Car Title Loan Agreement Form

Description

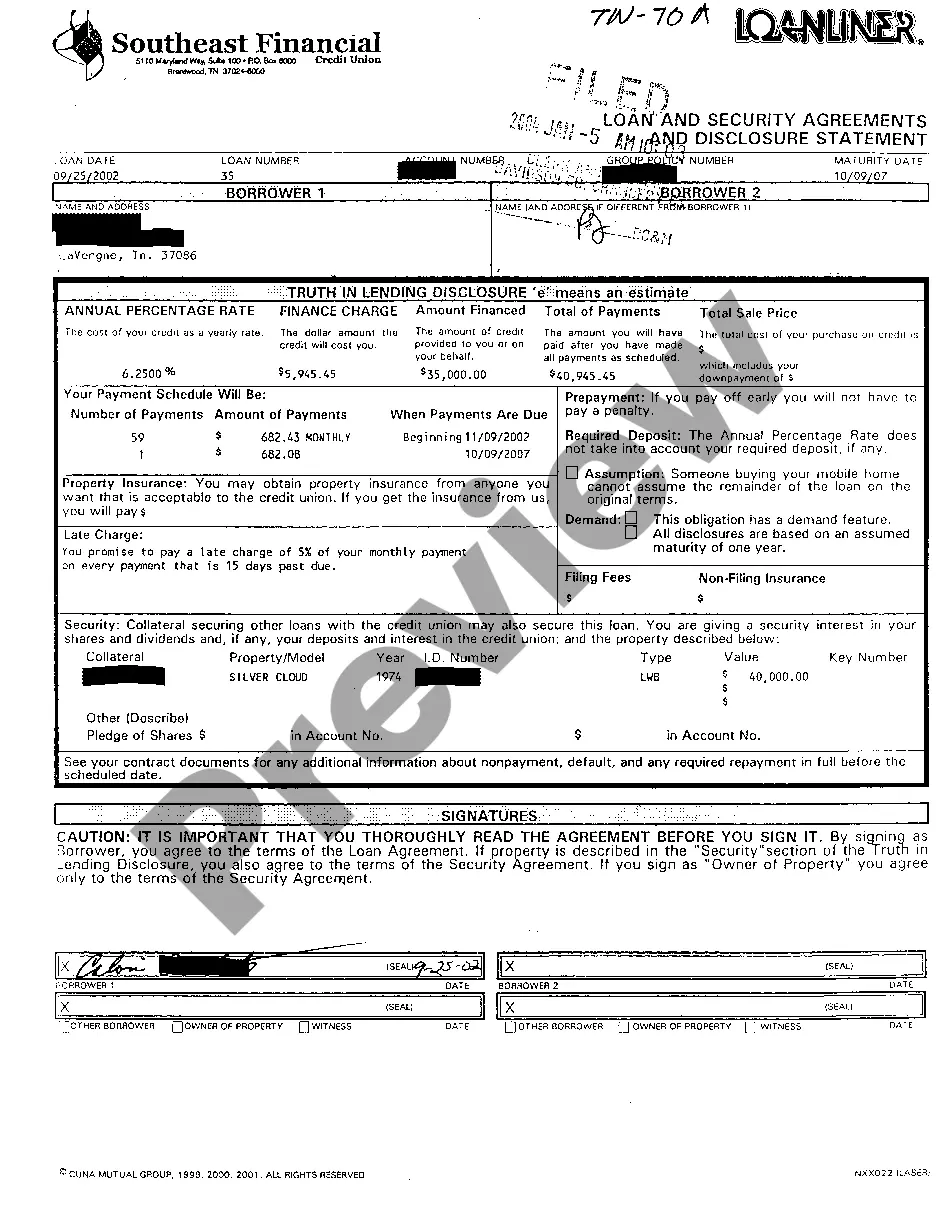

How to fill out Tennessee Loan And Security Agreement?

Individuals typically link legal documents with complexity that only an expert can handle.

In some respects, this is accurate, as creating a Car Title Loan Agreement Form requires significant knowledge of subject matter criteria, including state and local laws.

