California Age Of Majority For Utma

Description

Form popularity

FAQ

B or 1099DIV should be received at the end of the tax year from the financial institution handling the UGMA/UTMA account to report any interest or earnings on the account.

The first $1,100 in earnings in the UTMA account are tax-free. This earnings figure includes dividends, interest income, and any capital gains. The next $1,100 in earnings is taxable at the child's tax rate. Because your child probably doesn't earn much income, their tax rate is typically 10%.

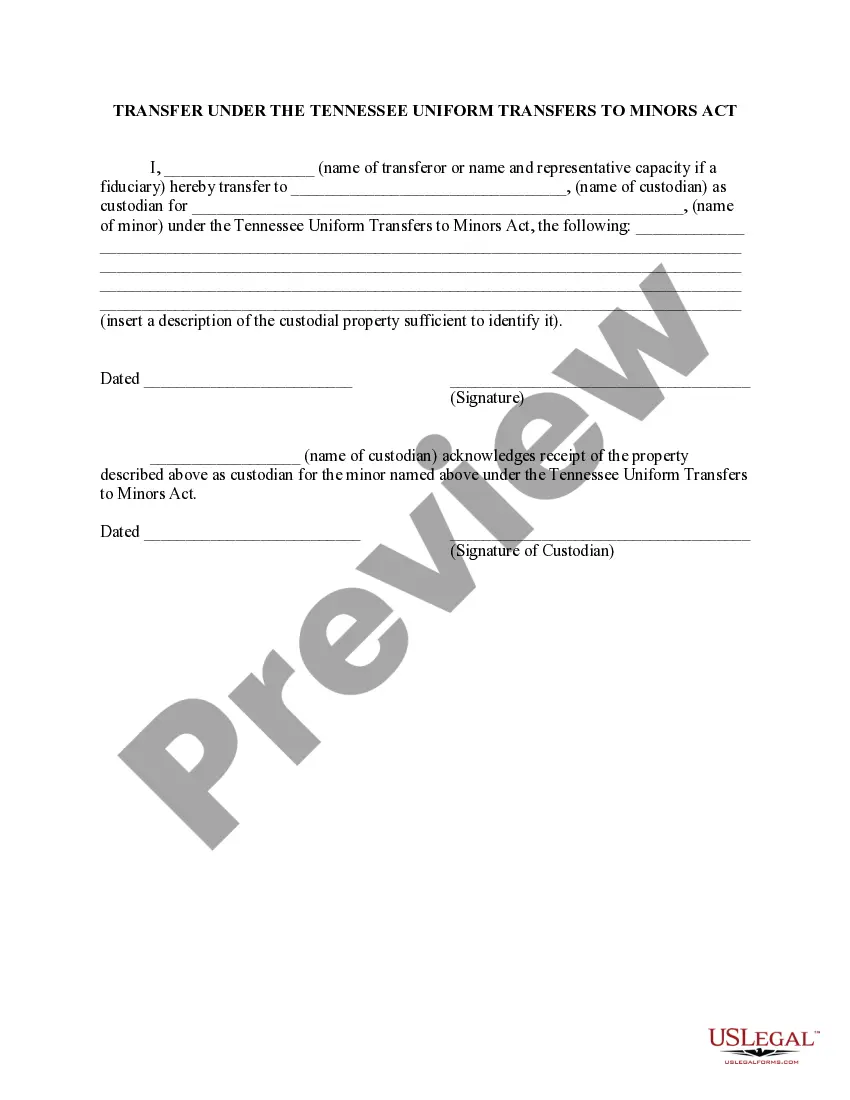

The age of majority for an UTMA is different in each state. In most states, the age of majority is 21 ? which means that when a child turns 21, the custodianship of assets will end. But in other states, the age of majority is either 18 or 25. The custodian can also sometimes choose between a selection of ages.

Age of Majority and Trust Termination StateUGMAUTMAArizona1821Arkansas2121California1818Colorado212149 more rows

Extending the Age of Majority Some states allow the custodian of a UTMA account to extend the age at which the minor child is entitled to receive the assets. The minor may have the right to reject the extension, though, after they are informed of your intent.