Texas Correction Grantor Form Application For 202

Description

How to fill out Texas Correction Deed - Prior Deed From An Individual To An Individual?

- If you're a returning user, log into your account and download your required form template by clicking the Download button. Ensure your subscription is active; if not, renew it as necessary.

- For first-time users, start by checking the Preview mode and form description to confirm you've selected the correct form that meets your local jurisdiction's requirements.

- If the initial template does not suit your needs, use the Search tab above to find a more appropriate form and make sure it aligns with your requirements.

- Purchase the document by clicking the Buy Now button, then select your preferred subscription plan. You will need to create an account to access the complete library.

- Complete your payment using your credit card or PayPal, and then download the template to your device. You'll always find it in the My Forms section of your profile.

US Legal Forms empowers users to complete their legal documentation hassle-free. With over 85,000 easily fillable forms, you can trust that you're well-equipped to handle any legal situation that arises.

Ready to simplify your legal processes? Explore US Legal Forms today and access a wealth of comprehensive legal templates at your fingertips!

Form popularity

FAQ

Not all estates in Texas must go through probate, as some may qualify for exemptions based on asset value and type. However, understanding when probate is necessary is essential for completing the Texas correction grantor form application for 202. If managing an estate seems complex, platforms like US Legal Forms can provide guidance on the probate process.

In Texas, legal heirs are typically the spouse, children, and sometimes other family members like parents or siblings, depending on the situation. Identifying heirs is vital when filling out the Texas correction grantor form application for 202, as it determines who can inherit property. It is important to know the laws governing inheritance to ensure proper distribution of assets.

Form 201 in Texas is a document used for the Application for Letters Testamentary or Letters of Administration in probate cases. When dealing with the Texas correction grantor form application for 202, it is crucial to understand how Form 201 interacts with estate management. This form is required to initiate the probate process and establish the authority of the executor.

Section 202.005 of the Texas Estates Code pertains to the administration of estates under certain circumstances. It outlines the requirements for a Texas correction grantor form application for 202. This section is essential for understanding how estates are managed and how legal heirs can process their claims.

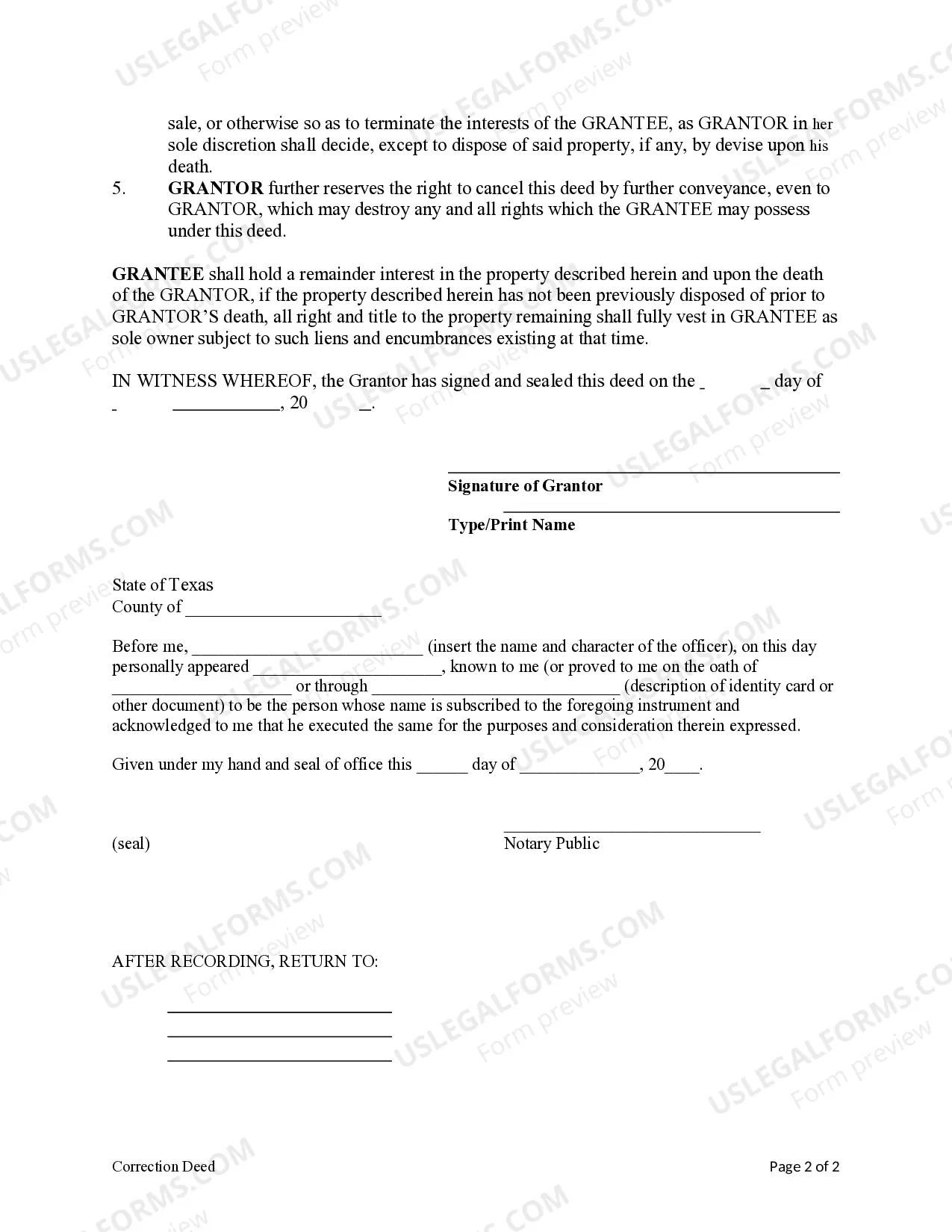

To correct a deed in Texas, you need to file a correction instrument with the County Clerk's office where the original deed is recorded. Ensure the document clearly states the nature of the correction and includes the original deed's details. Utilizing a reliable resource like USLegalForms can assist you in completing a Texas correction grantor form application for 202, streamlining the process.

It is not necessary for both parties to be present for a title transfer in Texas; however, it simplifies the process. If one party is absent, they can sign the title in advance and provide it to the other party. When applying for a Texas correction grantor form application for 202, it is helpful to have all documentation organized to ensure a smooth transfer.

Yes, you need a seller's signature on a Texas title application to validate the transfer of ownership. This signature proves that the seller authorizes the sale of the vehicle. When you're working through the Texas correction grantor form application for 202, ensuring you have all required signatures is critical to prevent delays.

Filling out a Texas title registration form requires you to complete sections detailing the vehicle's make, model, year, and identification number. Additionally, include your personal information as the owner, and ensure you have the seller's signature if applicable. This straightforward process is especially useful if you are working with a Texas correction grantor form application for 202 to make any necessary corrections.

Section 202.057 of the Texas Estates Code deals with the legal requirements for establishing heirship through an affidavit. It outlines how necessary information must be submitted to legally recognize heirs. When completing a Texas correction grantor form application for 202, understanding this section can significantly aid in accurately preparing your documentation.

To qualify for an affidavit of heirship in Texas, you must provide proof of your relationship to the decedent along with supporting documentation. This may include witness statements and other legal paperwork to establish your claim. Utilizing a Texas correction grantor form application for 202 can streamline this process, ensuring you properly document your heirship status.