Living Trust Certificate For Real Estate

Description

Form popularity

FAQ

A significant mistake parents make when setting up a trust fund is failing to fund the trust correctly. They may create the trust but overlook transferring assets into it, leaving it ineffective. To avoid this, ensure that you include a living trust certificate for real estate and other assets. Consult platforms like US Legal Forms to help navigate this process and ensure proper funding, protecting your children’s future.

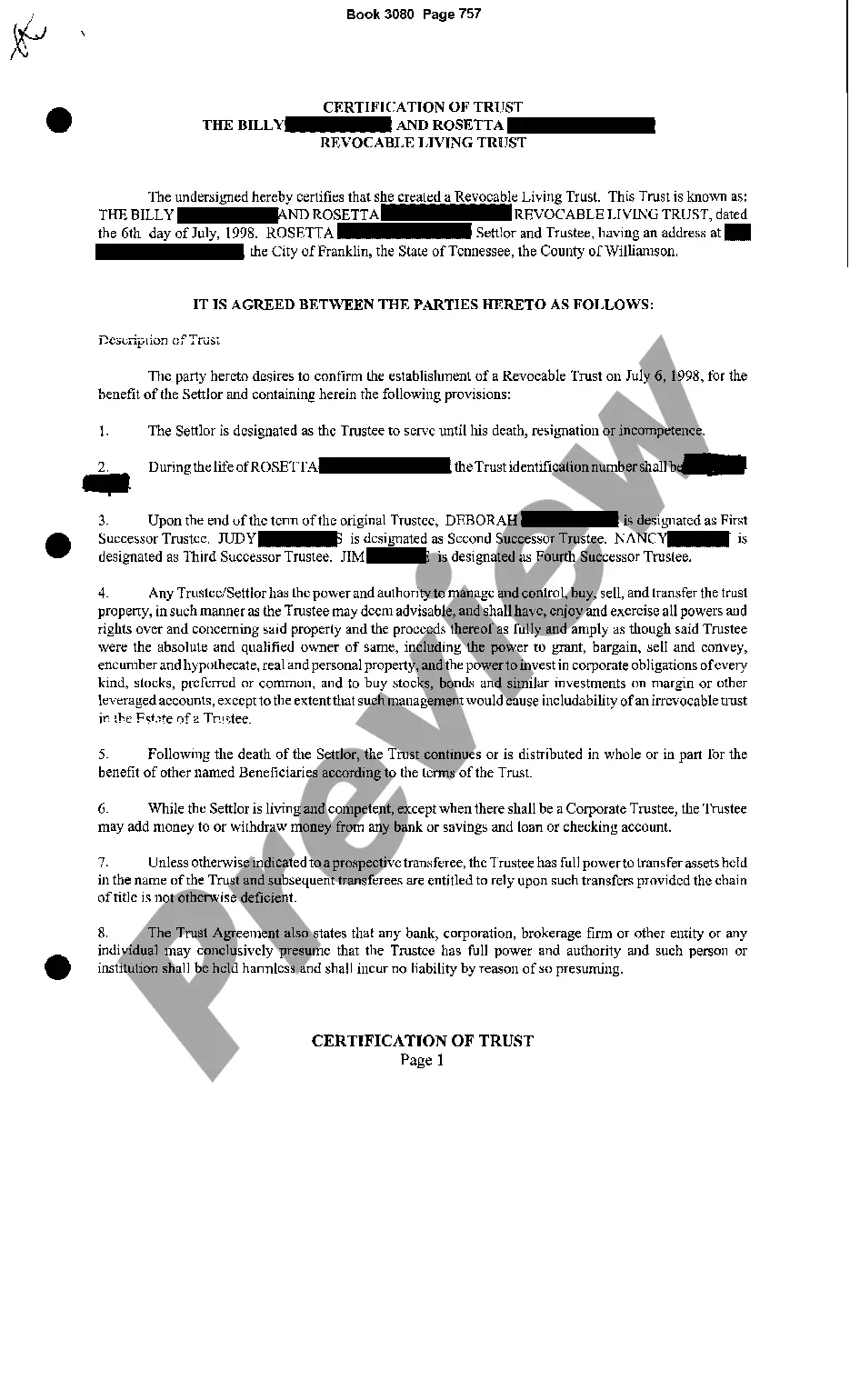

To put your assets in a living trust, you’ll need to formally transfer ownership of each asset into the trust's name. This process might vary based on the asset type; for instance, for real estate, you'll need to execute a new deed. Using a living trust certificate for real estate can streamline this process, allowing you to designate how your properties will be managed. Always consider seeking legal guidance to ensure a smooth transition.

Filling out a trust certification requires accurate details about the trust and its assets. Begin with the trust's name, dates, and the trustee's information. Be sure to reference your living trust certificate for real estate, if applicable, to ensure it aligns with the assets involved. Completing this document correctly is crucial for legal validity and ensuring smooth handling of your assets.

The best type of living trust often depends on your individual needs and circumstances. Revocable living trusts are popular because you can modify them as your situation changes. If you want to manage your real estate assets effectively while retaining flexibility, a living trust certificate for real estate might be the right choice for you. Choosing the right type involves examining your goals for asset distribution and future planning.

There is no specific minimum amount required to create a living trust; however, it's generally advisable to consider the value of your assets. A living trust certificate for real estate can be beneficial if you own a property of significant value, enabling a seamless transfer upon your passing. Always evaluate your financial situation to determine what amount makes sense for you and your loved ones.

