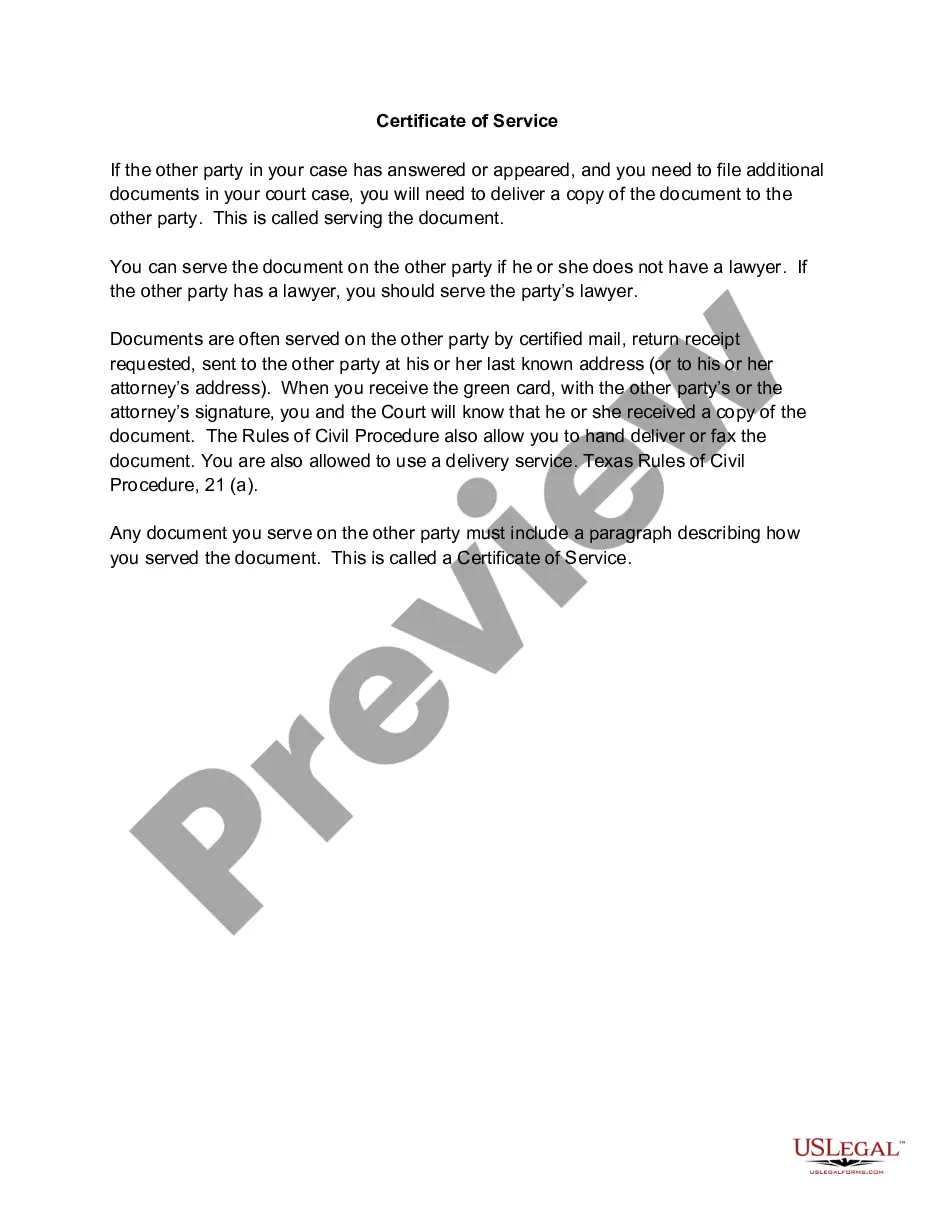

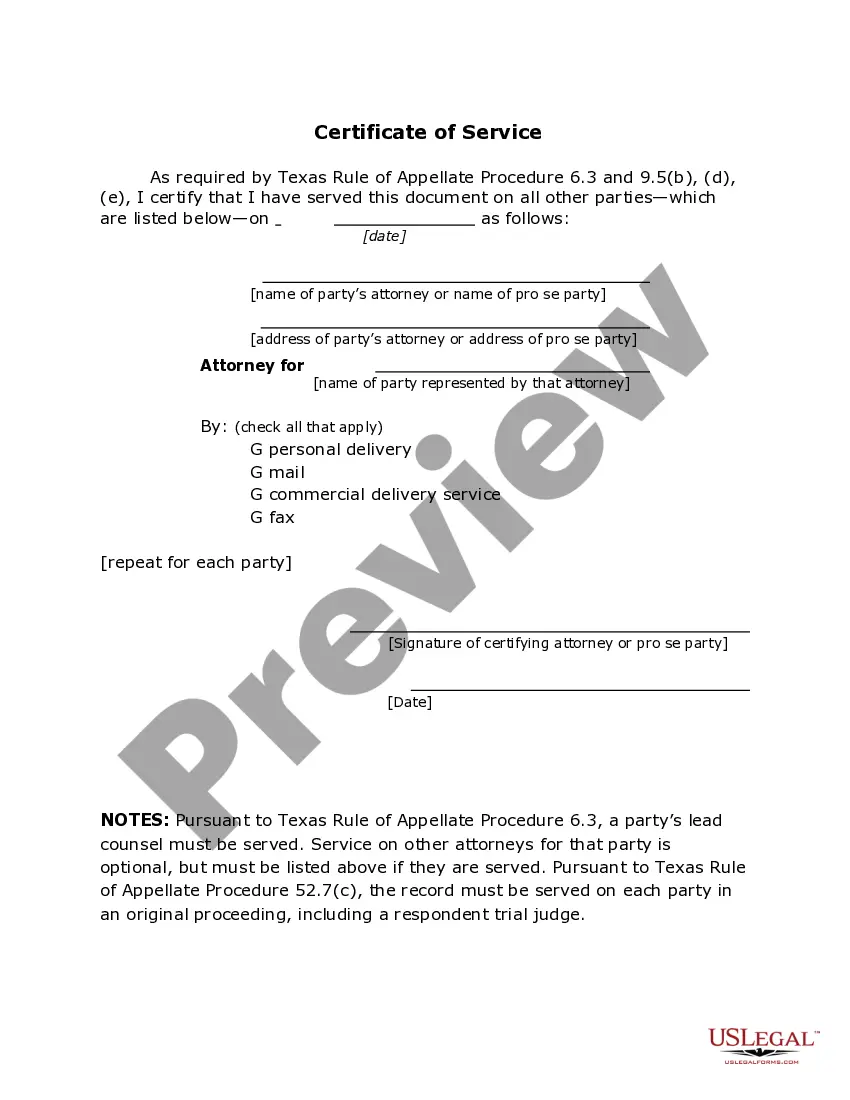

This form is a Certificate of Service and is used to establish the method used to serve documents on other parties to an action.

Texas Certificate Of Service Foreign Entity

Description

How to fill out Texas Certificate Of Service - TX R.App.Proc. 6.3?

It’s no secret that you can’t become a legal professional overnight, nor can you grasp how to quickly prepare Texas Certificate Of Service Foreign Entity without having a specialized background. Creating legal forms is a long venture requiring a certain education and skills. So why not leave the preparation of the Texas Certificate Of Service Foreign Entity to the professionals?

With US Legal Forms, one of the most comprehensive legal document libraries, you can find anything from court documents to templates for in-office communication. We know how crucial compliance and adherence to federal and state laws and regulations are. That’s why, on our website, all forms are location specific and up to date.

Here’s how you can get started with our platform and get the document you require in mere minutes:

- Find the document you need by using the search bar at the top of the page.

