Executor Fox

Description

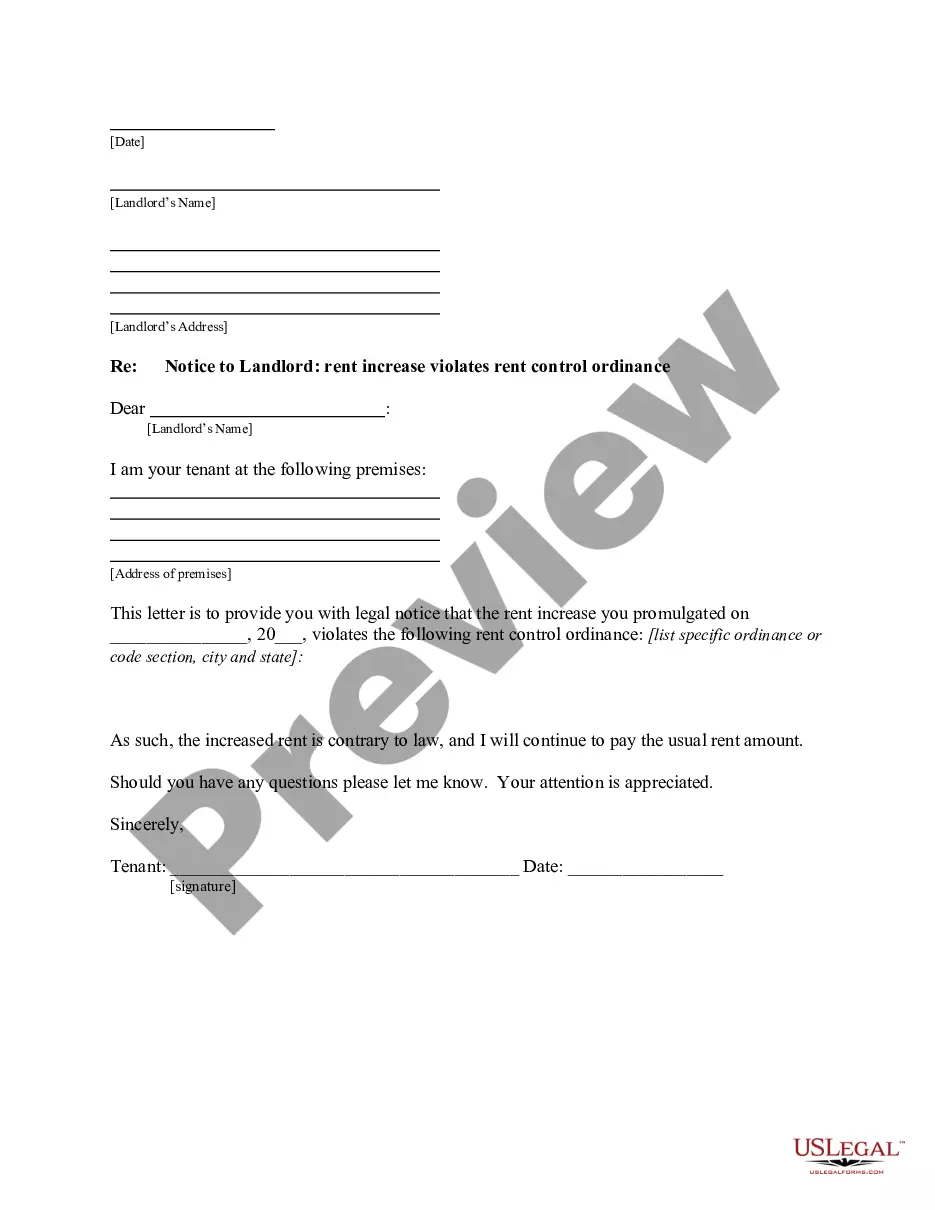

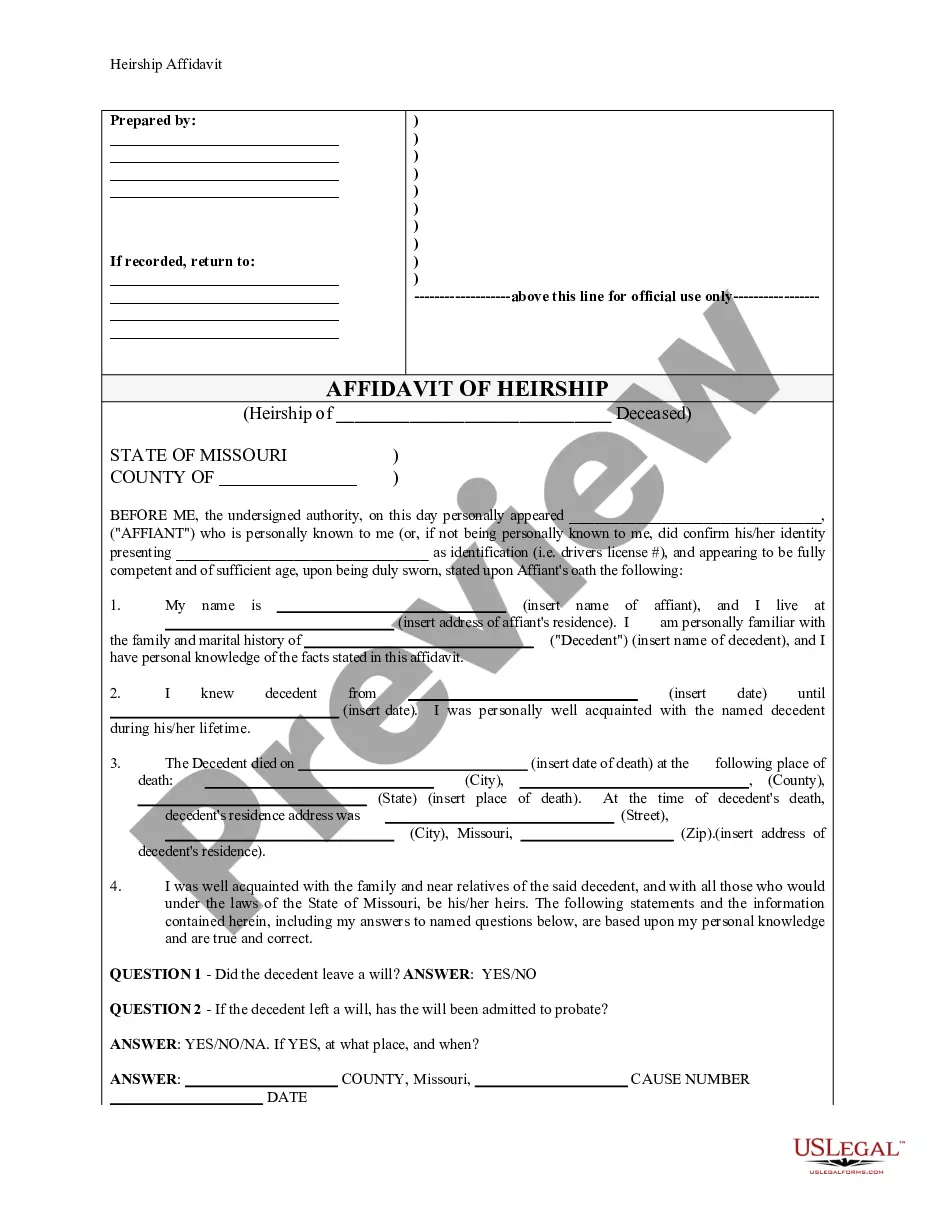

How to fill out Texas Contract For Deed Disclosure Of Property Condition - Residential - Land Contract, Executory Contract?

- If you are a returning user, log in to your account. Ensure your subscription is active and click the Download button to save the necessary form template.

- For first-time users, start by browsing the extensive library. Check the Preview mode and form description to choose the correct document that aligns with your needs and local jurisdiction.

- If you find any inconsistencies or need a different template, utilize the Search tab to locate the right one that suits you.

- Proceed to purchase your document by clicking the Buy Now button. Select your preferred subscription plan and create an account for full access to the library.

- Complete your purchase by providing your payment details, either through credit card or PayPal.

- Download your desired form and store the template on your device. You can access it anytime from the My Forms section of your profile.

By leveraging the Executor fox with US Legal Forms, you can benefit from a robust collection of forms, enjoy premium expert assistance, and ensure that your legal documents are precise and compliant.

Don't hesitate! Start your journey to hassle-free legal document management with US Legal Forms today.

Form popularity

FAQ

Yes, executor fees must be reported to the IRS as they are considered taxable income. Executors should ensure they keep accurate records and report this income correctly on their tax returns. Executor fox provides excellent resources to help you manage these financial responsibilities efficiently.

Yes, an estate must issue a 1099 form to report executor fees if they exceed $600. This form documents the income received and must be filed with the IRS. Executor fox can simplify the 1099 preparation process, ensuring compliance with tax regulations.

The IRS can pursue the executor of an estate for unpaid taxes owed by the estate. If taxes are not settled, the executor may face personal liability. Executor fox offers resources to help executors navigate tax responsibilities and avoid pitfalls.

