House Texas

Description

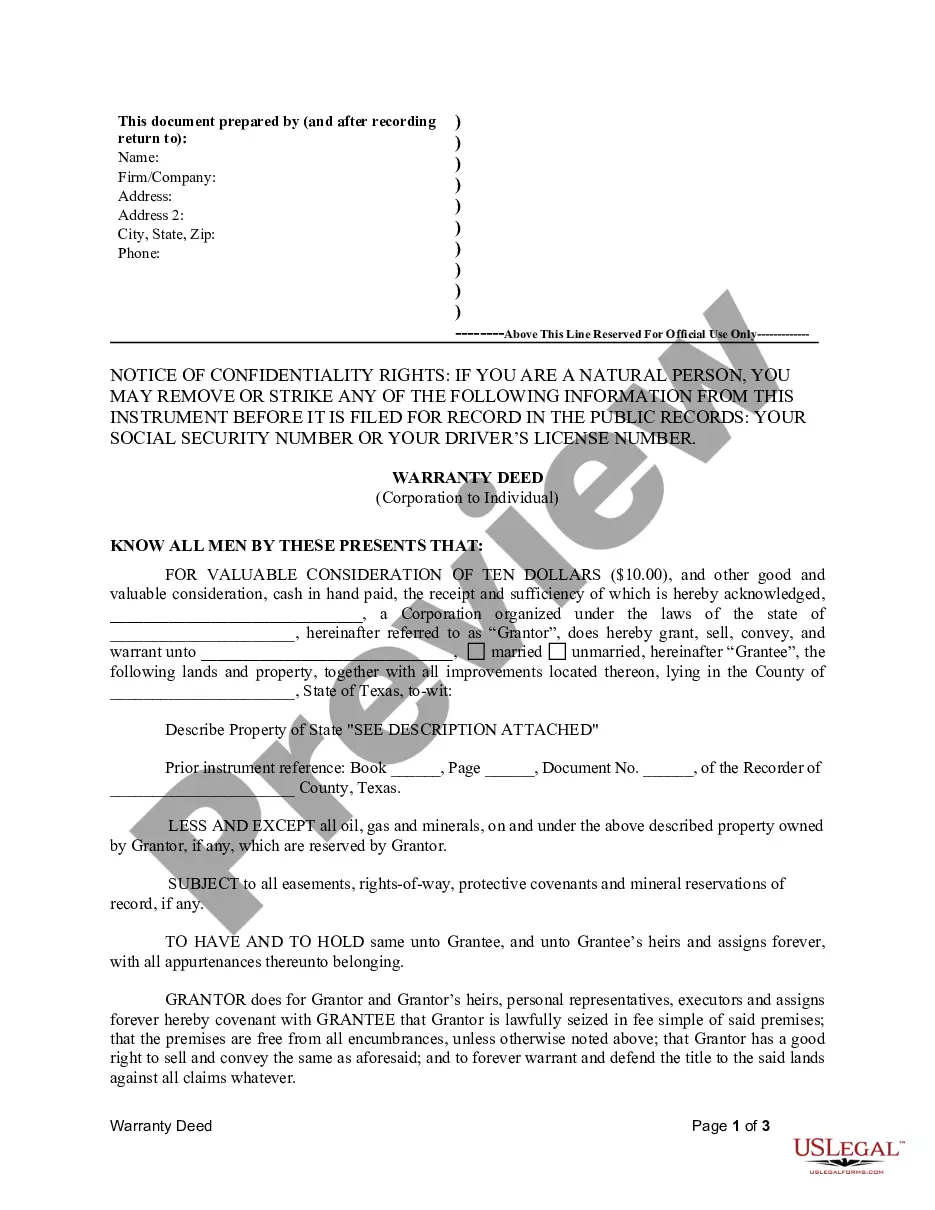

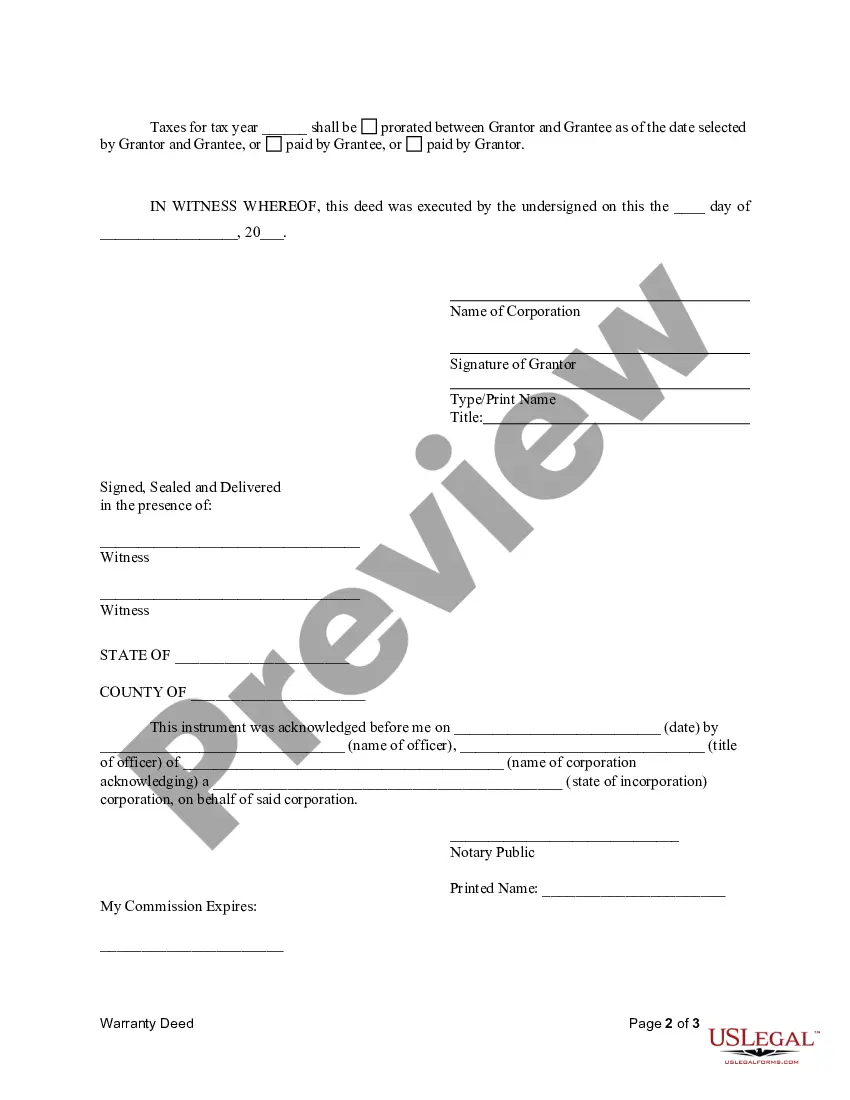

How to fill out Texas Warranty Deed From Corporation To Individual?

- Access your account: If you're a returning user, log in to your account to see your saved documents.

- Verify your subscription: Ensure that your subscription is active and up to date. If not, renew it based on your payment plan.

