Divorce Texas 10 Year Rule

Description

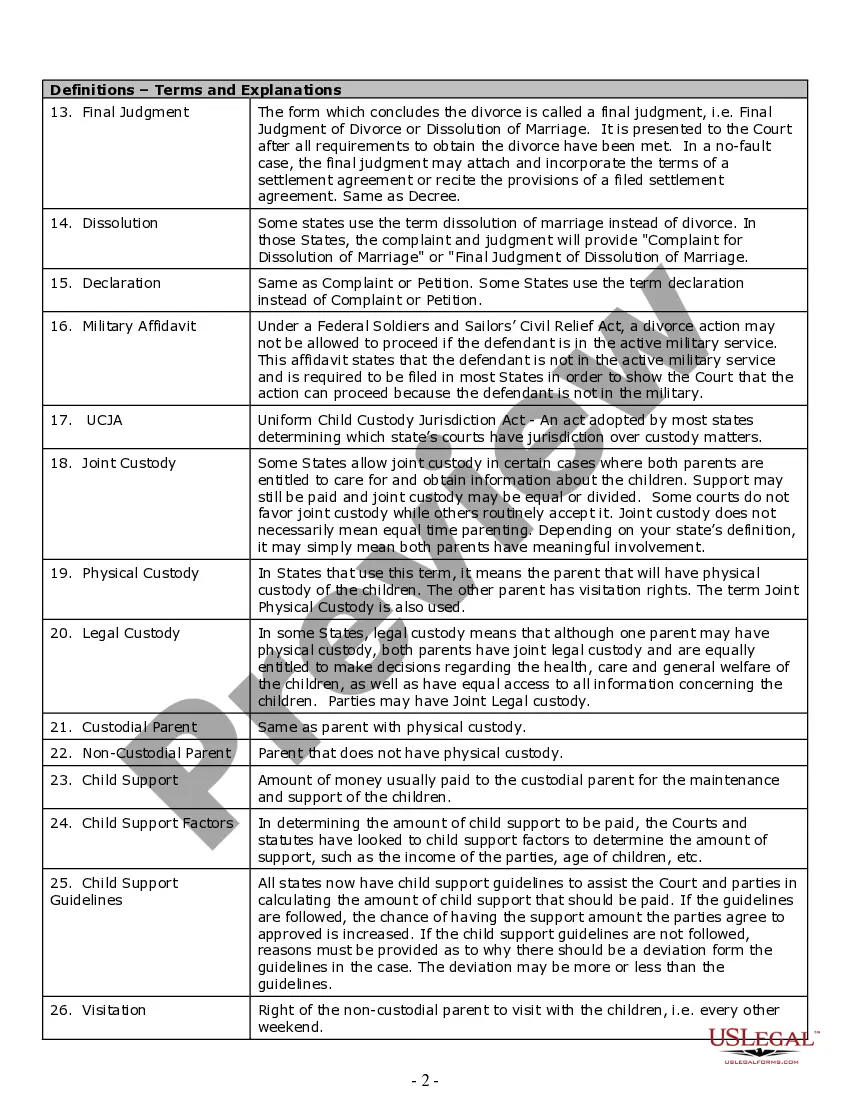

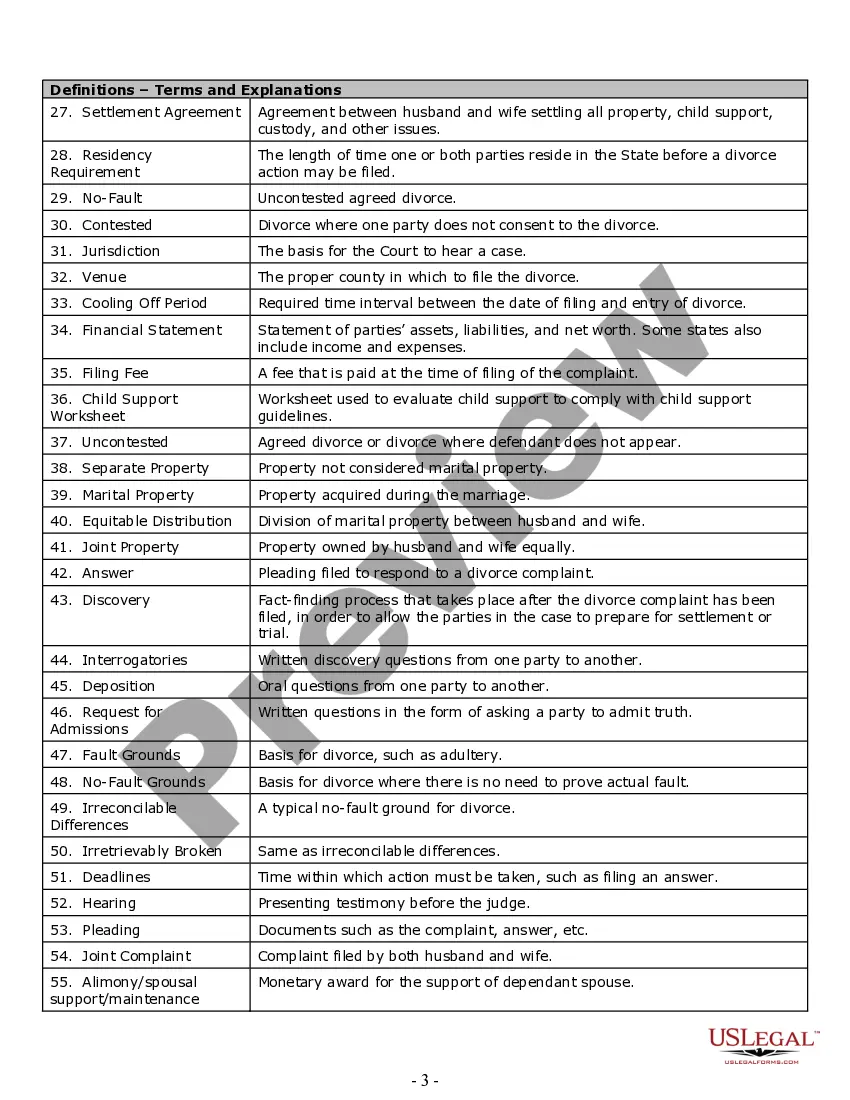

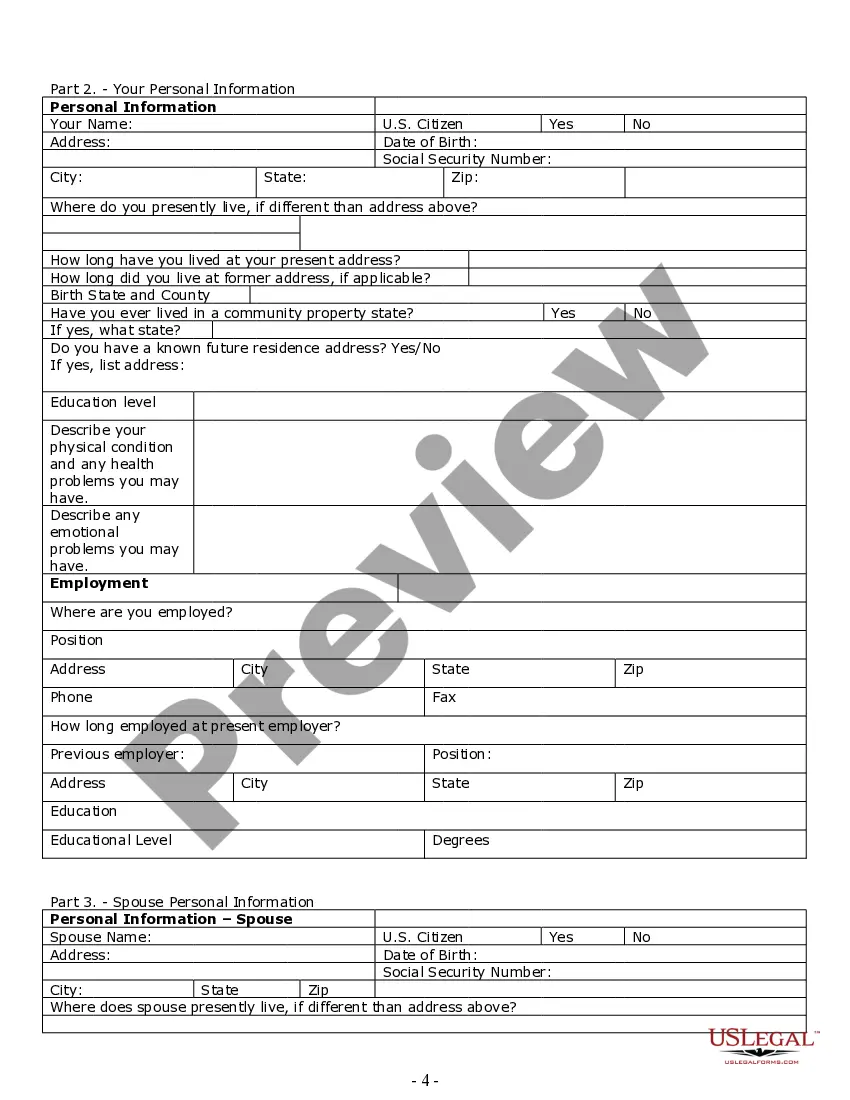

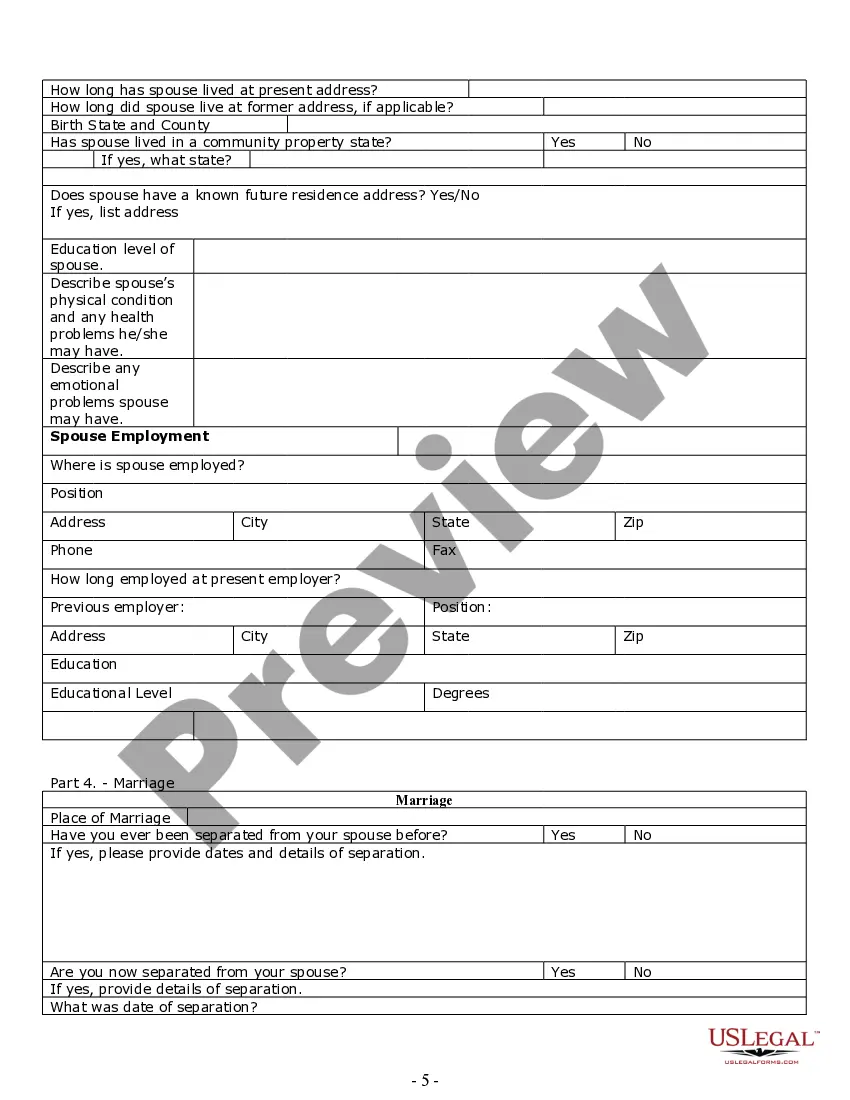

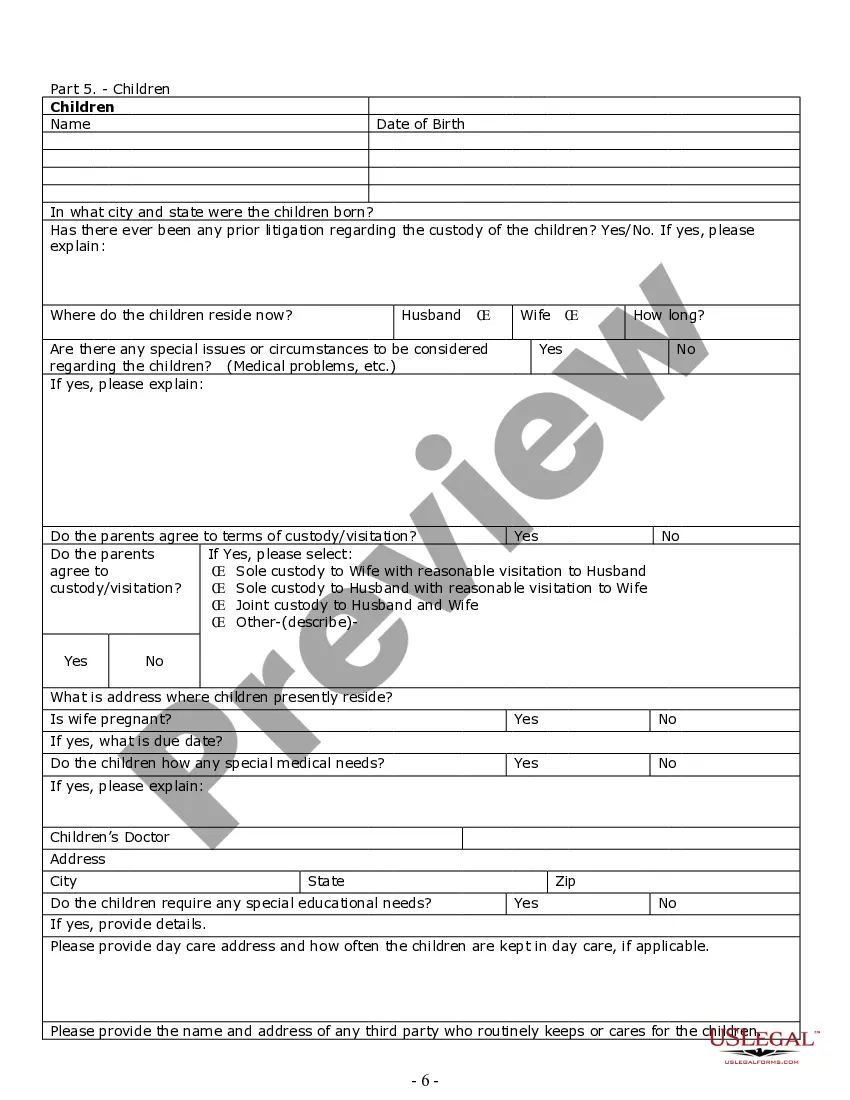

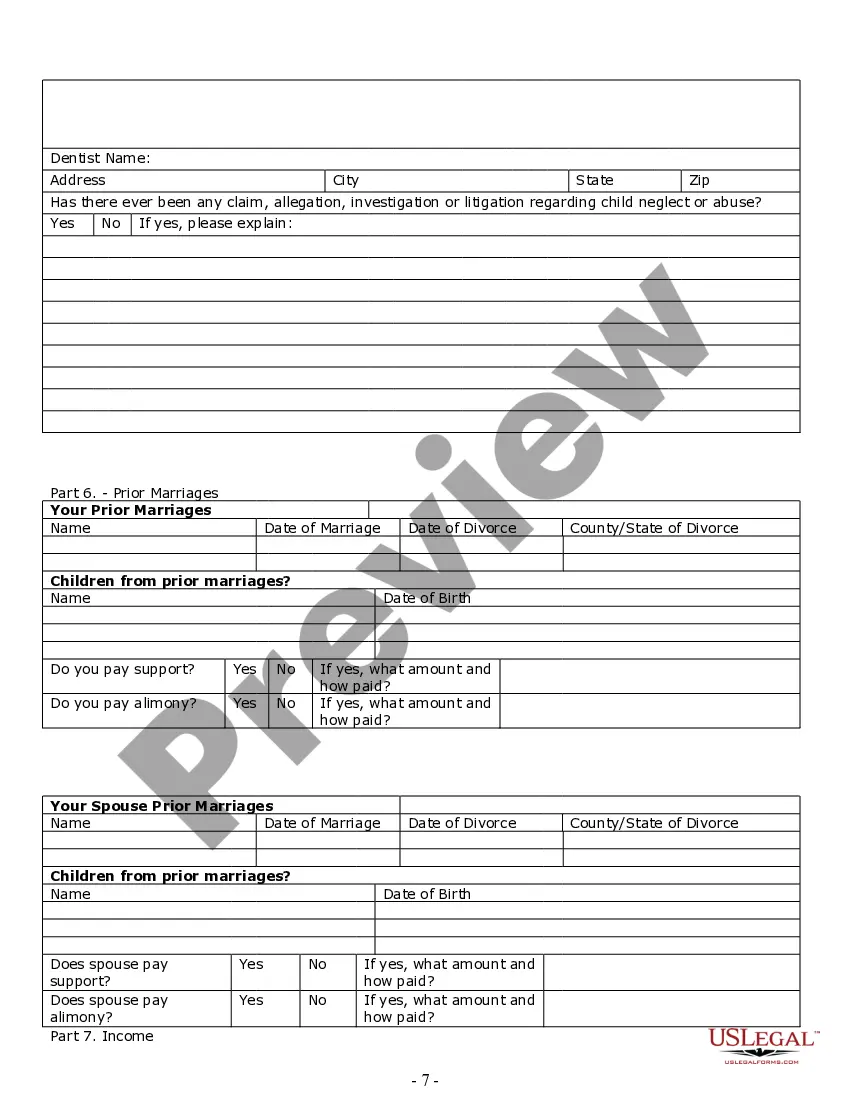

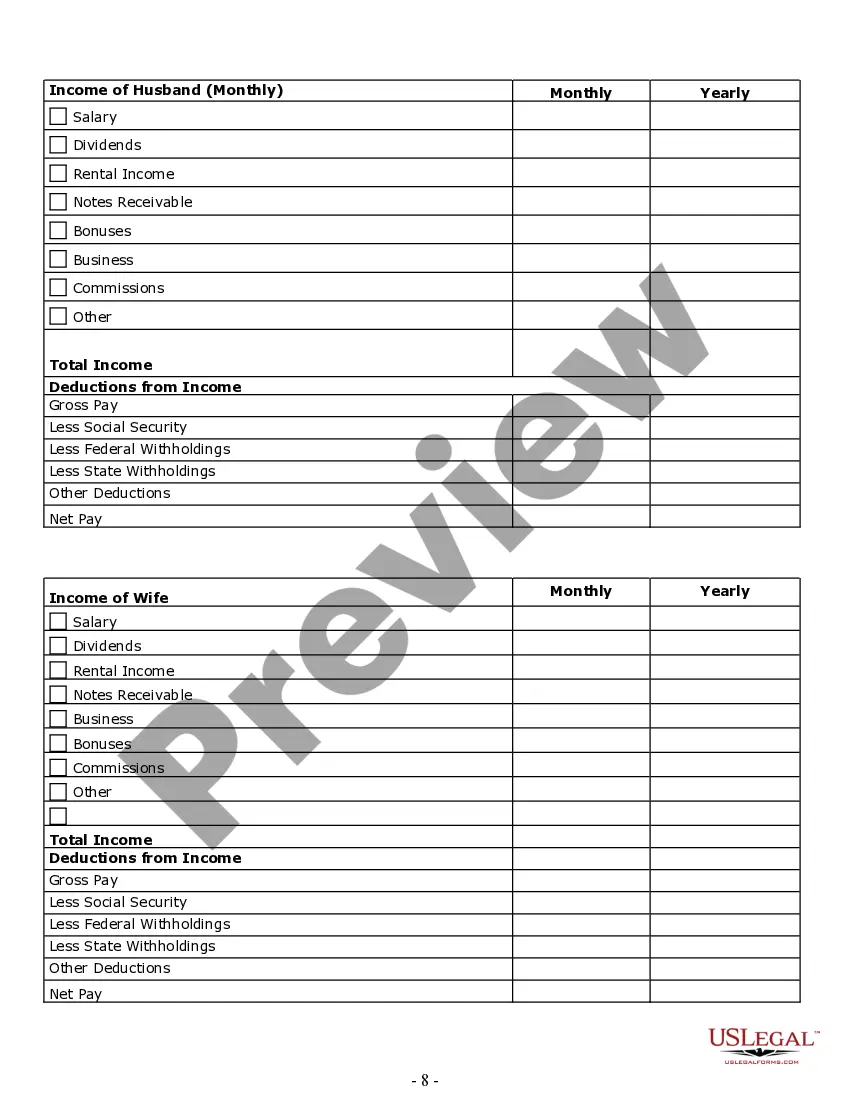

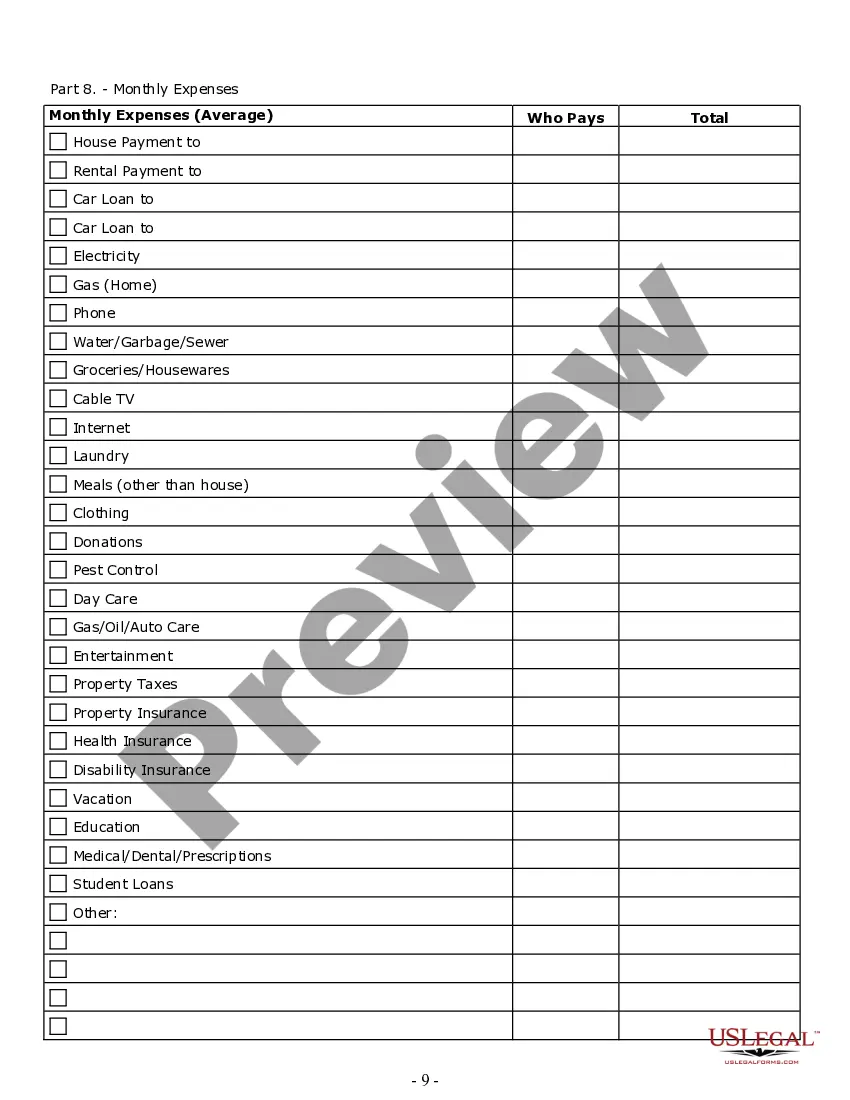

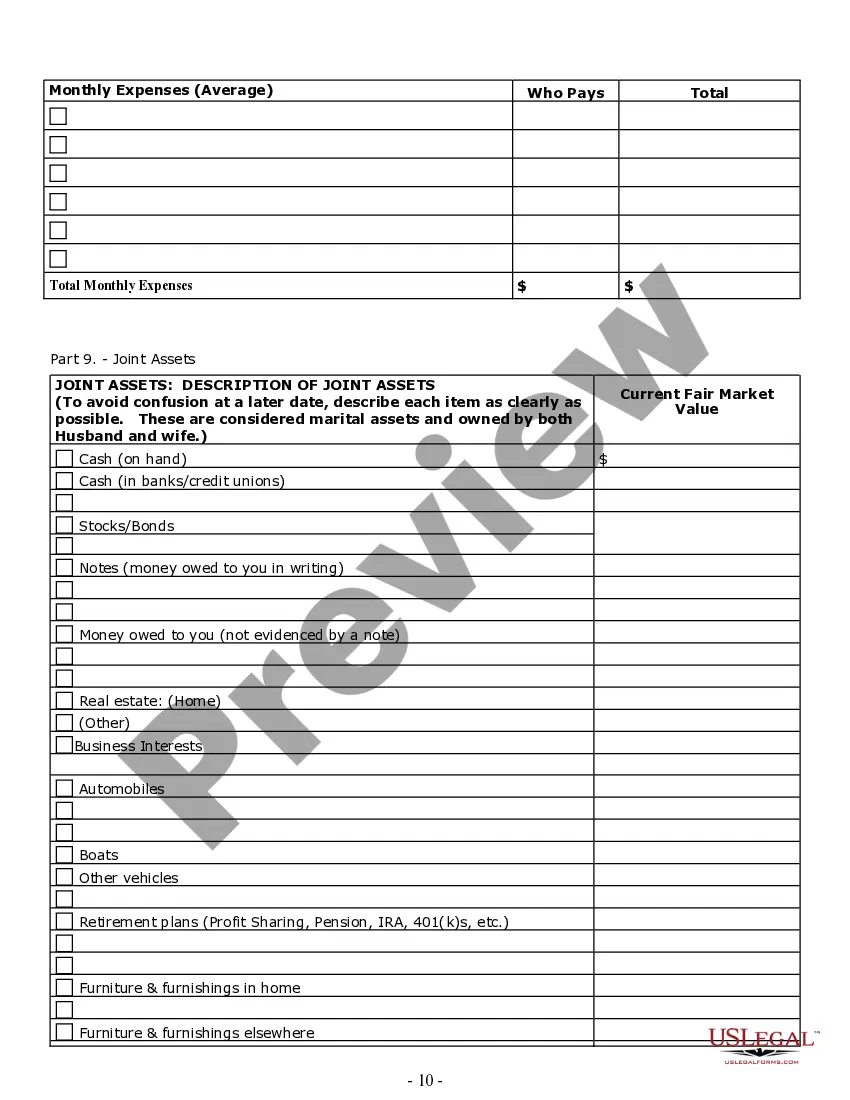

