Motion Order Form With Google

Description

How to fill out Texas Motion For Order Of Contempt For Failure To Pay Spousal Maintenance?

Legal administration can be exasperating, even for the most experienced experts.

When you are looking for a Motion Order Form With Google and lack the time to spend searching for the proper and updated version, the process might be stressful.

Obtain a valuable resource center of articles, guides, and manuals pertinent to your situation and requirements.

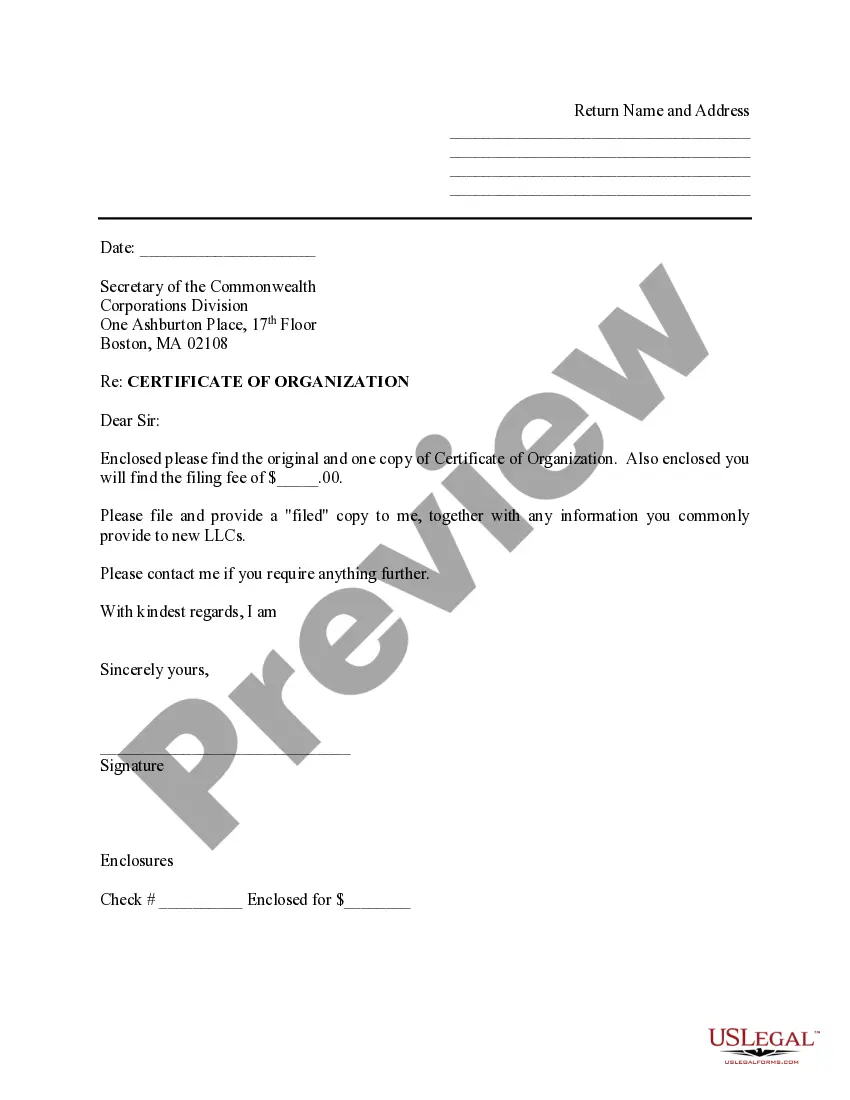

Save effort and time by searching for the documents you require, and utilize US Legal Forms' innovative search and Preview tool to locate Motion Order Form With Google and acquire it.

Ensure that the template is recognized in your state or county. Select Buy Now when you are prepared. Choose a subscription plan. Select the file format you desire, and Download, fill out, eSign, print, and deliver your documents. Benefit from the US Legal Forms web library, backed by 25 years of knowledge and dependability. Revolutionize your daily documentation management into a straightforward and user-friendly process today.

- If you have a monthly subscription, Log In to your US Legal Forms account, search for the form, and retrieve it.

- Check your My documents tab to review the paperwork you previously downloaded and manage your folders as desired.

- If this is your first time with US Legal Forms, create an account and receive unlimited access to all advantages of the library.

- Here are the steps to follow after acquiring the form you need.

- Confirm this is the correct form by previewing it and reviewing its description.

- Access state- or county-specific legal and organizational documents.

- US Legal Forms addresses any needs you might have, from personal to business paperwork, all-in-one location.

- Use advanced tools to complete and manage your Motion Order Form With Google.

Form popularity

FAQ

The Form 17 is required to be given to the contractor BEFORE he or she annexes building materials. The governmental unit or exempt organization must identify the project (e.g., east wing, chapel construction, or new school auditorium). Most nonprofit organizations are NOT exempt from sales tax in Nebraska.

The term tangible personal property also includes trade fixtures, which means machinery and equipment, regardless of the degree of attachment to real property, used directly in commercial, manufacturing, or processing activities conducted on real property, regardless of whether the real property is owned or leased, and ...

All depreciable tangible personal property, used in a trade or business, with a life of more than one year is subject to net book personal property tax in Nebraska. Personal property must be reported annually to the county assessor and is based on the depreciated life of an asset.

It is the Nebraska adjusted basis of the tangible personal property multiplied by the appropriate depreciation factor for the recovery period and year. The property tax is imposed on the net book value of tangible personal property.

Property owners in Nebraska pay taxes on real estate they own, unless the taxpayer's property is exempt. Notably, state law enables some taxpayers who own tax-exempt property to make payments, known as payments in lieu of taxes, to taxing authorities in certain circumstances.

013.01 A sale for resale is a sale of property (services) to any purchaser for the purpose of resale in the normal course of the purchaser's business. The property may be resold either in the form or condition in which it was purchased, or as an ingredient or component part of other property.

Form 13, Section B, may be completed and issued by governmental units or organizations that are exempt from paying Nebraska sales and use taxes. See this list in the Nebraska Sales Tax Exemptions Chart. Most nonprofit organizations are not exempt from paying sales and use tax.

Valuation is the function of assessing property and the improvements thereon. ing to Nebraska State Law, the assessed value of property is based on 100% of the actual market value of the property during the year in which it is assessed, not the year it was purchased.