Annulment In Tn Without Marriage

Description

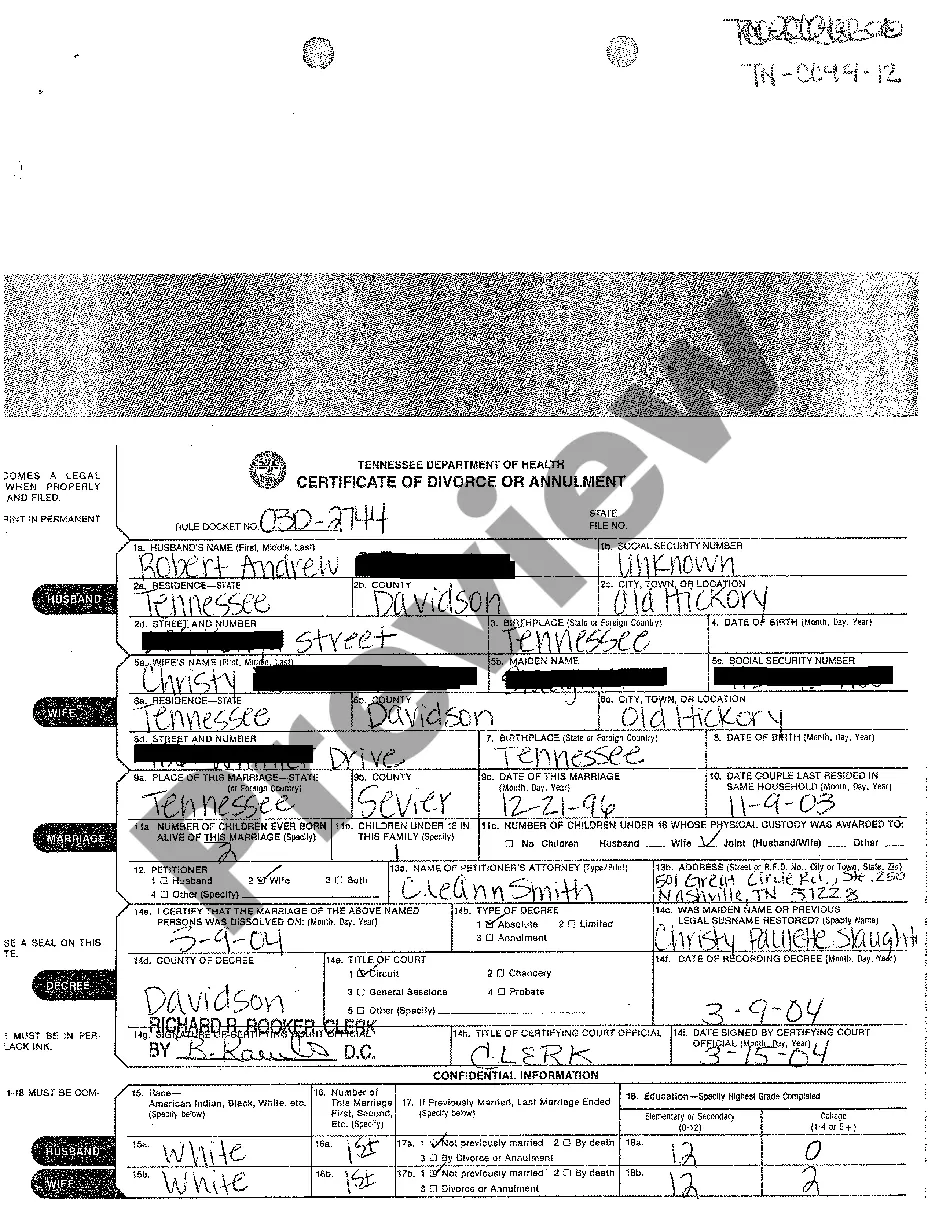

How to fill out Tennessee Certificate Of Divorce Or Annulment?

Acquiring legal document examples that comply with federal and state laws is essential, and the internet provides numerous alternatives to choose from.

However, why squander time searching for the appropriate Annulment In Tn Without Marriage template online if the US Legal Forms digital library already houses such documents in one location.

US Legal Forms is the largest online legal repository with over 85,000 editable templates crafted by attorneys for various business and personal situations.

Review the template using the Preview feature or through the text description to ensure it fulfills your needs.

- They're easy to navigate, with all documents categorized by state and intended use.

- Our experts stay informed on legal changes, guaranteeing that your form is current and adheres to regulations when you obtain an Annulment In Tn Without Marriage from our site.

- Getting an Annulment In Tn Without Marriage is straightforward and swift for both existing and new users.

- If you possess an account with an active subscription, Log In and store the document template you require in the appropriate format.

- For new users, follow the steps below.

Form popularity

FAQ

To revive or reinstate your Mississippi LLC, you'll need to submit the following to the Mississippi SOS: a completed Mississippi Application for Reinstatement Following Administrative Dissolution. a tax clearance letter from the Mississippi Department of Revenue. a $50 filing fee.

How to set up a sole proprietorship in Mississippi Choose your business name. Mississippi law allows you to operate a sole proprietorship under a name other than your own. ... File a trade name. ... Obtain licenses, permits, and zoning clearance if needed. ... Obtain an Employer Identification Number (EIN)

Sole Proprietorships: Because a sole proprietorship is not incorporated, it requires no filing with the Secretary of State. The individual owner is personally responsible for the debts and obligations of the business. Earnings are generally taxed as personal income for the owner.

In the case of a sole proprietorship, you declare your profit and loss on Schedule C of Form 1040. But, to file Schedule C, you'll have to qualify first. The conditions to qualify are: Your goal is to engage in business activity for income and profit.

7 Steps to Start a Sole Proprietorship Decide on a Business Name. ... Register Your Business DBA Name. ... Buy and Register a Domain Name. ... Apply For An EIN. ... Obtain Business License and Permits. ... Get Business Insurance. ... Open a Business Bank Account.

You may not have to register your business with the state. Good news for sole proprietors ? you may not need to register your business with the state. That's because the Mississippi Secretary of State generally only requires business owners who run limited partnerships, LLCs, and corporations to complete this step.

You don't have to file a document to ?form? your Sole Proprietorship with the state. However, there are a few things you may need to (or want to) do in order to operate legally. For example, your business may need a license or permit to operate. And it's best practice to open a separate business bank account.

Sole Proprietorships: Because a sole proprietorship is not incorporated, it requires no filing with the Secretary of State. The individual owner is personally responsible for the debts and obligations of the business. Earnings are generally taxed as personal income for the owner.