Statement Claim Form Online Without Net Banking

Description

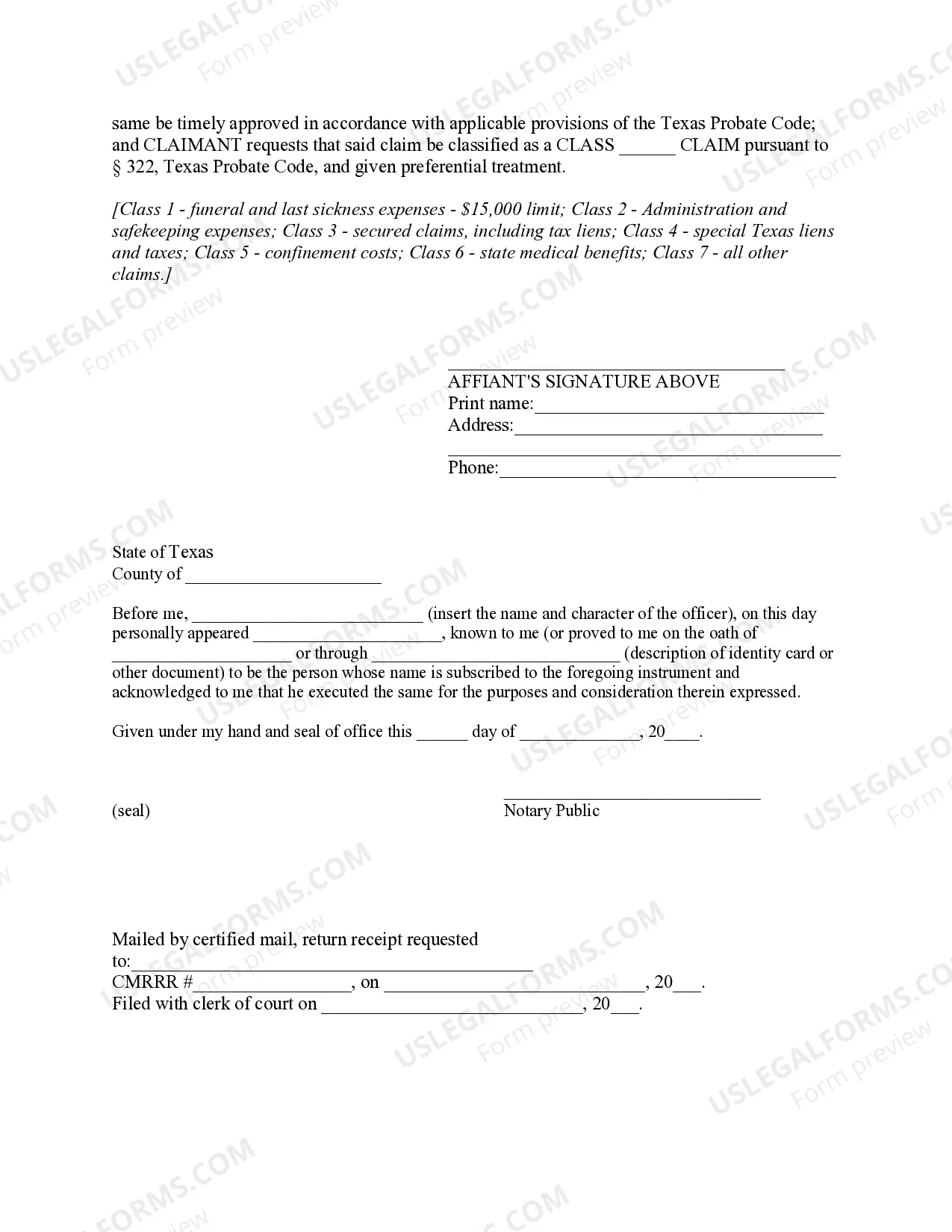

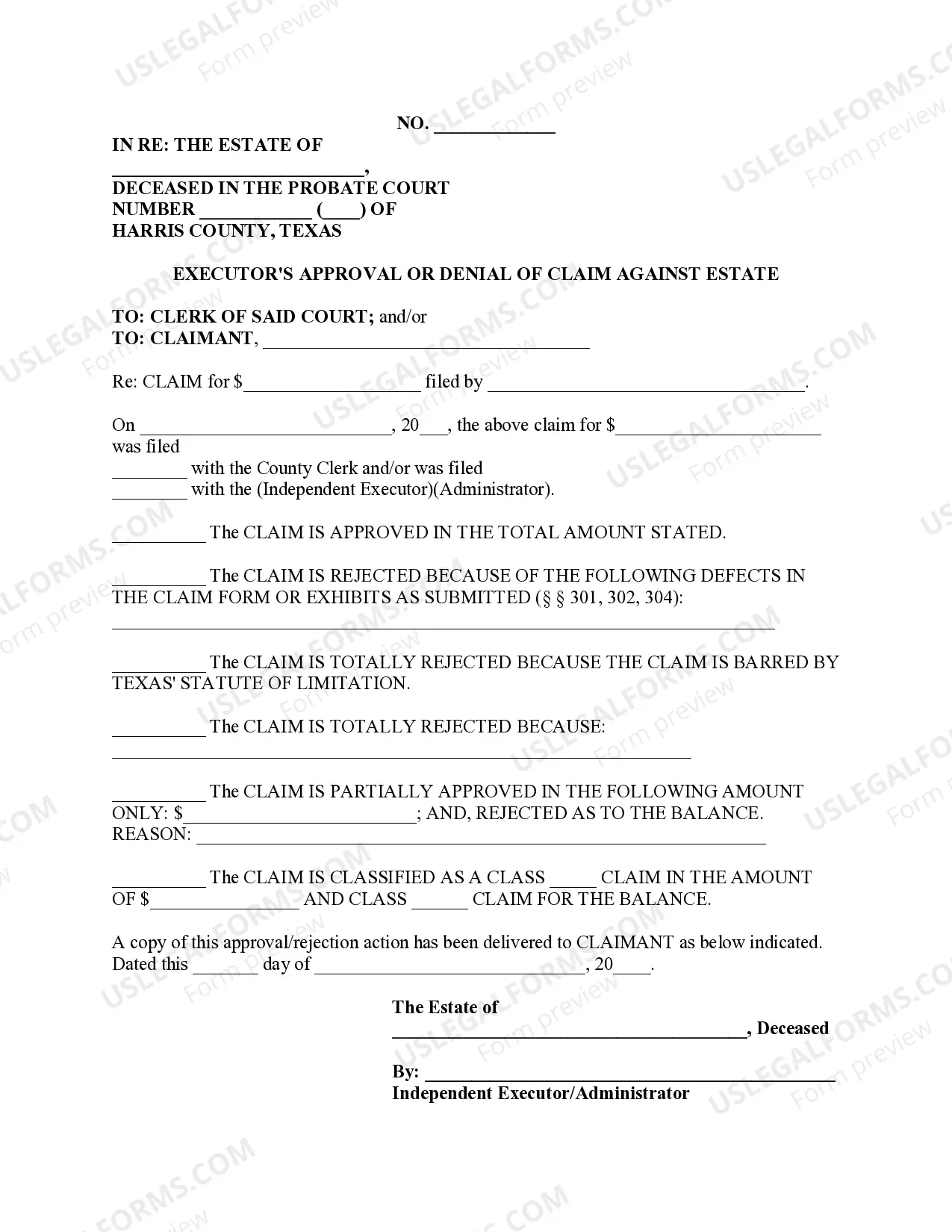

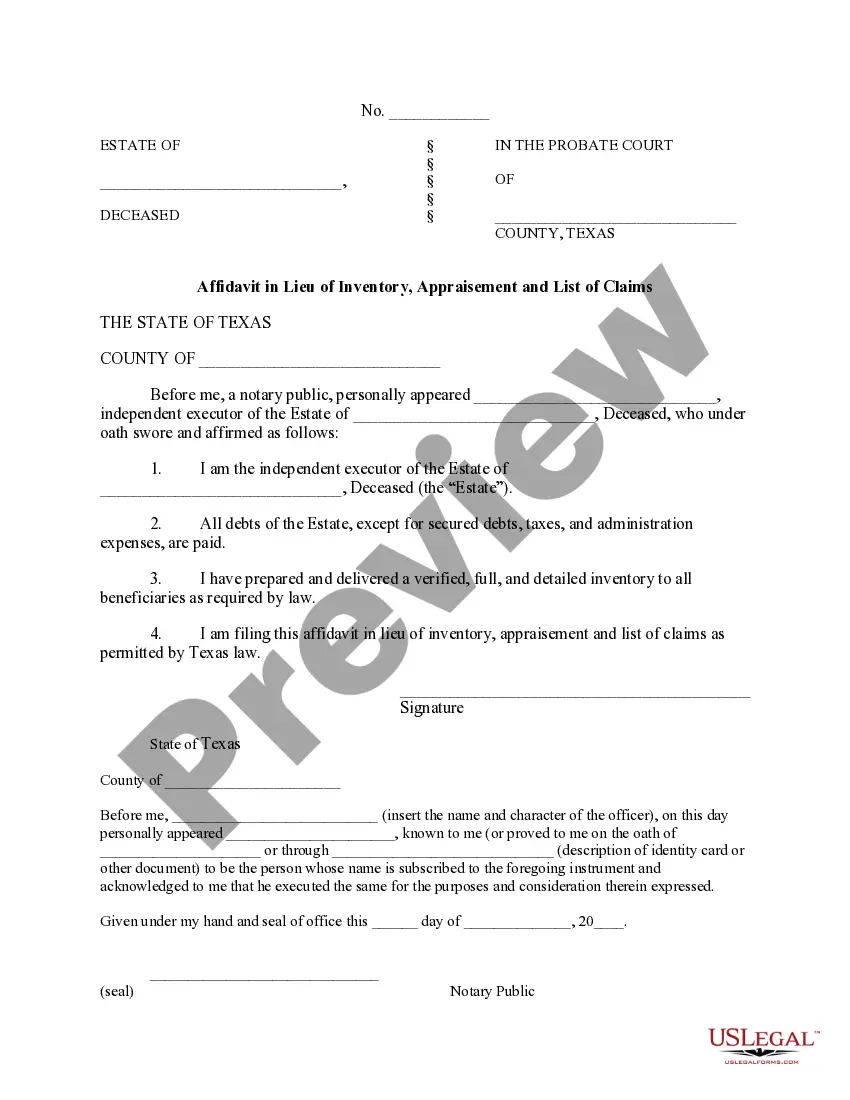

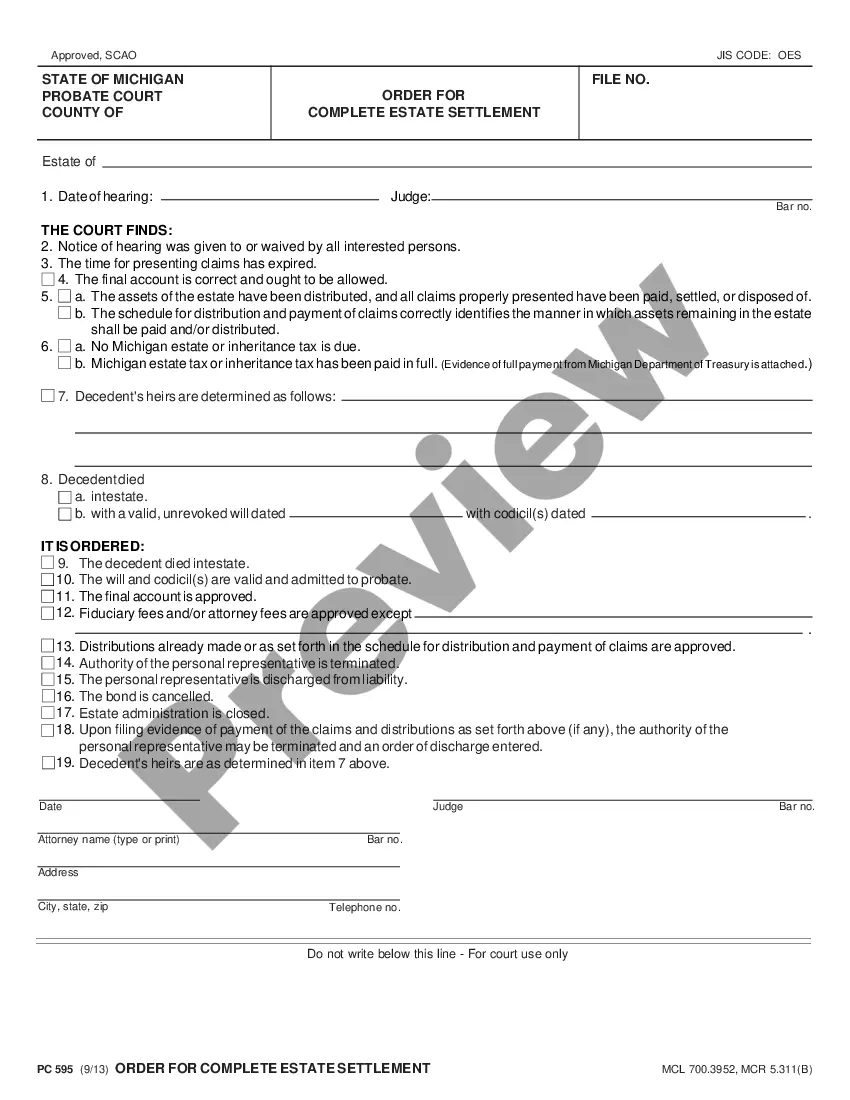

How to fill out Texas Sworn Statement Supporting Claim Against Estate?

Utilizing legal document examples that comply with both federal and local regulations is crucial, and there are numerous selections available online.

However, why waste time looking for the correct Statement Claim Form Online Without Net Banking template on the internet when the US Legal Forms online repository already compiles such forms in one convenient location.

US Legal Forms is the largest online legal database featuring over 85,000 editable templates prepared by legal professionals for various business and personal situations. They are straightforward to explore, with all documents organized by state and intended use.

