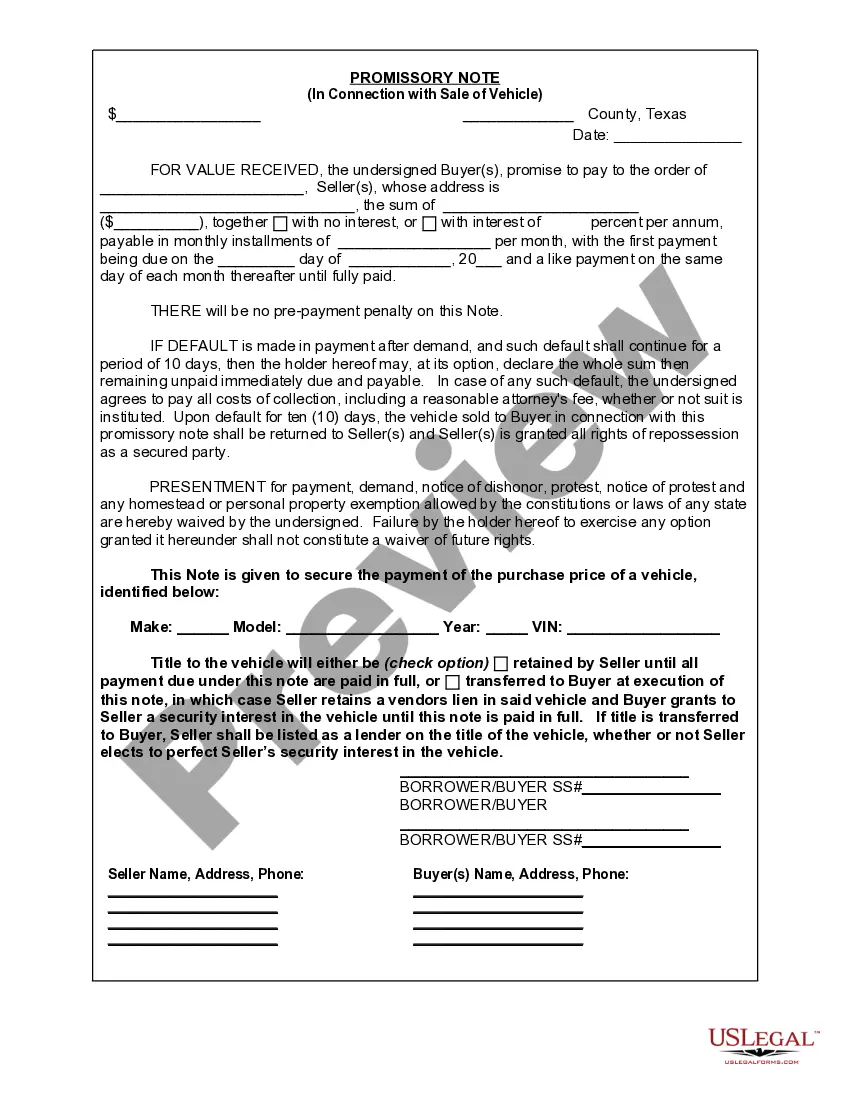

This forms package contains a Bill of Sale, Odometer Statement and Promissory Note. It is for the situation where the Buyer may be making a downpayment and paying the balance over time.

