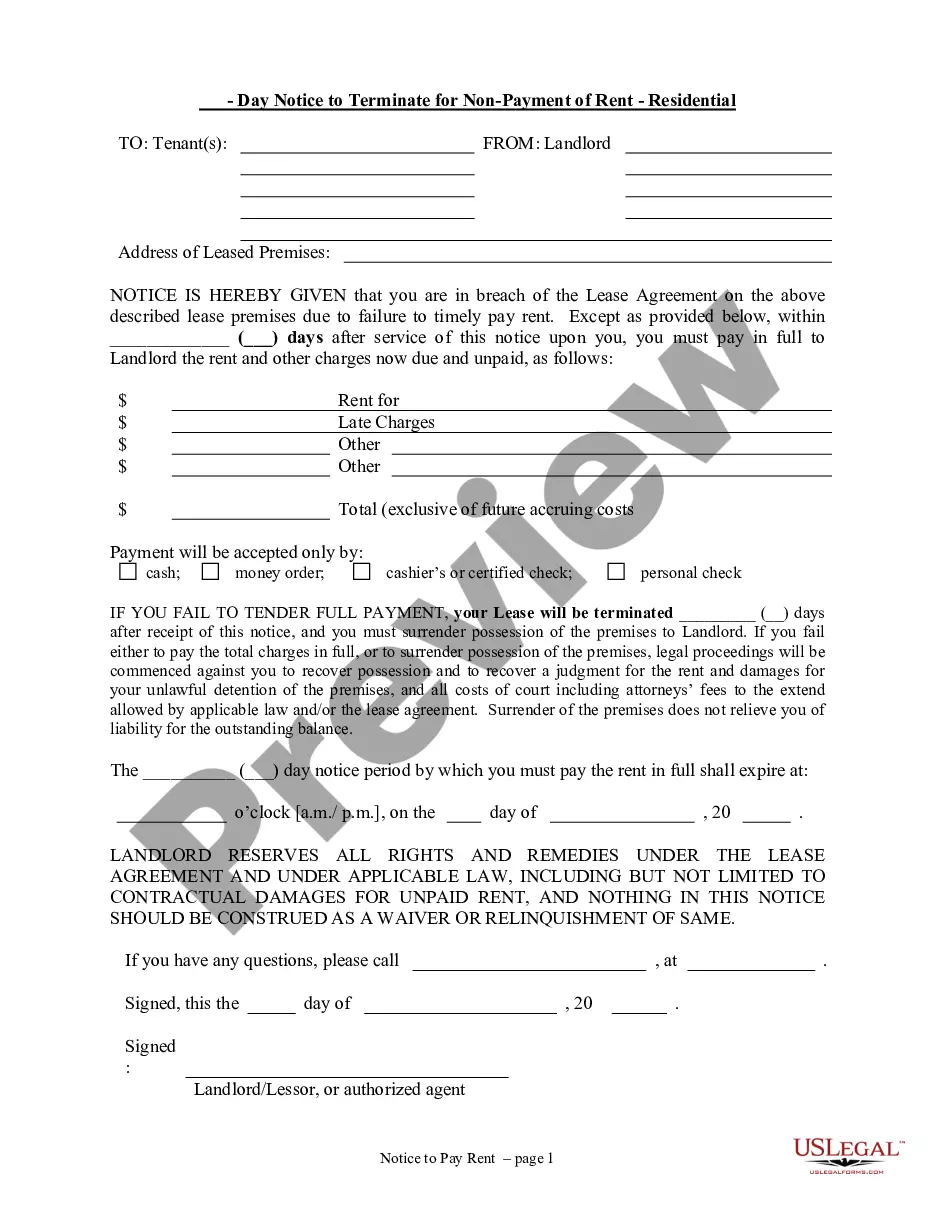

Non-payment

Description

How to fill out Tennessee Notice To Terminate For Nonpayment Of Rent - Residential?