Utilize the search tool at the top of the page to find alternative samples if necessary. Once you’ve identified the suitable form, click Buy Now and select a subscription option. Create an account or Log In and complete your payment using PayPal or a credit card. Select the appropriate format for your Statement Claim Form Online Without Net Banking and download it. All documents found through US Legal Forms can be reused. To redownload and complete previously acquired forms, visit the My documents section in your profile. Make the most of the most extensive and user-friendly legal document service!

- Our experts keep updated with legal changes, ensuring your documents are always current and compliant when obtaining a Statement Claim Form Online Without Net Banking from our platform.

- Acquiring a Statement Claim Form Online Without Net Banking is simple and fast for both existing and new users.

- If you possess an account with an active subscription, Log In and retrieve the document template you require in your desired format.

- For new visitors to our site, follow the steps outlined below.

- Review the template using the Preview function or examine the text description to confirm it fulfills your requirements.

Form popularity

FAQ

To obtain a bank statement offline, you can visit your bank branch and speak to a representative. They will guide you through the process, which usually includes filling out a request form. Alternatively, you can consider using a statement claim form online without net banking as a convenient way to secure your statement without visiting physically.

How to Activate Net Banking? Go to the bank's website. Click on the 'login' or 'register' button. Enter required account information, such as the account number, mobile number, branch code, and CIF number. Click the 'submit' button. Verify your identity by entering the OTP sent to your registered mobile number.

?Go to your nearest bank branch and request a statement for a specific period. You have to provide a start date and end date, just like in the online method, and collect the statement from the bank.

Both net banking and mobile banking apps are generally safe to use as banks have systems in place to detect fraudulent activity. Banks may also alert customers if they detect suspicious activity in their accounts.

Most banking apps offer a bevy of features meant to protect your sensitive information and identity that traditional banking websites might not. Some of these cybersecurity measures include: Encryption: Most mobile banking apps encrypt, aka disguise, sensitive data like login information and bank statements.

The biggest difference between the two is their functionality. Internet Banking allows you to conduct online transactions through your PC or laptop and an internet connection. On the other hand, mobile banking can be done with or without internet. Many banks nowadays have their mobile apps for mobile banking.