitution. The document must show that the organization is nonprofit.

What Property Tax Exemptions Are Available in Texas? General Residence Homestead. Age 65 or Older or Disabled. Manufactured and Cooperative Housing. Uninhabitable or Unstable Residence. Temporary Exemption for Disaster Damage.

Applications for property tax exemptions are filed with the appraisal district in which the property is located. The general deadline for filing an exemption application is before May 1. Appraisal district chief appraisers are solely responsible for determining whether or not property qualifies for an exemption.