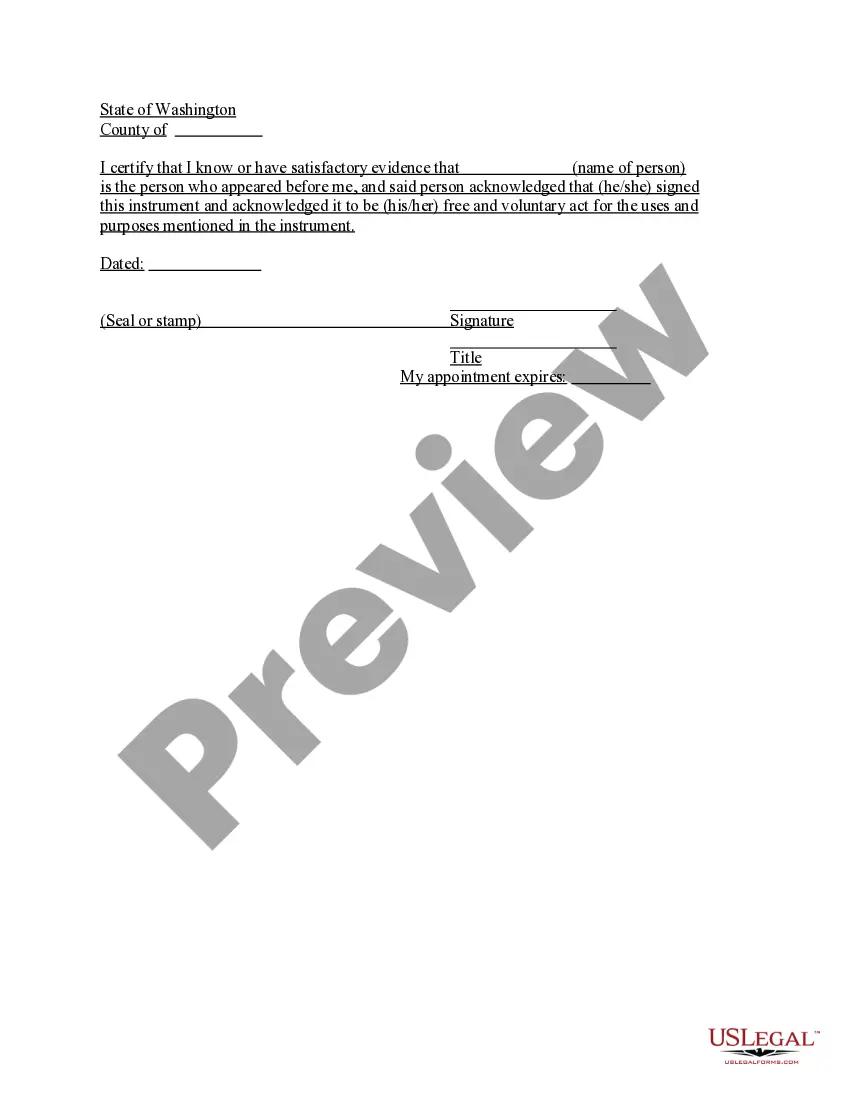

- Preview it (if this option provided) and read the supporting description to determine whether Texas Certificate Of Service Foreign Entity is what you’re looking for.

- Begin your search again if you need any other template.

- Set up a free account and choose a subscription plan to purchase the form.

- Choose Buy now. Once the transaction is through, you can download the Texas Certificate Of Service Foreign Entity, complete it, print it, and send or send it by post to the necessary individuals or entities.

You can re-access your forms from the My Forms tab at any time. If you’re an existing client, you can simply log in, and find and download the template from the same tab.

Regardless of the purpose of your documents-whether it’s financial and legal, or personal-our platform has you covered. Try US Legal Forms now!

Form popularity

FAQ

To withdraw or cancel your foreign Texas LLC in Texas, you fill out and send Form 608, Certificate of Withdrawal of Registration in duplicate to the Secretary of State by mail, fax or in person.

Online filing is available through the Secretary of State's website SOSDirect. (Please note that there is a 2.7% processing fee if you pay with a credit card, bringing your total up to $770.25). You can also download form 304 here, print it out and submit it (in duplicate) by mail, fax or in person.

A foreign entity is any corporation, business association, partnership, trust, society or any other entity or group that is not incorporated or organized to do business in the United States, as well as international organizations, foreign governments and any agency or subdivision of foreign governments.

A foreign entity is any corporation, business association, partnership, trust, society or any other entity or group that is not incorporated or organized to do business in the United States, as well as international organizations, foreign governments and any agency or subdivision of foreign governments.

