Executor Executors Will Forget

Description

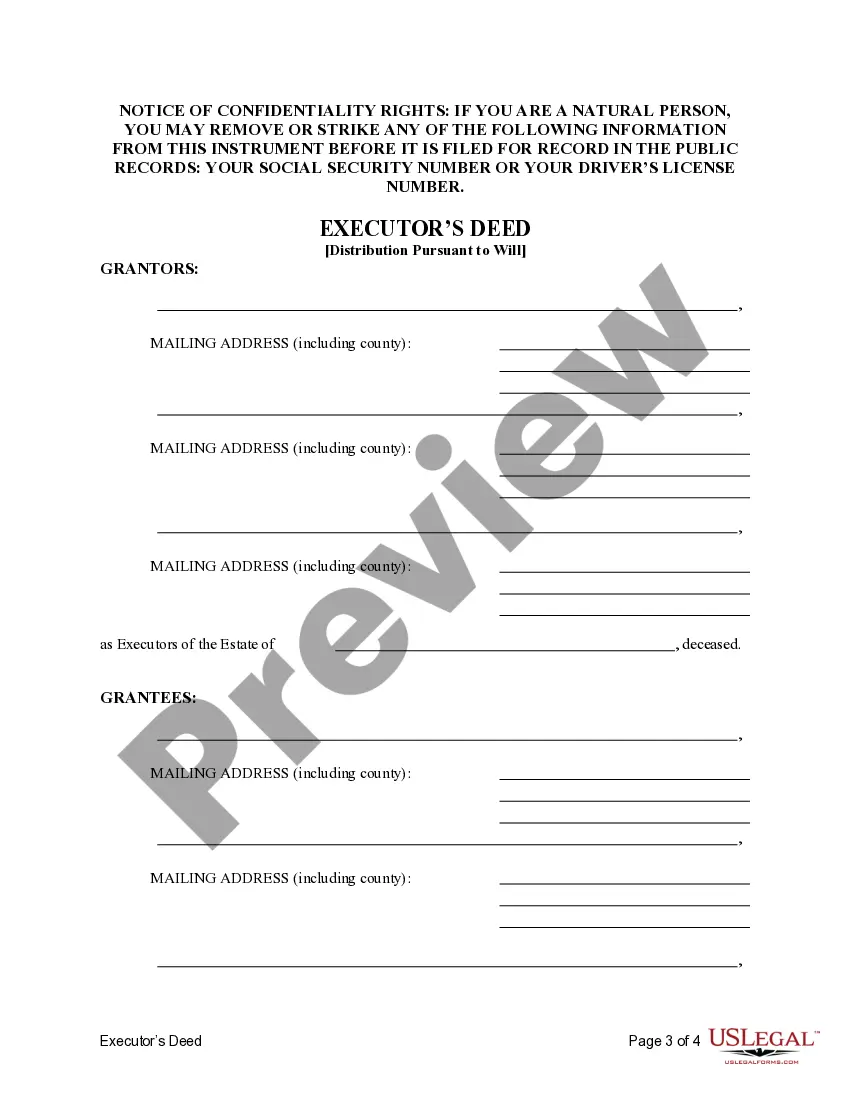

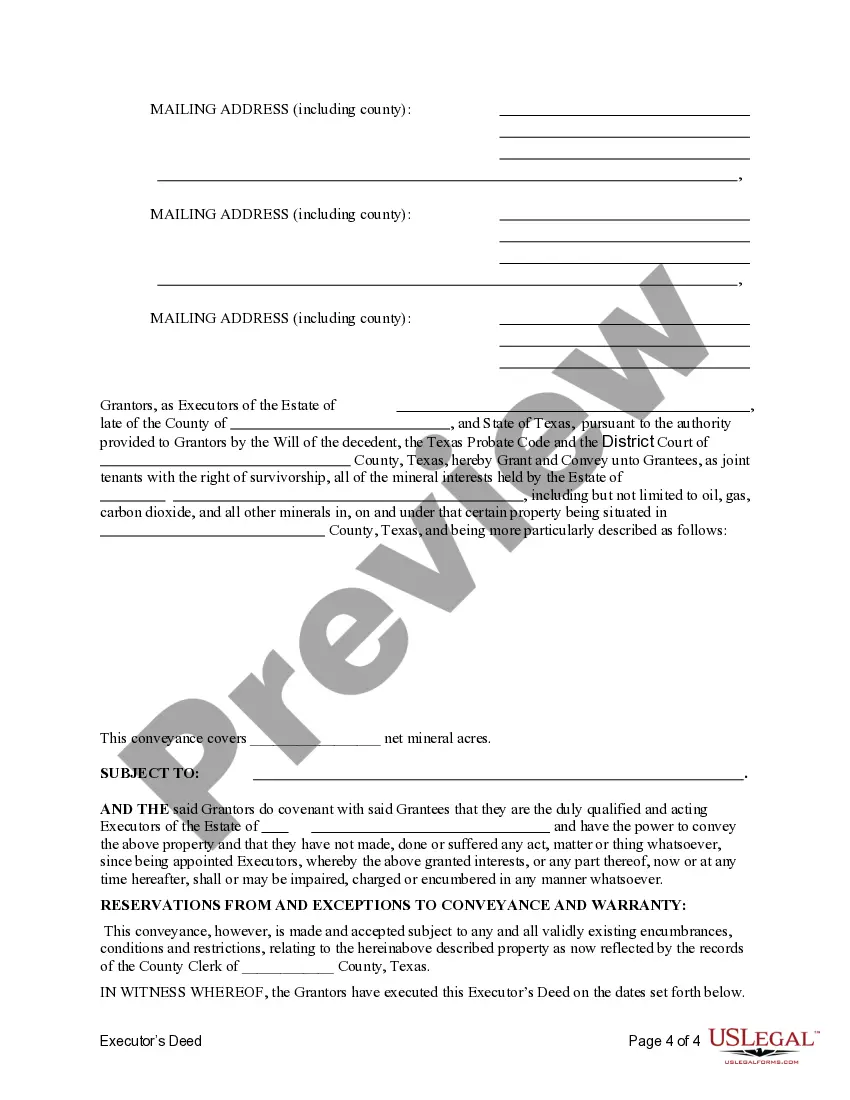

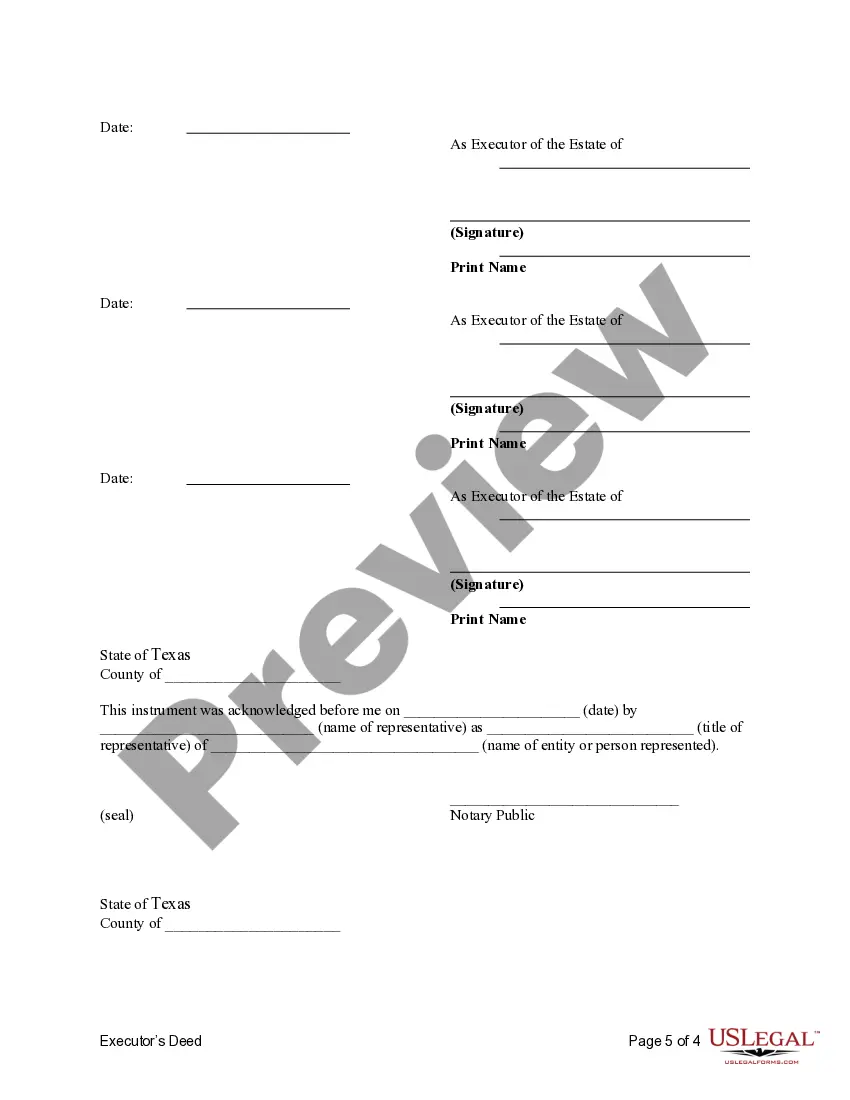

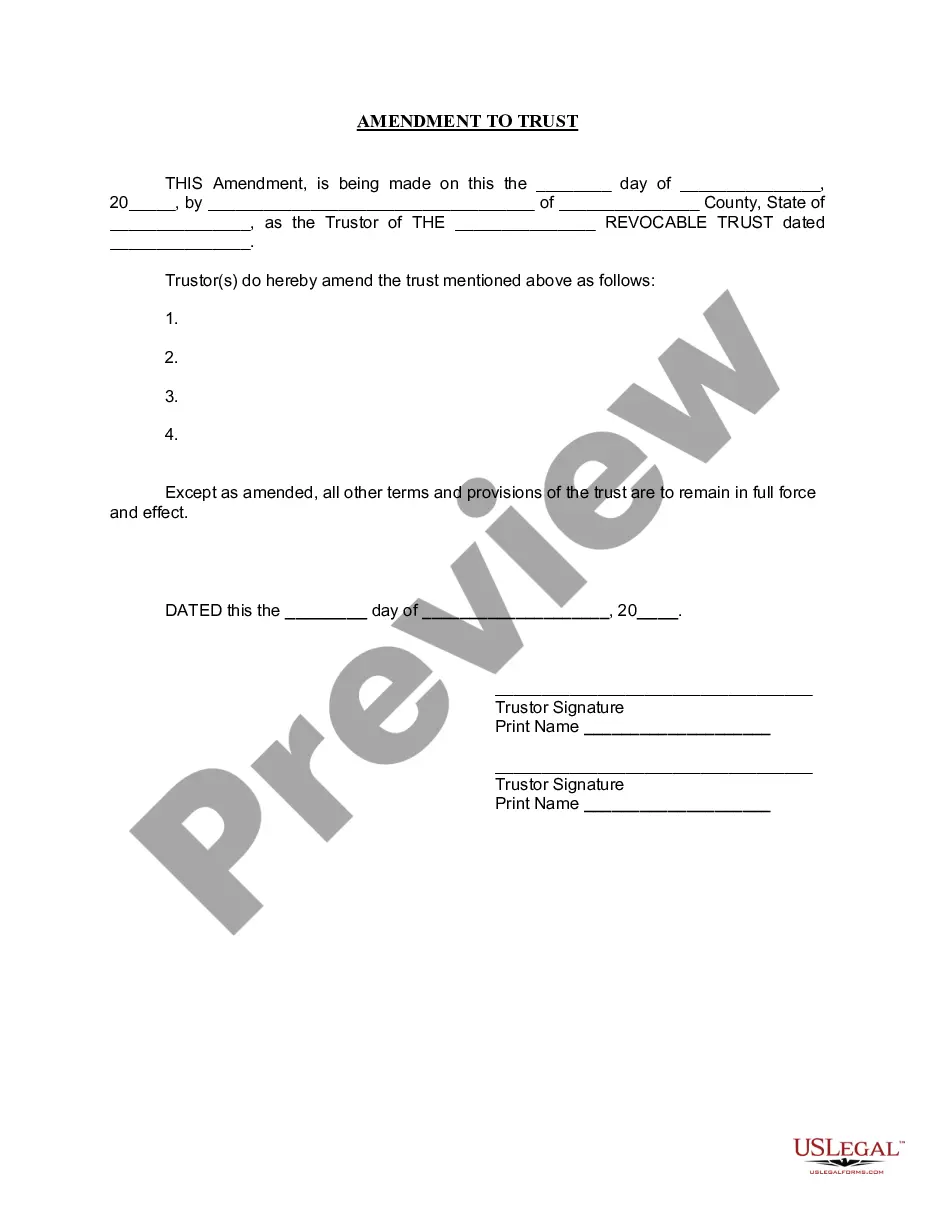

How to fill out Texas Executor's Deed - Three Executors To Five Beneficiaries Pursuant To Terms Of Will?

The Executor Executors Will Forget visible on this webpage is a versatile legal template crafted by experienced attorneys in accordance with national and local laws and regulations. For over 25 years, US Legal Forms has supplied individuals, businesses, and lawyers with more than 85,000 authenticated, state-specific documents for various business and personal scenarios. It’s the quickest, easiest, and most dependable method to acquire the necessary paperwork, as the service ensures bank-grade data protection and anti-malware safeguards.

