Tax Statement Claim Download For Android

Description

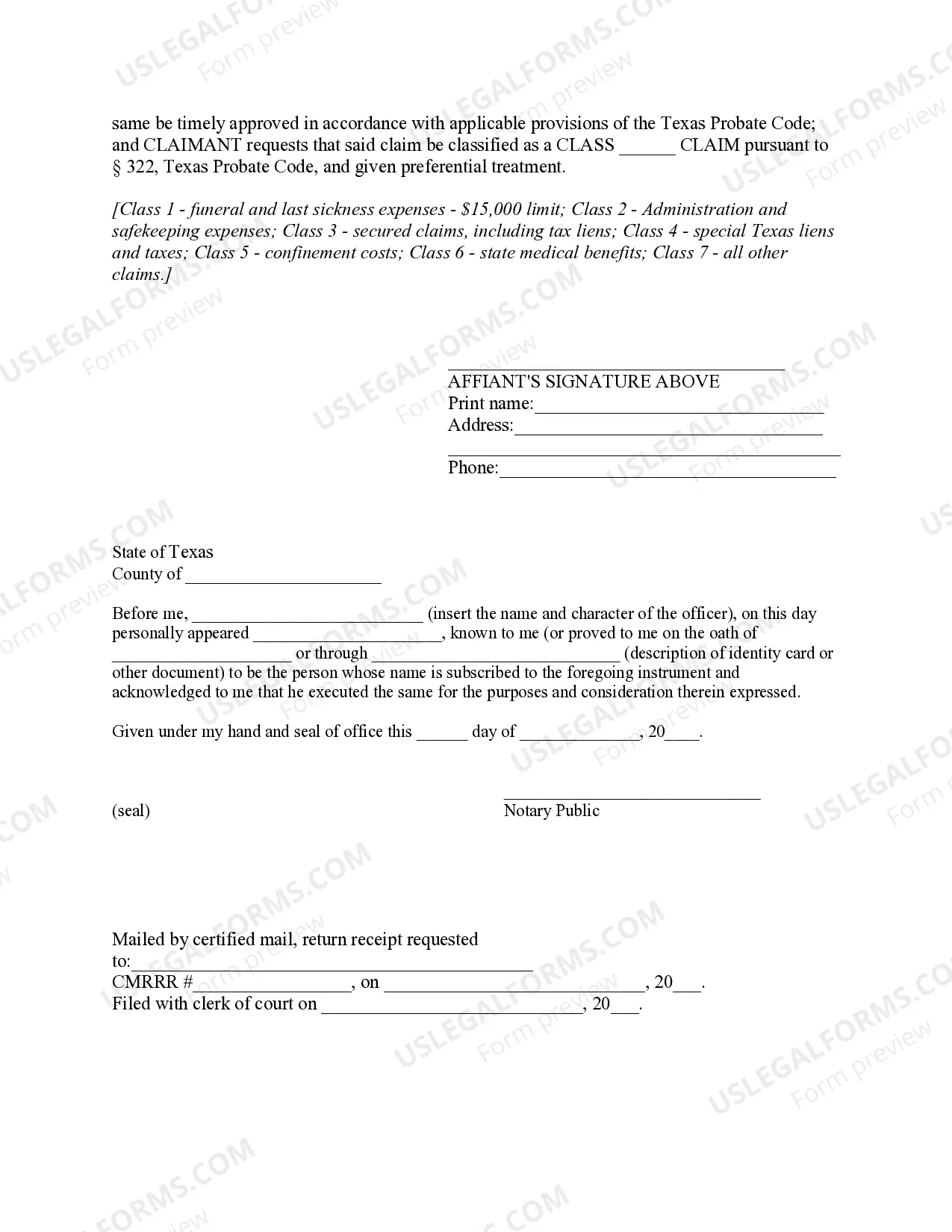

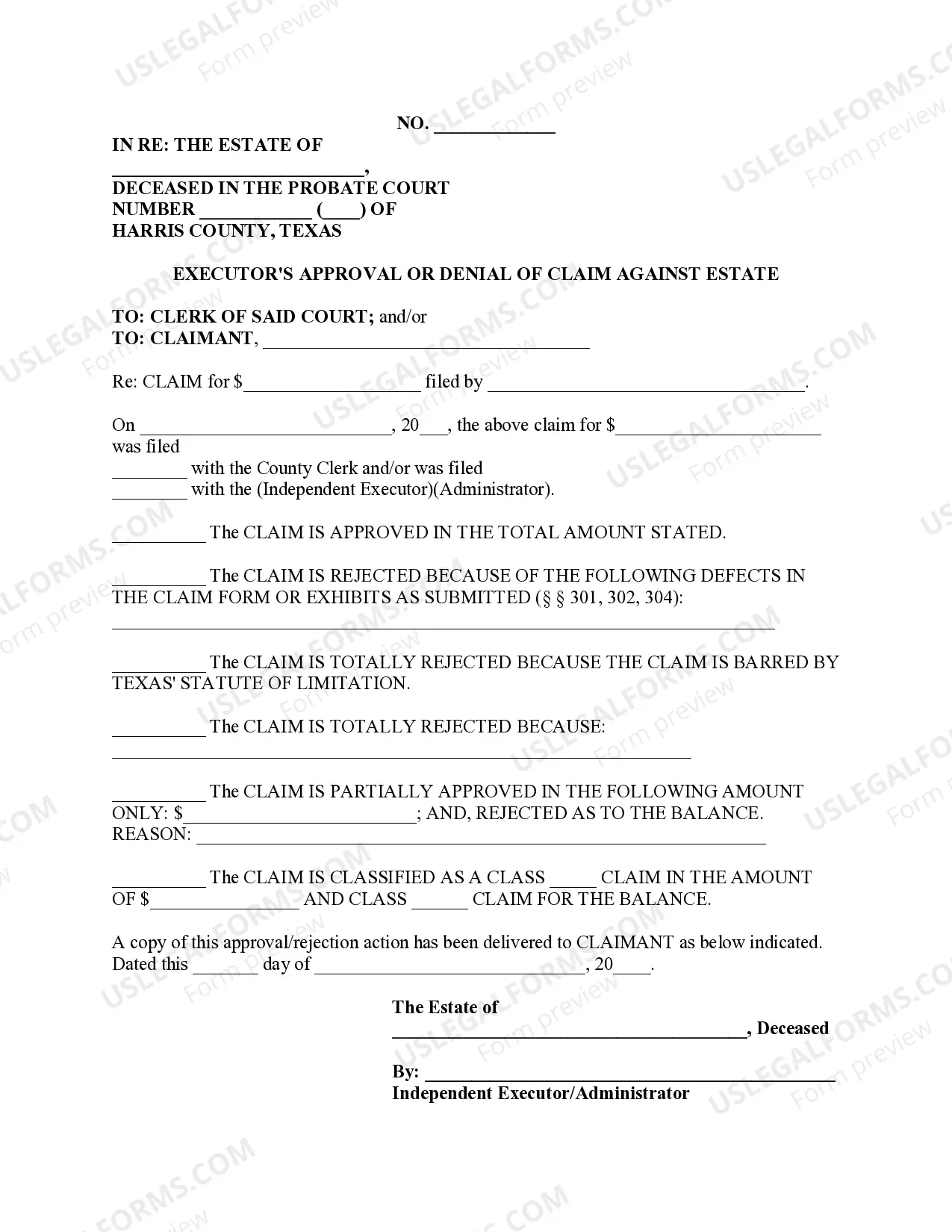

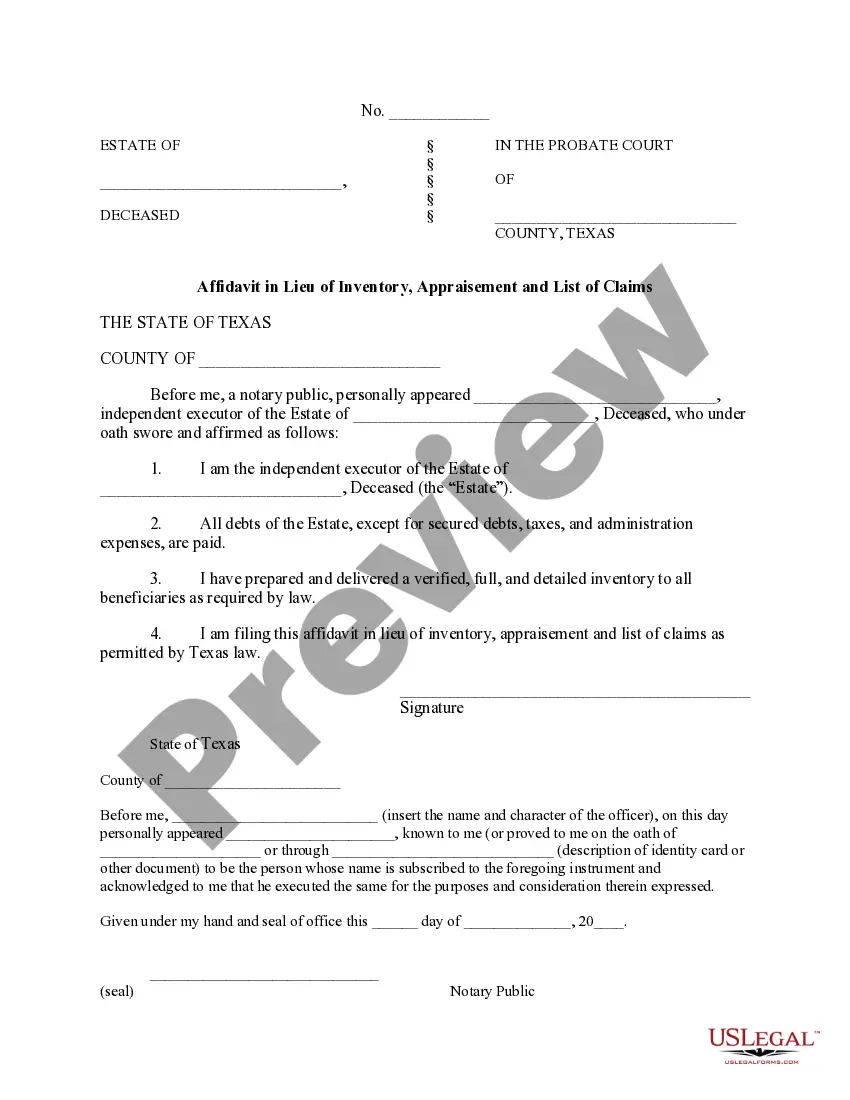

How to fill out Texas Sworn Statement Supporting Claim Against Estate?

It’s no secret that you can’t become a legal expert immediately, nor can you grasp how to quickly draft Tax Statement Claim Download For Android without having a specialized set of skills. Creating legal forms is a time-consuming venture requiring a particular education and skills. So why not leave the preparation of the Tax Statement Claim Download For Android to the professionals?

With US Legal Forms, one of the most extensive legal template libraries, you can access anything from court papers to templates for in-office communication. We know how crucial compliance and adherence to federal and state laws and regulations are. That’s why, on our platform, all forms are location specific and up to date.

Here’s start off with our website and get the form you need in mere minutes:

