Claim On Estate After Death

Description

How to fill out Texas Sworn Statement Supporting Claim Against Estate?

Regardless of whether for professional reasons or personal matters, everyone must confront legal scenarios at some point in their lives.

Completing legal papers requires meticulous attention, beginning with selecting the suitable form template.

Once it is saved, you can complete the form using editing software or print it and finish it by hand. With a comprehensive catalog at US Legal Forms, you don't need to waste time searching online for the correct template. Utilize the library's simple navigation to find the right form for any situation.

- For example, if you choose an incorrect version of a Claim On Estate After Death, it will be rejected when submitted.

- Thus, it is crucial to obtain a reliable source of legal documents such as US Legal Forms.

- If you need a Claim On Estate After Death template, follow these straightforward steps.

- Locate the template you require using the search feature or catalog navigation.

- Review the form’s details to verify it fits your situation, state, and county.

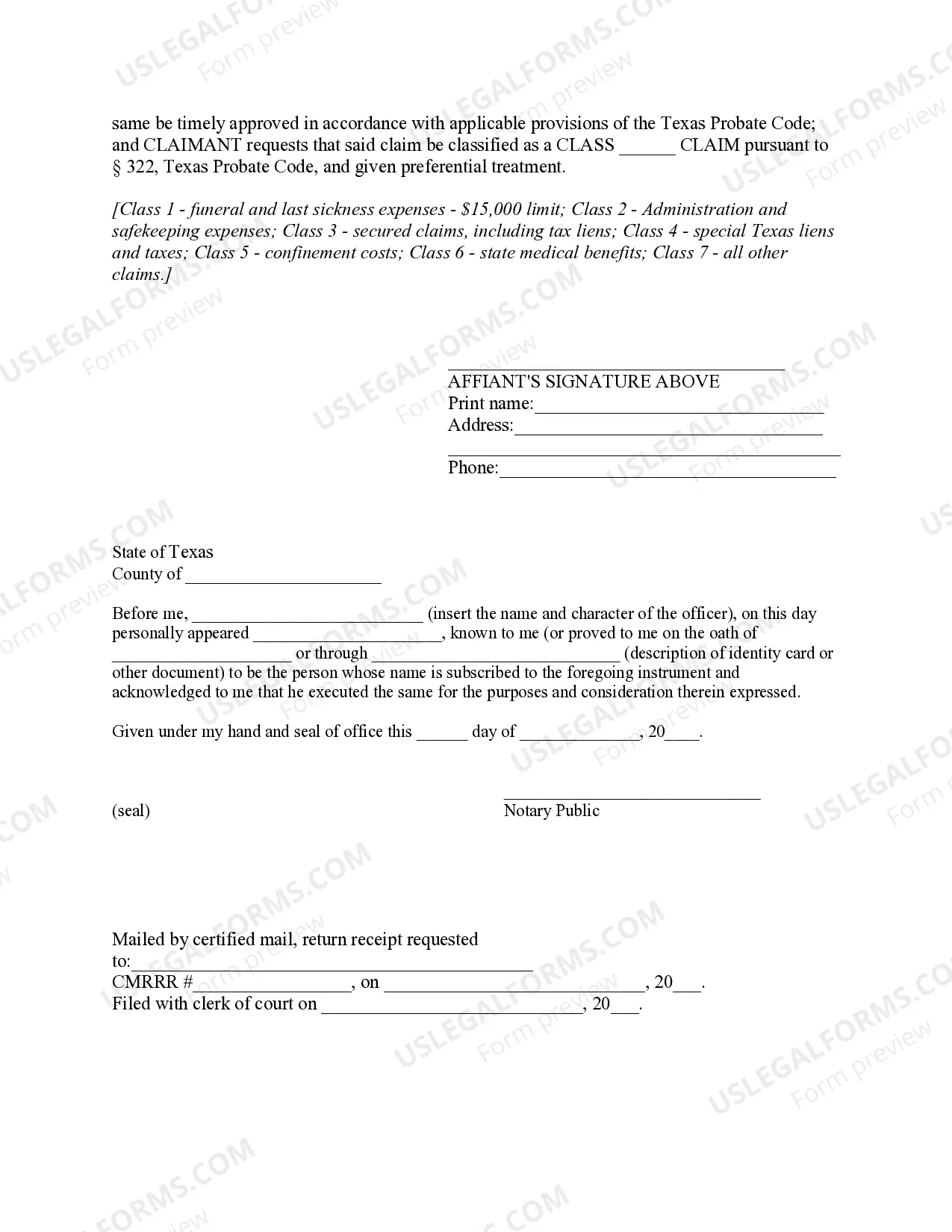

