Texas Pay Spousal Tx Withheld

Description

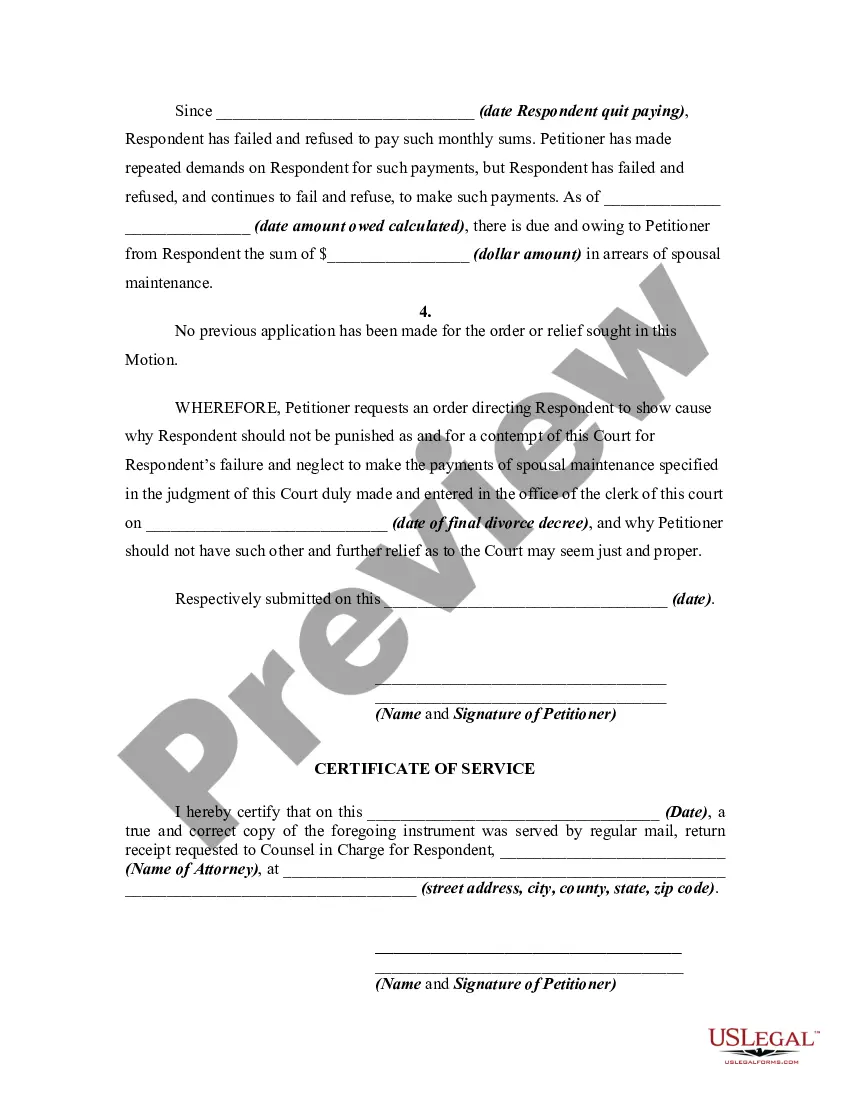

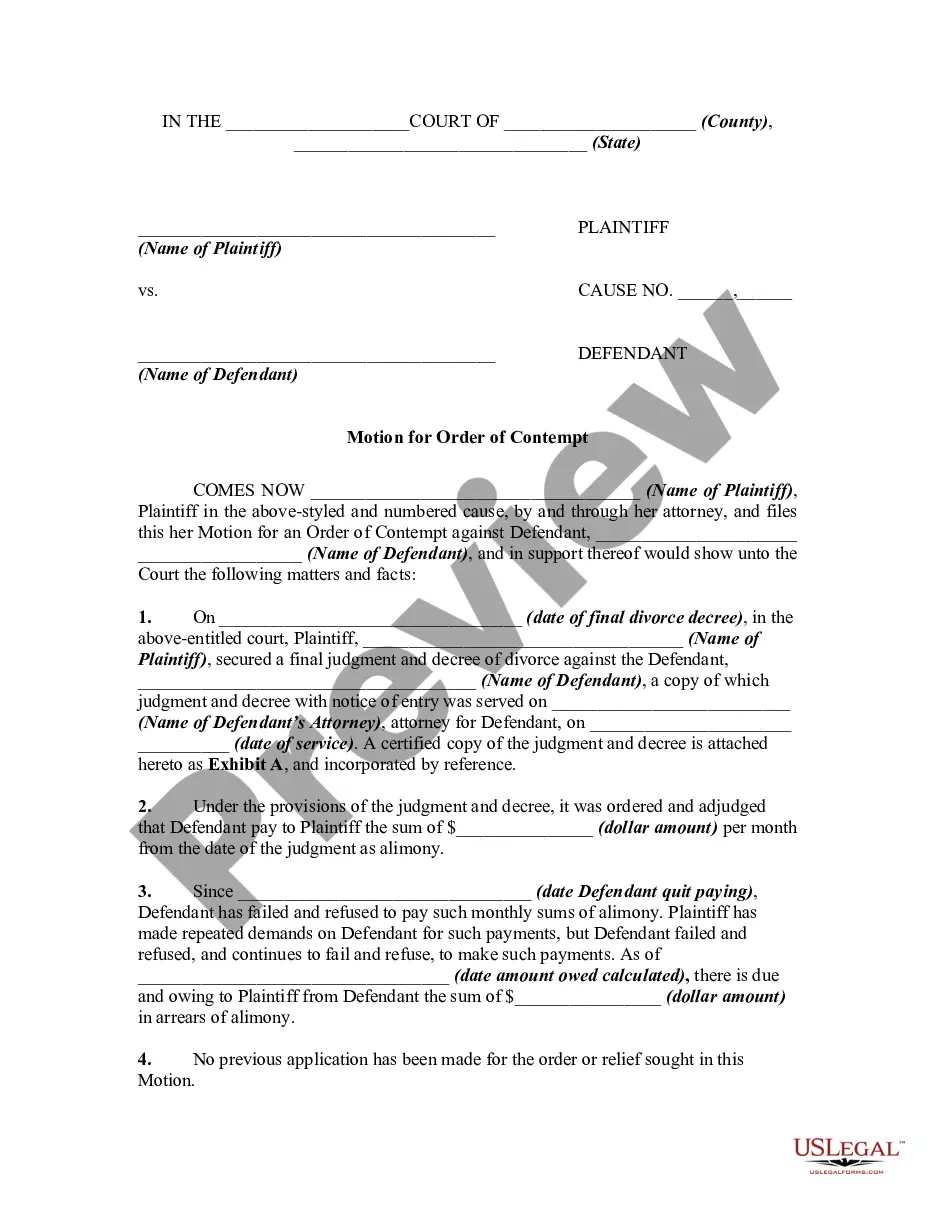

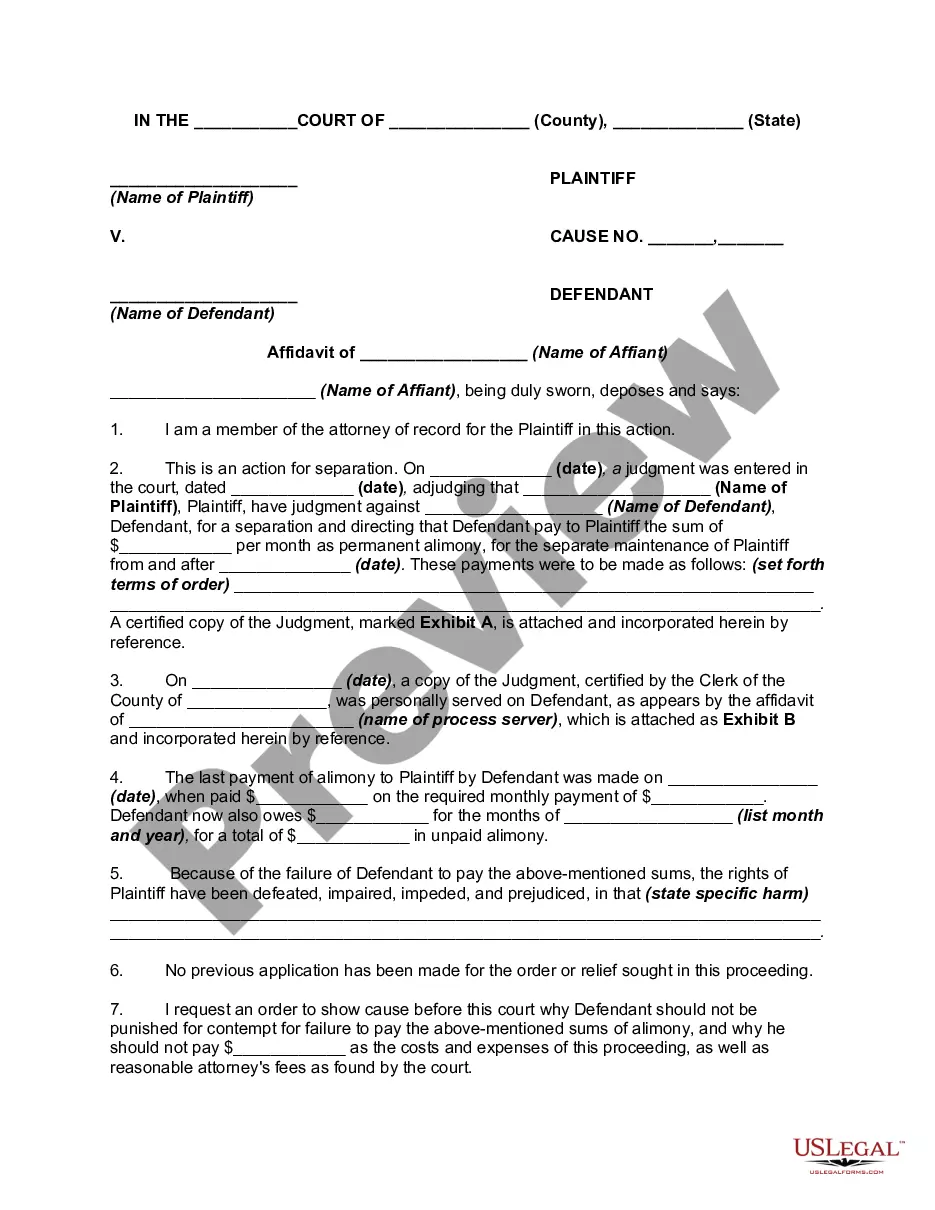