- Discover the form you need with the search bar at the top of the page.

- Preview it (if this option available) and check the supporting description to figure out whether Tax Statement Claim Download For Android is what you’re searching for.

- Start your search again if you need any other template.

- Set up a free account and select a subscription plan to purchase the template.

- Choose Buy now. As soon as the payment is complete, you can download the Tax Statement Claim Download For Android, fill it out, print it, and send or mail it to the necessary people or entities.

You can re-gain access to your documents from the My Forms tab at any time. If you’re an existing customer, you can simply log in, and find and download the template from the same tab.

Regardless of the purpose of your forms-be it financial and legal, or personal-our website has you covered. Try US Legal Forms now!

Form popularity

FAQ

File your way with the Tax Prep app. The newly designed H&R Block Tax Prep app lets you do your own taxes on any device, with on-demand help from our tax experts if needed. * Import or upload your W-2s with ease, then prep at your own pace. Start for free and get your biggest refund possible, guaranteed.

If the IRS sent the refund, but it was never received, use Form 3911 to request a ?refund trace.? Fill out Section I and Section II, then sign and date in Section III. Mail in the form, or fax it, to the appropriate office listed on the IRS website.

Can I Print Tax Forms Online? Yes, you can print the tax forms you download for free from the IRS website. You can also print forms from other sites that offer free downloads. If you use an online filing software, you can usually print the forms after you use the software to complete all the information.

You also have the option to view or download the form via the Income Tax Department's e-filing website, incometaxindiaefiling.gov.in. Once you've downloaded the form, you can compare the tax credit figures in Form 26AS and Form 16 to make sure they match and avoid tax default.