Motion Order Form Tx Withholding Tax

Description

How to fill out Texas Motion For Order Of Contempt For Failure To Pay Spousal Maintenance?

Securing a reliable source for obtaining the latest and pertinent legal templates is a significant part of managing bureaucracy. Locating the appropriate legal documents requires accuracy and meticulousness, making it crucial to acquire samples of Motion Order Form Tx Withholding Tax exclusively from trusted sources, such as US Legal Forms. Utilizing an incorrect template may result in wasted time and delay the situation you are confronting.

With US Legal Forms, you can have peace of mind. You are able to view all the information regarding the document's application and its relevance to your circumstances and locality.

Once you have the form on your device, you can modify it using the editor or print it out to complete it by hand. Alleviate the stress associated with your legal documentation. Explore the comprehensive collection at US Legal Forms to discover legal templates, assess their relevance to your situation, and download them instantly.

- Utilize the library navigation or search box to find your template.

- Review the form's description to verify if it meets the criteria of your state and locality.

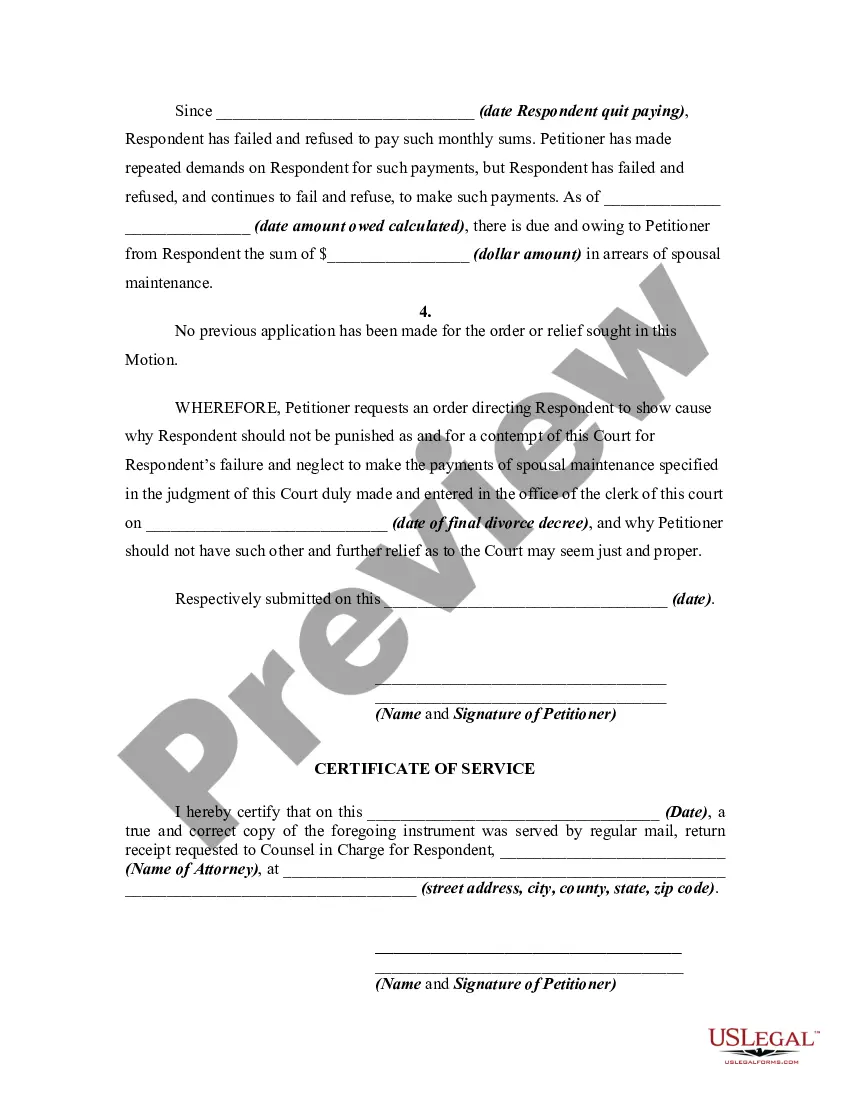

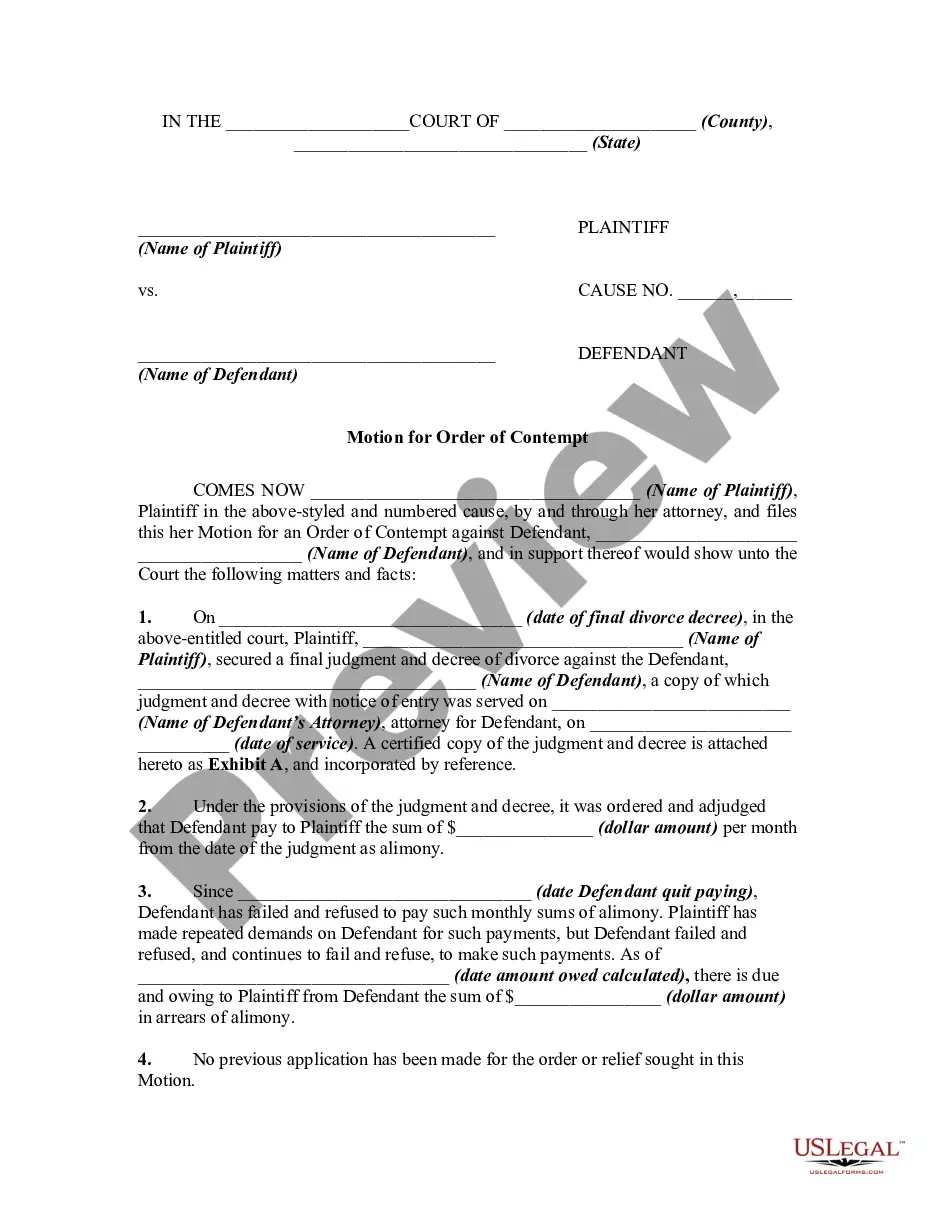

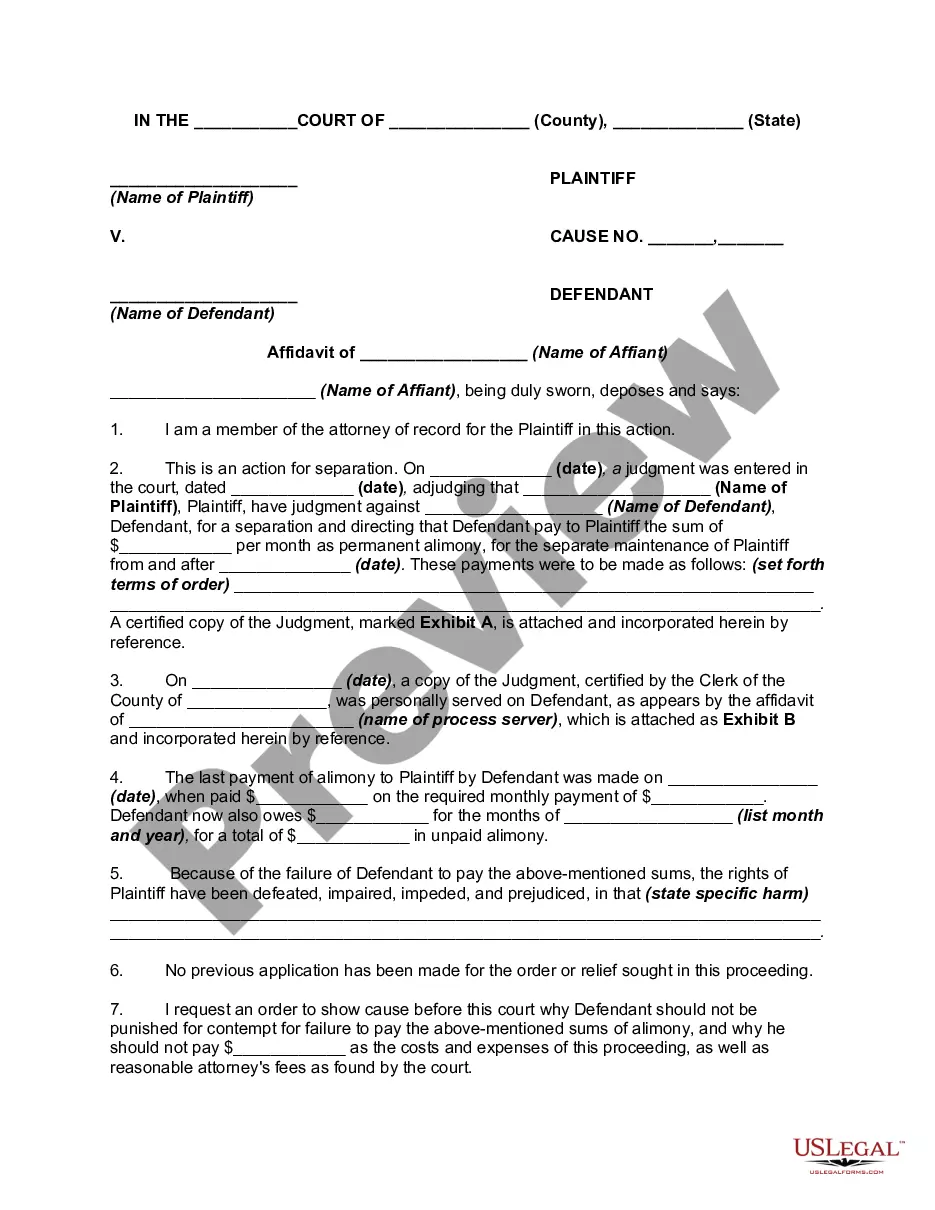

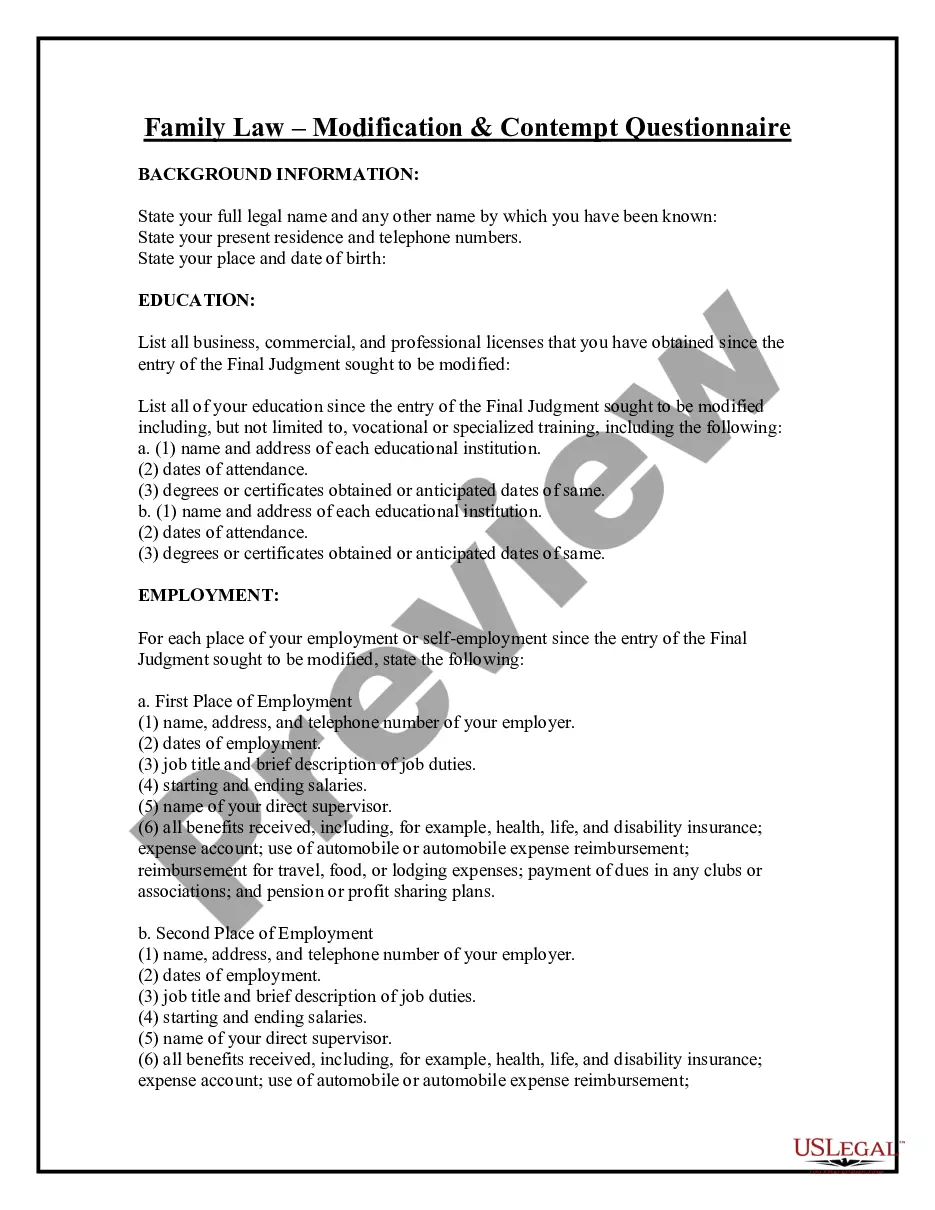

- Check the form preview, if available, to ensure that the form is the one you wish to acquire.

- If the Motion Order Form Tx Withholding Tax does not align with your needs, continue your search to locate the appropriate document.

- Once you are confident about the form's applicability, download it.

- If you are a registered user, click Log in to verify your identity and access your selected forms in My documents.

- If you do not possess an account yet, click Buy now to purchase the form.

- Select the pricing option that best suits your needs.

- Proceed to registration to finalize your acquisition.

- Complete your purchase by choosing a payment method (credit card or PayPal).

- Select the file format for downloading the Motion Order Form Tx Withholding Tax.

Form popularity

FAQ

To properly fill out a tax withholding form, begin by entering your personal details, including your name and Social Security number. Next, indicate your filing status and the number of allowances you wish to claim. It’s crucial to review the Motion order form tx withholding tax thoroughly to ensure all information is accurate, as this will affect your tax withholdings throughout the year.

