Tennessee Utma Age Of Majority With Minor

Description

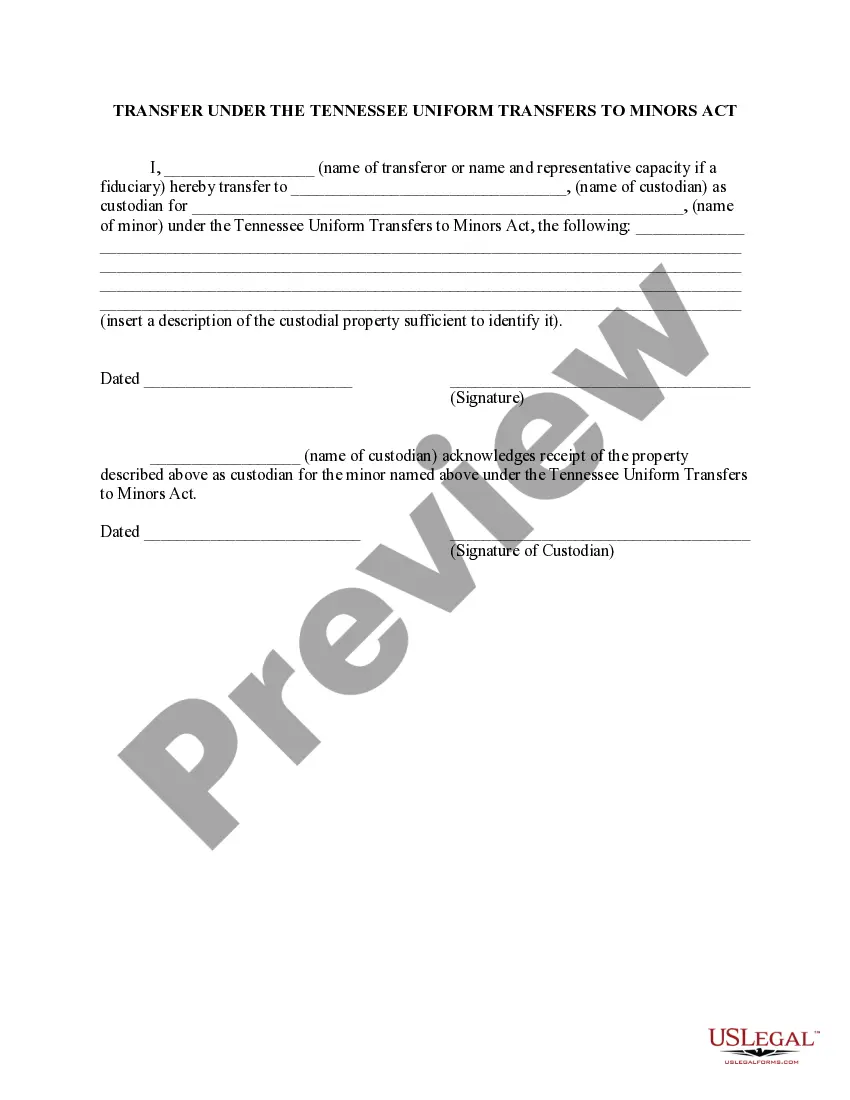

How to fill out Transfer Under The Tennessee Uniform Transfers To Minors Act?

Obtaining legal document samples that comply with federal and state regulations is essential, and the internet offers a lot of options to choose from. But what’s the point in wasting time looking for the correctly drafted Tennessee Utma Age Of Majority With Minor sample on the web if the US Legal Forms online library already has such templates collected in one place?

US Legal Forms is the most extensive online legal catalog with over 85,000 fillable templates drafted by lawyers for any professional and life situation. They are easy to browse with all files collected by state and purpose of use. Our professionals keep up with legislative changes, so you can always be confident your form is up to date and compliant when acquiring a Tennessee Utma Age Of Majority With Minor from our website.

Obtaining a Tennessee Utma Age Of Majority With Minor is quick and easy for both current and new users. If you already have an account with a valid subscription, log in and download the document sample you require in the right format. If you are new to our website, adhere to the guidelines below:

- Analyze the template utilizing the Preview feature or through the text description to ensure it meets your needs.

- Look for another sample utilizing the search tool at the top of the page if necessary.

- Click Buy Now when you’ve located the correct form and opt for a subscription plan.

- Create an account or log in and make a payment with PayPal or a credit card.

- Choose the right format for your Tennessee Utma Age Of Majority With Minor and download it.

All templates you locate through US Legal Forms are multi-usable. To re-download and complete earlier obtained forms, open the My Forms tab in your profile. Take advantage of the most extensive and simple-to-use legal paperwork service!

Form popularity

FAQ

The term Uniform Transfers to Minors Act (UTMA) refers to a law that allows a minor to receive gifts without the aid of a guardian or trustee. Gifts can include money, patents, royalties, real estate, and fine art.

Generally, the UTMA account transfers to the beneficiary when they become a legal adult, which is usually age 18 or 21, but it can be later. The age of adulthood may be defined differently for custodial accounts, like UTMAs or 529 plans, depending on your state.

The statutory age of majority for UTMA purposes is 21 for transfers by irrevocable gift or pursuant to a will or trust. The UTMA age of majority for transfers other than by gift, will, or trust is set as the State's standard age of majority, which is 18.

Depending on the state a UTMA account is handed over to a child when they reach either age 18 or age 21. In some jurisdictions, at age 18 a UTMA account can only be handed over with the custodian's permission, and at 21 is transferred automatically.

The Uniform Transfers to Minors Act (UTMA) is a law that has been adopted in substantially the same form in almost every state. Tennessee's UTMA is codified at T.C.A. § 35-7-101 et seq. Under the UTMA, you may choose someone to manage property you are leaving to a child.