Purchaser For Value Ucc

Description

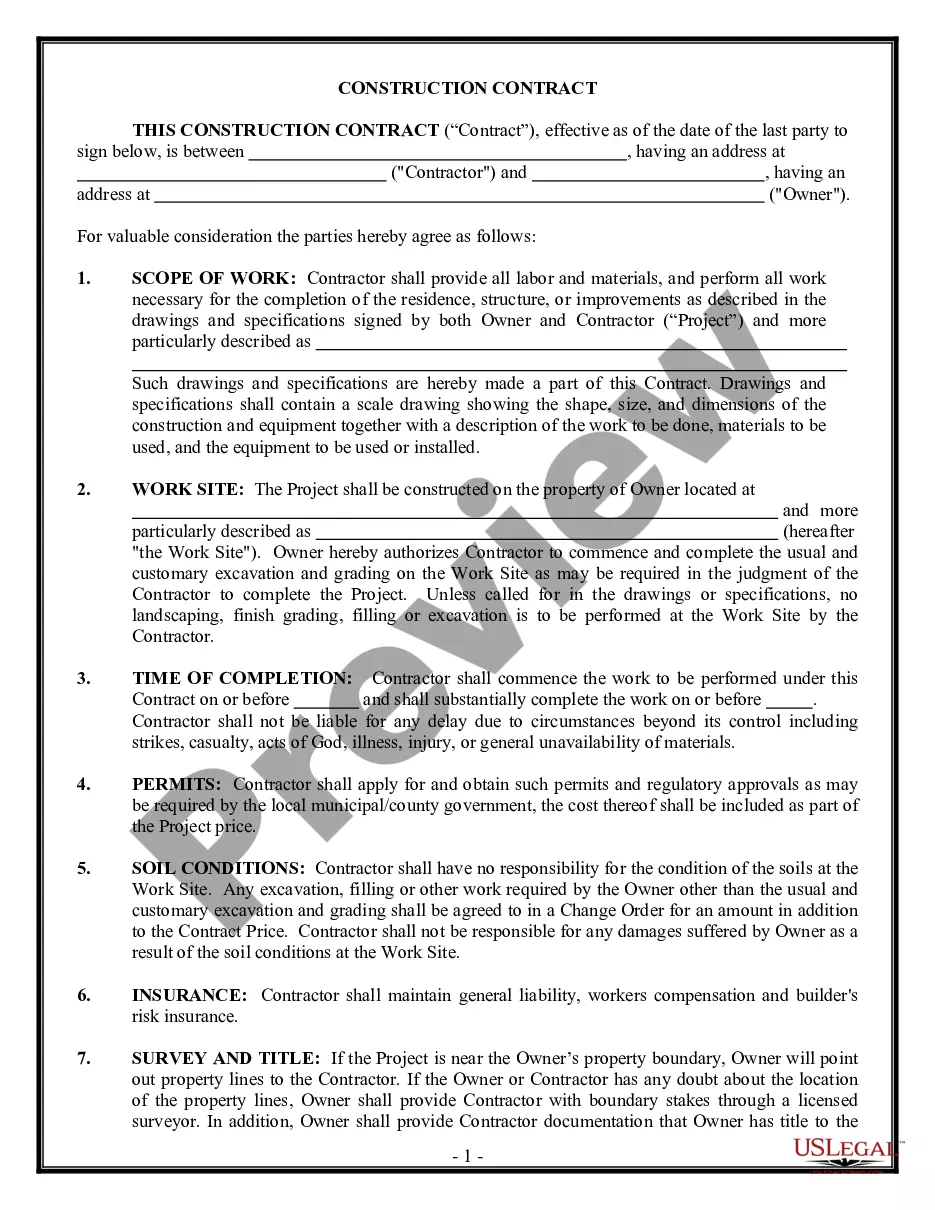

How to fill out Texas Contract For Deed Notice Of Default By Seller To Purchaser Where Purchaser Paid 40 Percent Or Made 48 Payments?

