Texas Supporting Form Online Withholding

Description

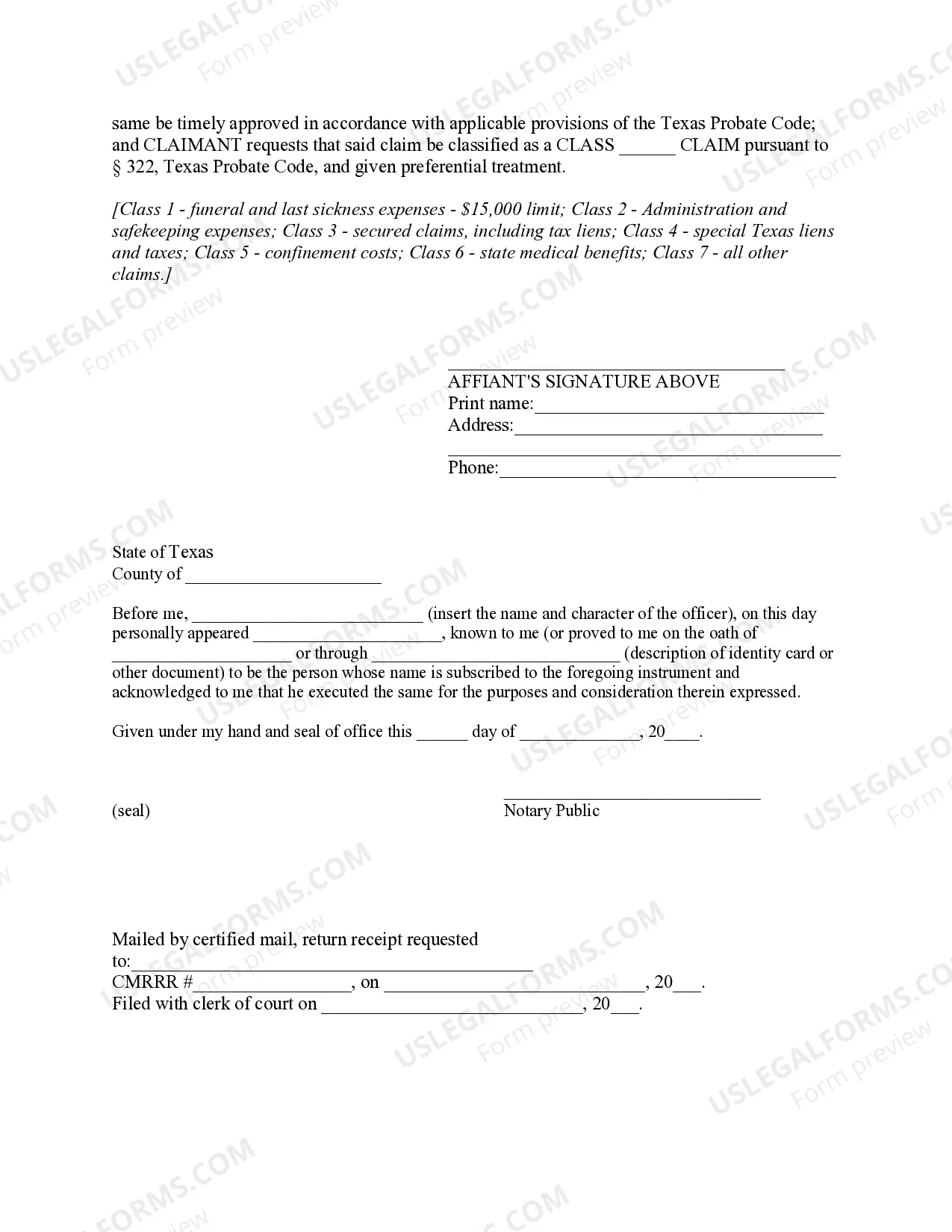

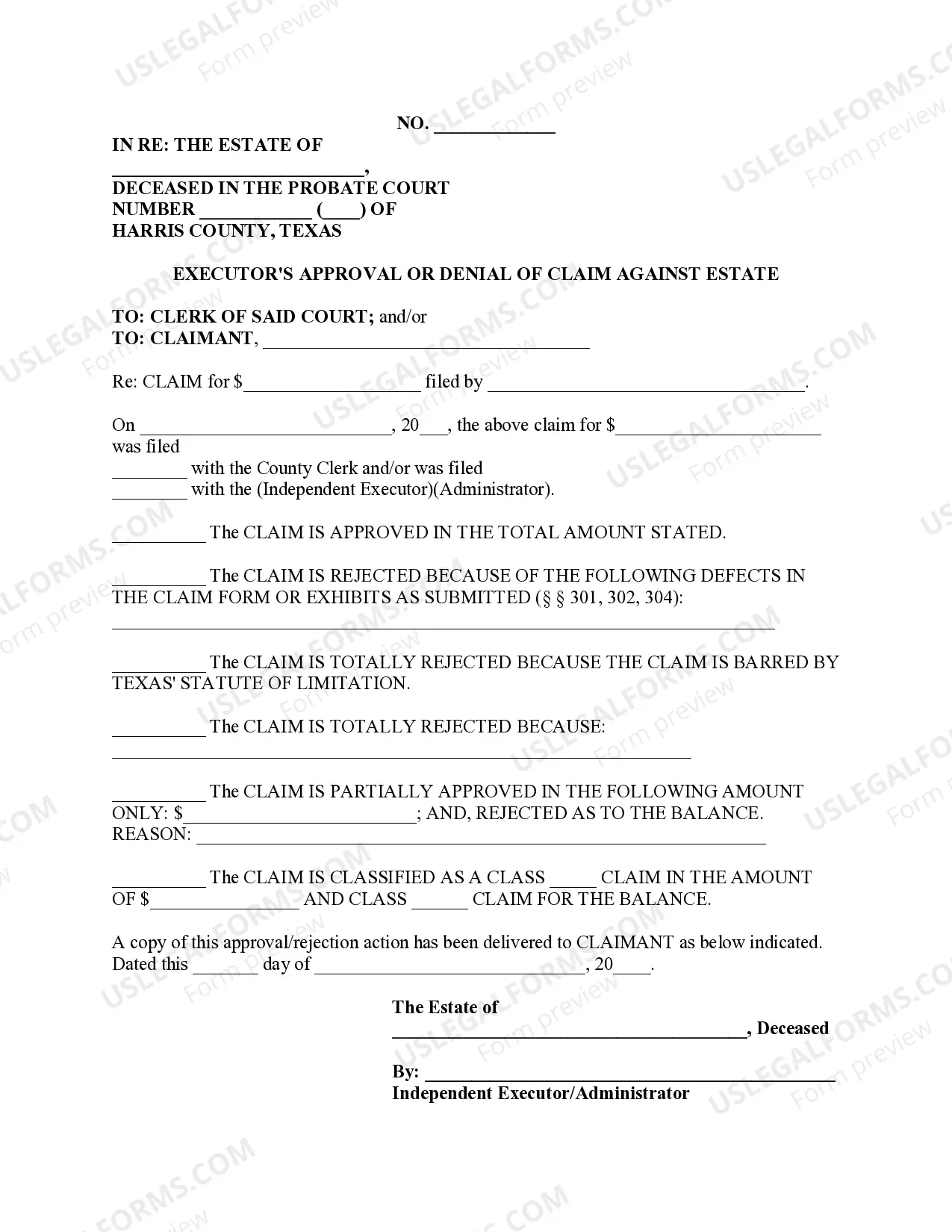

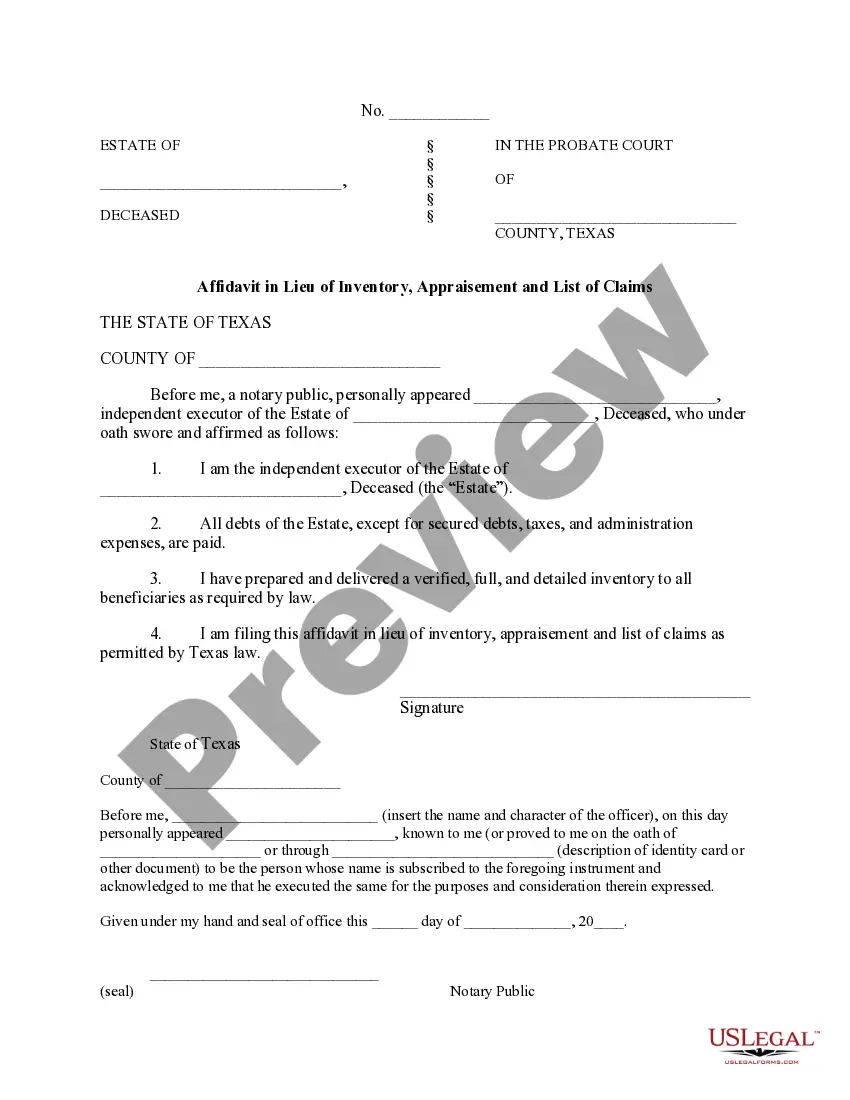

How to fill out Texas Sworn Statement Supporting Claim Against Estate?

The Texas Supporting Form Online Withholding displayed on this page is a reusable legal template created by qualified attorneys in compliance with federal and local laws.

For over 25 years, US Legal Forms has supplied individuals, organizations, and legal practitioners with more than 85,000 validated, state-specific documents for any business or personal situation. It’s the quickest, simplest, and most reliable method to acquire the forms you need, as the service ensures bank-level data security and anti-malware safeguards.

Select the format you wish for your Texas Supporting Form Online Withholding (PDF, DOCX, RTF) and download the document to your device. Print the template to fill it out