To fill a living trust, start by gathering essential information about your assets and beneficiaries. You can use templates provided by platforms like US Legal Forms to simplify the process. Ensure that all relevant details, such as asset descriptions and individual names, are accurate and complete. Finally, review your living trust certificate for real estate to confirm that everything aligns with your wishes.

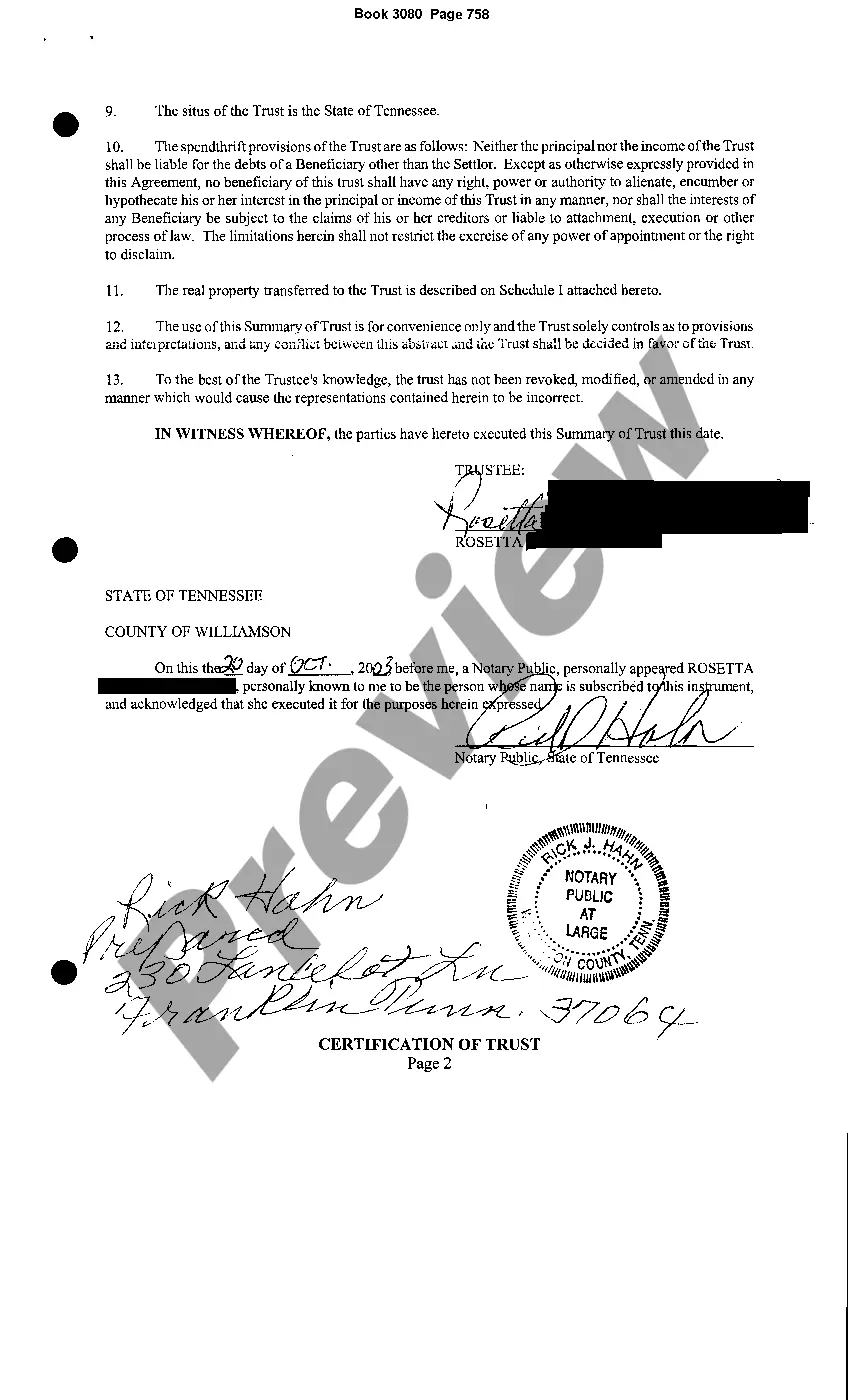

In Texas, a certificate of trust does not need to be recorded with the county. However, you should keep a copy safely, as it serves as proof of the trust's existence and the authority of the trustee. While not required, recording the living trust certificate for real estate can sometimes be beneficial in certain transactions. Consulting with legal experts or platforms like US Legal Forms can offer further insights.

A trust agreement is generally prepared by an attorney who specializes in estate planning. This legal document defines how the trust will operate and outlines the roles of the trustee and beneficiaries. Crafting a solid trust agreement is vital to ensuring that your living trust certificate for real estate functions as intended. You can access resources from US Legal Forms to guide you through the preparation of this agreement.

The deed of trust is typically provided by the lender or the trustee, depending on the context of the transaction. In many cases, it is a separate document from the living trust certificate for real estate and serves a specific purpose in securing loans. Therefore, it’s essential to communicate with your lender or attorney to ensure all documentation is in order. US Legal Forms can assist you in understanding what is required.

Yes, you can create your own living trust certificate for real estate. However, it is crucial to understand the legal requirements and ensure that the document is properly drafted. DIY solutions can be risky if they don’t comply with state laws. Platforms like US Legal Forms offer templates that can help you create an accurate and effective certificate.