Common withholding mistakes include failing to account for multiple jobs or not updating your form after a life change, such as marriage or the birth of a child. Many people also miscalculate the number of dependents they qualify for, leading to incorrect tax withholdings. To avoid these pitfalls, utilize the Motion order form tx withholding tax, which guides you through the process to ensure accuracy.

To fill out your tax withholding form, start by gathering your personal information, including your name, Social Security number, and filing status. Next, accurately report your income sources and the number of dependents you can claim. Using the Motion order form tx withholding tax, follow the instructions carefully to ensure you provide the correct information to maximize your refund or minimize your tax liability.

To file a motion to stop child support in Texas, you must first complete the required legal forms attesting to your reasons for the request. After filling out the forms accurately, submit them to the court where the original child support order was issued. If you need assistance, consider using uslegalforms to find the motion order form tx withholding tax, which can guide you through the filing process with confidence and clarity.

Yes, Texas has a state withholding form that employers must use to report and remit withholding tax to the state. This form simplifies the process of ensuring compliance with state tax laws. By utilizing the motion order form tx withholding tax, you can keep your tax obligations organized and ensure that all necessary paperwork is submitted correctly.

A withholding order in Texas is a legal directive that instructs an employer to deduct a specific amount from an employee's paycheck to cover obligations like child support or tax debts. This order ensures timely payments directly to the appropriate agency. By using the motion order form tx withholding tax, you can initiate or respond to such orders effectively, ensuring compliance with state regulations.

Yes, Texas does require a state withholding form for various employment and tax purposes. This is essential for employers to accurately report and withhold state taxes from employee wages. Utilizing the Motion order form tx withholding tax simplifies this process by ensuring you have all necessary information. By streamlining your tax compliance with the right form, you can focus more on your business operations.