Gift Deed Template With Signature

Description

How to fill out Texas Gift Deed For Individual To Individual?

Whether for commercial reasons or for personal issues, everyone must handle legal matters at some point in their lifetime.

Filling out legal documents requires meticulous care, starting from selecting the appropriate form template.

With a vast US Legal Forms library available, you do not need to waste time searching for the right template online. Utilize the library’s easy navigation to find the suitable form for any occasion.

- Locate the template you require by utilizing the search bar or catalog navigation.

- Review the form’s details to ensure it aligns with your situation, state, and area.

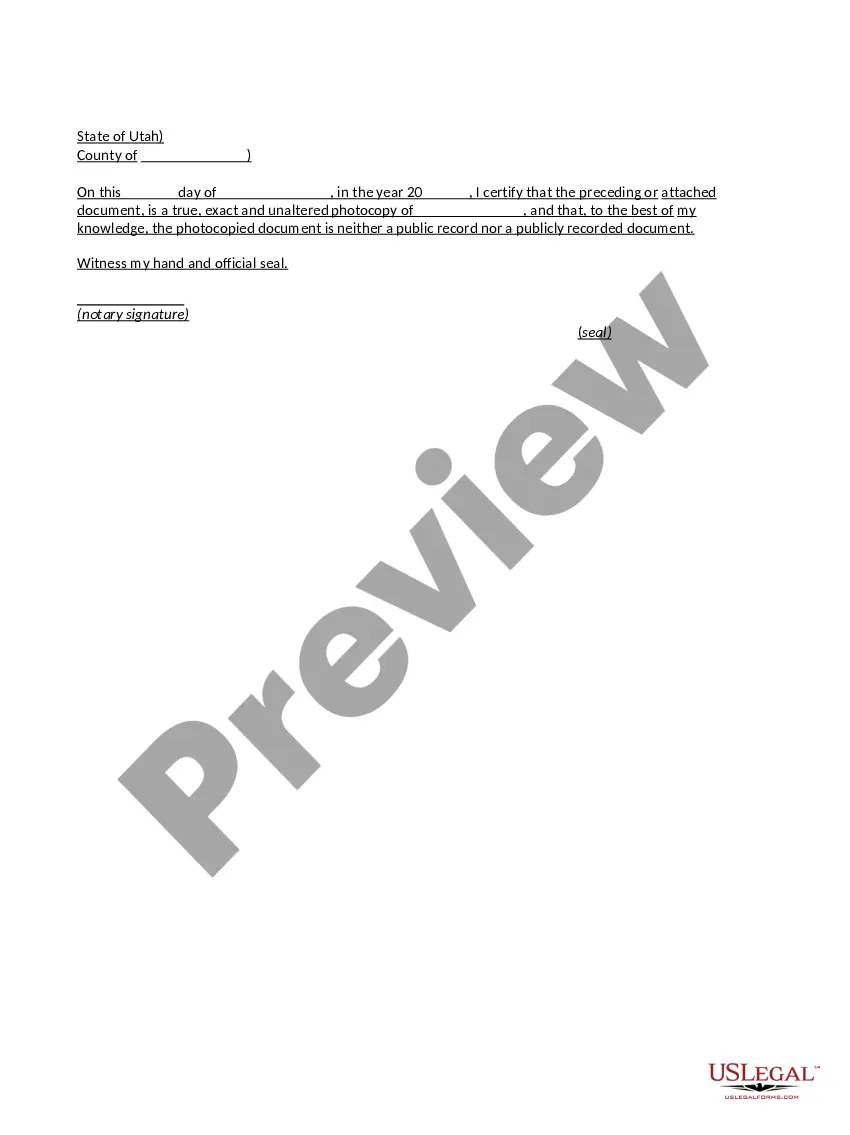

- Click on the form’s preview to examine it.

- If it is the wrong document, return to the search function to find the Gift Deed Template With Signature version you need.

- Download the file when it meets your requirements.

- If you have a US Legal Forms account, simply click Log in to access previously saved templates in My documents.

- If you don’t have an account yet, you can acquire the form by clicking Buy now.

- Choose the suitable pricing option.

- Complete the profile registration form.

- Select your payment method: use a credit card or PayPal account.

- Choose the document format you desire and download the Gift Deed Template With Signature.

- After it is downloaded, you can fill out the form using editing software or print it and fill it out by hand.

Form popularity

FAQ

Preparing a gift deed starts with selecting an appropriate gift deed template with signature to guide you. Gather the necessary information about the donor and recipient, as well as a clear description of the gift. Fill out the template carefully, ensuring you include all required details and signatures for validity.

Gift deeds in Texas are valid; however, there are strict requirements for gift deeds in Texas. Therefore, if you have a document that might be a gift deed or if someone is claiming they have a gift deed to a property that should be yours, you should contact an attorney as soon as possible.

The Gift Deed needs to be in writing. It must include the full name of the current owner and the full name, mailing address and vesting of the new owner. The property needs to be properly described.

How Do I Write a Gift Letter? The donor's name, address and phone number. The donor's relationship to the client. The dollar amount of the gift. The date when the funds were transferred. A statement from the donor that no repayment is expected. The donor's signature. The address of the property being purchased, if known.

A gift letter is a legal instrument that clearly and explicitly states, without question, that a friend or family member ?gifted? - rather than loaned - you money. You can use a gift letter for mortgage lenders who may be questioning a large influx of cash that suddenly showed up in your checking or savings account.

In Virginia, gifting a home involves transferring ownership of the property from the current owner (the parent) to their child or children as a gift. This transfer can be made during the parent's lifetime or after their death. Gifting a home can be done through a quitclaim deed or other legal instrument.