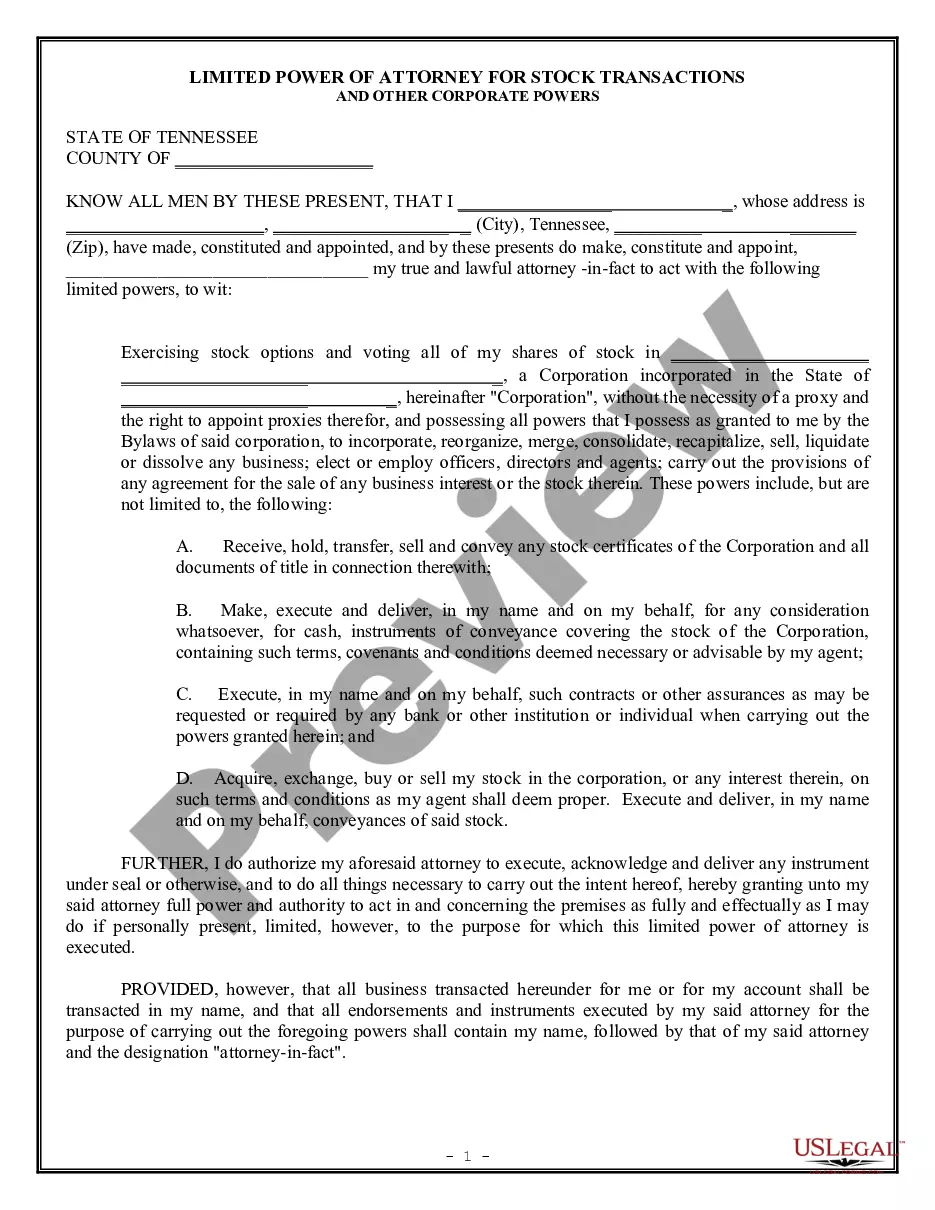

Power Attorney

Description

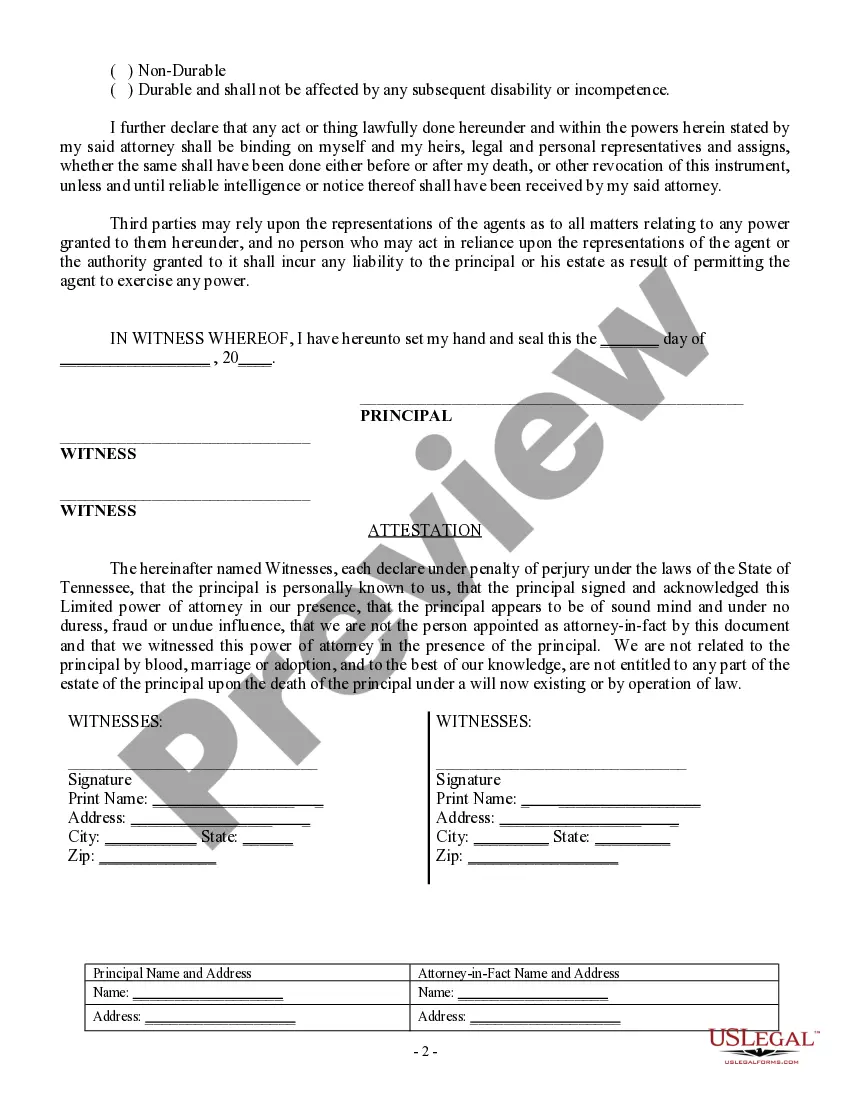

How to fill out Tennessee Limited Power Of Attorney For Stock Transactions And Corporate Powers?

- If you're a returning user, log in to your account at US Legal Forms. Ensure your subscription is active before proceeding to download your desired form.

- For first-time users, start by checking the form preview and description. Confirm that it meets your requirements and aligns with your local regulations.

- If necessary, utilize the search feature to find another suitable template if the first one doesn't fit your needs.

- Once you find the right form, click on 'Buy Now' and select your preferred subscription plan. You will need to create an account to access the full library.

- Complete your purchase by entering your payment information. You can use either a credit card or PayPal.

- Finally, download your form and save it on your device. You can also access it later from the 'My Forms' section in your profile.

By following these steps, you can secure the necessary power attorney documents swiftly. US Legal Forms is dedicated to helping you with an extensive library of over 85,000 legal templates, ensuring you find exactly what you need.

Ready to get started? Visit US Legal Forms today and empower yourself with the legal tools you need!

Form popularity

FAQ

The best way to set up a power of attorney is to carefully consider the scope and purpose of the document. Begin by choosing a trusted individual as your agent, then specify the powers you want them to have. You can create the document yourself or use a professional service like USLegalForms to ensure it meets legal standards. This approach gives you peace of mind knowing that your interests are protected.

To file a power of attorney with the IRS, you need to complete Form 2848, also known as the Power of Attorney and Declaration of Representative. This form must be signed by you and the appointed representative. Once filled out, send it to the IRS office that corresponds with your location. Ensure you keep a copy for your records and consider using USLegalForms to streamline the process.

The three basic types of power of attorney include general, durable, and limited powers. A general power of attorney grants broad authority to your agent, while a durable power remains effective even if you become incapacitated. A limited power of attorney only allows your agent to act in specific situations or for a set period. Understanding these options helps you choose the right power attorney to fit your needs.