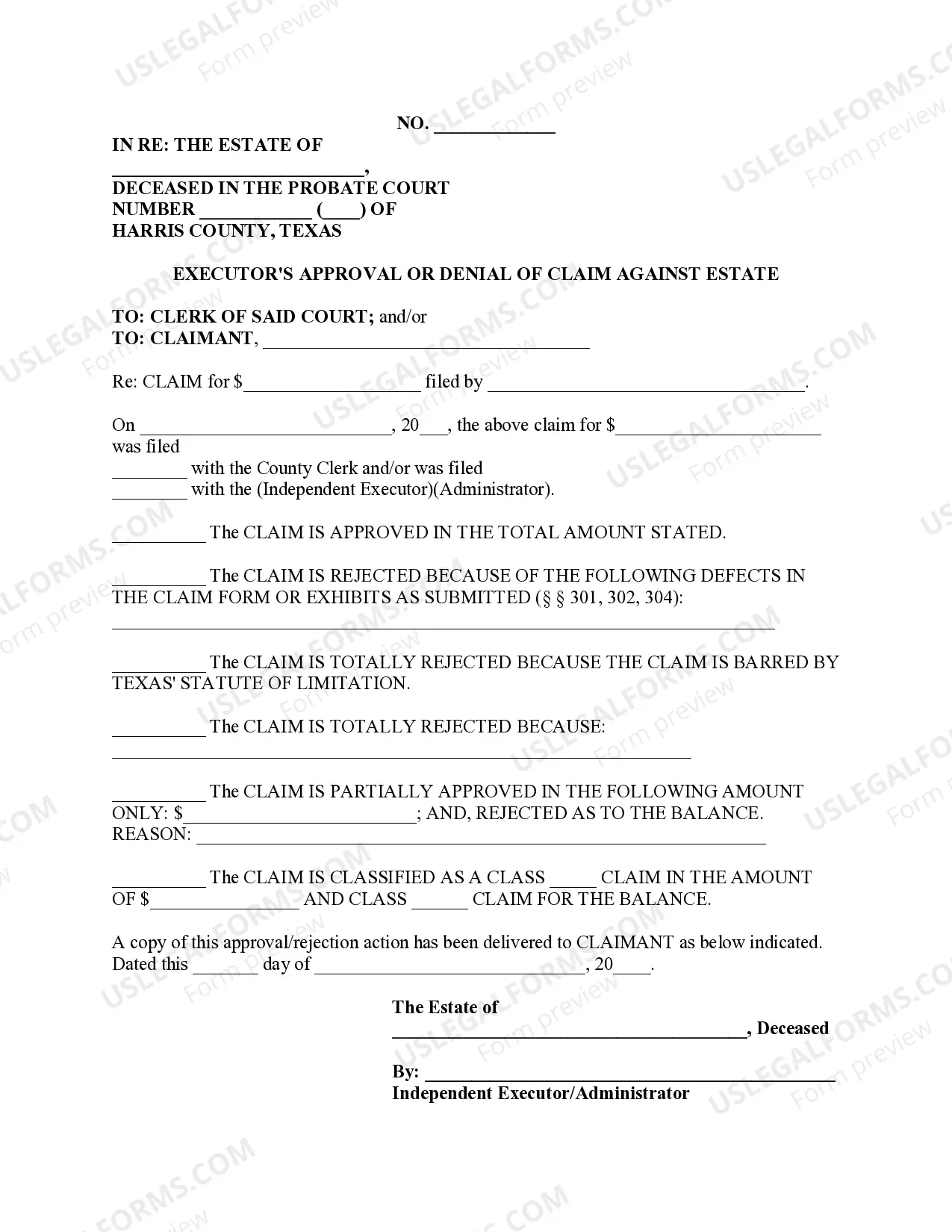

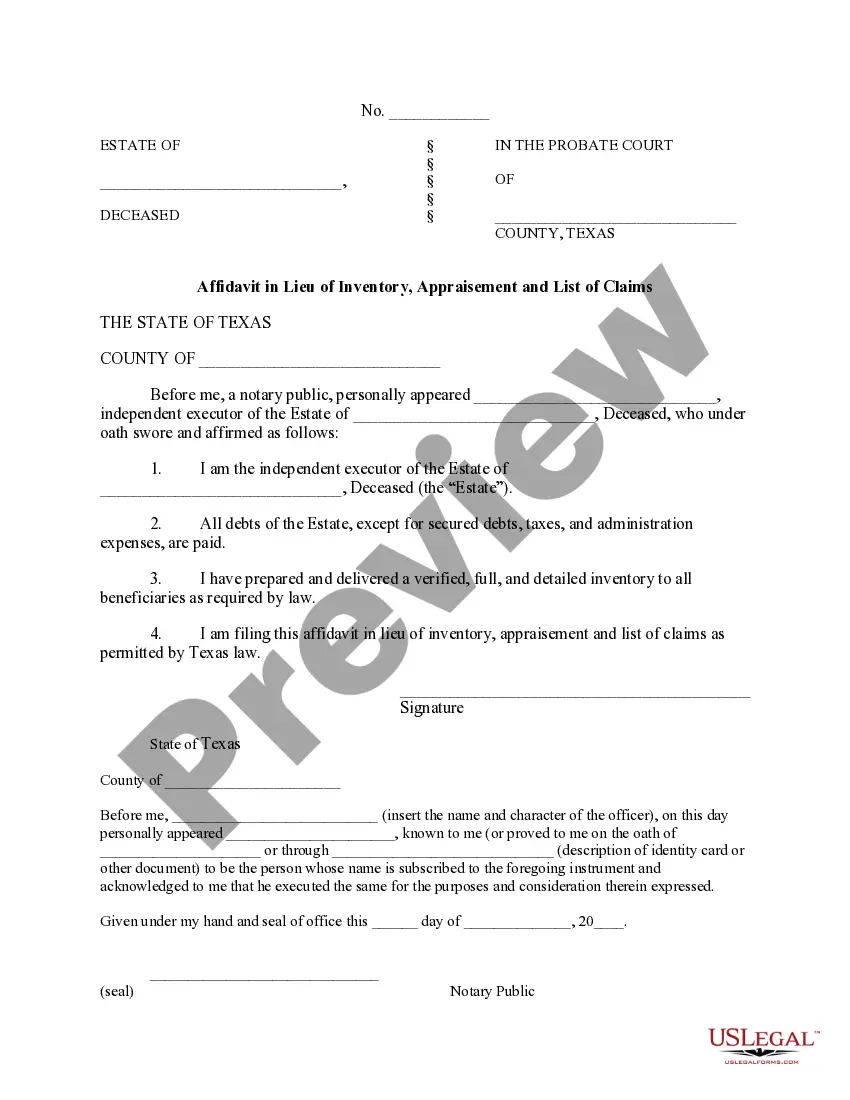

- Click on the form’s preview to examine it.

- If it is not the correct document, return to the search function to find the Claim On Estate After Death sample you need.

- Obtain the template if it aligns with your requirements.

- If you already possess a US Legal Forms account, click Log in to access documents you've previously saved in My documents.

- If you don’t have an account yet, you can acquire the form by clicking Buy now.

- Select the appropriate pricing option.

- Fill out the profile registration form.

- Choose your payment option: use a credit card or PayPal account.

- Select the file format you prefer and download the Claim On Estate After Death.

Form popularity

FAQ

The time limit to file a claim on estate after death varies by state, but it is commonly set between six months to a year after the start of probate. It is crucial to understand these timelines so you do not miss your chance to assert your rights. Therefore, reviewing local probate laws is essential. For assistance, US Legal Forms offers resources to help you navigate these deadlines effectively.

The executor has a duty to collect in the estate's assets and settle any outstanding debts (or liabilities), including the funeral bill. After all liabilities have been settled, whatever's left can then be distributed to the beneficiaries.

After one year, if the executor doesn't complete their duties, beneficiaries may demand payment (possibly with interest) by taking the executor to court.

A Personal Representative, or executor, has 365 days in which to administer the estate of the deceased and to distribute their assets to the Beneficiaries. As complex estates can take longer than a year to wind up, this isn't a strict deadline.

If an executor does not follow the terms of the will, then they (and even their estate if they happen to have since died) can be sued for any loss to the estate they were responsible for. This is where legal advice should be taken as it is a complex, costly, and fraught avenue to go down).

There are a few cases where it's acceptable for an executor to withhold funds. This is known as 'reserving', and should be only done when absolutely necessary. It's not unusual for executors to hold back on paying beneficiaries until they're confident that any debts have been paid off.