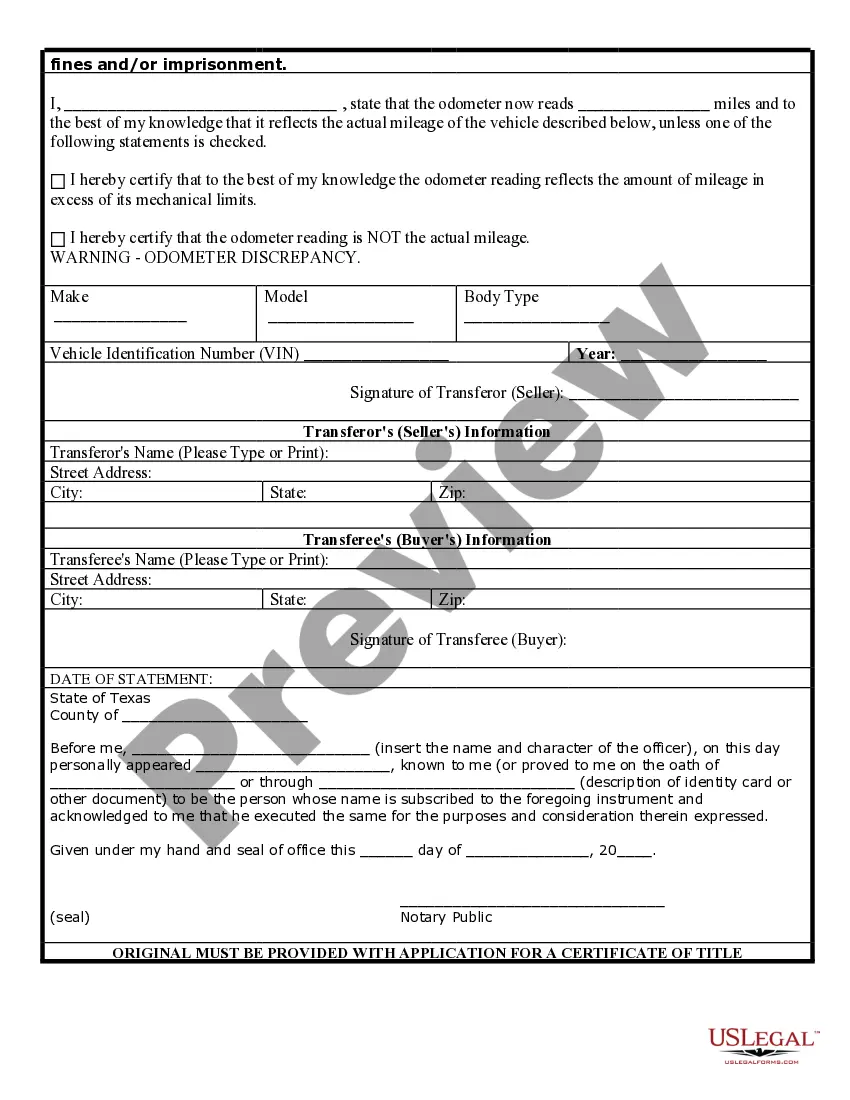

The Texas odometer disclosure statement with lien release is a crucial document used in vehicle transactions within the state of Texas. This statement serves two significant purposes: ensuring accurate recording of the vehicle's mileage information and releasing any liens or encumbrances on the vehicle. The Texas Department of Motor Vehicles mandates the usage of this statement to prevent odometer fraud and protect both buyers and sellers. The disclosure of the vehicle's mileage is vital for buyers to make informed decisions, ensuring transparency and preventing any misrepresentation. Furthermore, the lien release aspect of the statement is equally important in establishing the ownership status of the vehicle. If there is an outstanding lien against the vehicle, the lien holder must provide a lien release on this statement, indicating that they have no claim on the vehicle anymore. It guarantees the buyer a clear title and protects them from future complications arising from unsatisfied liens. There are a few different types of Texas odometer disclosure statement with lien release, each tailored for specific circumstances: 1. Standard Texas Odometer Disclosure Statement with Lien Release: This is the most common type used in regular vehicle sales where the seller discloses the mileage accurately, and there are no outstanding liens against the vehicle. 2. Odometer Disclosure Statement with Lien Release (Leased Vehicles): When a leased vehicle is being sold, this type of statement is utilized. It includes additional clauses to differentiate between the lessor and the lessee, ensuring proper disclosure of the vehicle's mileage and the verification of lien release from the leaseholder. 3. Odometer Disclosure Statement with Lien Release (Financed Vehicles): When a vehicle is being sold while still under a financing agreement, this specialized statement is used. It incorporates sections to convey accurate mileage, as well as to document the satisfaction of the lien through the release provided by the financing institution. Using the appropriate Texas odometer disclosure statement with lien release is crucial to comply with state regulations and protect all parties involved in the vehicle transaction. It ensures transparency, prevents fraud, and establishes a clear ownership status free from any encumbrances or outstanding liens.