South Dakota Transfer On Death Deed Form With Signature

Description

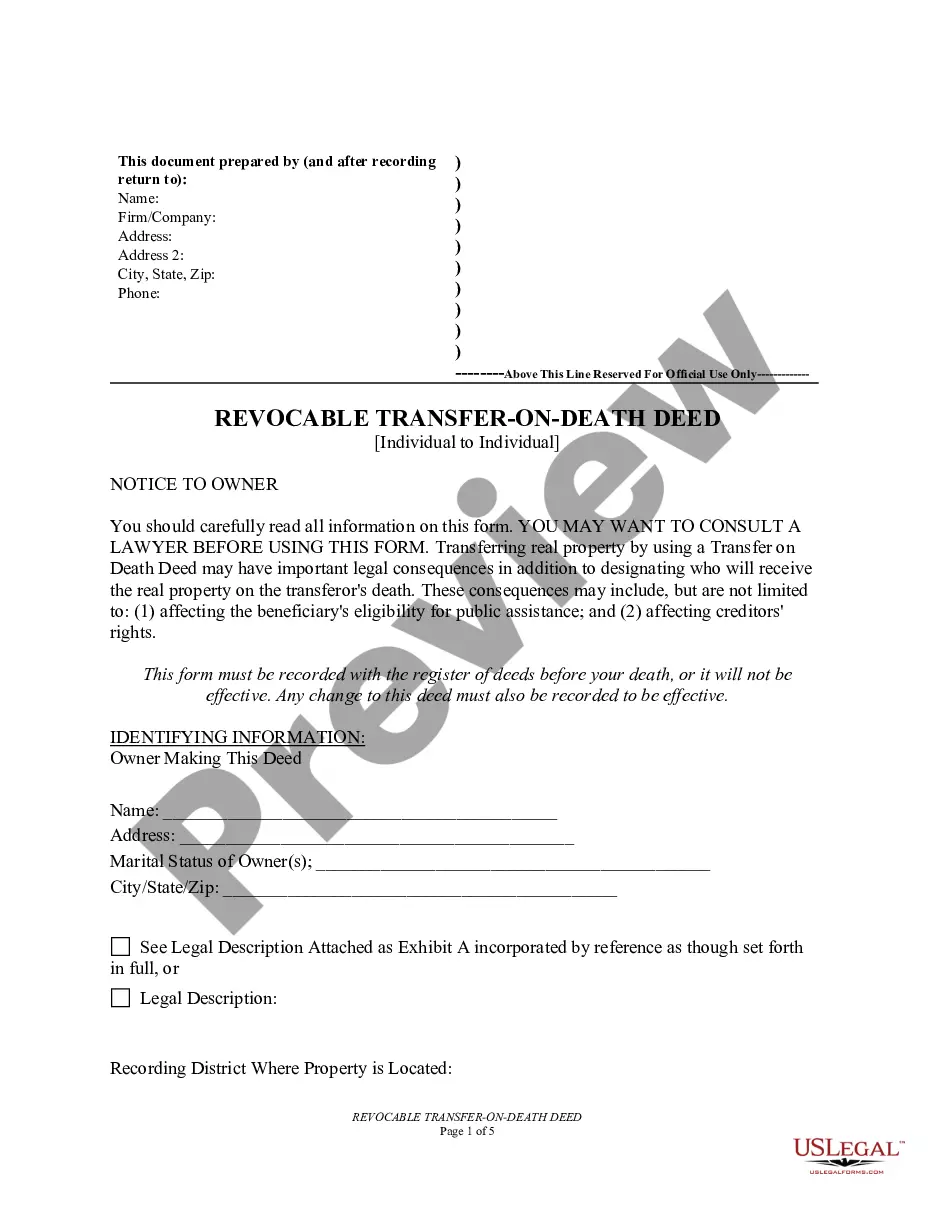

How to fill out South Dakota Transfer On Death Deed Or TOD - Beneficiary Deed For Individual To Individual?