How to fill out Texas Divorce Worksheet And Law Summary For Contested Or Uncontested Case Of Over 25 Pages - Ideal Client Interview Form?

Securing a reliable source to obtain the latest and most suitable legal templates is a significant part of dealing with bureaucracy.

Selecting the appropriate legal paperwork requires precision and careful consideration, which is why it is essential to obtain samples of the Divorce Texas 10 Year Rule only from trustworthy providers, such as US Legal Forms.

After you have the form on your device, you can modify it with the editor or print it out and fill it in by hand. Eliminate the complications associated with your legal paperwork. Investigate the extensive US Legal Forms catalog where you can locate legal samples, verify their suitability for your situation, and download them immediately.

- Utilize the directory navigation or search bar to find your template.

- Examine the form’s details to confirm if it meets the criteria of your state and locality.

- Preview the form, if available, to ensure the template is exactly what you need.

- Return to the search results and find the correct template if the Divorce Texas 10 Year Rule does not suit your requirements.

- Once you are certain of the form’s applicability, download it.

- If you are an authorized user, click Log in to verify your identity and access your selected templates in My documents.

- If you are not yet a member, click Buy now to acquire the form.

- Choose the payment plan that aligns with your needs.

- Continue to the registration to complete your order.

- Finalize your transaction by selecting a payment option (credit card or PayPal).

- Select the file type for downloading the Divorce Texas 10 Year Rule.

Form popularity

FAQ

Amended Returns - The amended Hawaii return must be filed in paper form, mailed to the appropriate address (see Mailing Addresses below). Electronic Signatures ? Currently, TaxSlayer Pro does not support electronic signatures on Hawaii forms.