manually. Alternatively, use an online multifunctional PDF editor to quickly and accurately complete and sign your form with an electronic signature. Reuse the same document whenever necessary. Access the My documents tab in your profile to redownload any previously purchased documents. Register with US Legal Forms to have verified legal templates for all of life’s scenarios at your fingertips.

- Search for the document you require and review it.

- Browse the sample you looked for and preview it or review the form description to confirm it meets your needs. If it doesn’t, utilize the search feature to find the correct one. Click Buy Now once you have located the template you need.

- Choose a subscription and Log In.

- Select the payment plan that fits you and create an account. Use PayPal or a credit card for a fast transaction. If you already possess an account, Log In and verify your subscription to continue.

- Acquire the editable template.

Form popularity

FAQ

The law in Texas requires child support to be taken directly out of the obligor's paycheck. When child support is established, an order called an Employer's Order to Withhold Income for Child Support, also called the Withholding Order, will be signed by the judge and sent to the obligor's employer.

By placing a ?0? on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period. 2. You can choose to have no taxes taken out of your tax and claim Exemption (see Example 2).

An employer who does not comply with the order/notice is liable for the following: To the obligee for the amount not paid. To the obligor/employee for the amount withheld and not paid. For reasonable attorney's fees and court costs.

The Form W-4 in Depth Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number. ... Step 2: Indicate Multiple Jobs or a Working Spouse. ... Step 3: Add Dependents. ... Step 4: Add Other Adjustments. ... Step 5: Sign and Date Form W-4.