Texas Estate Form For Everything

Description

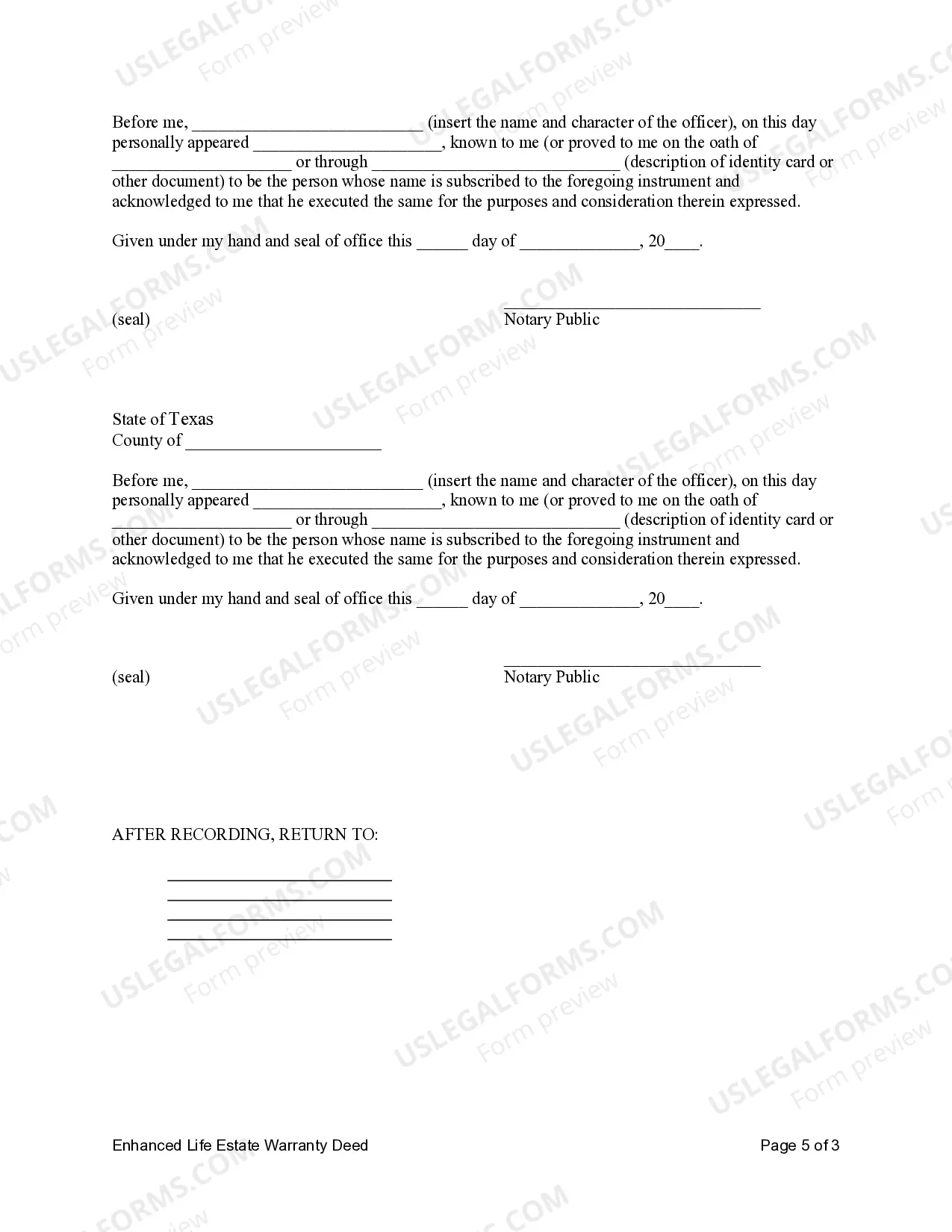

How to fill out Texas Enhanced Life Estate Or Lady Bird Grant Deed From Two Individuals, Or Husband And Wife, To An Individual?

- Log in to your US Legal Forms account if you're a returning user. Ensure your subscription is active to access the necessary templates.

- If you're new to our service, start by reviewing the Preview mode and description of your desired Texas estate form to ensure it meets your needs.

- If adjustments are needed, utilize the Search tab to find alternate templates that comply with your local jurisdiction.

- Select the form you require and click the 'Buy Now' button. Choose the subscription plan that best fits your requirements and create an account to access our extensive library.

- Finalize your purchase by entering your payment information through a credit card or PayPal.

- Download the completed form to your device for easy access, and find it in the 'My Forms' section of your profile whenever needed.

By using US Legal Forms, you access over 85,000 legal documents, more than what our competitors offer. Additionally, you have the opportunity to consult with premium experts to help ensure your documents are completed accurately.

Take control of your legal needs today. Start using US Legal Forms for your Texas estate form for everything you require!

