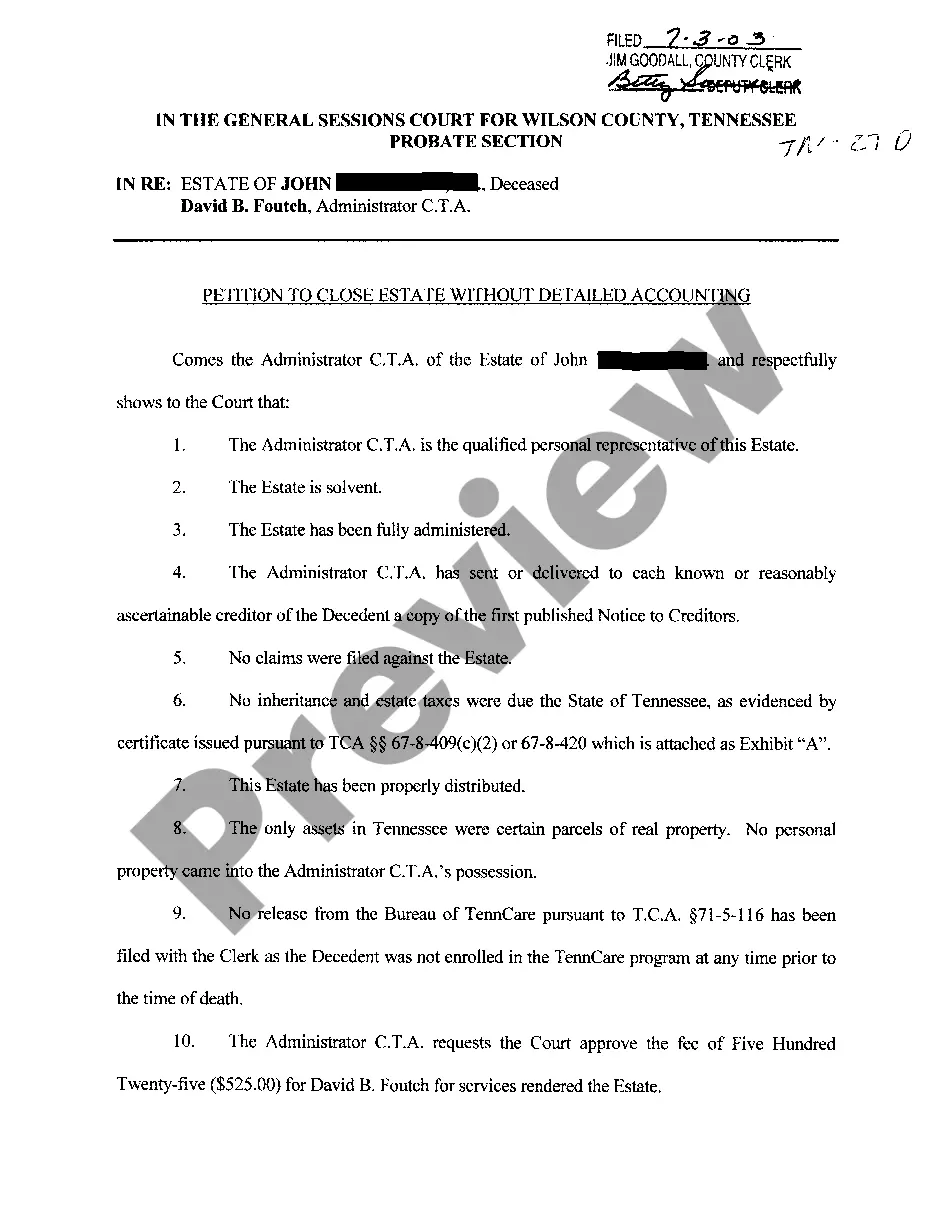

Petition To Close Estate Form

Description

How to fill out Petition To Close Estate Form?

Bureaucracy necessitates exactness and correctness.

Unless you are accustomed to completing documents like the Petition To Close Estate Form regularly, it might lead to some misunderstanding.

Choosing the appropriate template right from the beginning will guarantee that your document submission proceeds smoothly and avert any hassles of resending a file or repeating the task from the beginning.

Locating the correct and current samples for your documentation takes just a few minutes with an account at US Legal Forms. Bypass the bureaucratic issues and simplify your paperwork tasks.

- Acquire the template using the search box.

- Ensure the Petition To Close Estate Form you’ve found is suitable for your state or county.

- Review the preview or browse the description that includes the specifics regarding the sample's use.

- If the result aligns with your search, click the Buy Now button.

- Select the appropriate option from the offered subscription plans.

- Log in to your account or create a new one.

- Finalize the purchase using a credit card or PayPal payment option.

- Save the form in your desired format.

Form popularity

FAQ

In Tennessee, the probate process begins with filing the deceased's will and a petition in the local probate court. You'll need to provide several documents such as a death certificate and a list of the deceased's beneficiaries. Using a petition to close estate form can assist you in navigating these requirements, ensuring that you follow the correct procedures and make the process more efficient.

In most jurisdictions, you typically have to probate a will within a reasonable time frame, which usually ranges from a few months up to a year after death. However, it's crucial to check your local laws, as deadlines can vary. Promptly filing your petition to close estate form can avoid unnecessary delays and help you meet any legal deadlines following a death.

The notice of petition to administer estate signifies the start of legal proceedings to oversee the distribution of a deceased person's assets. This document alerts all interested parties, including heirs, creditors, and potential claimants, to the upcoming court action. Including a completed petition to close estate form in this process helps clarify intentions and provides a structured approach to estate management.

An order admitting a will to probate is a court directive that formally recognizes the validity of a deceased person's will. This order allows the executor to begin managing the estate according to the terms outlined in the will. If you are navigating this process, utilizing a petition to close estate form can help streamline your case and ensure compliance with legal requirements.

To file a probate petition in New York, you need to prepare several documents including the will, death certificate, and a petition detailing the appointment of an executor. You must file these documents in the Surrogate's Court of the county where the deceased resided. Using a petition to close estate form, available through platforms like USLegalForms, can simplify this process, ensuring all necessary information is included.

A notice of petition to admit will to probate is a document that notifies interested parties of the intent to validate a deceased person's will in court. This notice serves to inform beneficiaries and potential heirs about the legal proceedings involving the will. When you file this notice together with a petition to close estate form, it helps facilitate a smoother probate process.

The notice of petition to administer estate is a formal announcement that a person is requesting to manage the deceased's estate. This document informs interested parties, such as heirs and creditors, about the proceedings. By filing this notice along with a petition to close estate form, you ensure that everyone has the opportunity to contest or respond to the estate management.

To fill out a small estate form, start by gathering details about the deceased's assets and debts. Follow the instructions closely, as these forms often have specific requirements based on state laws. Using a Petition to close estate form can simplify this process, helping you ensure all necessary information is accurately reported.

An estate allows for the management and distribution of assets post-death, often providing a clearer legal framework than just a will alone. It includes the probate process to validate and enforce the will's terms, ensuring thorough administration of the deceased's wishes. A well-organized estate process, including the use of a Petition to close estate form, enhances transparency and efficiency.

Income for an estate typically includes interest earned on bank accounts, dividends from investments, and rental income from property. It's important to accurately calculate this income as it may affect the estate's taxes and distributions. Including this information in your Petition to close estate form can help clarify financial details for the court.