It’s no secret that you can’t become a law professional overnight, nor can you grasp how to quickly draft South Dakota Transfer On Death Deed Form With Signature without having a specialized set of skills. Putting together legal documents is a long process requiring a specific training and skills. So why not leave the creation of the South Dakota Transfer On Death Deed Form With Signature to the pros?

With US Legal Forms, one of the most comprehensive legal document libraries, you can find anything from court paperwork to templates for in-office communication. We know how important compliance and adherence to federal and local laws are. That’s why, on our platform, all templates are location specific and up to date.

Here’s start off with our website and get the document you require in mere minutes:

- Find the form you need by using the search bar at the top of the page.

- Preview it (if this option available) and read the supporting description to determine whether South Dakota Transfer On Death Deed Form With Signature is what you’re searching for.

- Begin your search over if you need any other template.

- Register for a free account and choose a subscription option to purchase the template.

- Pick Buy now. As soon as the payment is through, you can get the South Dakota Transfer On Death Deed Form With Signature, fill it out, print it, and send or send it by post to the designated individuals or organizations.

You can re-gain access to your forms from the My Forms tab at any time. If you’re an existing client, you can simply log in, and find and download the template from the same tab.

No matter the purpose of your documents-be it financial and legal, or personal-our website has you covered. Try US Legal Forms now!

Form popularity

FAQ

Transfer on Death Deeds are used in Estate Planning to avoid probate and simplify the passing of real estate to your loved ones or Beneficiaries. It's also known as a ?Beneficiary Deed? because in essence, you're naming a Beneficiary who will receive the deed to your property after you pass away.

