Gift Deed Form Blank With Blank Improves Creativity

Description

How to fill out Texas Gift Deed For Individual To Individual?

It’s no secret that you can’t become a law expert overnight, nor can you learn how to quickly prepare Gift Deed Form Blank With Blank Improves Creativity without having a specialized set of skills. Putting together legal documents is a long venture requiring a specific training and skills. So why not leave the preparation of the Gift Deed Form Blank With Blank Improves Creativity to the professionals?

With US Legal Forms, one of the most extensive legal template libraries, you can find anything from court paperwork to templates for in-office communication. We know how important compliance and adherence to federal and local laws and regulations are. That’s why, on our website, all forms are location specific and up to date.

Here’s how you can get started with our platform and get the form you require in mere minutes:

- Find the document you need with the search bar at the top of the page.

- Preview it (if this option provided) and check the supporting description to figure out whether Gift Deed Form Blank With Blank Improves Creativity is what you’re searching for.

- Begin your search over if you need any other template.

- Set up a free account and select a subscription plan to purchase the template.

- Pick Buy now. As soon as the payment is through, you can get the Gift Deed Form Blank With Blank Improves Creativity, fill it out, print it, and send or mail it to the designated people or organizations.

You can re-access your documents from the My Forms tab at any time. If you’re an existing customer, you can simply log in, and find and download the template from the same tab.

No matter the purpose of your forms-be it financial and legal, or personal-our platform has you covered. Try US Legal Forms now!

Form popularity

FAQ

Gift deeds in Texas are valid; however, there are strict requirements for gift deeds in Texas. Therefore, if you have a document that might be a gift deed or if someone is claiming they have a gift deed to a property that should be yours, you should contact an attorney as soon as possible.

A gift letter is a legal instrument that clearly and explicitly states, without question, that a friend or family member ?gifted? - rather than loaned - you money. You can use a gift letter for mortgage lenders who may be questioning a large influx of cash that suddenly showed up in your checking or savings account.

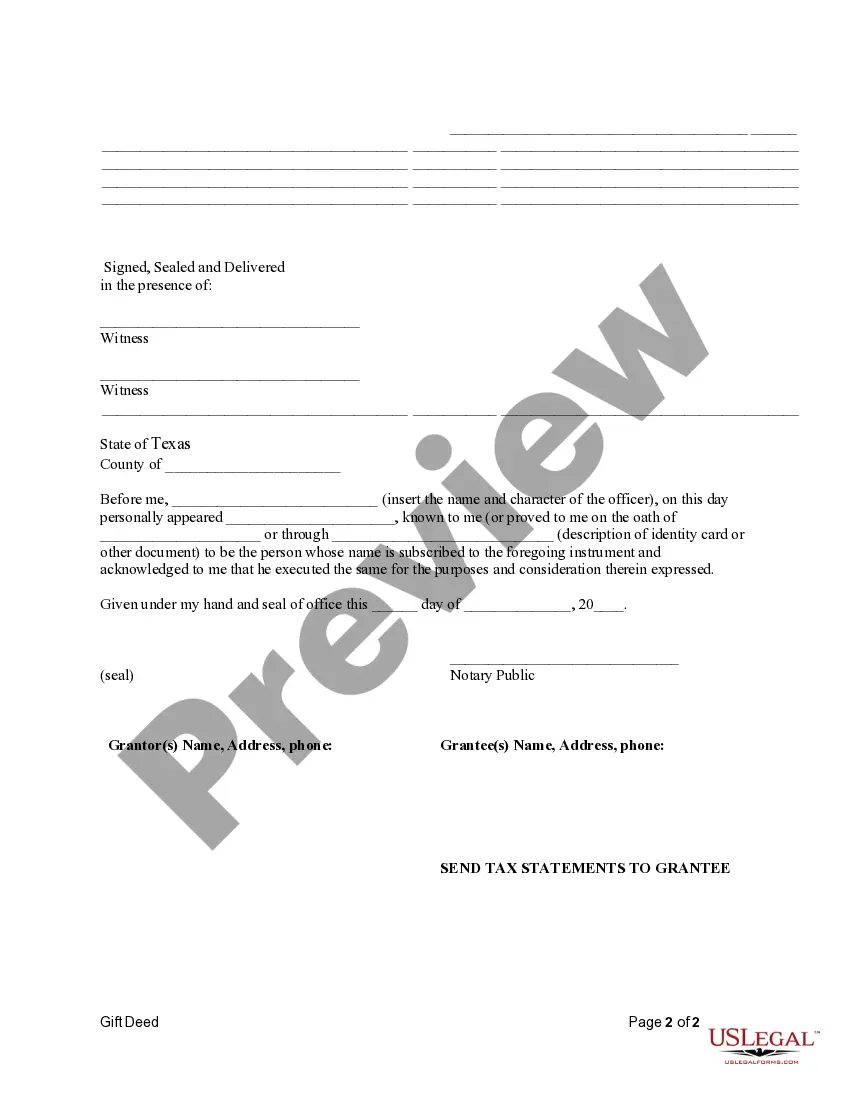

Ing to Texas Property Code § 5.021, a deed must be in writing, it must be signed by the grantor, it must include a legal description of the property, and it must be delivered, at which point the title immediately passes from the grantor to the grantee.

However, Texas does not impose a gift tax on transfers of real estate between family members nor is there a capital gains tax in Texas, so you may only be liable for federal taxes. When transferring a house after death through a will or trust, estate taxes may come into play.

These deeds need to be in writing and signed by the person giving the property in front of any notary. Once it has been properly prepared and signed, the deed needs to be filed with the county clerk for the county in which the property is located. The county will charge a filing fee of about $30 to $40.