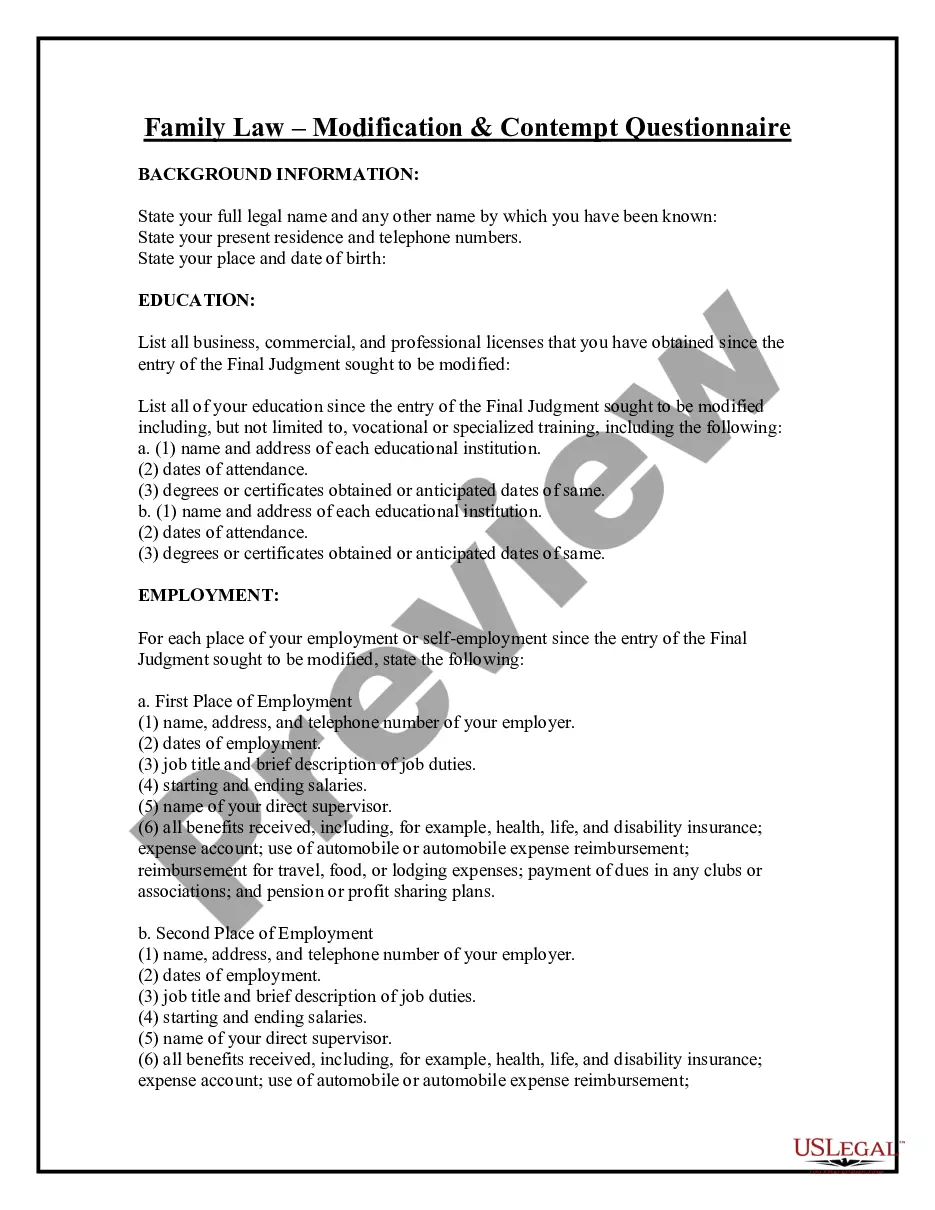

How to fill out Texas Motion For Order Of Contempt For Failure To Pay Spousal Maintenance?

Whether for corporate objectives or personal matters, everyone must manage legal issues at some stage in their life.

Completing legal paperwork requires meticulous care, starting from selecting the appropriate form template.

