Texas Estate Deed Without Will

Description

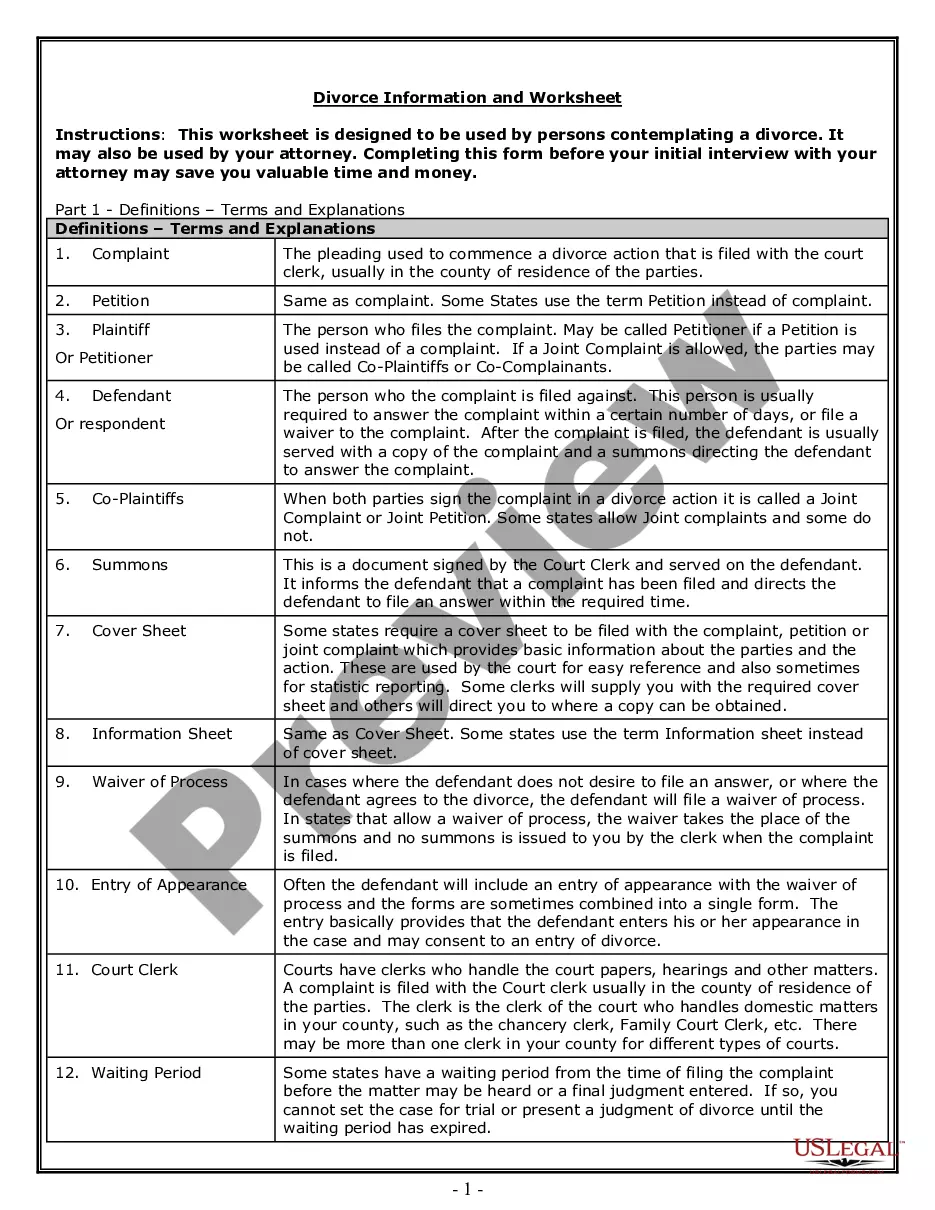

How to fill out Texas Lady Bird Or Enhanced Life Estate Warranty Deed - Individual To Individual?

Securing a reliable location for obtaining the latest and pertinent legal templates is a significant part of navigating through bureaucracy.

Finding the appropriate legal documents requires accuracy and careful consideration, which is why it is crucial to obtain Texas Estate Deed Without Will samples exclusively from trustworthy sources, such as US Legal Forms.

Once you have the form on your device, you can modify it with the editor or print it out and complete it manually. Eliminate the hassles associated with your legal documentation. Explore the extensive US Legal Forms library to find legal templates, assess their relevance to your case, and download them right away.

- Utilize the catalog navigation or search bar to locate your template.

- Examine the form's details to verify it meets your state's and area's requirements.

- Preview the form, if possible, to confirm it is exactly what you need.

- Return to the search if the Texas Estate Deed Without Will does not fulfill your criteria.

- Once you are confident about the form's suitability, proceed to download it.

- If you have an account, click Log in to verify your identity and access your chosen templates in My documents.

- If you lack an account, click Buy now to acquire the template.

- Choose the subscription plan that meets your requirements.

- Continue with the registration to finalize your purchase.

- Complete your transaction by selecting a payment option (credit card or PayPal).

- Determine the document format for downloading Texas Estate Deed Without Will.

Form popularity

FAQ

Transferring property after the death of a parent without a will in Texas requires following intestate succession laws. The closest relatives may inherit the property, but this can become a lengthy process. It’s advisable to gather necessary documents and consider how Texas estate deeds without will will affect the transfer. Engaging with experts can provide clarity and streamline the process.

Oil & gas mineral royalties are treated as ordinary income and are taxed at your marginal (highest) tax rate. The income is in addition to your hard earned pay checks, so prepare to pay a larger percentage than you pay out of your monthly salary.

The West Virginia Geological and Economic Survey provides an interactive map of over 144,000 oil and gas wells in West Virginia.

In the State of WV, minerals are considered property and therefore fall under the Ad Valorem Property Tax. All real and tangible personal property, with limited exceptions, is subject to property tax.

Class I. All tangible personal property employed exclusively in agriculture, including horticulture and grazing; All products of agriculture (including livestock) while owned by the producer; All notes, bonds, bills and accounts receivable, stocks and any other intangible personal property; Class II.

Royalty owners have the right to receive royalty payments for the oil and gas produced from the lands under which they own royalty. However, they do not have the right to lease and receive bonus and rental payments from the lease. Both mineral and royalties, however, are considered real property for tax purposes.

Class III: All real and personal property situated outside a municipality that is not taxed in Class I or Class II.

In many families, there's debate over the owners of mineral rights or surface rights. You can use the local authority website to find the general information in the state and county records.

Oil is restricted to reservoirs located primarily in northern and central West Virginia. First found in the Kanawha and the Little Kanawha river valleys in the 18th century, West Virginia's oil and gas have long been important economic resources.