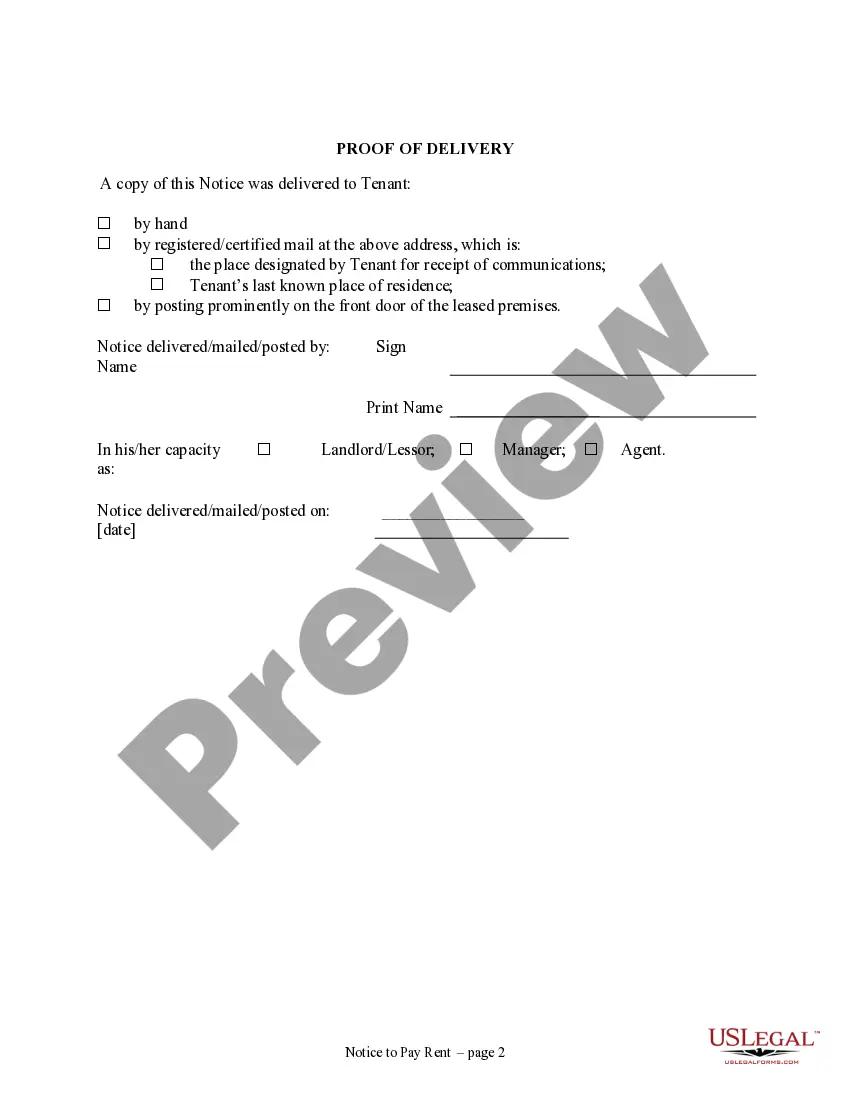

- If you are a returning user, log into your account and ensure your subscription is active. Click the Download button to get your required form template.

- For new users, begin by reviewing the Preview mode and form descriptions to select the appropriate legal form that fits your specific needs and jurisdiction.

- If you need to search for an alternative template, utilize the Search tab provided to find other legal forms that may be more suitable.

- Once you find the correct document, click the Buy Now button to select your preferred subscription plan. Registration for an account is necessary to access the full library.

- Complete your purchase by entering your credit card information or opting for payment via your PayPal account.

- After payment, download the form onto your device, which you can later access anytime through the My Forms menu of your account.

US Legal Forms empowers you with easy access to legal documents, ensuring that you can tackle non-payment situations effortlessly. With personalized support from premium experts, you can confidently complete your forms without the worry of legal missteps.

Start your journey today with US Legal Forms and transform how you handle your legal document needs!

Form popularity

FAQ

Yes, a contractor can sue you for non-payment, especially if there is a written contract that stipulates payment terms. It is advisable to resolve the non-payment issue amicably before resorting to legal action. Utilizing platforms like USLegalForms can assist you in drafting appropriate letters and understanding your rights in these situations.

To write a polite letter requesting overdue payment, start with a congenial greeting and a positive introduction. Outline the details of the overdue payment concisely and reiterate the importance of resolving the matter. Offering flexible payment options can also encourage a swift response.

When writing a warning letter for overdue payments, include a summary of the amount owed, along with the payment history. Clearly mention any agreements or contracts that are relevant to the non-payment situation. Be confident in your request for immediate action while remaining professional.

In a complaint letter about a late payment, identify the specifics of the payment, including the amount and original due date. Offer a summary of any previous communications regarding the issue, while requesting a quick resolution. It’s important to express your disappointment without sounding aggressive.

To politely ask for overdue payment, initiate the correspondence with a courteous greeting. Clearly state the amount due and specify the payment deadline, if any. Additionally, reinforcing the value of their partnership can motivate prompt payment.

When crafting a polite warning letter, start by acknowledging the recipient's prior relationship or business. State the purpose of the letter clearly, while using respectful language. You can express understanding about potential oversights to foster a cooperative atmosphere.

To write a warning letter for non-payment, begin with a clear statement of the amount owed. Include relevant details such as the due date and any previous communications about the non-payment issue. It is essential to maintain a professional tone while also conveying the urgency of the situation.

The percentage the IRS typically settles for can vary widely based on individual circumstances and specific case details. In instances of non-payment, it may not be uncommon for settlements to be accepted at significantly reduced percentages depending on your financial situation. Engaging professional assistance can drastically improve your negotiation outcomes. The tools available at uslegalforms help ensure you present a strong case to the IRS.

Yes, you can file your taxes even if you have not made payment. However, non-payment can lead to penalties and interest accruing on your tax debt. It is crucial to communicate with the IRS about your situation and explore potential payment arrangements. Using uslegalforms, you can find helpful resources to navigate the complexities of filing and managing your tax obligations.

The minimum payment the IRS will accept often depends on your specific circumstances and the total amount owed. In cases of non-payment, the IRS may offer options that allow for lower initial payments. However, it's important to provide adequate financial documentation to justify your payment plan. Our resources at uslegalforms can guide you in outlining your financial situation clearly to the IRS.