Yes, executor fees are considered taxable income by the IRS. Therefore, it is essential to report this income correctly on your tax return to avoid any issues. Using Executor fox can provide you with guidance on the tax implications of executor fees.

Filing as an executor of an estate requires submitting the will and a petition for probate to the local probate court. You must also provide necessary information about the estate’s value and its assets. Using Executor fox simplifies this process by offering easy-to-use forms and detailed instructions.

To start as an executor, first, locate the will of the deceased. Next, file the will and petition for probate in the appropriate court. Executor fox can help guide you through this process step by step, ensuring you don’t miss any important requirements.

The ideal executor should be someone responsible, trustworthy, and knowledgeable about your desires. Often, this person is a family member or close friend, but it could also be a professional, such as a lawyer, depending on your situation. Using Executor fox allows you to easily identify candidates and understand their qualifications for this important role.

To serve as an executor, you typically need to show the court that you are named in the will and have legal standing. This often includes providing the original will, proof of identity, and possibly a bond, depending on state requirements. Executor fox can help streamline this process and provide a checklist of necessary documents.

As an executor, you should avoid acting without a clear understanding of your responsibilities. Do not make distributions to beneficiaries before settling debts and taxes. Additionally, steer clear of mixing estate assets with personal funds. Rely on Executor fox to provide a clear roadmap for your responsibilities and ensure compliance.

Executors can make several mistakes that complicate the estate process. Common errors include failing to communicate with beneficiaries, mismanaging funds, or neglecting tax obligations. Avoiding these pitfalls is crucial to fulfilling your duties effectively. Utilize Executor fox to access guidance and tools that help prevent these issues.