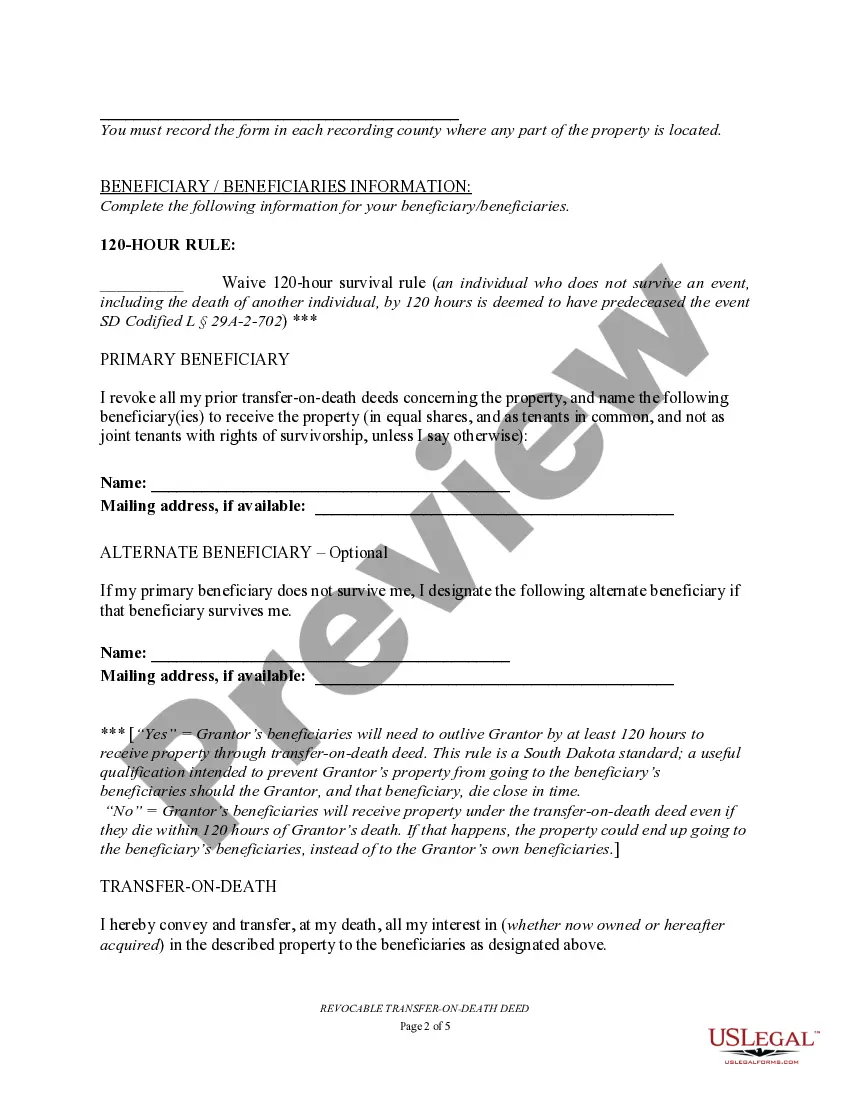

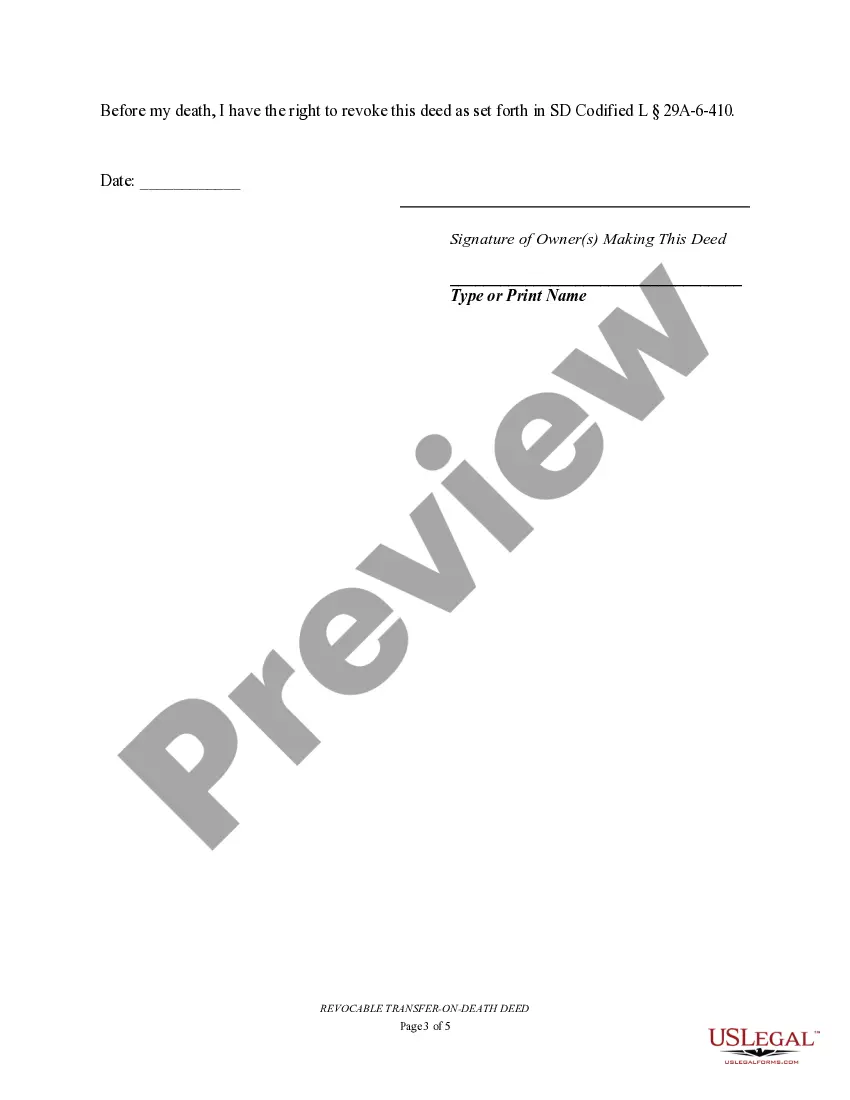

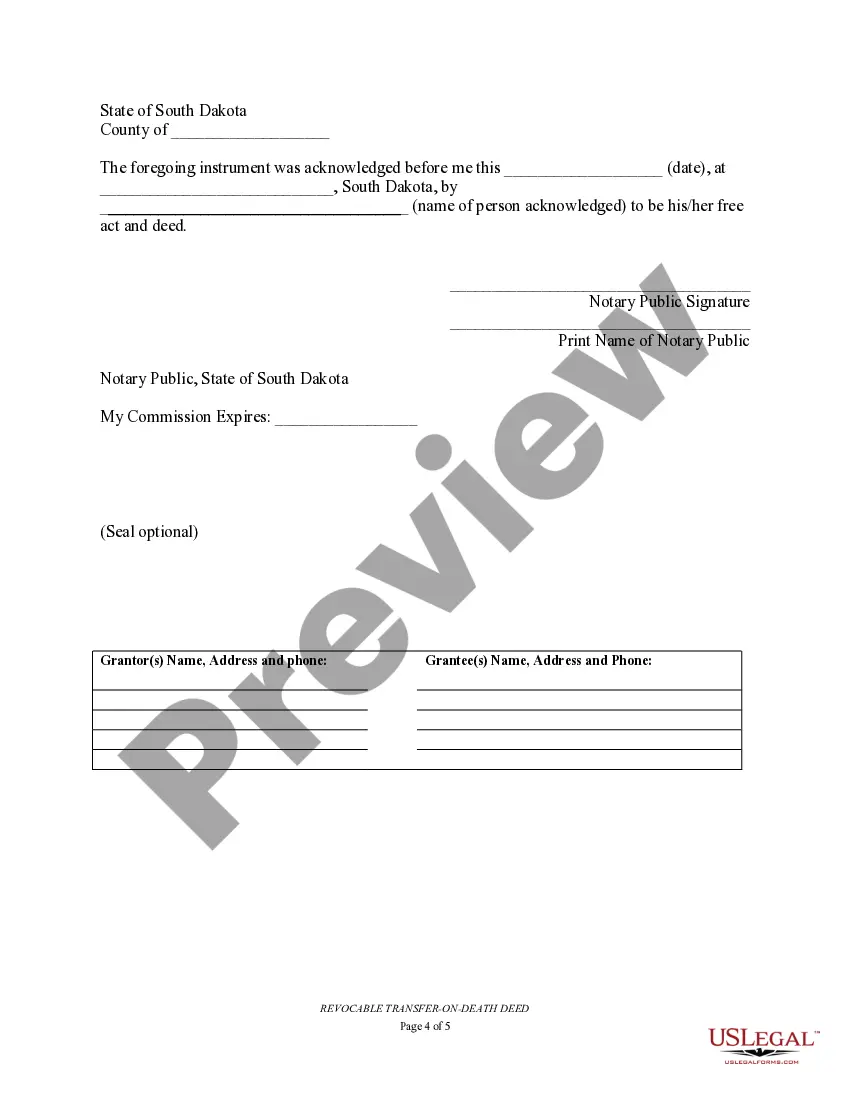

South Dakota Transfer on Death Deeds You must sign the deed and get your signature notarized, and then record (file) the deed with the county register of deeds office before your death. ... The beneficiary's rights. ... Earlier wills or TOD deeds. ... Your rights. ... Medicaid. ... Other creditor claims. ... Revoking the deed.

What Is the Difference Between TOD and Beneficiary? A transfer on death is an instrument that transfers ownership of specific accounts and assets to someone. A beneficiary is someone that is named to receive something of value.

The South Dakota Real Property Transfer on Death Act lets joint owners?which include joint tenants with right of survivorship, but not tenants in common?sign the same South Dakota TOD deed. If other joint owners are still living when an owner dies, the property passes to those owners under the right of survivorship.

A beneficiary who receives real estate through a transfer on death deed becomes personally liable for the debts of the dead property owner without proper counsel from an estate planning professional or a title company. The beneficiary becomes liable to potential financial obligations as a result.