Nevertheless, with US Legal Forms, the process has become simpler: pre-made legal templates for any personal and business scenario tailored to state regulations are compiled in a single online repository and are now accessible to everyone.

All templates within our library are reusable: once purchased, they are stored in your profile and accessible whenever needed through the My documents tab. Discover all the benefits of utilizing the US Legal Forms platform. Sign up today!

- US Legal Forms provides over 85,000 current forms categorized by state and area of use, allowing you to search for the Car Title Loan Agreement Form or another specific template in just a few minutes.

- Existing users with an active subscription must Log In to their account and click Download to retrieve the form.

- New users of the platform must first create an account and subscribe before they can store any paperwork.

- Here’s a detailed guide on how to obtain the Car Title Loan Agreement Form.

- Review the page content carefully to ensure it satisfies your requirements.

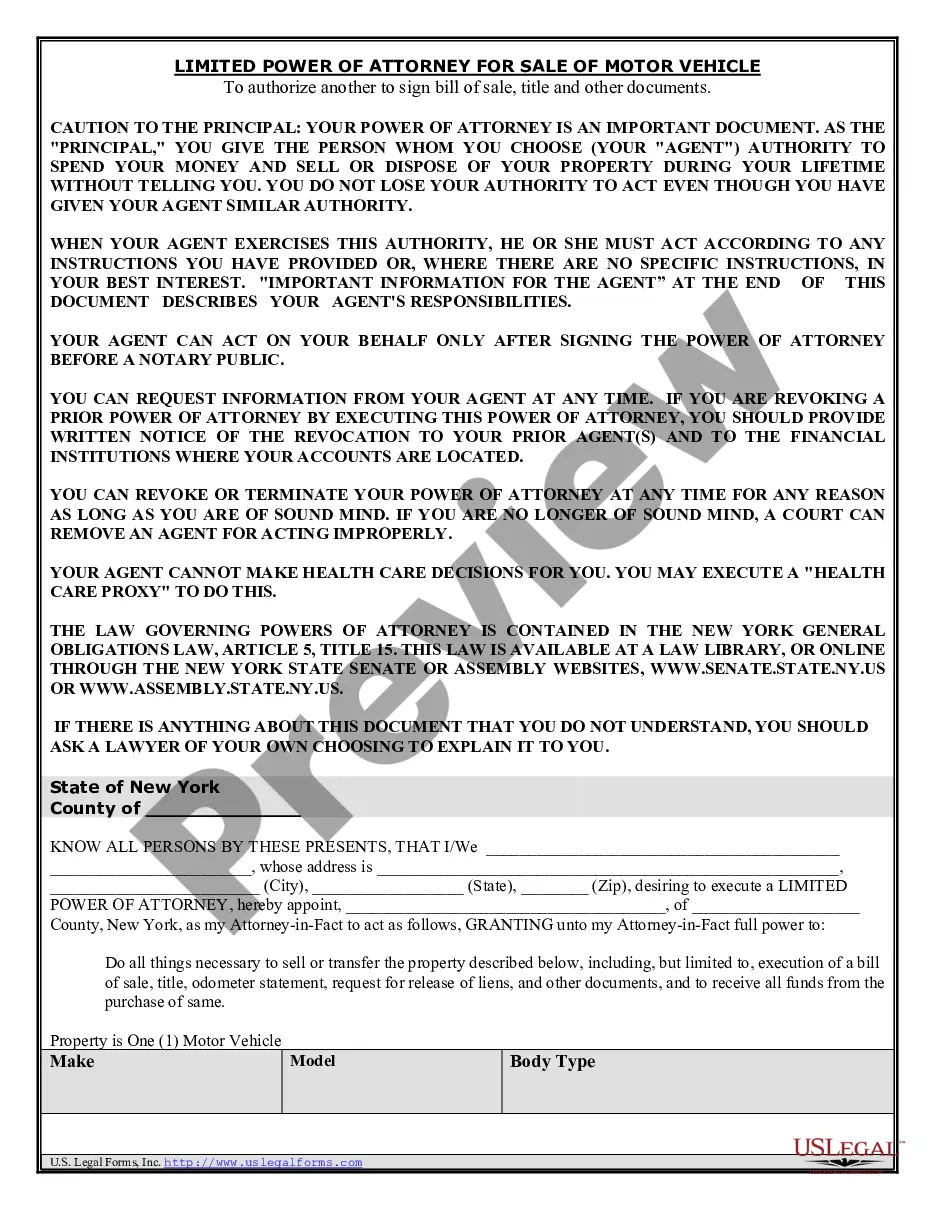

- Read the form description or check it out via the Preview option.

- If the prior sample doesn’t fit, search for another using the Search field above.

- Once you’ve found the suitable Car Title Loan Agreement Form, click Buy Now.

- Select a subscription plan that fits your needs and financial situation.

Form popularity

FAQ

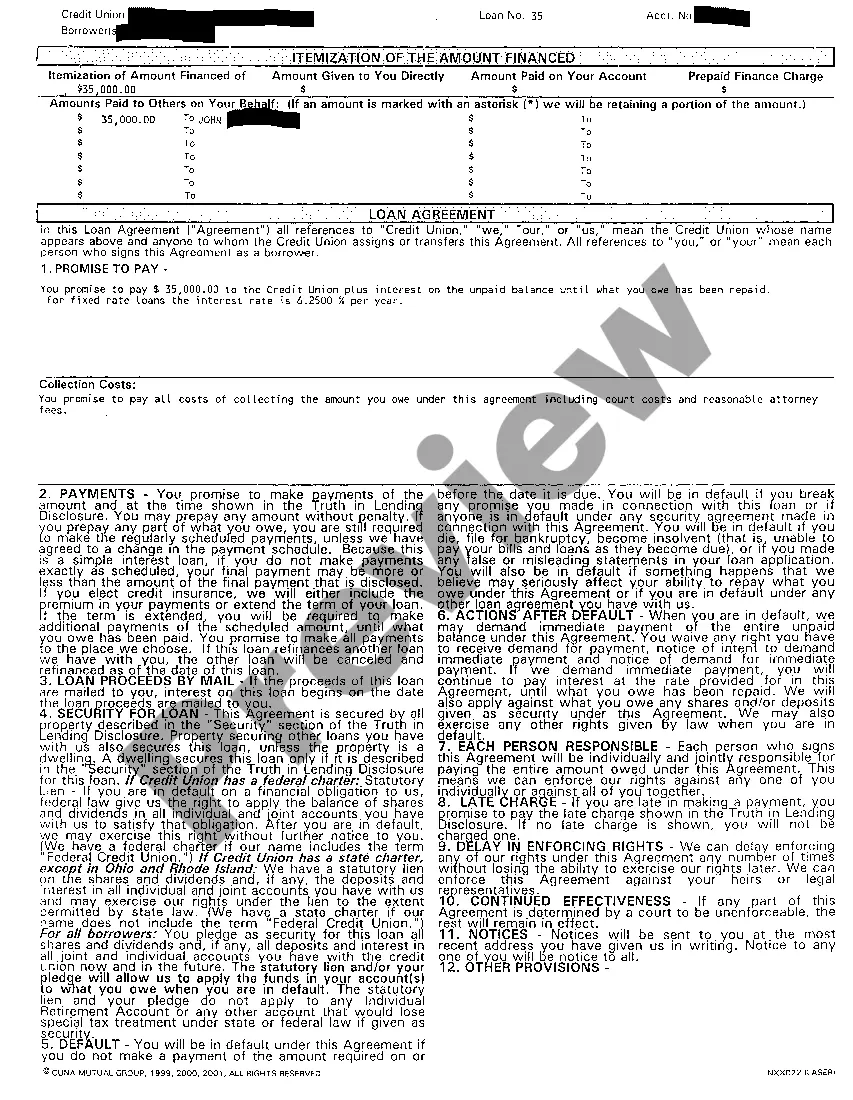

To draft a Loan Agreement, you should include the following:The addresses and contact information of all parties involved.The conditions of use of the loan (what the money can be used for)Any repayment options.The payment schedule.The interest rates.The length of the term.Any collateral.The cancellation policy.More items...