Acquiring this Executor Executors Will Forget will involve just a few straightforward steps.

Subscribe to US Legal Forms to have verified legal templates for all of life's circumstances at your fingertips.

- Search for the document you require and review it. Browse through the example you searched for and preview it or examine the form description to ensure it meets your requirements. If it doesn’t, use the search function to locate the appropriate one. Click Buy Now once you have found the template you need.

- Create an account and Log In. Choose the pricing plan that fits your needs and set up an account. Utilize PayPal or a credit card to make a swift payment. If you already possess an account, Log In and verify your subscription to continue.

- Obtain the fillable template. Choose the format you desire for your Executor Executors Will Forget (PDF, Word, RTF) and save the document on your device.

- Fill out and sign the documents. Print the template to fill it out manually, or alternatively, utilize an online multifunctional PDF editor to swiftly and accurately complete and sign your form with a legally-binding electronic signature.

- Redownload your documents as needed. Use the same document again whenever required. Access the My documents tab in your account to redownload any previously saved documents.

Form popularity

FAQ

How to write a codicil to a will Read through your existing will. Take note of desired alterations. Write the opening statement and last will information. Propose your amendments. Sign the codicil. Secure the document. Consult with estate planning professionals (optional)

If a beneficiary requests access to financial institution statements and the executor refuses to provide them, the beneficiary can take legal action. They can follow the court for an order compelling the executor to reveal the requested information.

As a beneficiary you are entitled to information regarding the trust assets and the status of the trust administration from the trustee. You are entitled to bank statements, receipts, invoices and any other information related to the trust.

If you resign from your role as Executor, generally, another Executor will be appointed. If more than one Executor is named in the deceased's Will or a backup Executor, then the responsibility will fall to them. Alternatively, if you have been named as a sole Executor, a suitable replacement will need to be found.

If the executor hasn't notified you about the death or shown you the will within a reasonable amount of time ? or if they aren't keeping you in the loop about how probate is going, this may signal a lack of honesty on the executor's part.