Deed Transfer Upon Death

Description

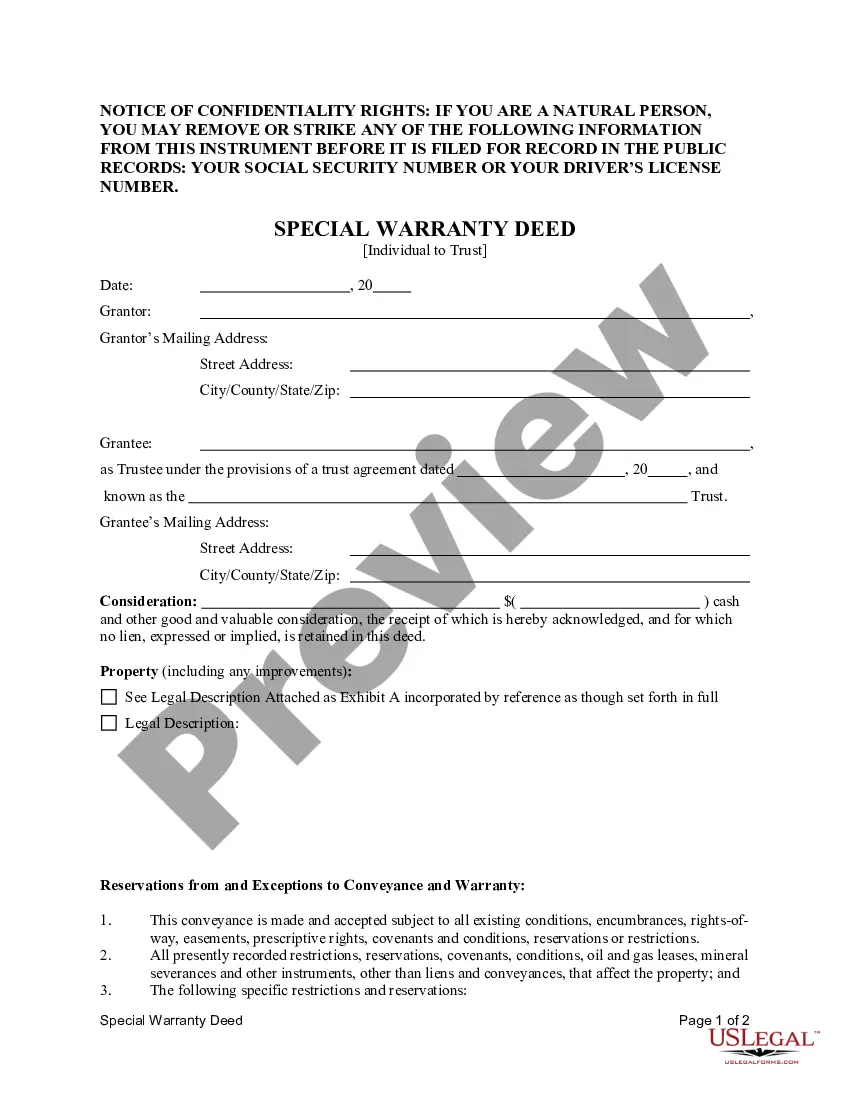

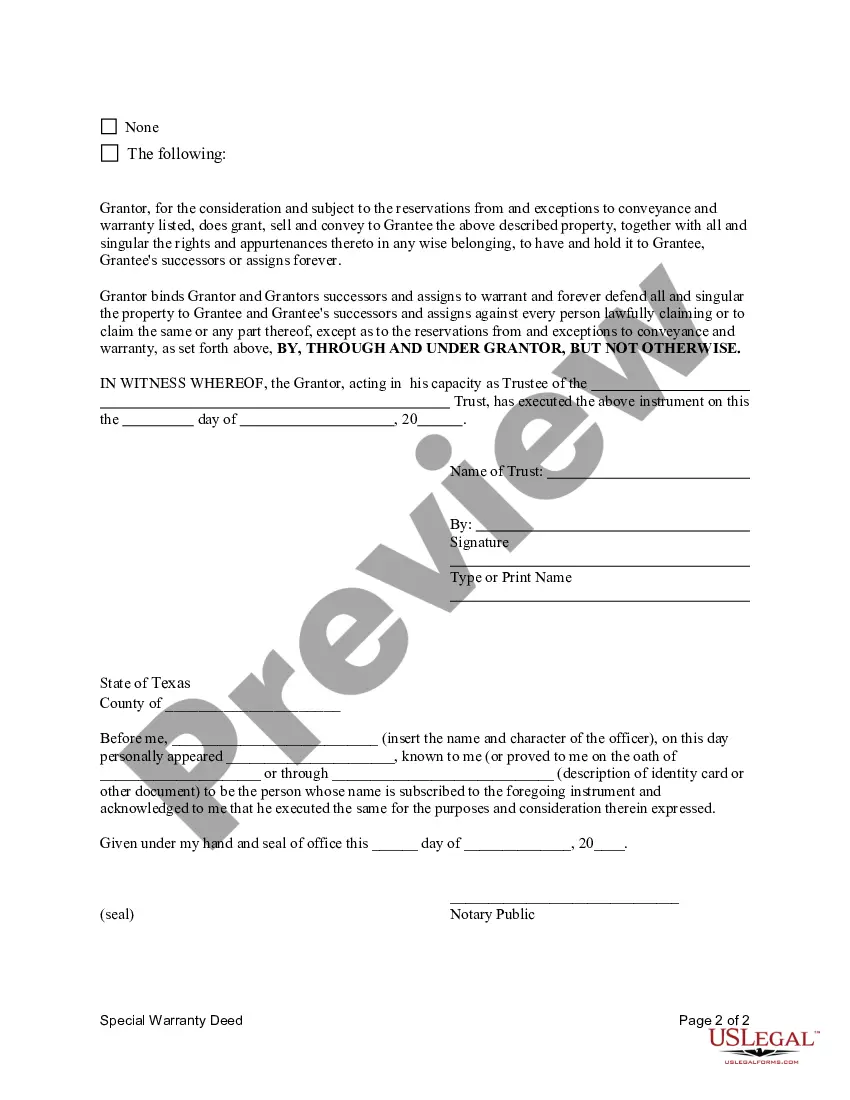

How to fill out Texas Special Warranty Deed From An Individual To A Trust?

What is the most dependable service to acquire the Deed Transfer Upon Death and other recent iterations of legal documents.

US Legal Forms is the solution! It features the largest assortment of legal paperwork for any circumstance. Each template is meticulously drafted and verified for adherence to federal and local statutes. They are categorized by region and state of application, making it straightforward to find the one you require.

US Legal Forms is an excellent option for anyone needing to manage legal documentation. Premium users can enjoy even more benefits as they can complete and sign the previously saved documents electronically anytime within the integrated PDF editing feature. Give it a try today!

- Experienced users of the platform only need to Log In to the system, verify their subscription status, and click the Download button next to the Deed Transfer Upon Death to receive it.

- Once saved, the document remains accessible for future use within the My documents section of your account.

- If you do not have an account yet, here are the steps you need to follow to create one.

- Form compliance confirmation. Before you obtain any template, ensure it aligns with your intended use and complies with your state's or county's regulations. Review the form details and utilize the Preview option if available.

Form popularity

FAQ

A notable downside of a Transfer on Death is that it only applies to the assets you specifically designate. If you forget to include certain properties, they will still go through probate. Additionally, there may be challenges related to changing your mind about beneficiaries after establishing a TOD. It's essential to keep your designations updated and consult reliable resources, like USLegalForms, for comprehensive estate planning.