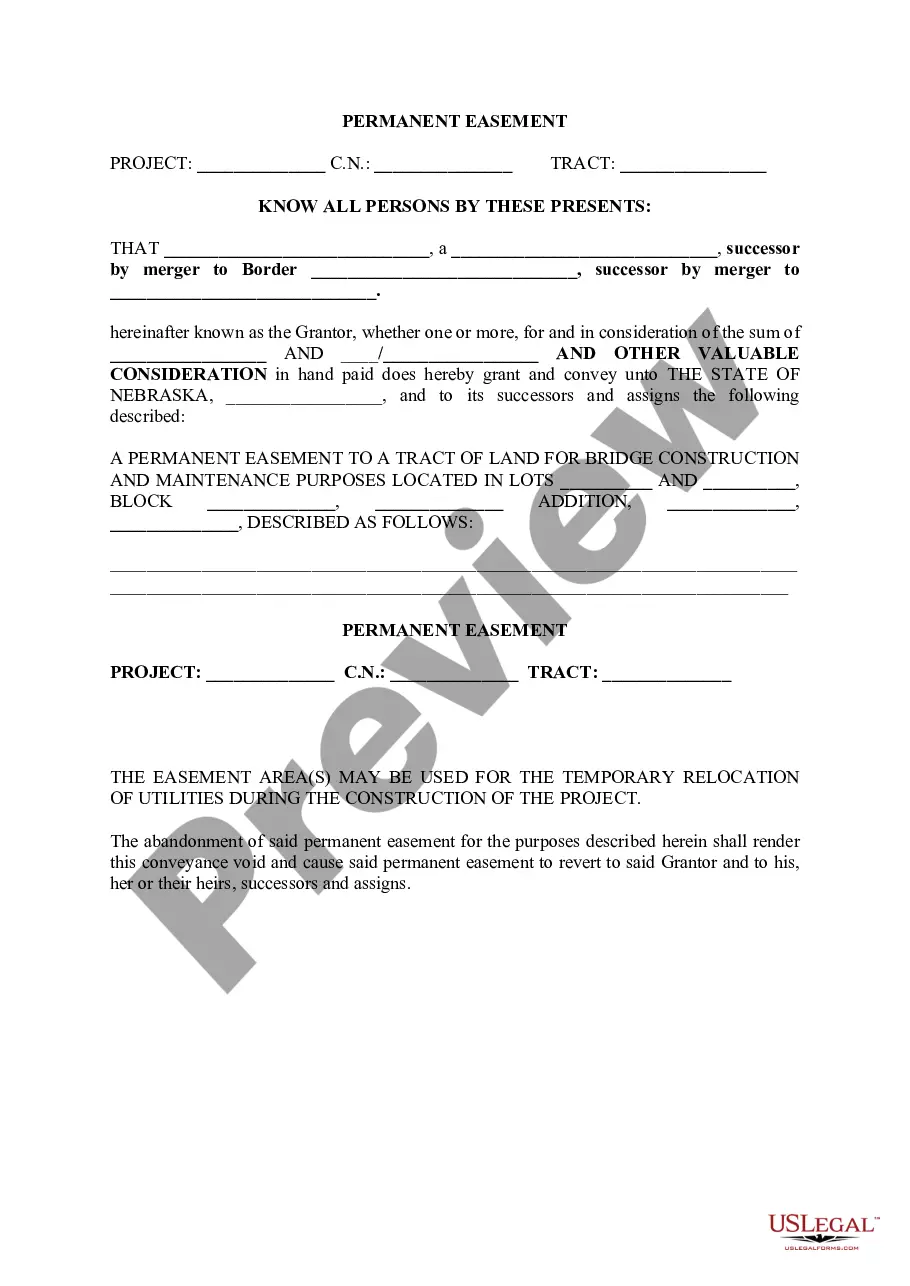

Provisions. This form and the information provided are not substitutes for the advice and services of an attorney and tax specialist. To transact business in Texas, a foreign entity must register with the secretary of state under chapter 9 of the Texas Business Organizations Code (BOC).