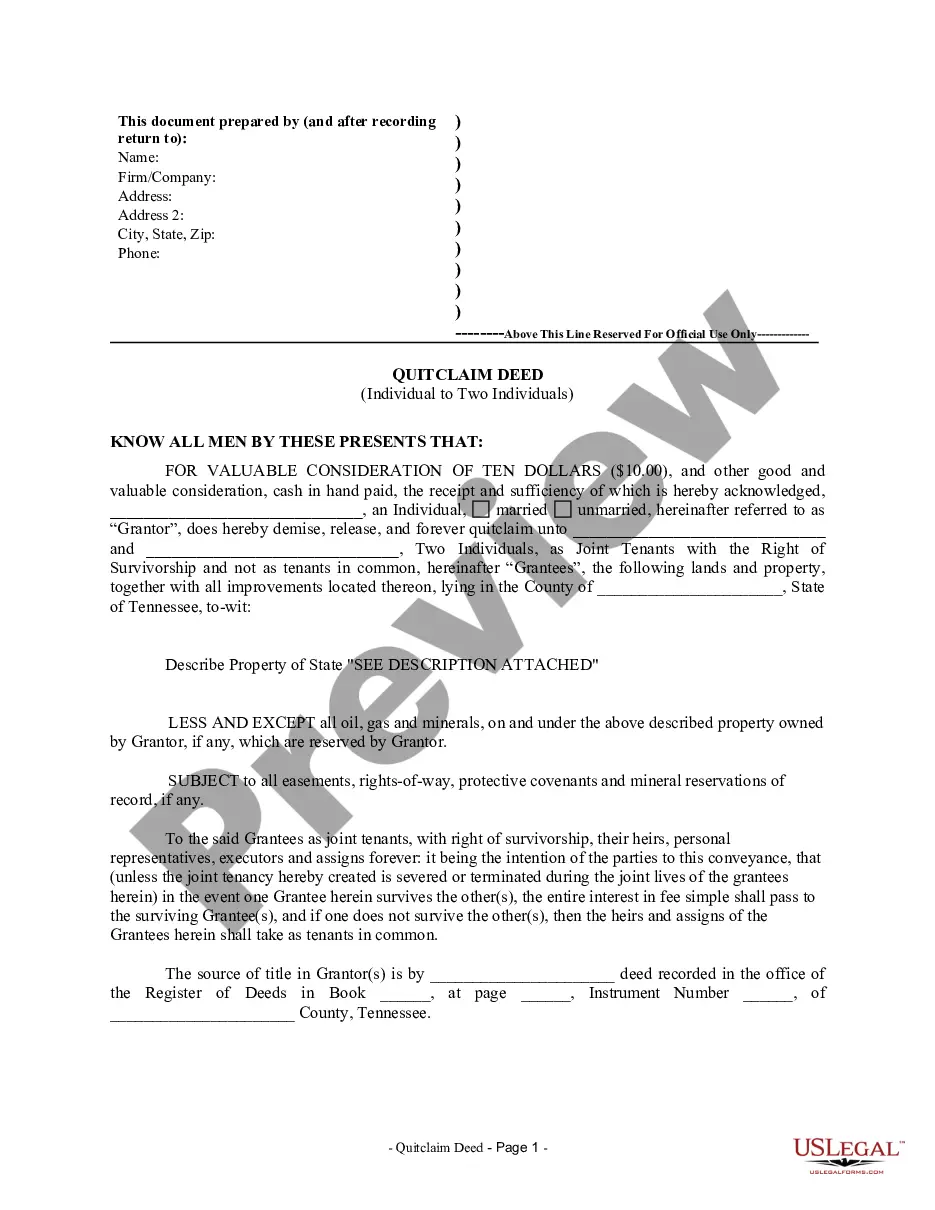

This Quitclaim Deed from Individual to Two Individuals in Joint Tenancy form is a Quitclaim Deed where the Grantor is an individual and the Grantees are two individuals. Grantor conveys and quitclaims the described property to Grantees less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This form complies with all state statutory laws.

Tennessee Joint Tenants With Rights Of Survivorship

Description

Form popularity

FAQ

The step-up basis for joint tenants with rights of survivorship in Tennessee indicates that the property owned jointly will adjust to its fair market value at the time of a joint tenant's death. This means that the surviving tenant can benefit from reduced taxes when they sell the property afterward. It is critical to evaluate this feature during estate planning, as it can have substantial financial implications.

To file a joint tenancy with right of survivorship in Tennessee, you must first prepare a deed that explicitly states the nature of the joint ownership. Both parties should then sign the deed and have it notarized. Finally, file the deed with your county's register of deeds to ensure proper public recording and protect your interests.

Generally, a joint account does not receive a step-up in basis, unlike property held under Tennessee joint tenants with rights of survivorship. However, the specific tax implications can vary based on contributions to the account and the state statutes. For clarity, consulting a tax professional can help you navigate these complexities.

In the context of Tennessee joint tenants with rights of survivorship, the step-up basis means that when one joint tenant passes away, the surviving tenant's share of the property is adjusted to its current market value. This adjustment can significantly reduce capital gains taxes if the property is later sold. Understanding the step-up basis is essential for effective estate planning, and it can offer financial benefits for surviving tenants.

Yes, Tennessee recognizes joint tenancy with rights of survivorship as a legal form of property ownership. This structure allows multiple individuals to own property together while ensuring that upon the death of one owner, their share immediately transfers to the surviving owner. Understanding the legal framework can help you make informed decisions regarding property investment in Tennessee.

Establishing joint tenancy with rights of survivorship in Tennessee involves drafting a deed that specifically states your intention. Each owner must be listed on the deed, and the language used must clearly indicate the right of survivorship. For an efficient process, using a platform like USLegalForms can provide you with templates and guidance tailored to your needs.

Tax implications for Tennessee joint tenants with rights of survivorship can vary based on ownership percentages and the value of the property. It's crucial to recognize that while the transfer of property upon death may avoid probate, it does not necessarily prevent tax liabilities. Consulting with a tax professional can help clarify how joint ownership affects your overall tax situation.

Yes, in Tennessee, joint tenancy with rights of survivorship generally overrides a will. This means that upon the death of one joint tenant, the surviving tenant automatically becomes the sole owner, regardless of any directives in the deceased's will. It is important to understand how this can impact estate planning, as it may lead to unintended consequences.

Some cons of joint tenancy with right of survivorship include limited control for individual tenants. All decisions regarding the property must be agreed upon, which can lead to conflicts. In Tennessee, joint tenants may also face potential tax implications that can affect their financial standing, making it essential to consider these factors thoroughly.

While Tennessee joint tenants with rights of survivorship offer benefits, there are notable disadvantages. For instance, if one joint tenant incurs debts, creditors may target the property. Furthermore, in the case of a dispute, ending the joint tenancy can be complex and requires legal processes, which may lead to unexpected costs.