Determining whether a TOD is better than having a designated beneficiary often depends on your unique situation. A TOD can streamline asset transfers efficiently, while beneficiary designations might be more suitable for certain types of accounts. Evaluating which option fits your needs best is crucial for effective estate planning. Consider consulting with an expert on platforms like USLegalForms to guide your decision.

One significant advantage of a Transfer on Death is the simplicity it offers in estate management. It enables a smooth deed transfer upon death, allowing your beneficiaries to receive property without lengthy probate proceedings. This feature can also minimize costs associated with estate administration. By using a TOD, you create a straightforward path for your heirs to gain access to your assets seamlessly.

While a transfer on death option provides many benefits, there are some disadvantages to consider. One downside is that it cannot address all aspects of your estate. A TOD only applies to the specific assets you designate, leaving other assets subject to probate. Additionally, if you change your mind about the beneficiaries, you'll need to update the TOD documentation, which could be overlooked.

Indeed, TOD accounts can be a sound choice for many individuals. They allow for an efficient deed transfer upon death without the hassle of probate, which can be time-consuming and costly. This feature gives your heirs quick access to the assets you've designated. However, it's essential to evaluate your personal circumstances to ensure it aligns with your overall estate strategy.

The key difference between a Transfer on Death (TOD) designation and naming beneficiaries lies in how assets are transferred after death. A TOD transfers property directly to the named person upon your death, avoiding probate. In contrast, a beneficiary designation might involve multiple assets or accounts and can require more legal steps. Understanding this distinction is vital for effective estate planning.