In Maryland, to create a valid power of attorney, you need to be at least 18 years old and of sound mind. The document must be signed by you and witnessed by two individuals or notarized. Additionally, it is important to specify the powers you are granting to your agent clearly. Utilizing platforms like USLegalForms can simplify the process and ensure compliance with Maryland regulations.

In New Jersey, a power of attorney does not need to be recorded to be valid. However, if the power of attorney pertains to real estate transactions, it is advisable to record it in the county clerk's office. Recording provides a public record that protects the rights of those involved. Be sure to consult legal advice to ensure your power of attorney meets all necessary requirements.

Florida law sets forth specific rules regarding the use of power of attorney. For instance, the agent must act in the principal's best interest and must not exceed the powers granted. Familiarizing yourself with these rules can prevent misuse and ensure that your power attorney operates smoothly, allowing your agent to manage affairs effectively.

In Florida, to establish a valid power of attorney, the principal must be at least 18 years old and mentally competent. The document must be in writing, signed by the principal, and either notarized or witnessed by two people. Ensuring that you follow these requirements helps protect your interests through a well-structured power attorney.

Yes, you can create a power of attorney without a lawyer in Florida, as the state allows individuals to complete this process on their own. However, it is crucial to understand your rights and obligations, as well as to ensure the document meets all legal requirements. Utilizing online resources, like USLegalForms, can simplify the process and help you create a valid power of attorney.

Yes, in Florida, a health care power of attorney must be notarized or signed in the presence of two witnesses. This requirement helps validate your document and ensures that your choices regarding health care are recognized. Making sure your power attorney is executed correctly provides peace of mind during critical situations.

Power of attorney allows you to designate someone to make decisions on your behalf. This authority can include managing your financial matters, handling real estate transactions, or making health care decisions. By establishing a power of attorney, you ensure that your chosen representative can act in your best interest when you are unable to do so.