Form popularity

FAQ

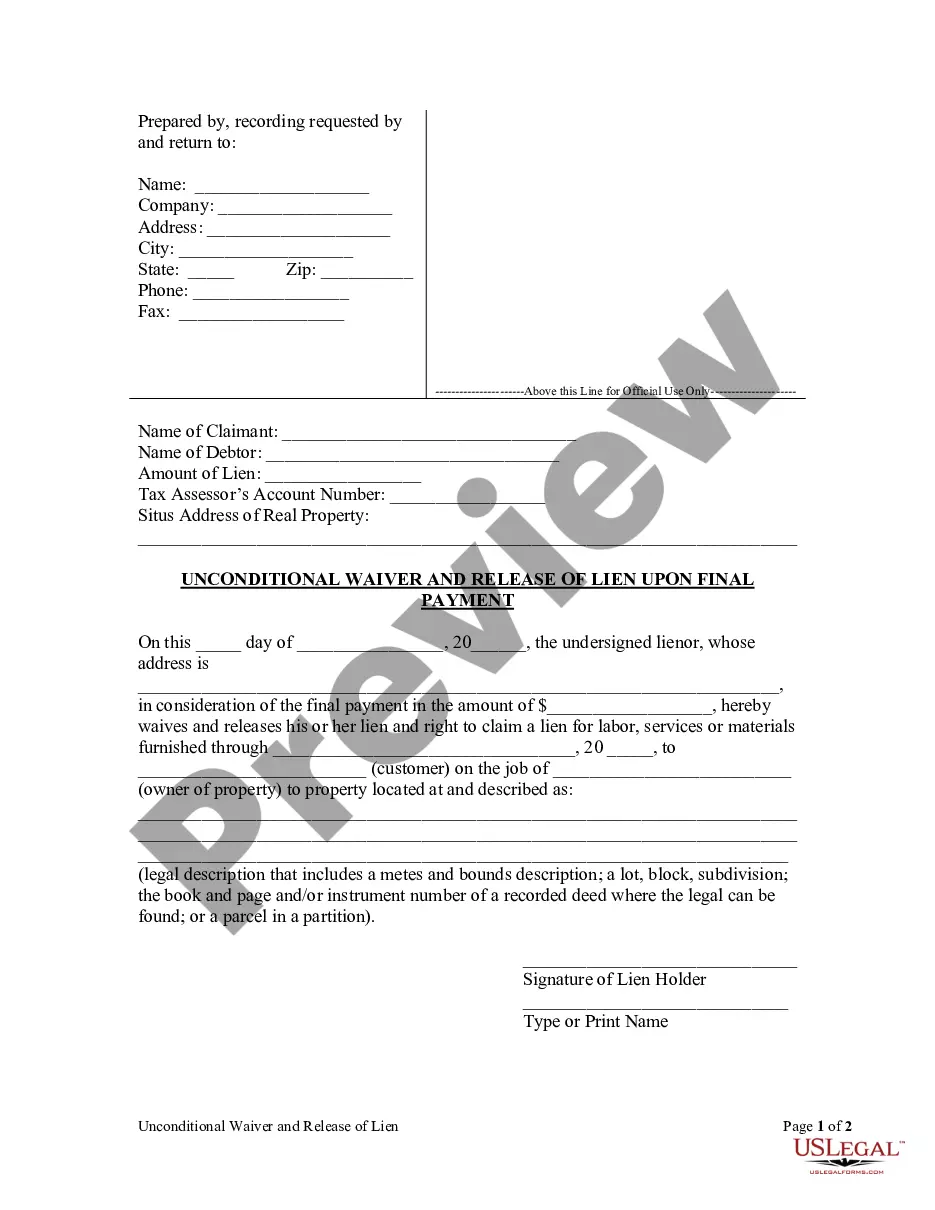

To fill out an estate inventory in Texas, start by listing all assets owned by the deceased at the time of death. Include real estate, bank accounts, investments, personal belongings, and any other significant items. It's crucial to provide accurate descriptions and estimated values for each asset. Leveraging a Texas estate form for everything through uslegalforms can ease this process and ensure compliance with legal requirements.

In Texas, assets that typically must go through probate include solely owned real estate, bank accounts in the decedent's name, and other personal property not designated for transfer. Additionally, items with significant value often require probate to ensure proper distribution. It’s essential to know what assets belong to the estate. A Texas estate form for everything can help you effectively manage those assets and streamline any necessary proceedings.

Yes, an estate can often be settled without probate in Texas under certain conditions. If assets are held in joint tenancy or have designated beneficiaries, they may pass outside of the probate process. Small estates may qualify for simplified procedures, avoiding the traditional probate path. Thinking about using a Texas estate form for everything can provide clarity and assistance in these situations.

Texas does not set a specific minimum estate value for probate. However, if the estate exceeds $75,000 and includes real estate or personal property, probate becomes necessary. This ruling highlights the importance of understanding applicable estate laws in Texas. Utilizing a Texas estate form for everything can help streamline your probate experience.

To establish an estate in Texas, you typically need a few critical documents. These include a valid will, the Texas estate form for everything, and a list of assets and debts of the deceased. You may also require proof of identity and relationship to the deceased, along with any relevant court filings. Utilizing the US Legal Forms platform simplifies this process by providing precise templates that cater to your estate planning needs.

Certainly, you can file probate yourself in Texas. Many individuals choose this route to save on legal fees. By obtaining the right Texas estate form for everything, you can manage the filing process and ensure that all necessary information is included correctly.

Yes, you can file probate in Texas without a lawyer, but it requires thorough preparation. Each step must be executed with care to meet legal standards. Leveraging a comprehensive Texas estate form for everything can help you complete your filing accurately and efficiently.

To probate a will in Texas, several forms are necessary, including the application for probate and the original will. These documents streamline the process and ensure that you meet the legal requirements. By using the appropriate Texas estate form for everything, you can make sure you have all the essential paperwork in place.

No, hiring an attorney to probate a will in Texas is not mandatory. Individuals often choose to handle probate independently if they feel confident. Nonetheless, using the right Texas estate form for everything can simplify your process and help you avoid common pitfalls.

Yes, you can probate an estate without a lawyer in Texas. However, navigating the probate process alone can be challenging. You will need to understand the required Texas estate form for everything involved. It is essential to review local laws and regulations to ensure compliance.