Texas Gov

Description

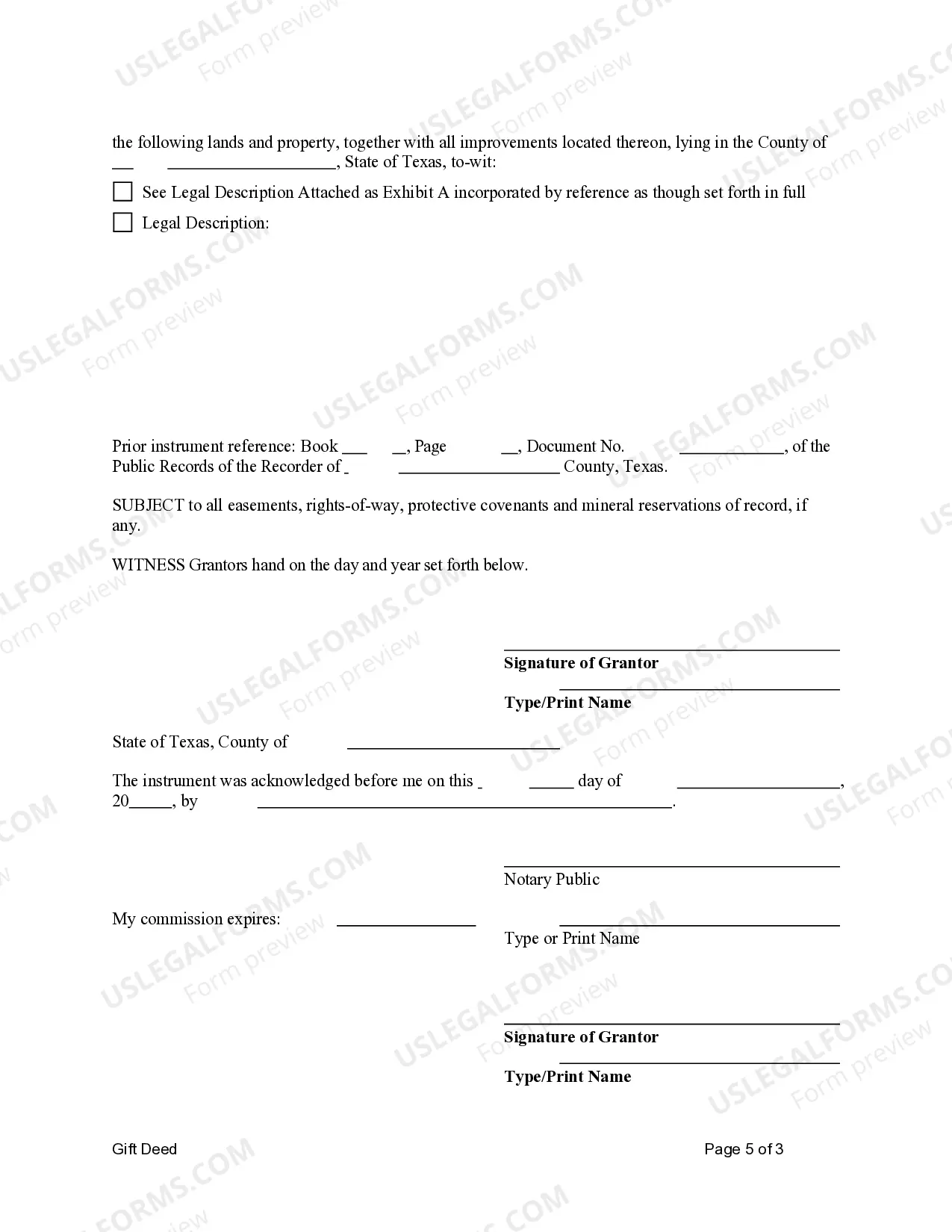

How to fill out Texas Gift Deed Gift Deed From Husband And Wife, Or Two Individuals, To Husband And Wife, Or Two Individuals.?

- Begin by logging into your existing US Legal Forms account. If you do not have an account, create one to get started.

- Explore the Preview mode and form descriptions to ensure you're selecting the right template for your legal needs.

- If you need to find another document, utilize the Search tab to locate specific forms that meet your local jurisdiction requirements.

- Proceed to purchase the document by clicking on 'Buy Now' and selecting a suitable subscription plan.

- Enter your payment details and confirm the transaction to activate your subscription.

- Once purchased, download your desired form and save it on your device for future access. You can also find it in the 'My Forms' section of your account.

By following these steps, you can easily leverage the resources available through Texas gov and US Legal Forms.

Take control of your legal documentation today by accessing the vast library at US Legal Forms. Start your journey now!

Form popularity

FAQ

To win the Texas Two Step, you need to match at least two of the four main numbers drawn, along with the bonus number. The more numbers you match, the larger the prize you may receive. Winning can often be achieved with combinations, so take the time to understand the different prize tiers. For more information about prizes and how to play, visit the Texas gov website.

Filling out a Texas Lotto ticket is a straightforward process, making it accessible for everyone. First, choose six numbers from one to 54. Be careful to mark each number clearly, or consider the quick pick option for random selections. Once completed, take your ticket to an authorized retailer to have it validated. Always check your ticket after the draw on the Texas gov website to see if you've won.

You can file your Texas 1040 tax return online or by mail, depending on your preferences. Online filing is often the quickest and easiest method and can be done through the Texas gov website or authorized e-filing providers. If you prefer to file by mail, send your completed form to the address specified for your region on the IRS website. Review your paperwork carefully to ensure everything is accurate before submission.

Filling out a Texas two-step lottery ticket involves a few simple steps. Start by choosing four numbers between one and 35, and then pick a bonus number from the same range. It's important to ensure all numbers are clearly marked on your ticket to avoid any confusion. Once done, you can take your completed ticket to a Texas lottery retailer to enter the draw.

To fill out the Texas Two Step lottery ticket, first, select your numbers. You need to pick four numbers from a set of one to 35. After that, choose a bonus number from one to 35 as well. Make sure to double-check your selections for accuracy before submitting your ticket at any authorized Texas retailer.

Yes, Texas gov is indeed a legitimate website. It serves as the official online portal for the state of Texas, providing residents and visitors with access to vital information and resources. By visiting Texas gov, you can find reliable details about government services, business resources, and community features. This platform is designed to simplify your interactions with state services and ensure you have the information you need.

In Texas, you generally need to file taxes if your income exceeds specific thresholds set by the IRS, which can vary based on filing status. It’s important to check Texas gov resources to confirm these thresholds and the requirements associated with your income level. Being informed helps you avoid penalties and ensures you meet tax obligations.

To file your Texas franchise tax online, visit the Texas gov website to access the necessary forms and guidelines. You can also use platforms like uslegalforms to simplify the filing process. Ensure you have all required documentation ready to complete your filing efficiently.

While eFiling is not mandatory for all taxpayers in Texas, it is encouraged by the state for its efficiency and speed. According to Texas gov guidelines, certain taxpayers may be required to eFile, particularly those with specific income levels. Understanding your requirements can simplify your tax process significantly.

Yes, eFileTexas is a legitimate platform authorized by the Texas government to assist with online tax filing. Users can complete their tax returns securely and conveniently. For more assurance, you can check the Texas gov website for additional information on the platform’s legitimacy.