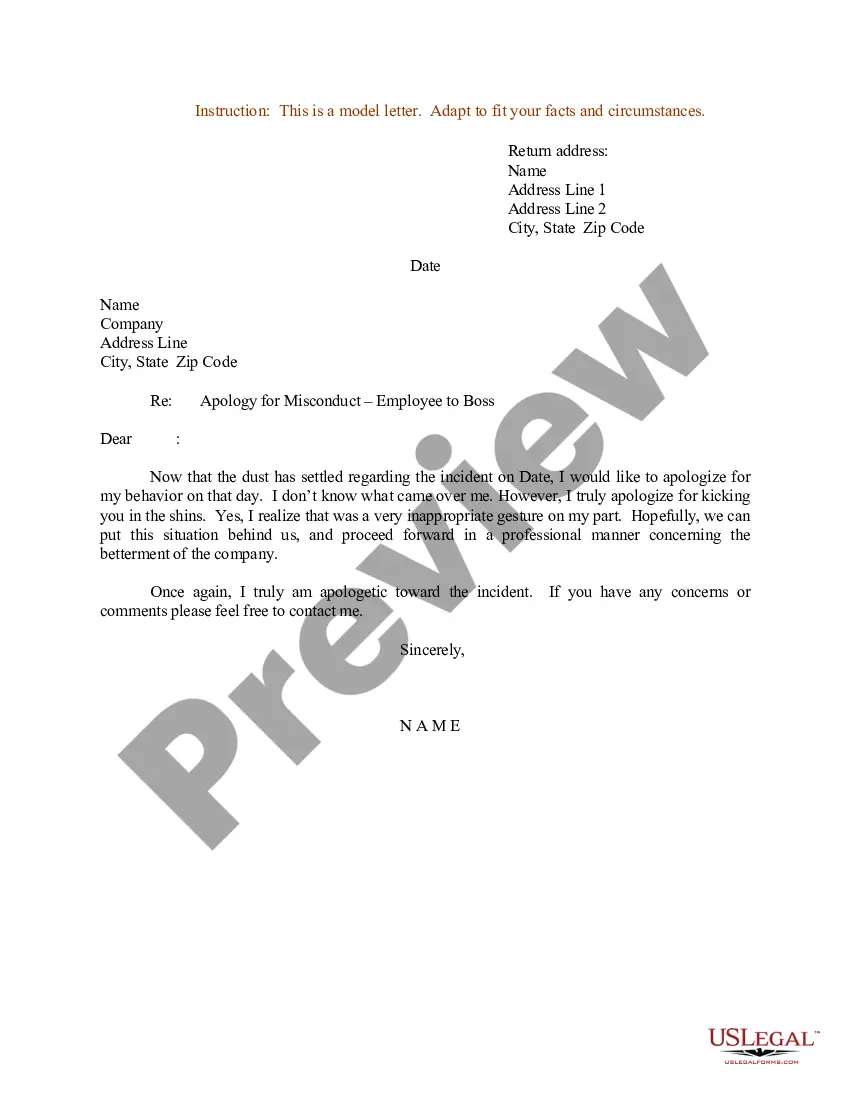

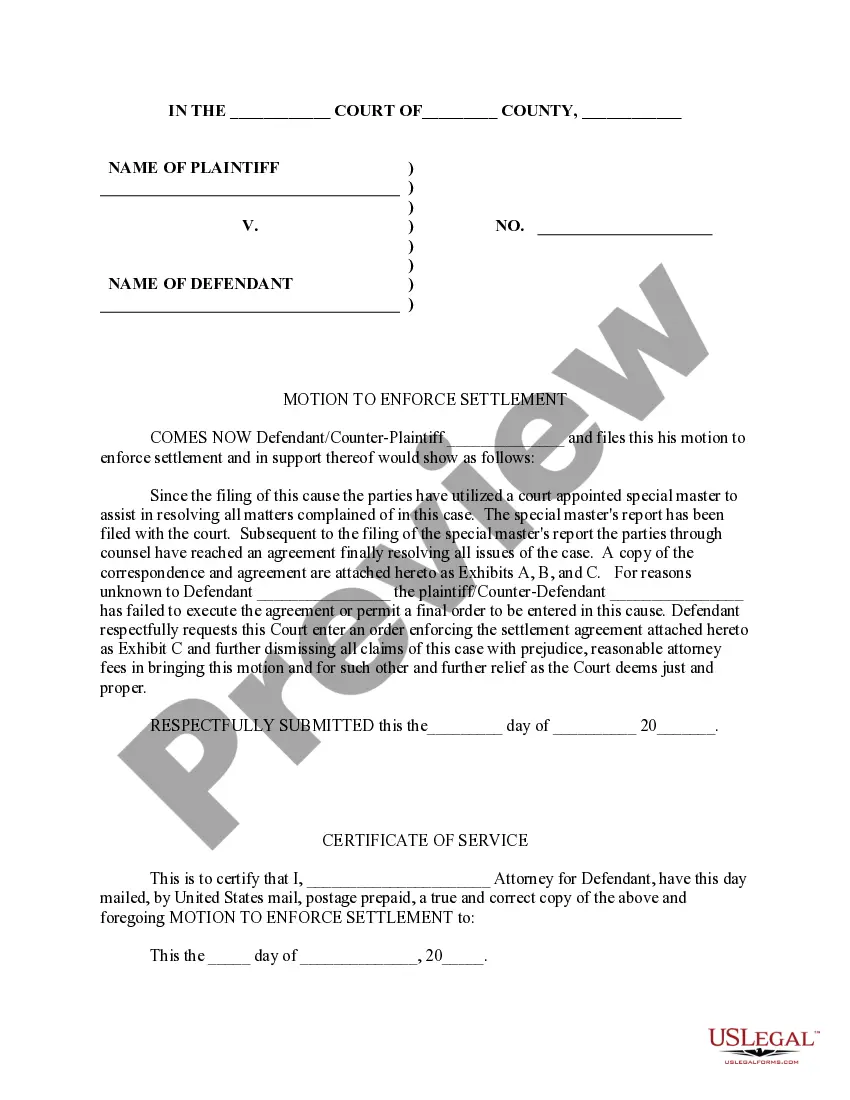

Once downloaded, you can complete the form using editing software or print it and fill it out manually. With a vast US Legal Forms catalog available, you don’t have to waste time searching for the right template online. Utilize the library’s straightforward navigation to find the suitable form for any circumstance.