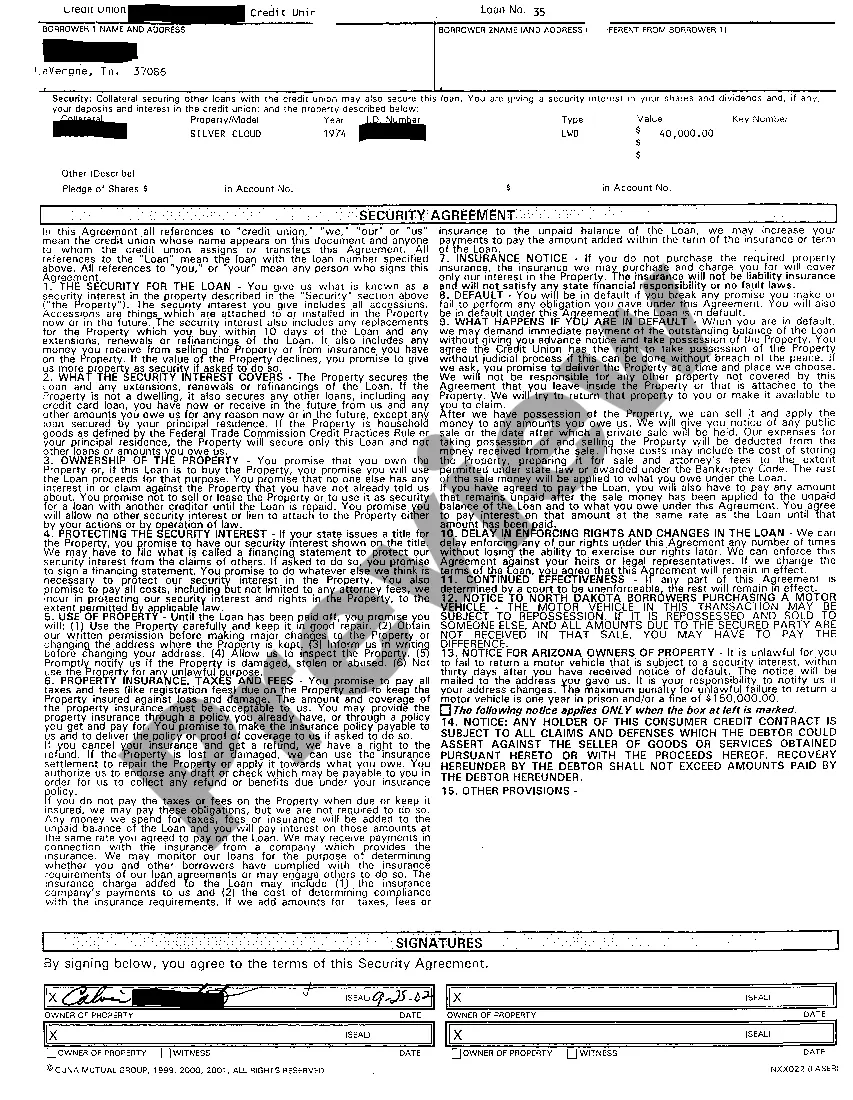

Title is another word for deed and is a legal document that denotes ownership in a piece of property, typically a vehicle or house.

An Auto Title Loan is a short-term loan where the lender takes title to your car to secure the loan. This means if the loan is not repaid, the lender may take the car and sell it to get the loan money back. Most title lenders will only make the loan if you do not owe anything else on the car.

Key Takeaways. A loan that requires an asset as collateral is known as a title loan. Title loans are popular because they do not take into consideration an applicant's credit rating and because they can be approved very quickly.

For a personal loan agreement to be enforceable, it must be documented in writing and signed by both parties. You may choose to keep a copy in your county recorder's office if you wish, though it's not legally necessary. It's sufficient for both parties to store their own copy, ideally in a safe place.