Form N-15 is filed by nonresident individuals who have Hawaii tax liability and by individuals who are Hawaii residents for only part of the tax year.

Several forms are on NCR paper and must be obtained from the tax office. If you need any forms which are not on this list, please call our Taxpayer Services Forms Request Line at 808-587-4242 or 1-800-222-3229. Viewing and printing forms and instructions, requires Adobe Reader.

11, Rev. 2022, Individual Income Tax Return (Resident) Page 1. FORM. STATE OF HAWAII ? DEPARTMET OF TAXATIO.

Hawai?i nonresidents or part-year residents should file state Form N-15. A completed copy of the federal return must be attached to the Form N-15. Full-year Hawai?i residents filing a federal return should file state Form N-11.

288A (Rev.2022), Statement of Withholding on Dispositions by onResident Persons of Hawaii Real Property Interests.

Any person who is in Hawai?i for a temporary or transient purpose and whose permanent residence is not Hawai?i is considered a Hawai?i nonresident. Each year, a nonresident who earns income from Hawai?i sources must file a State of Hawai?i tax return and will be taxed only on income from Hawai?i sources.

Where do I mail my n 15 Form Hawaii? Please address your written suggestions to the Department of Taxation, P.O. Box 259, Honolulu, HI, 96809-0259, or email them to Tax.