- For example, if you choose an incorrect version of the Texas Pay Spousal Tx Withheld, it will be rejected upon submission.

- Thus, it is vital to have a trustworthy source for legal documents like US Legal Forms.

- If you need a Texas Pay Spousal Tx Withheld template, follow these straightforward instructions.

- Search for the required template using the search box or catalog browsing.

- Review the form’s details to confirm it is appropriate for your situation, state, and locality.

- Click on the form’s preview to inspect it.

- If it is not the correct form, return to the search tool to find the Texas Pay Spousal Tx Withheld example you need.

- Download the template if it fulfills your criteria.

- If you already possess a US Legal Forms account, simply click Log in to view previously stored documents in My documents.

- If you have not created an account yet, you can acquire the form by clicking Buy now.

- Select the appropriate pricing plan.

- Fill out the account registration form.

- Choose your payment method: use a credit card or PayPal account.

- Select the file format you prefer and download the Texas Pay Spousal Tx Withheld.

Form popularity

FAQ

Texas does not mandate spousal support in every divorce case. The court evaluates whether one spouse needs financial assistance and whether the other spouse can provide it. If you are concerned about potential spousal support payments, you can explore resources like US Legal Forms to help you navigate the laws surrounding Texas pay spousal tx withheld and ensure you are prepared.

After a divorce in Texas, you may be required to support your wife through spousal support, depending on specific circumstances. The court considers factors such as the length of the marriage, each spouse's financial resources, and the recipient spouse's needs. If you are unsure about your obligations, using US Legal Forms can provide you with the necessary tools to understand how to Texas pay spousal tx withheld and what that might entail.

In Texas, spousal support is not automatically required. The need for spousal support depends on various factors, including the financial situation of both spouses and the duration of the marriage. If you find yourself in a situation where you may need to Texas pay spousal tx withheld, consider seeking guidance from legal resources like US Legal Forms. They can help clarify your responsibilities and options.

Spousal support is not automatically mandatory in Texas; it depends on various factors, including the length of the marriage and the financial situation of both parties. Courts assess each case individually to determine if support is necessary. If you find yourself in a situation where spousal support might be needed, US Legal Forms can assist you in understanding your rights and obligations.

In Texas, spousal support is not tax-deductible for the payer, nor is it considered taxable income for the recipient. This means that while you may need to Texas pay spousal tx withheld, you will not receive any tax benefits from these payments. Understanding tax implications can be complicated, but resources like US Legal Forms can provide clarity on your financial responsibilities.

In Texas, the duration of spousal support varies based on the circumstances of the marriage and the need for support. Generally, the court may order payments for a specific period, often ranging from a few months to several years. If you face unique challenges, such as disability, the duration may extend. Utilizing platforms like US Legal Forms can help you understand your obligations and navigate the process effectively.

To seek spousal maintenance in Texas, you typically need to provide evidence of financial need, marital standard of living, and the ability of the other spouse to pay. Documents like income statements, bank statements, and expense records are crucial. Using uslegalforms can help you gather and organize this evidence efficiently, ensuring compliance with Texas pay spousal tx withheld regulations.

In Texas, spousal maintenance is calculated based on several factors, including the length of the marriage, the financial resources of each spouse, and the standard of living during the marriage. Courts often consider the needs of the lower-earning spouse when determining the amount. To get a clearer picture, utilizing a platform like uslegalforms can provide insight into the calculations and Texas pay spousal tx withheld.

In Texas, spousal support is taxed as ordinary income for the recipient. This means that the recipient will need to include it when calculating their total income for tax purposes. To ensure compliance with Texas pay spousal tx withheld requirements, consider consulting a tax expert or using uslegalforms to navigate the tax landscape.

Spousal support gets taxed when the recipient includes it as income on their tax return. The payer may deduct the amount they pay from their taxable income. This exchange ensures that each party understands their obligations, which is where tools like uslegalforms can simplify the process regarding Texas pay spousal tx withheld.