- If you're already a subscriber, simply log in to your account and locate the necessary form template. Ensure your subscription is active; renew if required.

- For newcomers, first, check the Preview mode and form description to confirm that it meets your specific legal requirements.

- If discrepancies arise, utilize the Search tab to find alternative templates that suit your needs.

- Select your desired document by clicking on the Buy Now button, then choose a suitable subscription plan. You'll need to create an account to access the full library.

- Complete your purchase by entering your payment details or linking your PayPal account.

- Finally, download the form and save it on your device. You can revisit and manage your documents anytime through the My Forms section in your profile.

In conclusion, US Legal Forms offers a comprehensive suite of legal documents accessible at your fingertips. With an extensive library and expert guidance available, you can be assured of the accuracy and compliance of your legal materials.

Ready to streamline your legal form needs? Explore US Legal Forms today!

Form popularity

FAQ

A UCC 9 filing is a legal document used to secure a lender's interest in a debtor's personal property, creating a public record of their security interest. For businesses and individuals, establishing a UCC 9 is vital, as it highlights the priority of the lender's rights over the assets. If you're a purchaser for value UCC, knowing about UCC 9 filings can help you understand how to protect your assets and ensure transparency in transactions. The US Legal Forms platform provides easy access to the necessary forms, simplifying this process.

UCC 2 203 refers to a specific provision under the Uniform Commercial Code, which outlines the rights of a purchaser for value UCC. This section emphasizes that a buyer who purchases goods in good faith and for valuable consideration can acquire certain rights, even against potential claims from creditors. Essentially, as a purchaser for value UCC, you gain protections that help secure your investment. Understanding this concept is crucial for anyone involved in commercial transactions.

Under the UCC, buyers have three key remedies: they can reject the goods, demand repair or replacement, or seek damages for any losses caused by the seller's breach. Each remedy serves to uphold the rights of the purchaser for value UCC and ensures they have options for recourse. When navigating these remedies, utilizing tools from USLegalForms can streamline the process and make it easier to enforce these rights.

Possible remedies to buyers under the UCC include the right to reject goods that fail to conform to contract specifications. Additionally, buyers may rescind the contract, seeking damages for any losses incurred, or demand specific performance when appropriate. For those seeking further understanding, platforms like USLegalForms can provide valuable resources to navigate these options effectively.

The main purpose of filing a UCC financing statement is to publicly declare a secured party's interest in specific collateral. This process protects creditors and informs other potential buyers about existing claims, making it essential for a purchaser for value ucc. By filing, you enhance your financial security and support transparent transactions in business dealings.

To fill out an UCC-1, start by obtaining the correct form and gathering information about the debtor and secured party. Next, clearly describe the collateral involved in the transaction. Follow this by carefully filling in all required fields on the form, ensuring complete accuracy. Lastly, submit the filing with your state's Secretary of State office, which you can easily manage through uslegalforms to avoid any missteps.

Filling out a UCC financing statement involves providing key details about the debtor and the collateral being secured. You will need to include the names and addresses of both the debtor and the secured party, along with a description of the collateral. If you seek guidance, platforms like uslegalforms can simplify the process by offering templates and resources for accurate filing.

In a UCC financing statement, the grantee is the person or entity that receives the security interest in the collateral. This could be a bank or an individual who is acting as a purchaser for value ucc. The grantee is essentially the one who has a right to the property if the borrower defaults, providing crucial protection for their investment.

A UCC filing is a legal document that a creditor files to assert their rights to a debtor's collateral. In simple terms, it helps ensure that a purchaser for value ucc can secure their investment by informing others of their claim. It's a way to outline who owns what in terms of business assets, helping to keep transactions clear and organized.

Good faith serves as a fundamental principle in contracts, representing the expectation that parties will act honestly and fairly towards each other. This principle builds trust and facilitates cooperation, creating smoother transactions. Thus, for any purchaser for value UCC, embracing good faith strengthens both their relationships and business dealings. It is essential for sustaining long-term partnerships.