Renunciation Property Intestate For Foreigner

Description

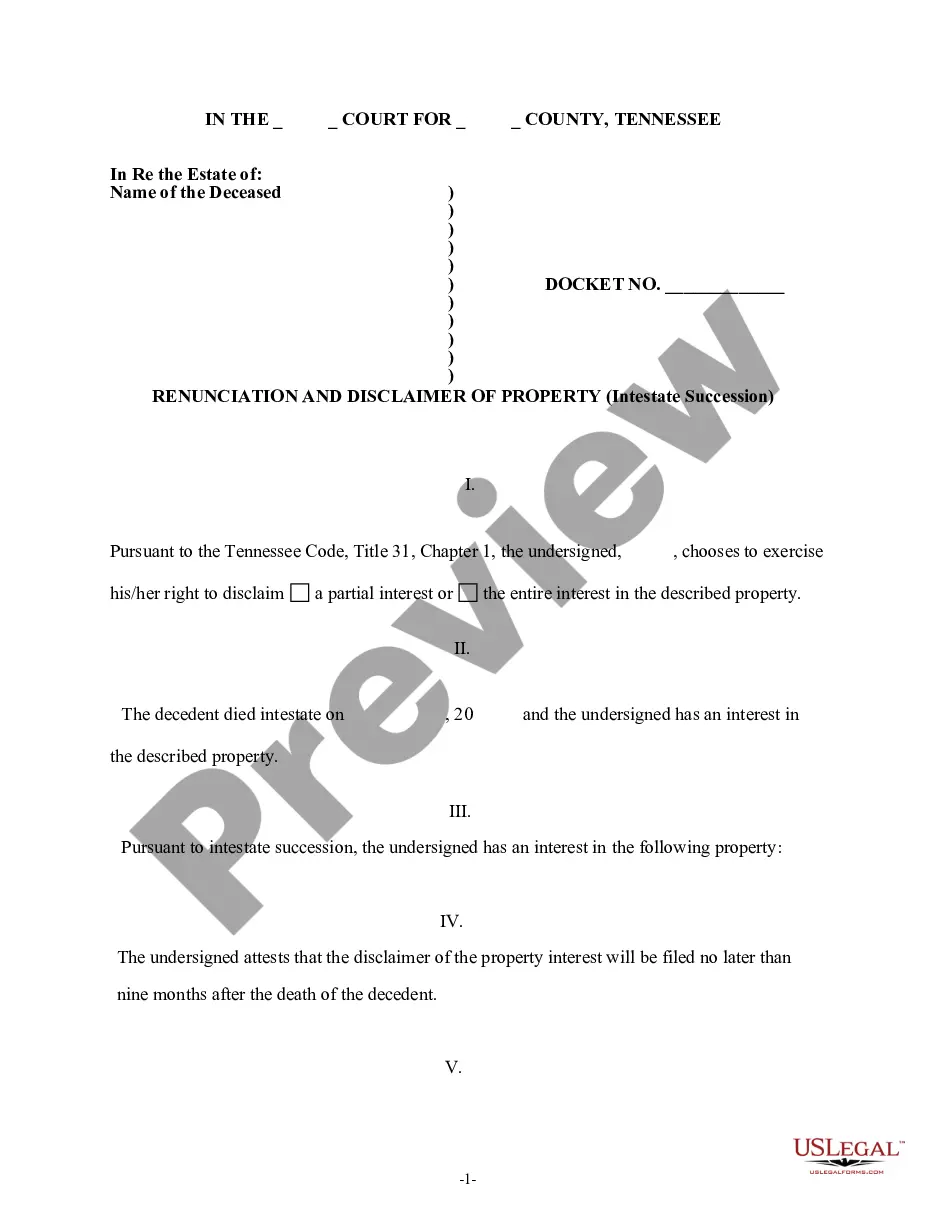

How to fill out Tennessee Renunciation And Disclaimer Of Property Received By Intestate Succession?

- Begin by visiting the US Legal Forms website and logging into your existing account. If you haven’t registered yet, create a new account to get started.

- Assess your document needs by utilizing the Preview mode and reading the form descriptions to ensure compliance with your local jurisdiction.

- If the desired template doesn’t meet your requirements, use the Search feature to find the appropriate form that better suits your needs.

- Once you find the correct document, select the Buy Now button and choose your preferred subscription plan to gain access to their vast library.

- Complete your purchase using your credit card or PayPal account to confirm your subscription.

- After purchasing, download the completed form directly to your device for convenient access and completion. You can also find it later in the My Forms section of your profile.

US Legal Forms empowers individuals and attorneys to quickly execute legal documents with its easy-to-navigate library containing over 85,000 fillable forms. This is a significant advantage, offering more options at a competitive price.

In conclusion, using US Legal Forms enables a smooth process for renouncing property intestate as a foreigner. Don’t hesitate to access the resources available and start your journey today!

Form popularity

FAQ

Yes, a non-U.S. citizen can be appointed as an executor in the United States. However, it is essential to consider the specific requirements set forth by the state’s probate laws, especially regarding renunciation property intestate for foreigner. Having an experienced attorney can simplify the appointment process and help you understand any legal obligations.

A foreign citizen can inherit property in the US. The process may differ compared to what U.S. citizens experience, especially if it involves renunciation property intestate for foreigner. Additionally, tax implications may arise based on the type of property inherited. Consulting an expert can make the process clearer and ensure compliance with U.S. laws.

Yes, a non-U.S. citizen can inherit property from a U.S. citizen without any prohibitions. It's crucial to understand the implications of renunciation property intestate for foreigner, especially concerning taxes and property laws. There may be different regulations depending on the state, so consider legal guidance to manage the inheritance process smoothly.

You can name a non-U.S. citizen as a beneficiary in your will or trust. This choice does not generally impact your ability to pass on your assets. However, renunciation property intestate for foreigner may create different tax liabilities for your beneficiary. Working with a professional can ensure your intentions are clear and legally sound.

Yes, a non-US citizen can serve as an executor of a US estate, but some conditions may apply. It's important to understand the implications of renunciation property intestate for foreigner. The appointment may depend on the state's laws governing estate administration. Consulting with a qualified attorney can help navigate these complexities.

Laws for intestate succession in New York state that if an individual dies without a will, their assets will be distributed based on their family structure. Spouses, children, and parents are prioritized, receiving designated shares. For foreigners concerned about renunciation property intestate matters, understanding these laws is essential to protect their interests and navigate the process smoothly.

Transferring property after death without a will in New York requires you to file for probate or administration of the estate. The court will appoint an administrator to oversee the estate and distribute the assets according to intestate succession laws. Engaging with legal professionals can greatly assist foreigners in managing the renunciation property intestate process effectively.

To disclaim an inheritance in New York, a beneficiary must file a disclaimer with the court, staying true to specific timeframes and legal requirements set by the law. This allows you to refuse your inheritance formally, which may be necessary for various financial reasons. For foreigners tackling renunciation property intestate issues, understanding the disclaimer process is crucial to navigate potential tax implications.

Transferring real property after death without a will in New York involves filing a petition for letters of administration to appoint an administrator for the estate. The administrator will distribute the property according to intestacy laws. If you are a foreign national facing renunciation property intestate challenges, it is essential to consult legal experts for effective solutions tailored to your situation.

To get heir property in your name without a will, you may need to initiate a probate process, if applicable, or file for administration of the estate. The court will examine the relationships and determine rightful heirs during this process. For foreigners dealing with renunciation of property intestate, local laws often dictate the specific procedures and rights, highlighting the need for professional guidance.