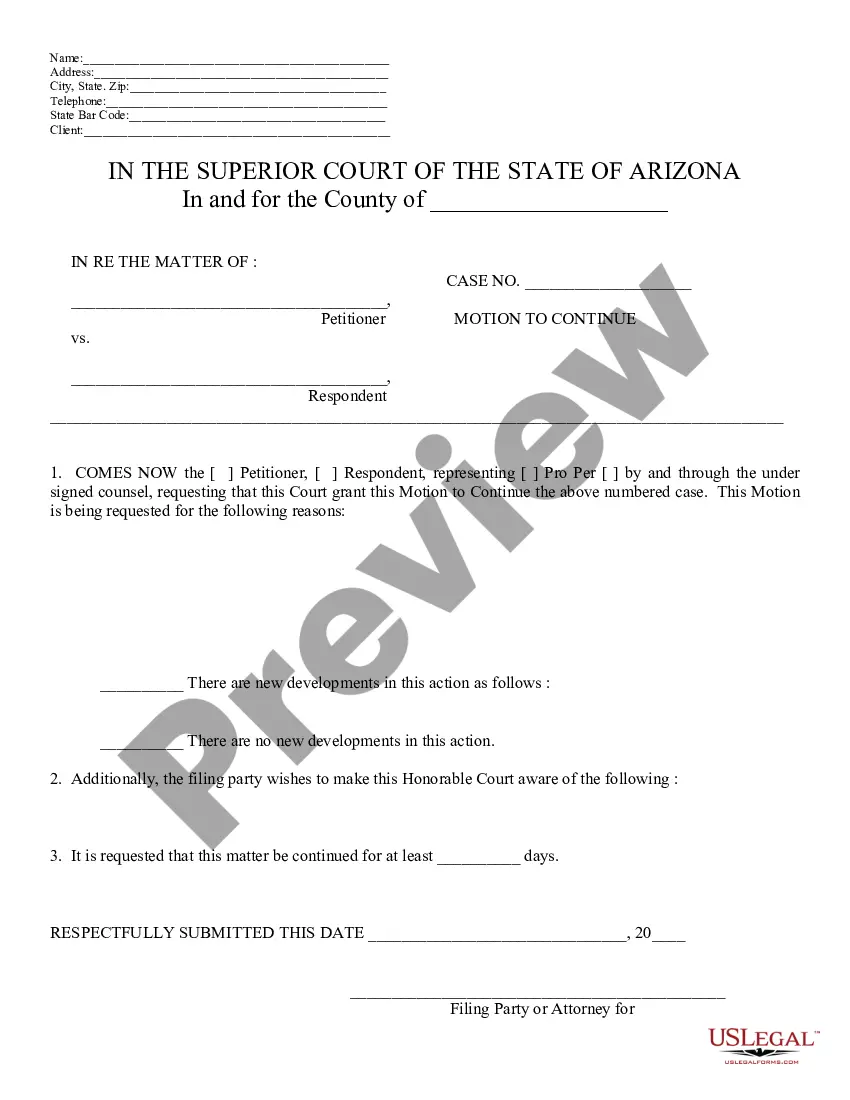

- Explore the library: For new users, start by checking the Preview mode and form descriptions to identify the house texas forms that meet your needs.

- Search if needed: If you can’t find the right document, use the Search tab to locate the correct form that aligns with Texas legal requirements.

- Make a purchase: Once you've selected the right document, click on the Buy Now button and choose your preferred subscription plan.

- Complete your purchase: Enter your payment details, either credit card or PayPal, to finalize your subscription.

- Download your document: After your transaction, download the form to your device. You can also access it in the My Forms section whenever you need it.

US Legal Forms enables fast and efficient access to a vast array of legal documentation, making it a valuable resource for anyone dealing with house transactions in Texas.

Get started today to ensure you have the correct legal forms at your fingertips—visit US Legal Forms now!

Form popularity

FAQ

Homesteading your home in Texas involves applying for a homestead exemption with your local appraisal district. You’ll need to submit proof that your house is your primary residence and meet other state requirements. By successfully filing, you can gain certain tax benefits, ultimately protecting your home in Texas from unforeseen financial challenges.

To claim a property in Texas, you must establish legal ownership through a deed and possibly file for adverse possession if you do not hold the title. If you have been living in the house in Texas and can prove your occupancy, you might pursue claiming rights through appropriate legal channels. It’s advisable to consult with a real estate attorney or utilize platforms like uslegalforms to understand your options fully.

Filing a property deed in Texas requires completing the appropriate deed form based on your situation. You must then sign the deed in front of a notary and file it with the county clerk's office in the county where your house in Texas is located. It’s crucial to ensure that all information is accurate to avoid issues in the future.

To declare your property as your primary residence in Texas, you should file for a homestead exemption with your local appraisal district. This includes providing necessary documentation that shows your house in Texas is where you reside most of the year. By doing so, you can receive tax benefits that can help reduce your property taxes.

Claiming primary residence in Texas starts with establishing your house as your main living location. To do this, you may need to file a homestead exemption application with your county appraisal district. Besides that, it is important to keep records like your Texas driver's license and any official correspondence that includes your Texas address.

Proving your primary residence in Texas involves presenting various documents that confirm you live in your house in Texas. You can use a Texas driver's license, utility bills, or bank statements that show your name and address. It is essential to maintain consistent documentation to demonstrate your intent to make Texas your primary residence.

To file for a homestead exemption in Texas, you need to provide proof of ownership of your house in Texas and that it is your principal residence. You'll also need to complete the appropriate exemption application for your county and submit it by the deadline, usually by April 30th. Some counties may require additional documentation like a copy of your driver's license or a utility bill.

To claim residency for taxes in Texas, you must establish a permanent home in the state. This often involves getting a Texas driver's license, registering to vote, and filing your taxes using your Texas address. Additionally, consider gathering documentation that shows your intent to treat Texas as your primary residence, such as utility bills or a lease agreement for your house in Texas.

Yes, you can buy a house in Texas with an annual salary of $30,000; however, it may limit your options significantly. Lenders commonly use your income to evaluate how much you can afford to borrow, and additional financial factors come into play. It’s important to examine your credit score, savings for a down payment, and other debts. UsLegalForms can assist you with resources tailored for first-time buyers who may have lower incomes.

The minimum credit score required to buy a house in Texas usually varies, but most lenders prefer a score of 620 or higher. A stronger credit score can lead to better financing options and lower interest rates. It's beneficial to maintain good credit by managing debt responsibly. If you're unsure about your credit status, consider seeking advice or resources that can help you navigate the buying process.